Have you ever found yourself in a bind because a rent check bounced? It can be a frustrating situation for both tenants and landlords alike. In this article, we'll explore how to effectively resolve the issue of a bounced rent check, ensuring open communication and understanding between parties. Join us as we delve into practical steps and templates you can use to address this sensitive matter smoothly.

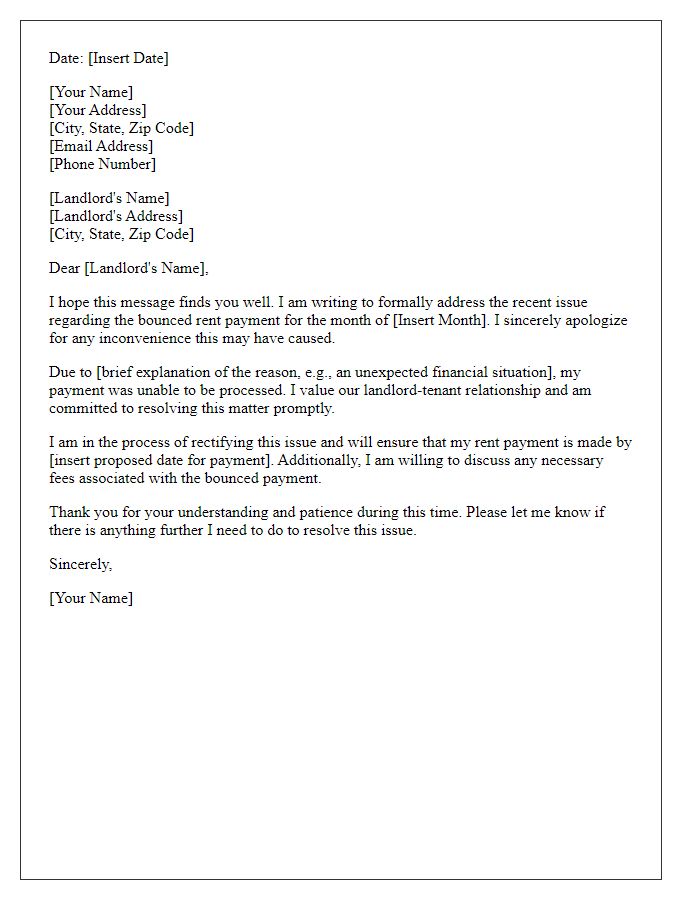

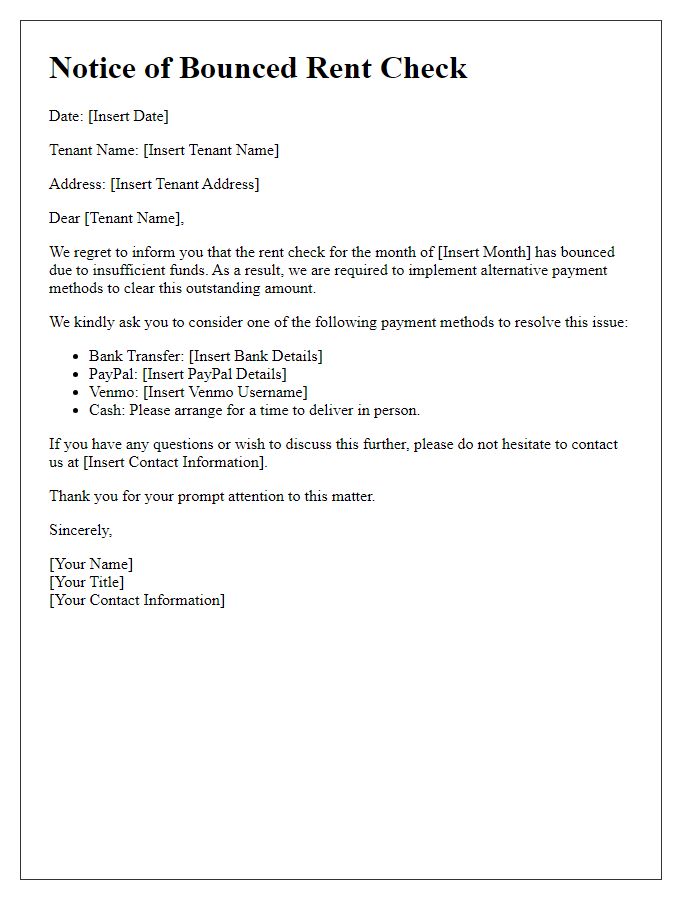

Landlord's contact information and tenant's contact information.

