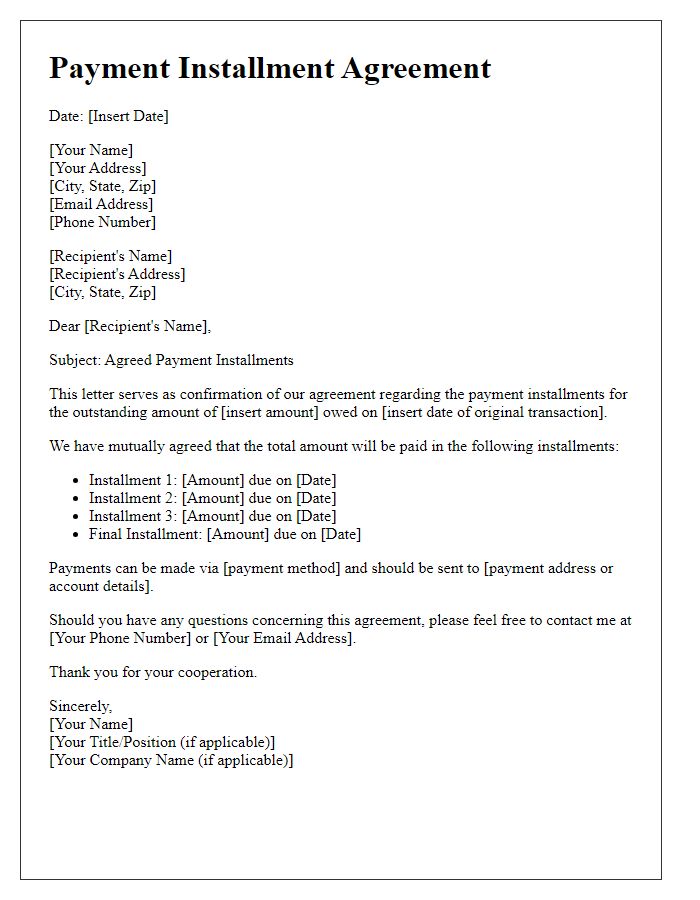

Are you looking for a way to ease your financial burden through a payment installment agreement? It's a practical solution that allows you to break down larger payments into manageable sums, making it easier to stay on top of your obligations without overwhelming your budget. In this article, we'll guide you through the essential components of a payment installment agreement letter, ensuring you include all the necessary details. So, grab a cup of coffee and read on to unlock the key to financial ease!

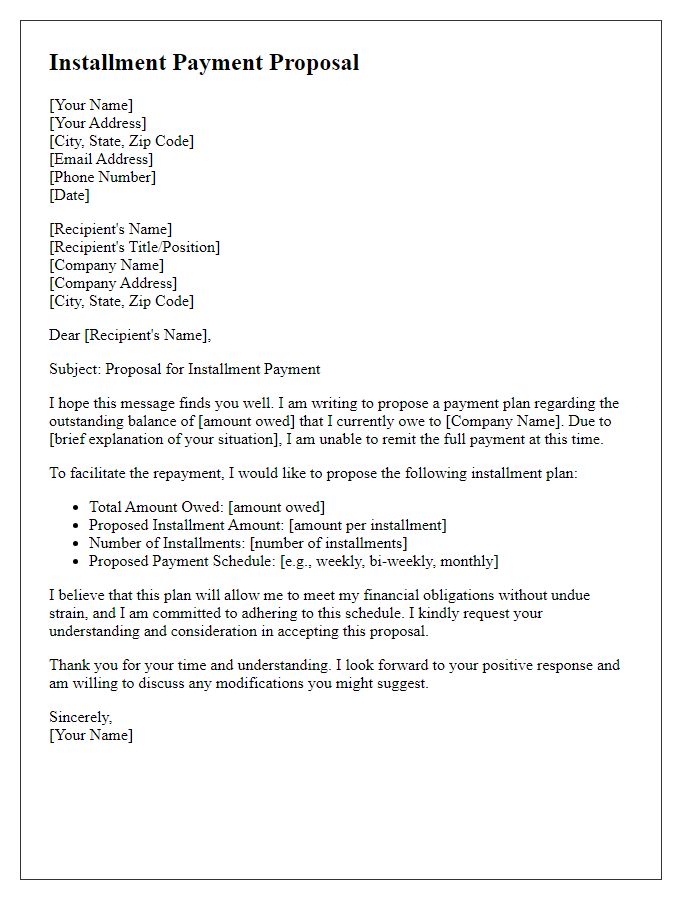

Clear Identification of Parties

A payment installment agreement is crucial for establishing a clear understanding between the involved parties regarding repayment terms. Parties should be identified with full legal names, addresses, and contact information to prevent ambiguity. The lender, who might be a financial institution or individual, must be detailed alongside the borrower, representing the entity responsible for repaying the agreed sum. Additionally, identification may include business registration numbers for companies or Social Security numbers for individuals for added clarity and legal validation. This clear identification ensures accountability and aids in future correspondence related to the agreement.

