Are you feeling overwhelmed by student loans that just don't seem right? You're not aloneâmany students and graduates encounter discrepancies in their loan accounts that can be frustrating and confusing. Understanding how to address these issues is key to regaining control over your financial future. Join us as we explore an effective letter template for disputing your student loans and ensure your voice is heard!

Account and Loan Details

Student loan disputes often arise due to issues with account status or loan terms. For instance, a loan account may have a balance discrepancy of $2,500 despite regular payments made over a two-year period. Borrowers may experience problems with the Federal Direct Subsidized Loan program, where interest accrual upon graduation is not accurately reflected, potentially leading to unexpected costs. Additionally, issues may arise from servicing companies like Navient, which might misreport payment history to credit bureaus, resulting in a negative impact on the borrower's credit score. Proper documentation, such as account statements, payment confirmations, and communication records with loan servicers, is essential for effectively addressing these discrepancies.

Specific Dispute Explanation

Student loan disputes often arise from discrepancies in loan amounts, interest rates, or repayment terms. A common example involves Federal Direct Loans, which must be accurately documented for borrowers. Issues may surface regarding disbursement amounts, often leading to confusion about what is owed. Misinformation from loan servicers can exacerbate disputes, particularly if borrowers feel misled about deferment options or inability to access public service loan forgiveness programs. Proper documentation, such as the Master Promissory Note, should be reviewed to identify any inconsistencies. Engaging in timely communication with the loan servicer is critical; borrowers should provide detailed evidence and clear explanations of the specific dispute to facilitate resolution.

Supporting Documentation

Supporting documentation for a student loan dispute often includes critical materials that substantiate the borrower's claims. Copies of loan agreements from specific lenders, such as Federal Direct Loans or private banks, can clarify loan terms and interest rates. Payment history statements, including documentation from servicers like Navient or Nelnet, may reveal discrepancies concerning repayment amounts or missed payments. Academic records, including transcripts from accredited institutions such as state universities or community colleges, can prove enrollment status, which may affect loan deferment eligibility. Invoices or billing statements can demonstrate any overcharges, while correspondence with loan servicers, such as emails or letters, will provide a timeline of communication regarding the dispute. Including these documents strengthens the case for the disputing student, ensuring that all relevant information is available for the review process.

Resolution Request

Student loan disputes often arise due to incorrect billing, misleading information, or disputes over eligibility. For instance, borrowers experiencing issues with federal loans, such as Direct Subsidized Loans, may face challenges related to interest capitalization when transitioning into repayment. Issues may also occur with private lenders like Sallie Mae, impacting credit scores in the event of delayed payments. Additionally, borrowers should be aware of the implications of forbearance periods, which can impact total loan repayment amounts, and ensure accurate documentation, including payment records and correspondence, is kept for reference during disputes. Prompt resolution requests, ideally submitted within 30 days of identifying discrepancies, can mitigate negative consequences on a borrower's financial standing.

Contact Information and Signature

A student loan dispute often requires clear communication regarding the borrower's identity and account status. Essential details include the borrower's full name, which typically aligns with the name on the loan account. The account number, often a unique identifier assigned by the lender or loan servicer, is crucial for processing the dispute efficiently. Contact information must encompass a current phone number, ideally a mobile number for immediate contact, and email address for electronic updates. The mailing address should correspond with the address on file with the loan servicer. Furthermore, the signature must be handwritten to validate the document, establishing a formal acknowledgment of the dispute raised. This signature, often accompanied by the date of signing, signifies the borrower's consent for any communication regarding the dispute and is generally placed at the end of the letter.