A bounced rent check can lead to significant complications in lease agreements. Each party involved, such as the landlord and tenant, must have clear communication to resolve the situation effectively. The landlord's contact information generally includes their name, phone number, and email address, while the tenant's contact details consist of their full name, phone number, and email. Situations may arise where the tenant's bank account has insufficient funds, resulting in the bounced check, typically involving fees for both the tenant and the landlord. According to state laws, tenants may be afforded a grace period for restitution while landlords often require prompt payment to avoid eviction proceedings. Documenting all exchanges and agreements is crucial for clarity and ensuring both parties adhere to the obligations outlined in the lease agreement.

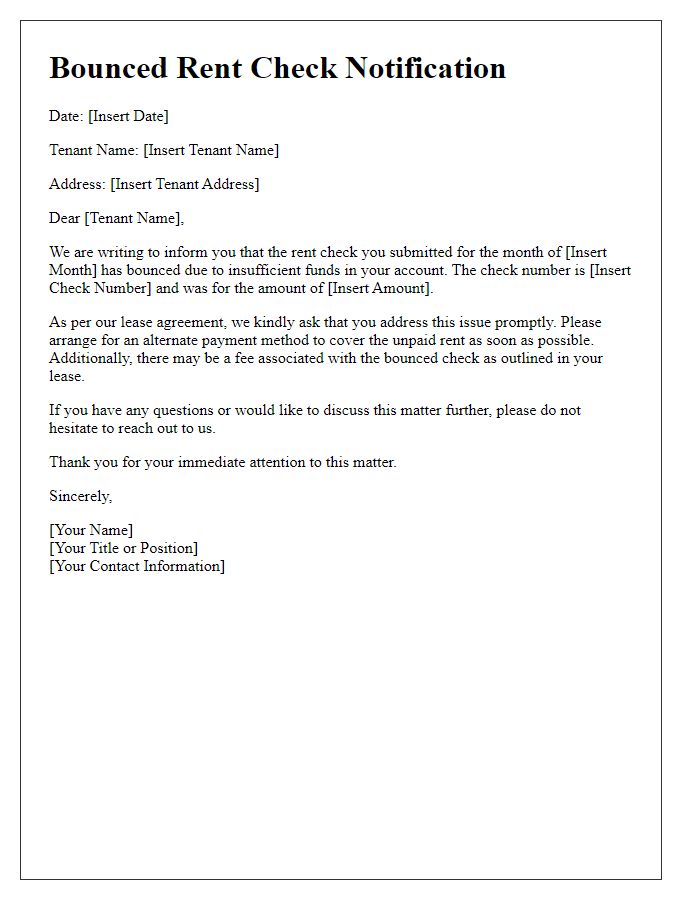

Subject line: Notification of Bounced Rent Check.

