Are you ready to wrap up your real estate transaction and take the next exciting step in your journey? Closing a deal can be quite a milestone, and having a well-structured letter helps streamline the process and ensures all parties are on the same page. Whether it's a heartfelt note of appreciation or a formal communication of final terms, the right template can make all the difference. Join us as we explore essential tips and examples that will guide you in crafting the perfect closing letter!

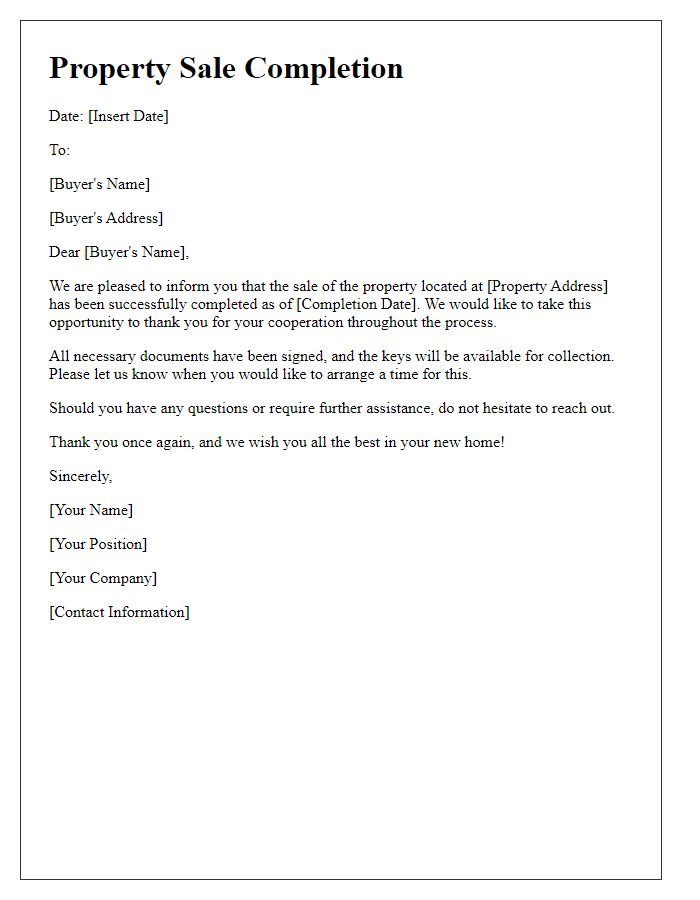

Property Details

The final stage of real estate transactions often involves the closure of property sales, including details such as the property address (e.g., 124 Maple Street, Springfield), purchase price (e.g., $300,000), and closing date (e.g., November 15, 2023). Buyers may receive a comprehensive breakdown of fees, including title insurance costs (approximately $1,200), property taxes (averaging $2,500 annually), and closing costs (ranging from 2% to 5% of the sale price). The property itself might include specifics such as square footage (e.g., 2,000 square feet), number of bedrooms (e.g., 4), and any contingencies having been settled (such as home inspections or financing approvals). Necessary documentation includes the deed transfer, escrow agreements, and legally binding signatures from both buyer and seller to finalize the acquisition.

