Creating a will and testament is an essential step in ensuring that your loved ones are taken care of according to your wishes after you're gone. Many people find the process daunting, but it can actually be quite straightforward with the right guidance. In this article, we'll explore the key components of drafting a will and provide a useful letter template to help you get started. So, let's dive in and empower you to secure your legacy!

Personal Identification

Creating a will and testament involves carefully detailing personal identification information. Essential personal identifiers include full legal name (matching official documents), date of birth (for establishing age and identity), Social Security number (for legal identification in the United States), and current address (to verify residency). Additionally, it is important to include marital status (single, married, divorced, or widowed) and names of dependents (children or other beneficiaries) for clarity on inheritance intentions. Other valuable specifics can encompass occupation (which may influence testamentary decisions) and a list of previously prepared legal documents (like previous wills or trusts), helping to ensure comprehensive estate planning and legal recognition.

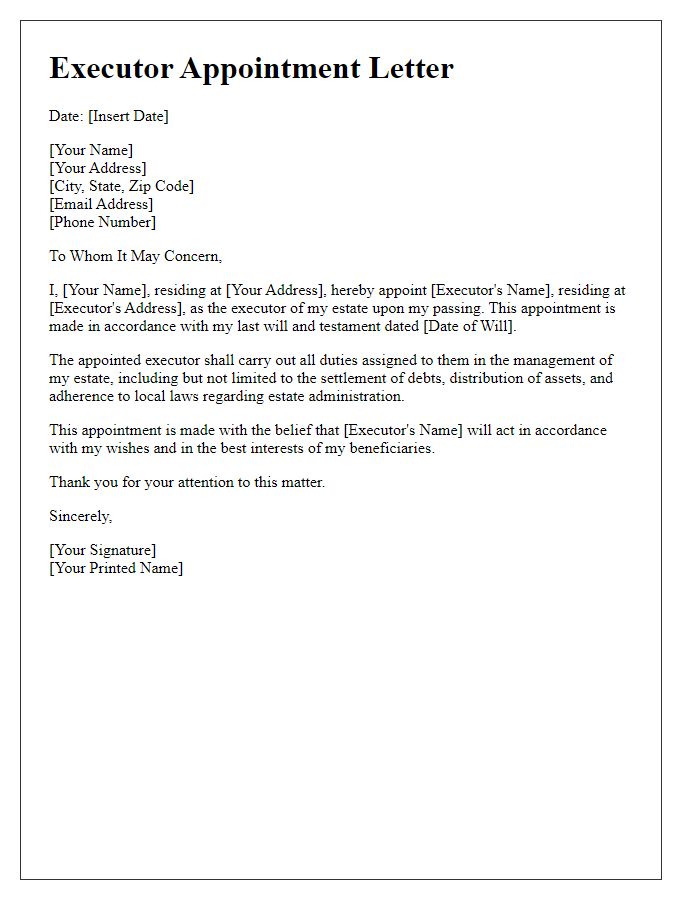

Executor Appointment

An executor appointment is a crucial element in a will, determining the individual responsible for administering the estate of the deceased. Appointing an executor requires careful consideration, ensuring the chosen person is trustworthy, organized, and capable of handling financial and legal matters. Ideal candidates often include family members, close friends, or legal professionals experienced in estate management. Executors must understand their responsibilities, such as settling debts, distributing assets, and managing estate taxes. In some jurisdictions, there are specific legal requirements for executor appointments, including age restrictions (usually over 18 years) and competency standards. Proper documentation, notarization, or witnessing might be required to validate the appointment in a court of law. Selecting an executor significantly impacts the efficiency and effectiveness of the estate's administration process after the testator's passing.