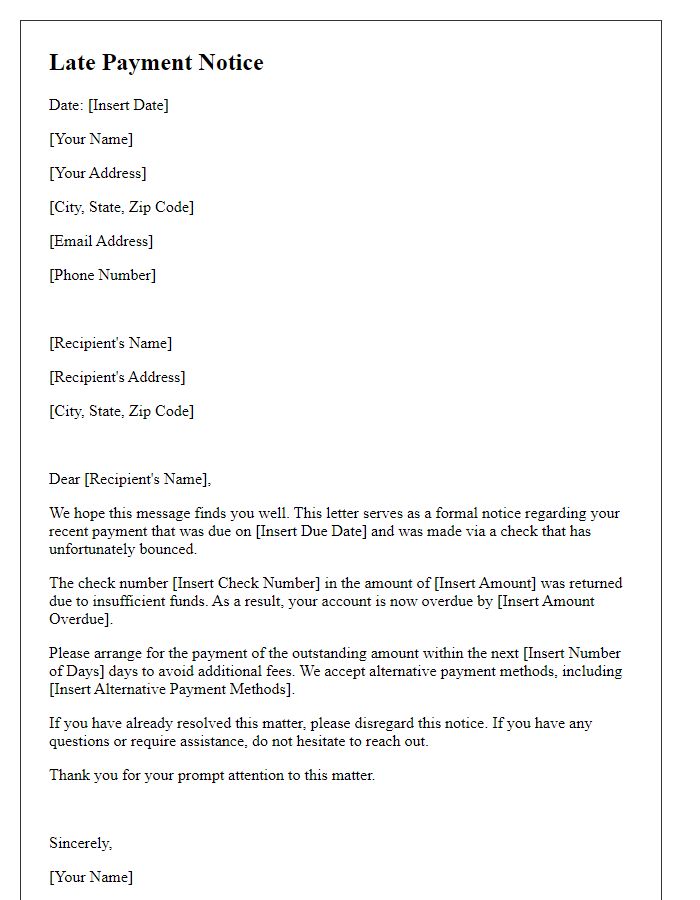

A bounced rent check can cause significant disruptions in financial planning for both landlords and tenants. When a check, typically valued at a monthly rental amount (for example, $1,500 for a one-bedroom apartment in urban areas), fails to clear, it can lead to late fees, additional bank charges, and potential eviction notices under state landlord-tenant laws. Issues such as insufficient funds (often cited when checks bounce) require immediate communication, often through written notifications detailing the situation. Such correspondence emphasizes the urgency of rectifying the payment amount and may require action within a specified timeframe, usually within five business days. Clear documentation and a professional tone can help maintain relationships and ensure compliance with local regulations governing rental agreements.

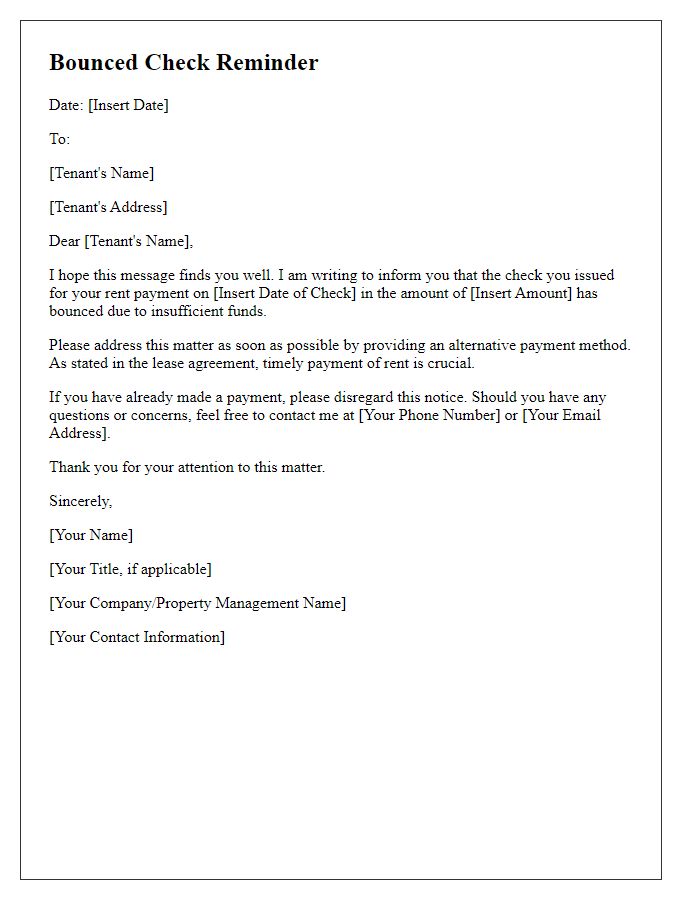

Statement of the issue: Description of the bounced check and its implications.