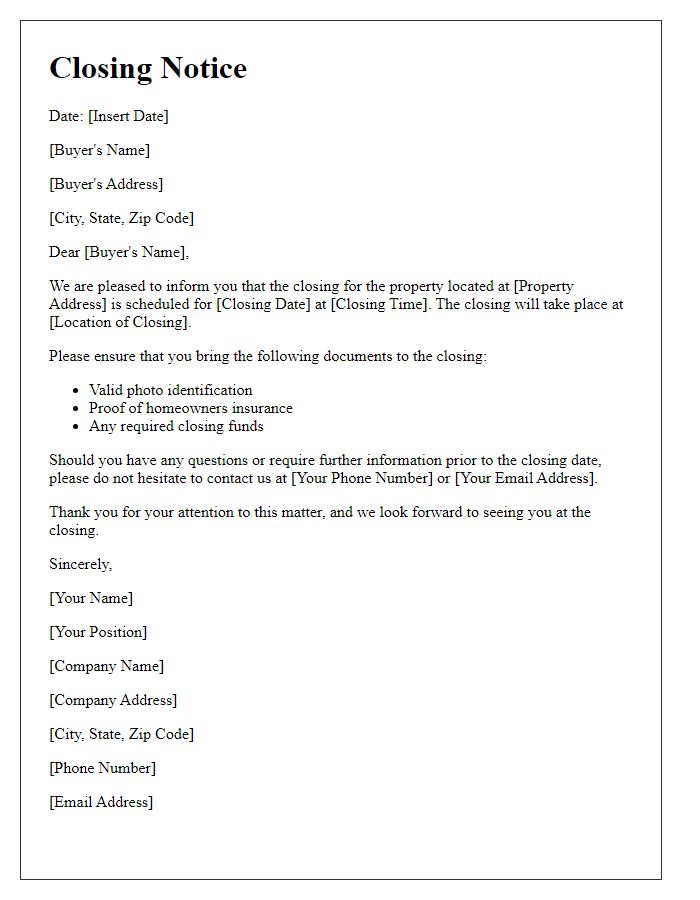

Closing Date and Time

The closing date and time for the real estate transaction, scheduled for November 15, 2023, at 10:00 AM, will take place at Green Valley Title Company located in Boise, Idaho. This crucial event will finalize the transfer of ownership for the property situated at 123 Maple Street, ensuring that all legal documents are executed and funds are disbursed. Participants include the buyer, seller, and real estate agents representing both parties, along with a title officer who oversees the closing process. It is essential for all parties to arrive punctually to facilitate a smooth transaction and adhere to state regulations.

Final Purchase Price

The final purchase price of residential properties in real estate transactions often reflects numerous factors including market conditions, property location (e.g., urban areas versus suburbs), and comparative market analysis of similar sales. As of October 2023, the average purchase price in the United States for single-family homes was approximately $400,000 according to the National Association of Realtors (NAR). Closing costs can add an additional 2-5% to overall expenses, encompassing fees like title insurance, appraisal services, and local governmental transfer taxes, which depend on regional regulations. Buyers and sellers typically finalize the purchase price during the closing meeting, where they sign documentation and transfer ownership, usually held in a neutral location like a title company or attorney's office. Quick market adjustments can also impact pricing, highlighting the importance of a timely assessment prior to the transaction's conclusion.

Payment Instructions

In real estate transactions, clear payment instructions are crucial for ensuring a successful closure. Buyers must transfer funds to an escrow account, typically held by a title company or attorney, to protect both parties. The total payment amount usually encompasses the purchase price, closing costs, and any other associated fees, which can range from 2% to 5% of the purchase price based on local regulations in areas such as California or Texas. Payment methods often accepted include bank wire transfers, certified checks, or sometimes credit card payments, subject to the policies of the escrow provider. Specific account details, including the account name, number, and routing number, are meticulously outlined in the closing statement to prevent errors. Timely payment is crucial, with funds required to be deposited prior to the agreed closing date, which typically falls within 30 to 60 days after the initial purchase agreement is signed.

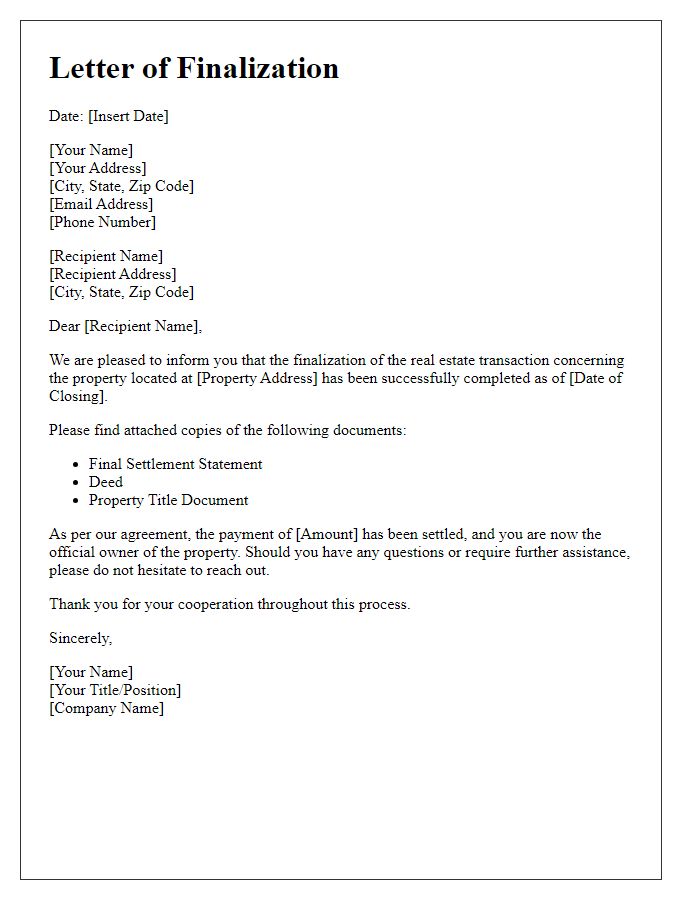

Seller and Buyer Information

Seller information includes name, address, and contact number of the individual or entity selling the property, typically a residential unit or commercial real estate. Buyer information contains the name, address, and contact number of the individual or entity purchasing the property. Accurate details are crucial for legal documentation and ensuring clear title transfer. Both parties may also include tax identification numbers for verification during the transaction process. Ensuring the inclusion of correct legal names and addresses is essential to prevent any disputes during the closing of the real estate transaction, which generally takes place at a designated title company or attorney's office.

Comments