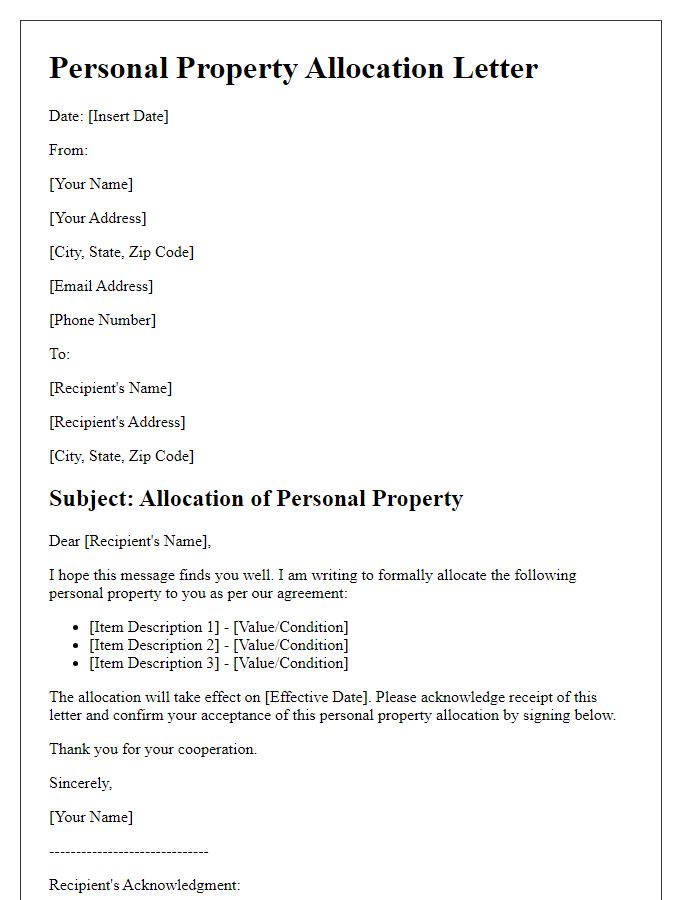

Asset Distribution

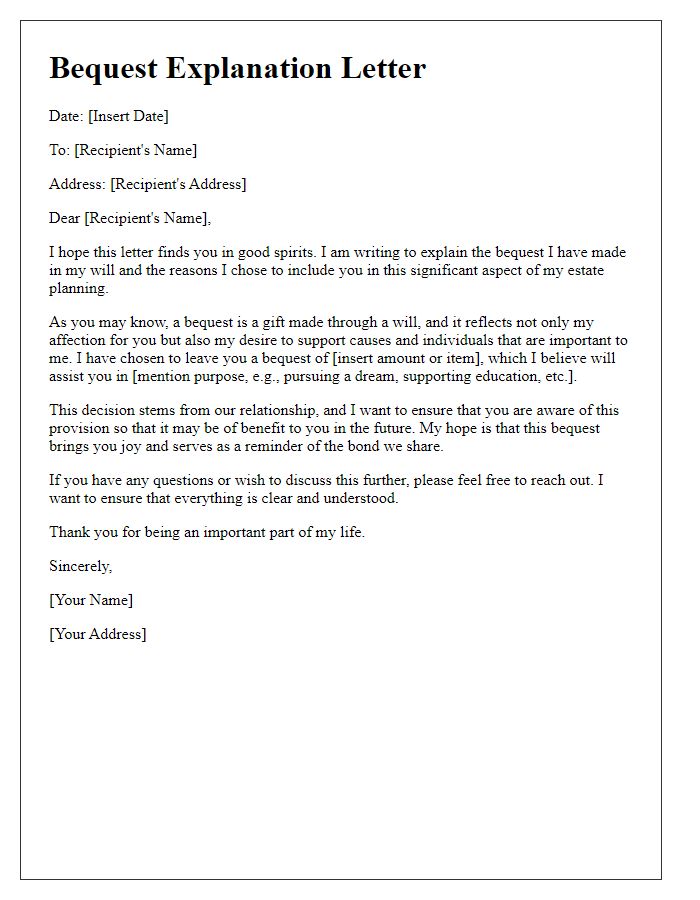

A will and testament outlines the distribution of assets, such as real estate (property with unique titles), bank accounts (financial resources held in depository institutions), personal belongings (valuables including jewelry and art), and investment portfolios (collections of stocks, bonds, and mutual funds). Executors (individuals appointed to carry out the will's provisions) play a crucial role in ensuring assets are allocated according to the deceased's wishes. Beneficiaries (individuals or organizations designated to receive assets) can include family members, friends, charitable organizations, or trusts. Legal requirements (such as notarization and witness signatures) vary by jurisdiction, necessitating attention to specific laws to ensure the will's validity. A clear asset distribution plan helps prevent disputes among heirs and clarifies intentions, facilitating a smoother probate process in the appropriate court.

