Are you looking to ensure your charity meets all the necessary legal requirements? Navigating the world of charity law compliance can feel overwhelming, but it's essential for the sustainability of your organization. From understanding registration protocols to adhering to financial reporting obligations, every detail matters in keeping your charity in good standing. Dive in with us as we explore essential letter templates that can help streamline your compliance efforts and safeguard your charitable missionâkeep reading to find out more!

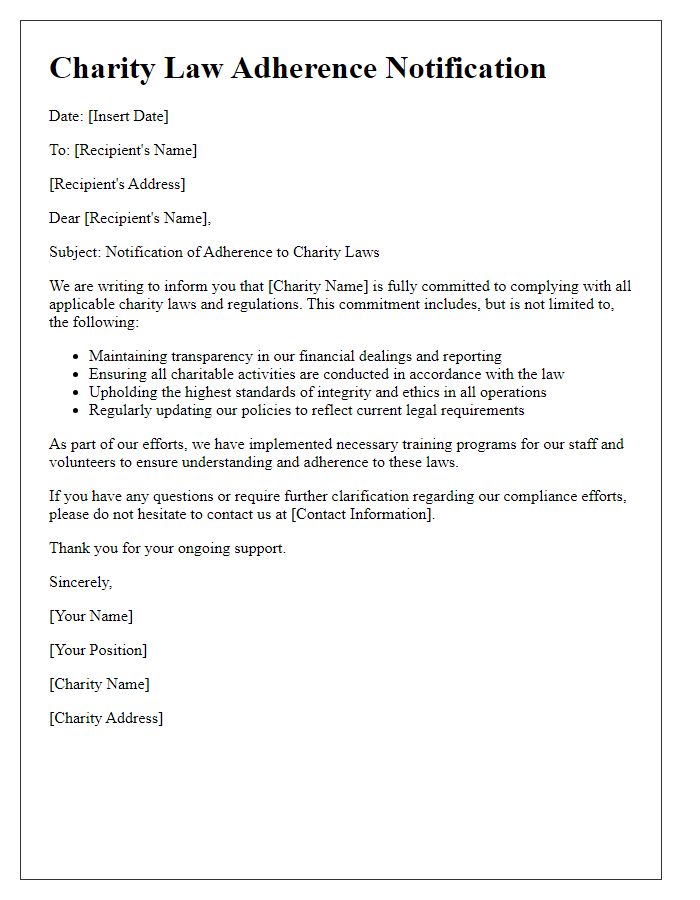

Legal Structure and Registration

Charitable organizations must adhere to specific legal structures and registration processes to ensure compliance with charity law. Nonprofit entities, such as 501(c)(3) organizations in the United States, must register with both state and federal authorities to gain tax-exempt status. Registration typically involves submitting forms, such as the IRS Form 1023, which requires detailed information about the charity's mission, governance, and financial plans. Additionally, many jurisdictions mandate that charities file annual reports, ensuring transparency and accountability in operations. Adherence to the legal framework not only facilitates funding opportunities but also provides public trust in the charity's activities, impacting donor engagement and volunteer participation.

Governing Documents and Policies

Charity organizations must adhere to rigorous regulatory frameworks when developing governing documents and policies to ensure compliance with charity law, particularly in jurisdictions like the United Kingdom and the United States. The governing documents, such as the Articles of Incorporation or the Bylaws, must outline key operational elements, including mission statements, governance structures, and membership guidelines. These documents should comply with specific legal requirements, such as those outlined by the Charity Commission (in the UK) or the Internal Revenue Service (in the US). In addition, charities must implement policies related to conflicts of interest, financial controls, and ethical fundraising practices to foster transparency and accountability. Regular reviews of these documents and policies are essential, especially in light of changing legislation, such as the Charities Act or IRS regulations, which can impact operational compliance and public trust.

