Are you part of a nonprofit organization that needs guidance on compliance matters? Navigating the complexities of regulatory requirements can be daunting, but having the right letter template can make the process smoother and more efficient. This template can help ensure that your organization meets necessary legal standards while maintaining transparency with your stakeholders. Let's dive deeper into how this can benefit your nonprofit and keep you on track!

Organization's Name and Address

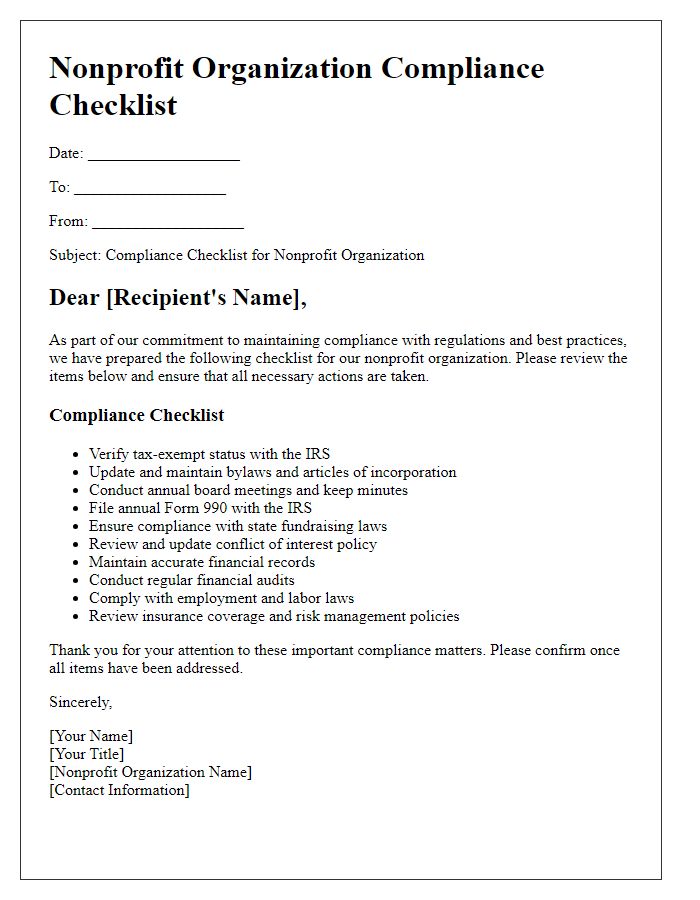

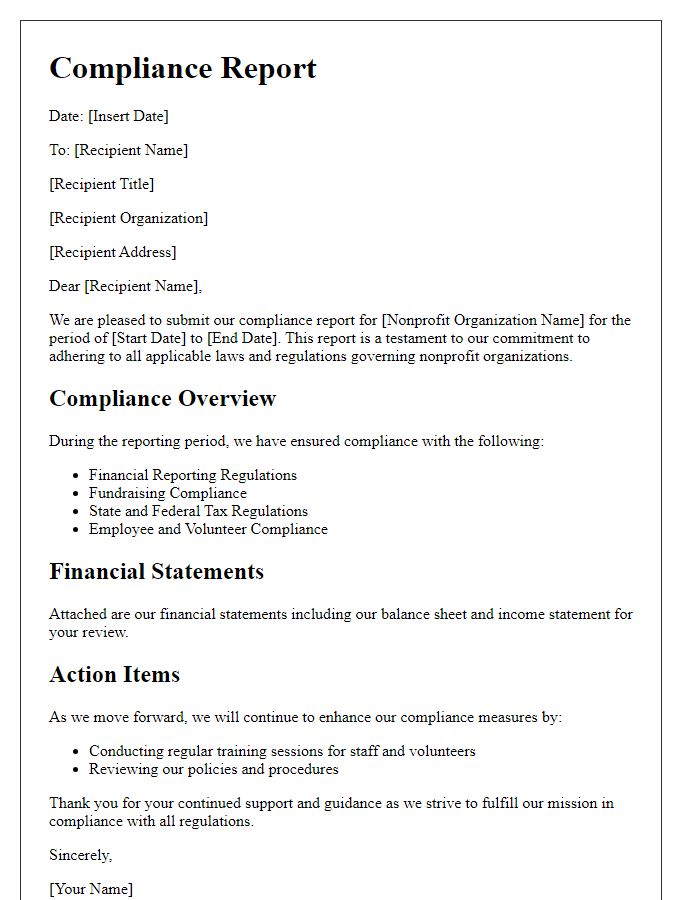

The compliance requirements for nonprofit organizations, such as 501(c)(3) entities in the United States, dictate that they must maintain accurate records and adhere to regulations set forth by the Internal Revenue Service (IRS). Compliance includes filing the annual Form 990, which outlines financial information, program activities, and governance practices from the previous fiscal year. Failure to comply can result in penalties, loss of tax-exempt status, or additional scrutiny from regulatory bodies. Furthermore, proper documentation of donations and expenditures is essential for transparency. Local laws also require nonprofits to register with state authorities, which varies by jurisdiction. Nonprofit organizations must ensure adherence to these regulations to maintain their operational integrity and public trust.

Clear Statement of Purpose

A clear statement of purpose is essential for nonprofit organizations, such as 501(c)(3) entities in the United States, to delineate their mission and objectives. This statement should articulate the organization's specific goals, whether in supporting education, alleviating poverty, or promoting public health, providing context for stakeholders. By detailing the intended beneficiaries, whether communities, individuals, or specific demographic groups, the purpose aligns with federal regulations and enhances transparency. Moreover, including measurable outcomes--like the number of people served annually or target fundraising goals--further solidifies the organization's commitment to its mission. Clarity in purpose not only guides internal strategies but also builds trust among donors, volunteers, and the communities served.

Compliance Requirements and Regulations