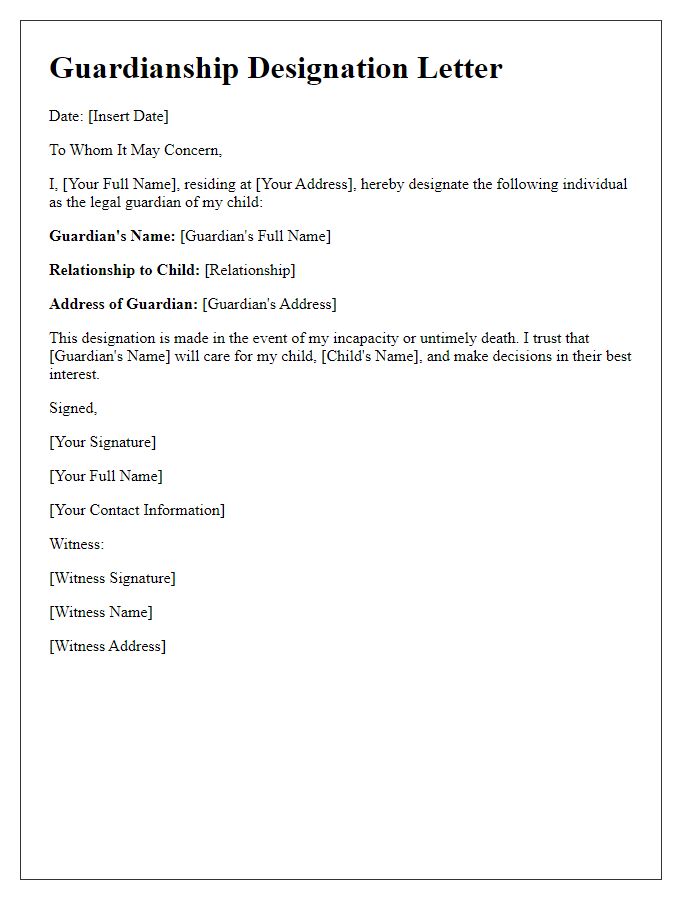

Guardianship Provision

When drafting a will and testament, the guardianship provision is a crucial section that outlines the appointment of guardians for minor children in the event of the parents' passing. This section serves to ensure that trusted individuals, such as family members or close friends, will assume responsibility for the child's upbringing, education, and welfare. Typically, the document will include the full names of the proposed guardians, their relationship to the deceased, and any relevant background information, such as age, occupation, and parenting experience. Additionally, the provision should outline backup guardians in case the primary guardians are unable or unwilling to serve. Detailed appointments can also address financial responsibilities, ensuring that guardians have access to resources for the child's needs, including education, healthcare, and general living expenses. Clarifying these choices provides peace of mind and aligns with the deceased's wishes for their children's future.

Witness and Notarization Requirements

Witness and notarization requirements play a crucial role in the validity of a will and testament, ensuring that the document is recognized and respected by legal systems. Typically, most jurisdictions mandate at least two witnesses, individuals who are not beneficiaries of the estate, to sign the will in the presence of the testator, the person creating the will. The witnesses verify that the testator is of sound mind and is signing willingly. Notarization may enhance the will's legitimacy, with a notary public certifying the authenticity of the signatures. In certain regions, self-proving wills allow testators to include a notarized affidavit from witnesses, streamlining the probate process (legal process through which a will is validated). Compliance with specific state laws is essential, as requirements can vary significantly, affecting enforceability.

Comments