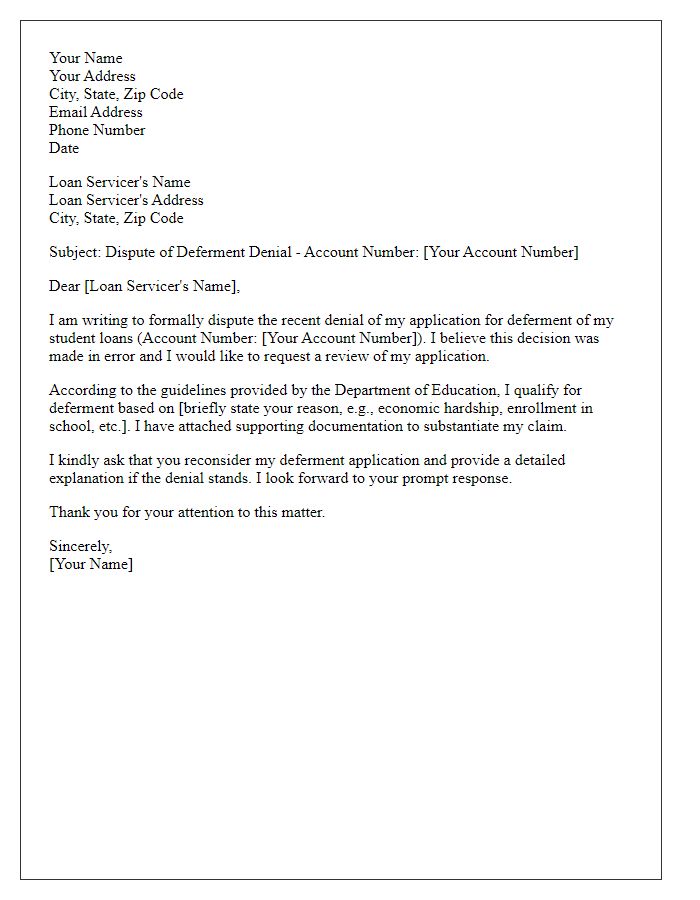

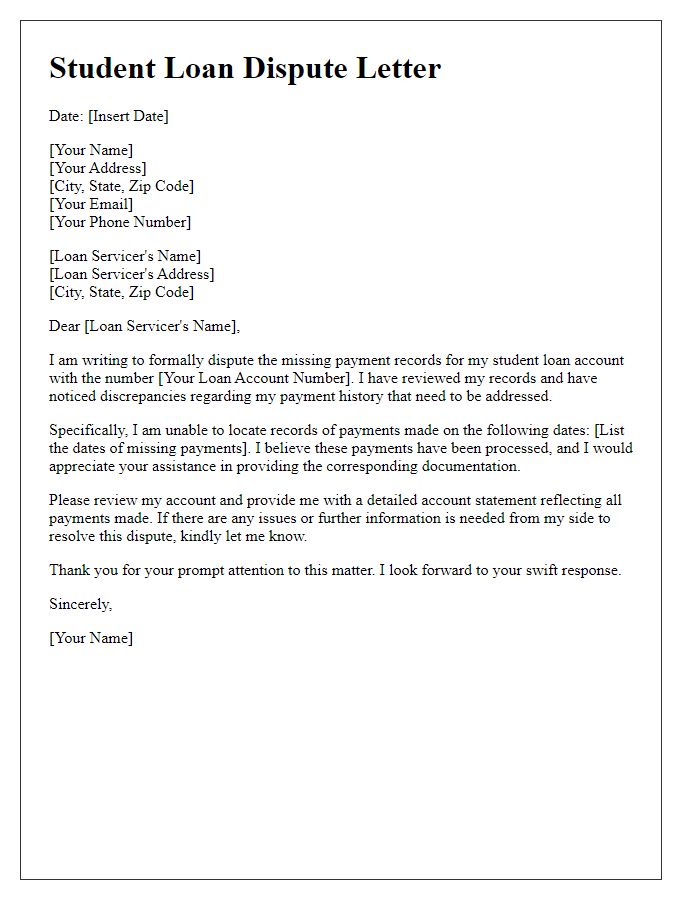

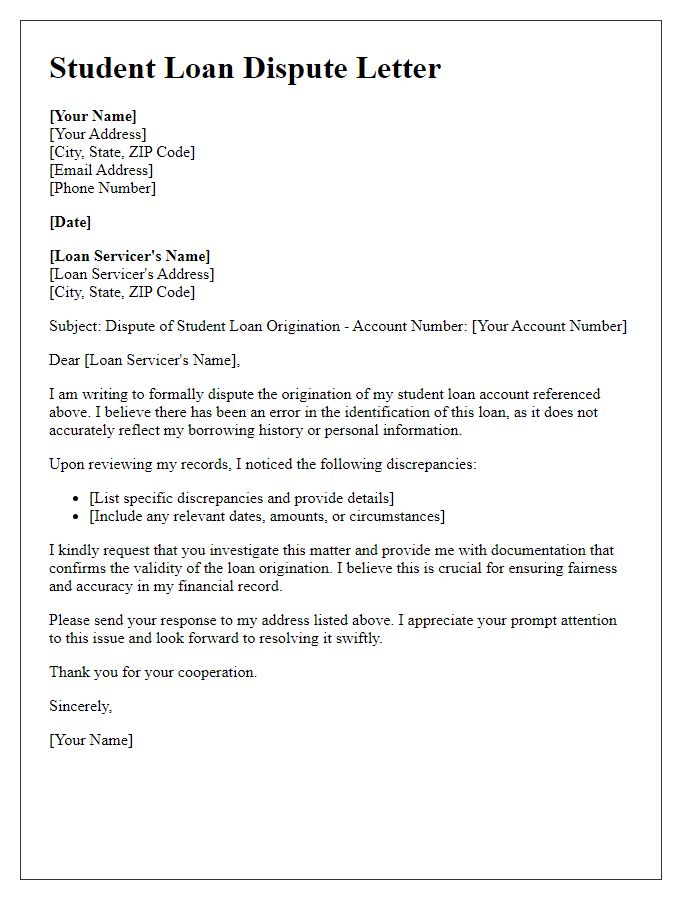

Letter Template For