Nonprofit organizations must adhere to various compliance requirements and regulations to maintain their tax-exempt status and operate legally. These regulations often include filing annual Form 990 with the Internal Revenue Service, which provides detailed financial information about income, expenses, and programs. Additionally, state-level registrations may be necessary depending on the nonprofit's jurisdiction, such as charity registration in states like California or New York, which typically requires additional disclosures. Transparent record-keeping of donations and expenditures is crucial, ensuring accountability to donors and stakeholders. Compliance with the Sarbanes-Oxley Act, particularly regarding whistleblower policies and document retention, is also critical to preventing fraud. Nonprofits must remain vigilant about lobbying limits and political activities to avoid jeopardizing their tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Regular audits and adherence to reporting standards help ensure ongoing compliance and foster trust within the community and among supporters.

Documentation and Record-Keeping Protocols

Proper documentation and record-keeping protocols are crucial for nonprofit organizations to maintain compliance with federal and state regulations. Nonprofits must accurately document their financial transactions, including income from donations (averaging 30-40% of total revenue), grants (often exceeding $1 million annually), and fundraising events, which may require reporting to the IRS under Section 501(c)(3). Essential records include minutes from board meetings, budget projections, and donor information, all of which should be stored securely for a minimum of three years in accordance with IRS guidelines. Furthermore, organizations should implement a robust system for tracking receipts, invoices, and any correspondence regarding compliance matters to facilitate audits and ensure transparency. This meticulous approach to record-keeping not only fosters trust with stakeholders but also safeguards the nonprofit's tax-exempt status and eligibility for future funding opportunities.

Signature Lines for Authorization and Verification

Authorization and verification are critical components for nonprofit organizations to ensure compliance with regulations and internal policies. Clear signature lines facilitate accountability and confirm approval for financial transactions, contracts, and important documents. Typically, these signature lines will include designated roles such as Executive Director, Board Chair, and Treasurer, ensuring comprehensive oversight. The date alongside the signature provides a timeline reference for the approval process. Incorporating titles into signature areas minimizes ambiguity, enhancing clarity for all stakeholders involved. Adhering to these structured lines mitigates risks of miscommunication and non-compliance with governance requirements.