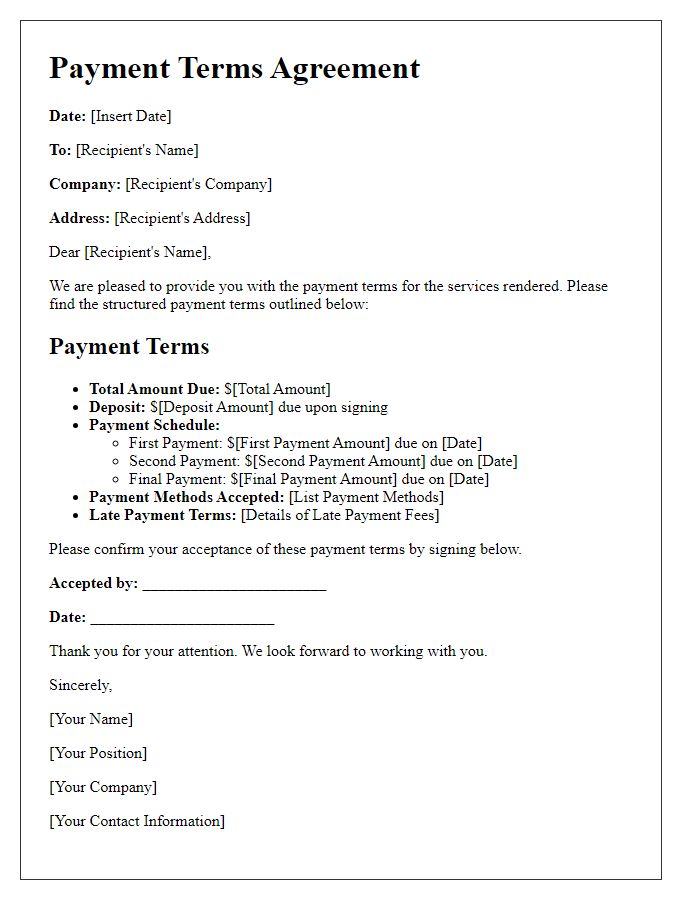

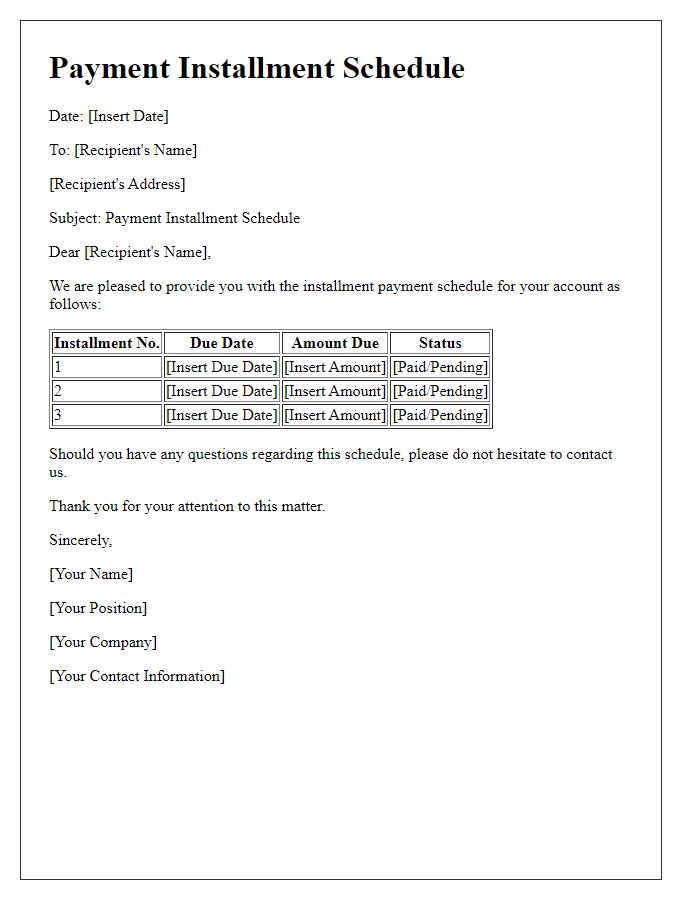

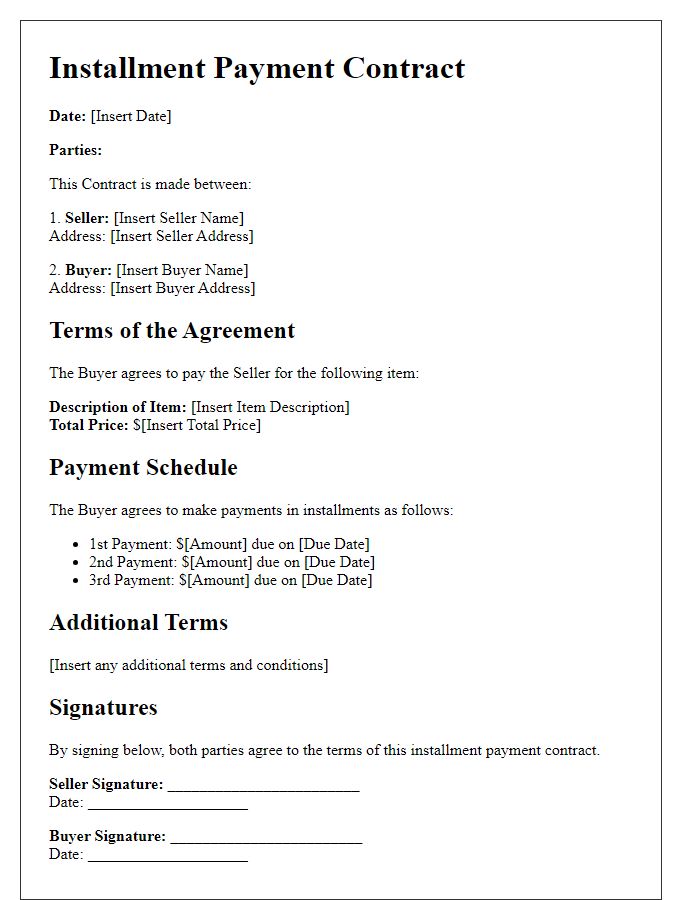

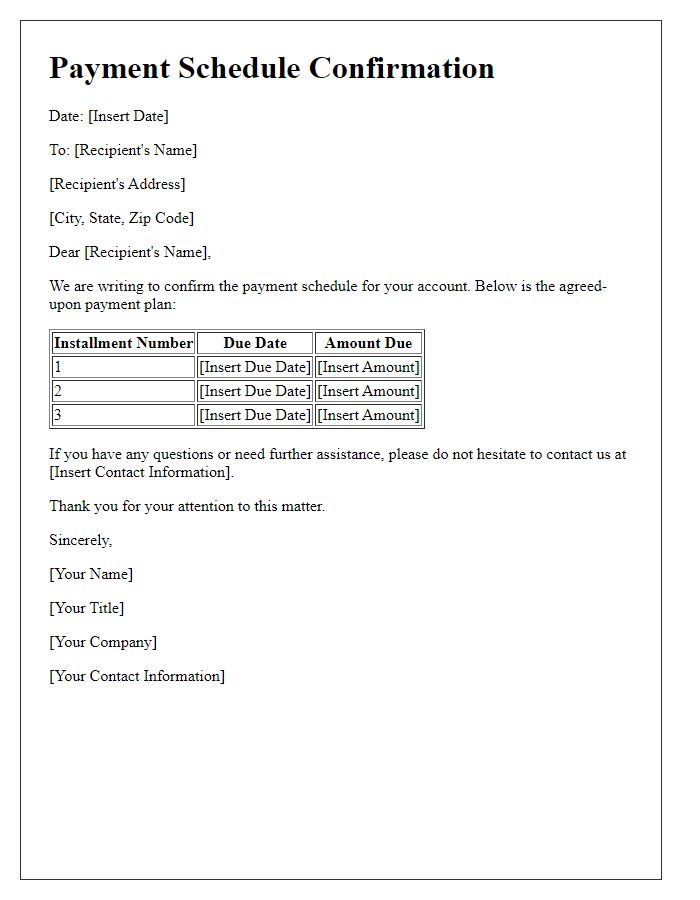

Detailed Payment Schedule

A payment installment agreement outlines the financial obligations of a borrower to repay a loan or purchase over a specified period. This document typically includes essential information such as the total amount owed (for example, $5,000), interest rate (annual percentage rate of 5%), and the payment schedule. A detailed payment schedule includes specific dates, amounts (e.g., $500 monthly payments), and any late fees applicable if payments aren't made on time (for instance, a fee of $50 for each missed payment). The agreement may also specify the method of payment, such as bank transfer or check, and the consequences of default (loss of collateral or increased interest rates). Proper documentation ensures transparency in financial transactions and helps prevent disputes between the borrower and lender.