Student Loan Dispute Letter Samples

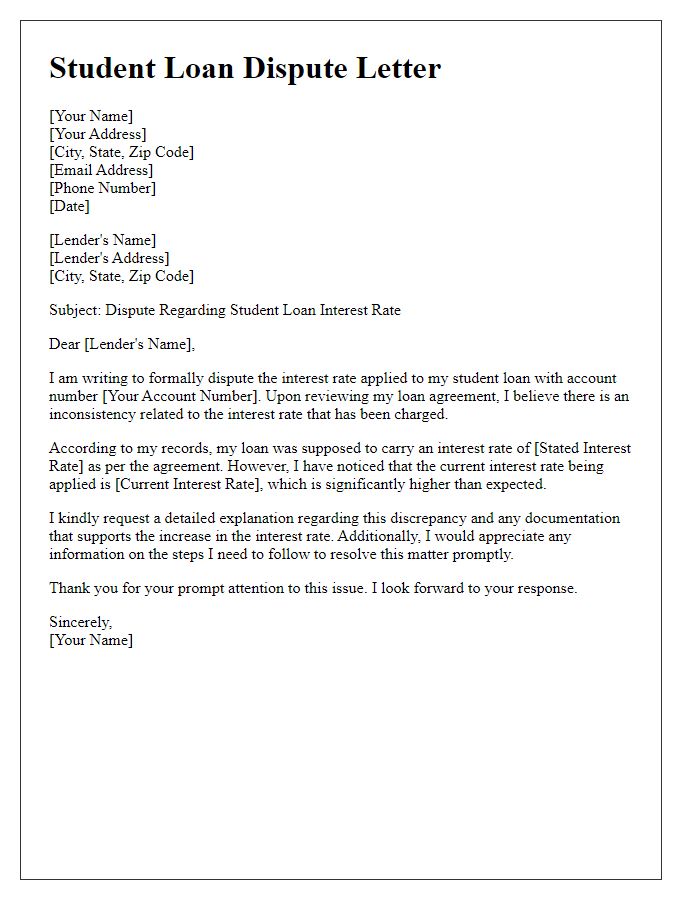

Letter template of student loan dispute related to interest rate issues.