A bounced rent check, often referred to as an insufficient funds check, occurs when the account holder's funds are not enough to cover the payment amount, such as the monthly rent of $1,200 for the apartment located at 123 Main Street, Springfield. This event can lead to various complications, including late fees which, depending on the rental agreement, may amount to $50, and potential negative impacts on the landlord's cash flow, affecting their ability to cover property expenses. Additionally, repeated occurrences of bounced checks may result in strain on the tenant-landlord relationship and could ultimately lead to legal action or eviction proceedings if not addressed promptly. Furthermore, the tenant may face bank penalties that can escalate quickly, leading to financial stress and further complications in maintaining timely payments.

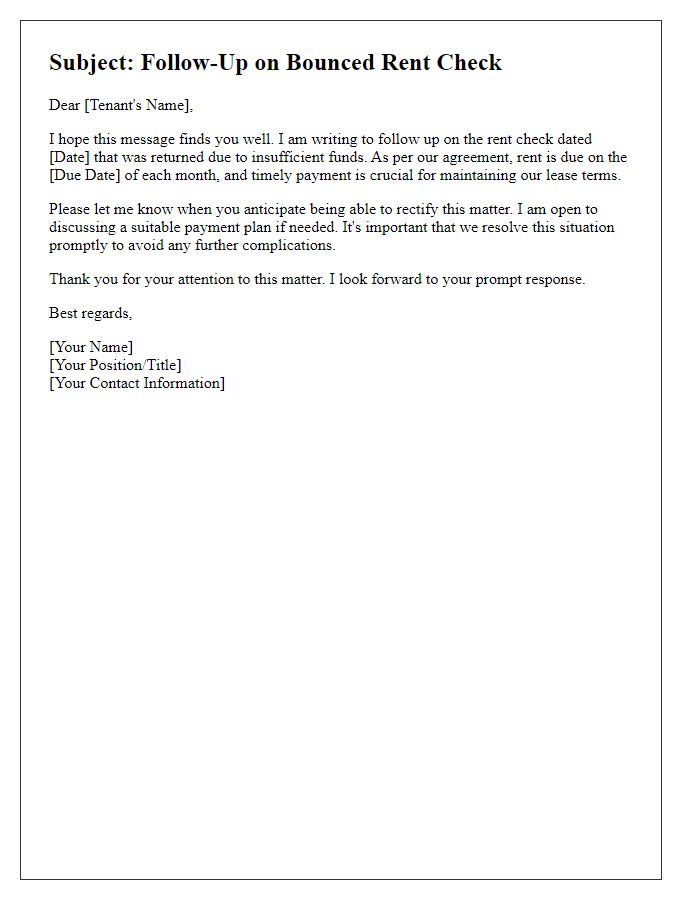

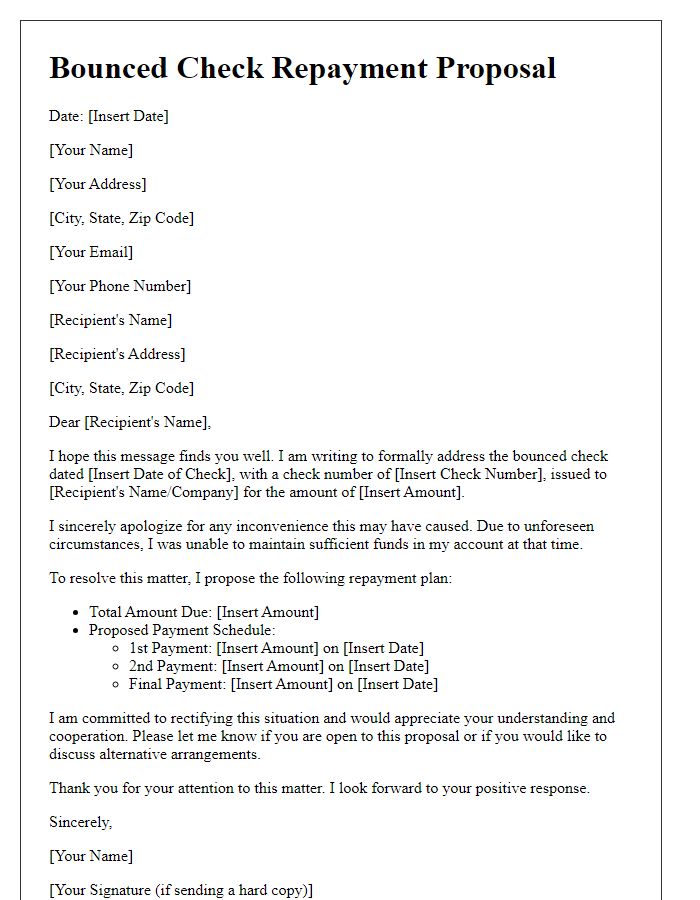

Proposal for resolution: Payment options, deadlines, and any applicable fees.

A bounced rent check can disrupt the financial arrangements between landlords and tenants, causing stress for both parties. Common issues include insufficient funds, which can result in bounced check fees (typically ranging from $20 to $40), depending on the rental agreement and state laws. Resolution proposals often include options for immediate payment (credit card or electronic