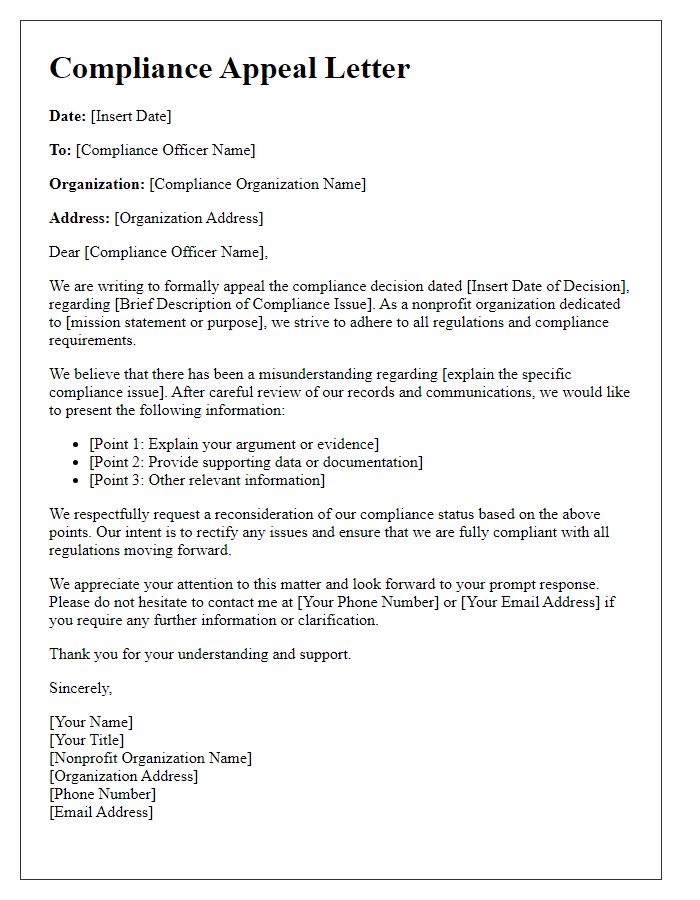

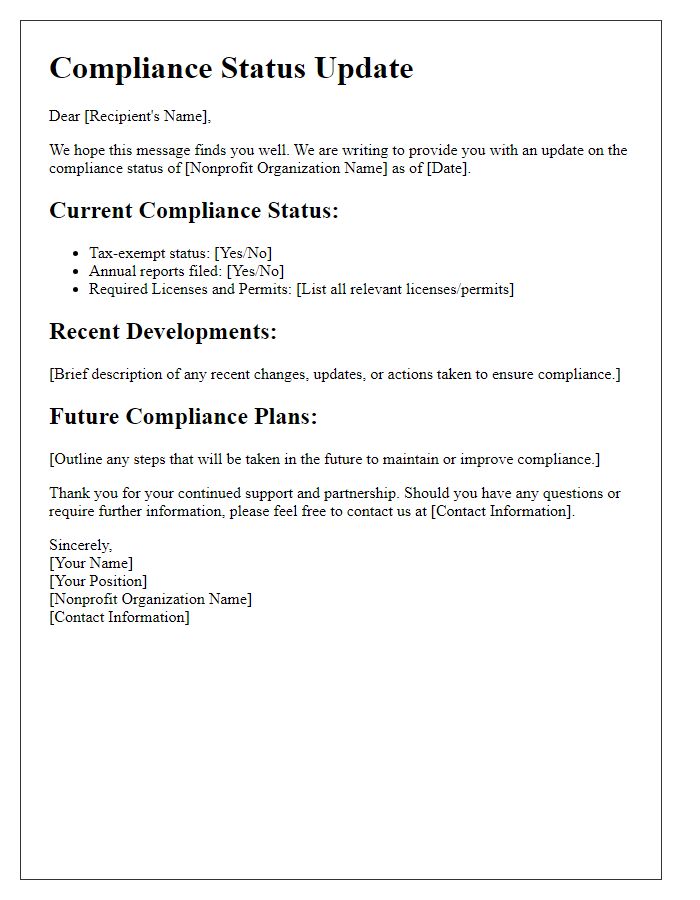

Letter Template For Nonprofit Organization Compliance Samples

Letter template of nonprofit organization compliance training invitation

Comments