Interest and Fees Terms

In a payment installment agreement, interest and fees can significantly impact the overall repayment amount. Standard interest rates may vary between 3% to 8% annually, depending on creditworthiness and lender policies. Fees such as origination fees--up to 5% of the total loan amount--can apply at the start of the agreement. Additionally, late payment fees can range from $25 to $50, depending on the lender's terms. Clear disclosure of these fees is essential to ensure transparency throughout the repayment period, typically ranging from 6 to 36 months, affecting the total repayment figure substantially. Maintaining timely payments helps avoid increasing costs linked to accumulated fees and elevated interest rates.

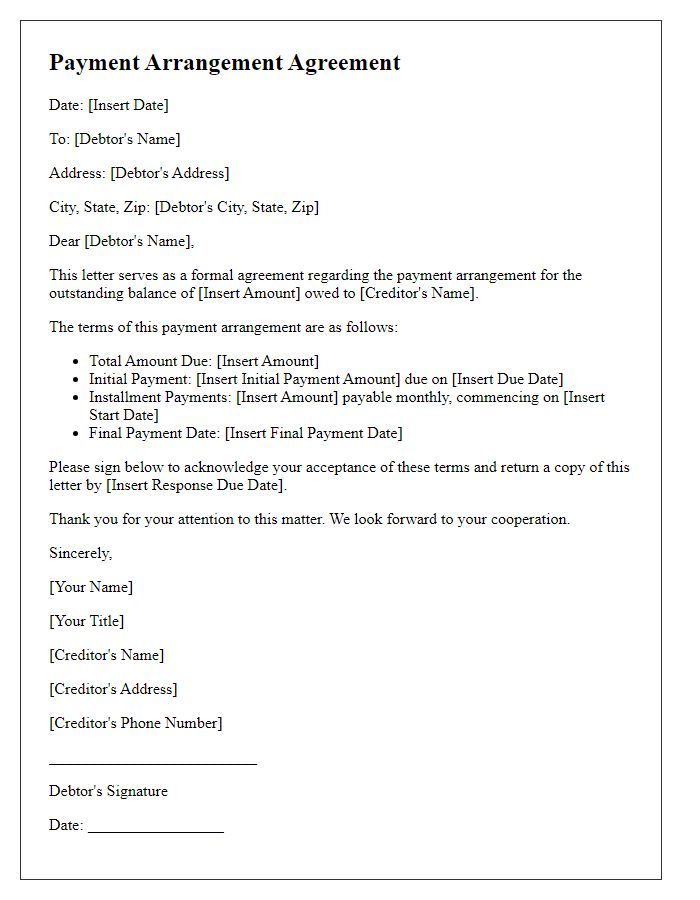

Default and Penalties Clause

A payment installment agreement outlines the terms between a borrower and lender, detailing the repayment schedule and conditions. In the Default and Penalties Clause, specific conditions under which a borrower is considered in default are clearly defined, typically including missed payments beyond a grace period of 10 to 15 days. Penalties may involve late fees, often calculated as a percentage of the missed payment (commonly 5% to 10%), or increased interest rates that might rise by 1% to 3% after the default. Additionally, the lender reserves the right to demand immediate repayment of the remaining balance under default conditions, potentially initiating collection procedures or legal action, depending on state laws and jurisdictional statutes. This clause serves to protect the lender while ensuring the borrower understands the serious implications of failing to adhere to the agreed-upon payment schedule.