transfer), deadlines for settling the outstanding balance (such as within five business days), and potential installment plans for larger amounts. Clear communication is vital to maintain a positive landlord-tenant relationship and to prevent future payment issues, emphasizing the importance of timely rent deposits and financial management.

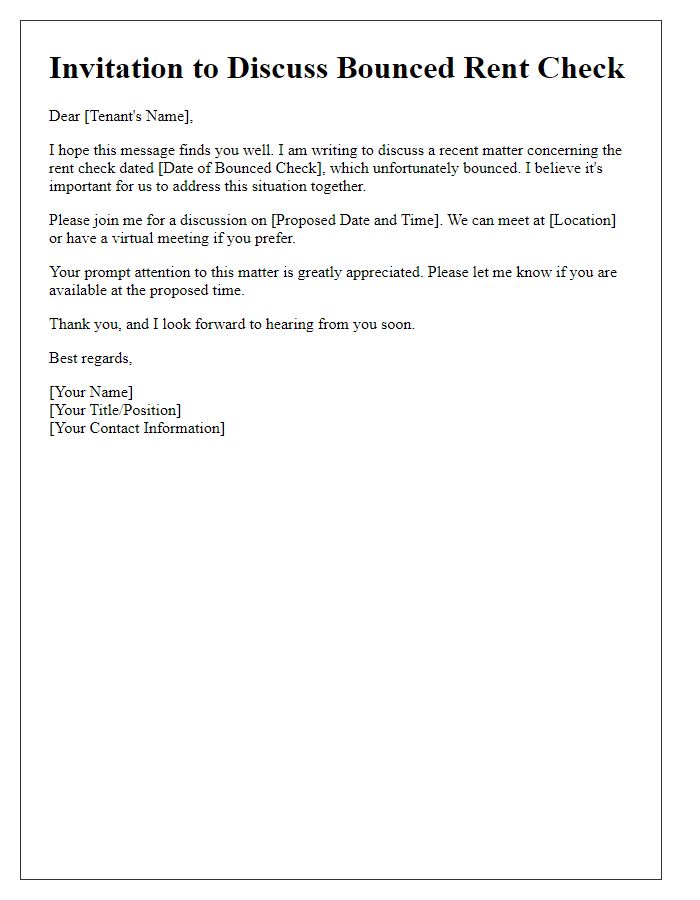

Request for confirmation and next steps: Contact information for clarification or assistance.

A bounced rent check can create significant stress for both tenants and landlords. This situation typically arises when insufficient funds are in the tenant's bank account or if there are processing errors by financial institutions. The landlord should promptly notify the tenant regarding the bounced check, providing details such as the date of the original rent payment, amount due, and potential bank fees that may apply. It is advisable to state the importance of resolving this matter quickly to avoid further complications, such as late fees or eviction processes. Tenants should confirm whether they have rectified their bank situation and provide alternative payment methods, such as wire transfers or online payment platforms, to ensure timely rent settlement. Clear communication about next steps and contact information for further assistance can foster a cooperative resolution for both parties involved.

Comments