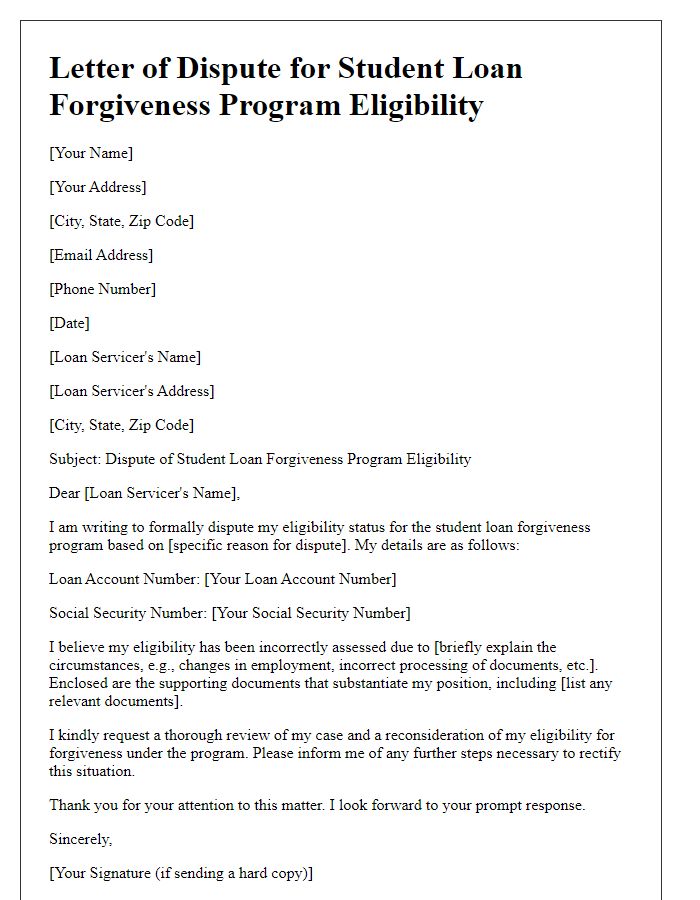

Letter template of student loan dispute on forgiveness program eligibility.

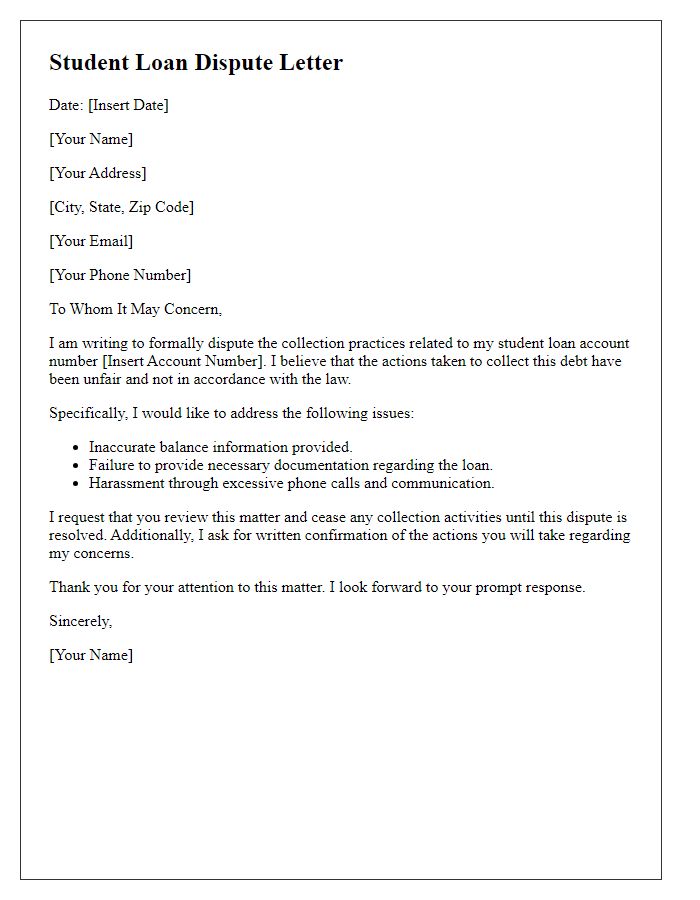

Letter template of student loan dispute addressing collection practices.

Letter template of student loan dispute regarding identity theft claims.

Comments