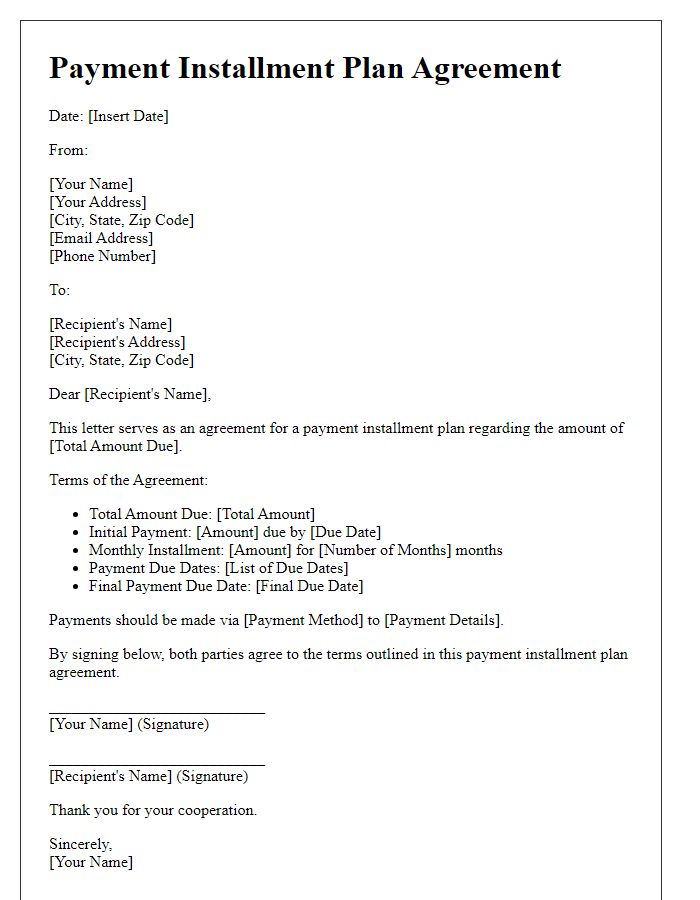

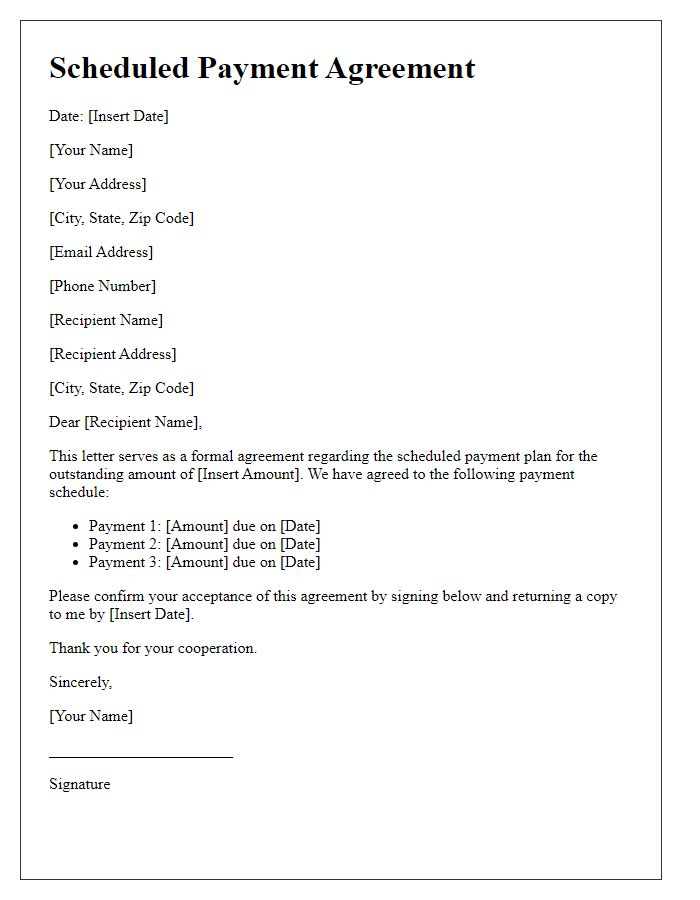

Signature and Date Requirements

A payment installment agreement outlines the terms under which a debtor pays back a loan or debt in regular installments rather than a lump sum. This contract specifies essential details, including the total amount owed, the installment amounts, payment frequency (such as monthly), and the duration of the agreement (such as 12 months). Signature requirements typically include the signatures of both the debtor and creditor, validating the terms of the agreement and ensuring mutual consent. The date of signing is crucial for tracking payment schedules and establishing the timeline for the debt repayment process. Including witness signatures may also enhance the document's legality, particularly in formal agreements involving significant sums.

Comments