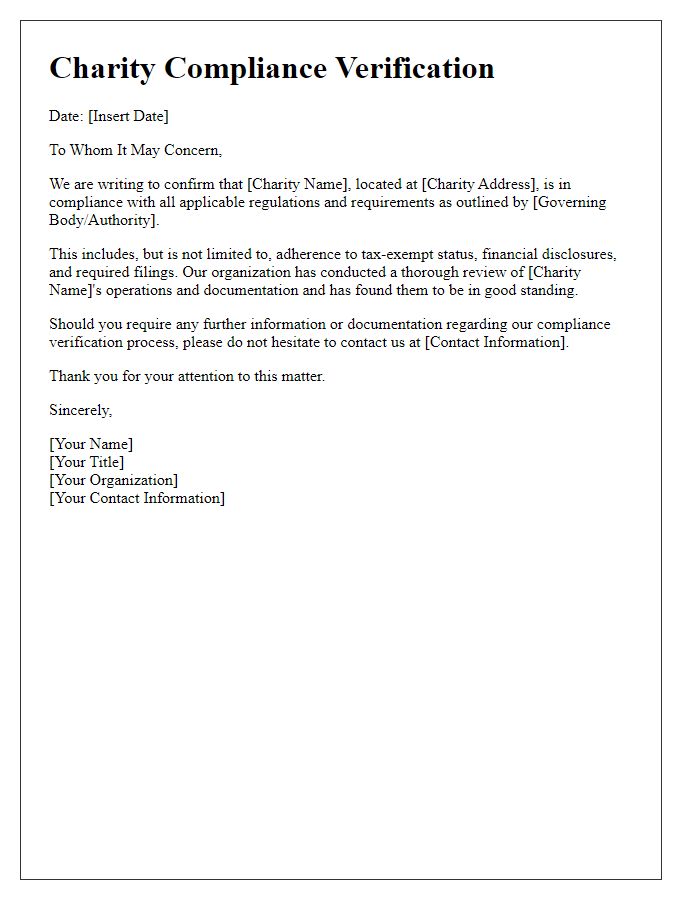

Financial Transparency and Reporting

Charity organizations must uphold financial transparency, ensuring compliance with regulations set forth by governing bodies such as the Internal Revenue Service (IRS) in the United States. Accurate reporting of financial statements, including Form 990 submissions, is critical, providing stakeholders with insights into revenue sources (donations, grants) and expenditure allocations (program service costs, administrative expenses). Transparency fosters trust, encouraging donor engagement and continued financial support. Compliance checks conducted annually help identify discrepancies, safeguarding the charity's reputation and operational integrity. Detailed disclosures regarding executive compensation and funding sources further enhance accountability, aligning with best practices in the nonprofit sector.

Board Governance and Accountability

Board governance and accountability are crucial for non-profit organizations to ensure transparency, ethical behavior, and adherence to legal regulations. Non-profit boards, such as those of 501(c)(3) organizations in the United States, must meet specific requirements, including holding regular meetings (at least annually), maintaining detailed minutes, and having a diverse group of members to represent various community interests. Compliance with charity laws, like the Sarbanes-Oxley Act, requires board members to uphold fiduciary duties, such as acting in the organization's best interest and avoiding conflicts of interest. Proper governance structures help foster trust among stakeholders, including donors, beneficiaries, and the public, ultimately strengthening the nonprofit's mission and sustainability. Additionally, state regulations, such as those enforced by the New York Attorney General, mandate financial accountability, requiring organizations to file annual financial reports and undergo independent audits to maintain operational integrity and donor confidence.

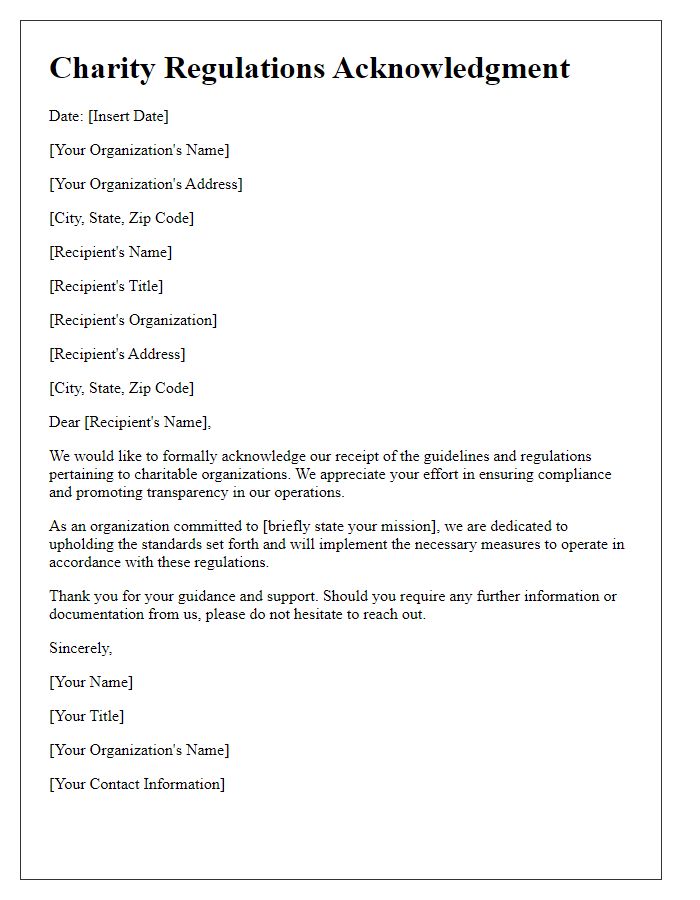

Fundraising and Donor Management

Charity organizations must ensure compliance with fundraising regulations to maintain public trust and adhere to legal standards. Fundraising activities, whether online or offline, require transparency about financial allocations, with at least 75% of funds raised designated for charitable purposes, according to regulations in multiple jurisdictions. Donor management practices must include secure handling of personal information, ensuring compliance with data protection laws such as GDPR (General Data Protection Regulation) in the European Union and CCPA (California Consumer Privacy Act) in the United States. Regular audits, detailed reporting, and ethical fundraising practices are essential to avoid penalties and build lasting relationships with donors. Additionally, awareness of specific local laws and guidelines set forth by bodies like the Charity Commission in the UK or the IRS in the U.S. further supports adherence to ethical standards in fundraising endeavors.

Comments