Setting up recurring invoices can be a game changer for your business, making payment tracking easier and cash flow more predictable. By automating this process, you can save precious time and minimize the hassle of manual billing every month. Plus, clients appreciate the convenience of consistent billing, which helps maintain strong relationships. Curious about how to set up your own recurring invoice system? Read on to discover our step-by-step guide!

Business Information

Setting up recurring invoices is essential for businesses aiming for consistent cash flow and streamlined billing processes. Business information, including company name, address, and tax identification number (TIN), plays a critical role in ensuring the accuracy of invoices. The business name, prominently displayed, reflects brand identity, while the address (often including city, state, and ZIP code) ensures proper delivery and compliance with regional regulations. The TIN, necessary for tax purposes, helps maintain transparency with clients and tax authorities. Additionally, including contact information such as email and phone number facilitates communication regarding billing queries. Integrating these elements into the recurring invoice schema enhances professionalism and efficiency in financial transactions.

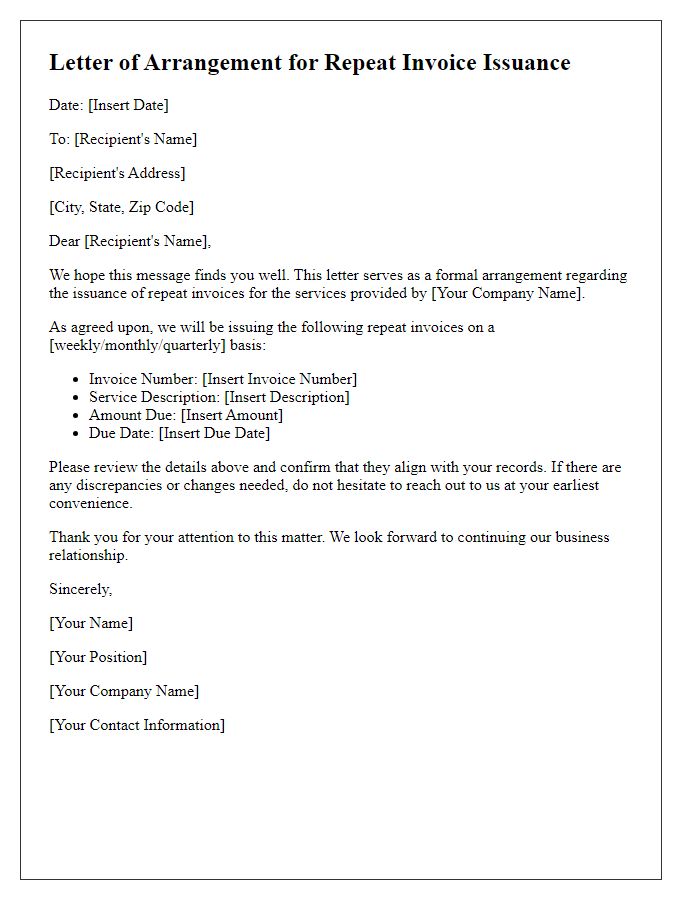

Client Information

Recurring invoice setup for client information includes essential details such as client name, contact person, billing address, email address, and phone number. Accurate data entry ensures timely invoicing (monthly, quarterly, or annually) for services rendered. Payment terms, such as due date and late fees, should be clearly specified. Additionally, including the invoice frequency (e.g., every first of the month) and specific service descriptions (like web hosting or consulting) enhances clarity. Important notes about the client's purchase order requirements or specific invoicing format may also apply. This systematic documentation promotes efficient billing communication and ensures consistent revenue flow.

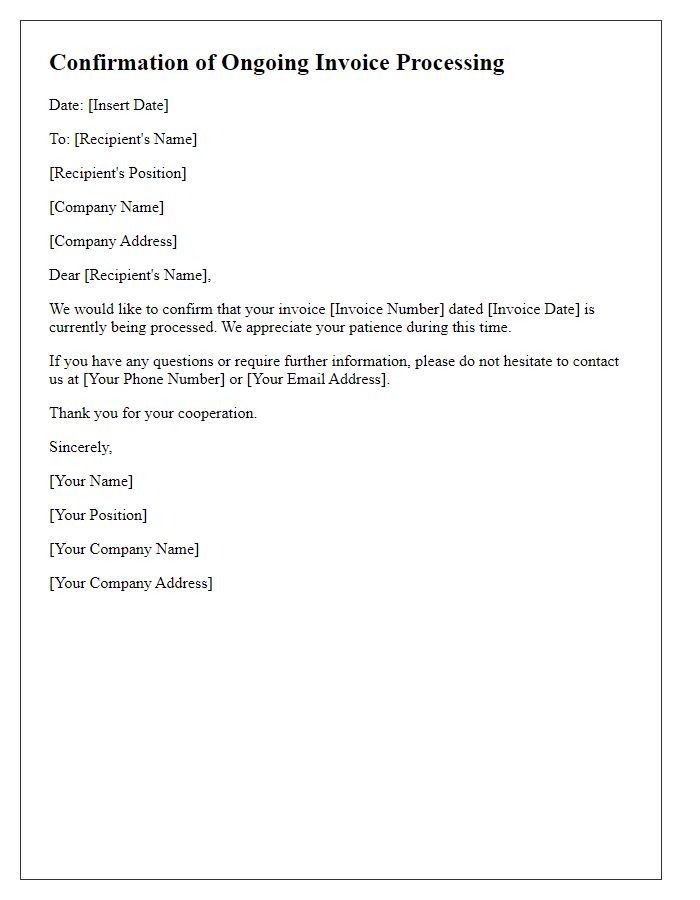

Detailed Invoice Terms

Recurring invoices play a crucial role in subscription-based services, ensuring consistent cash flow management for businesses. These invoices typically include key terms such as billing frequency, which can be monthly, quarterly, or annually. Payment methods accepted may include credit cards, direct bank transfers, or automated debit systems, enhancing convenience for clients. Clear due dates must be stated, usually upon receipt or a specific number of days post-invoice issuance, such as net 30 days. It is essential to outline late payment penalties, often a percentage of the outstanding balance, which serves as a deterrent for delays. Moreover, cancellation policies need to be explicitly defined, enabling customers to understand the process and any notice periods required.

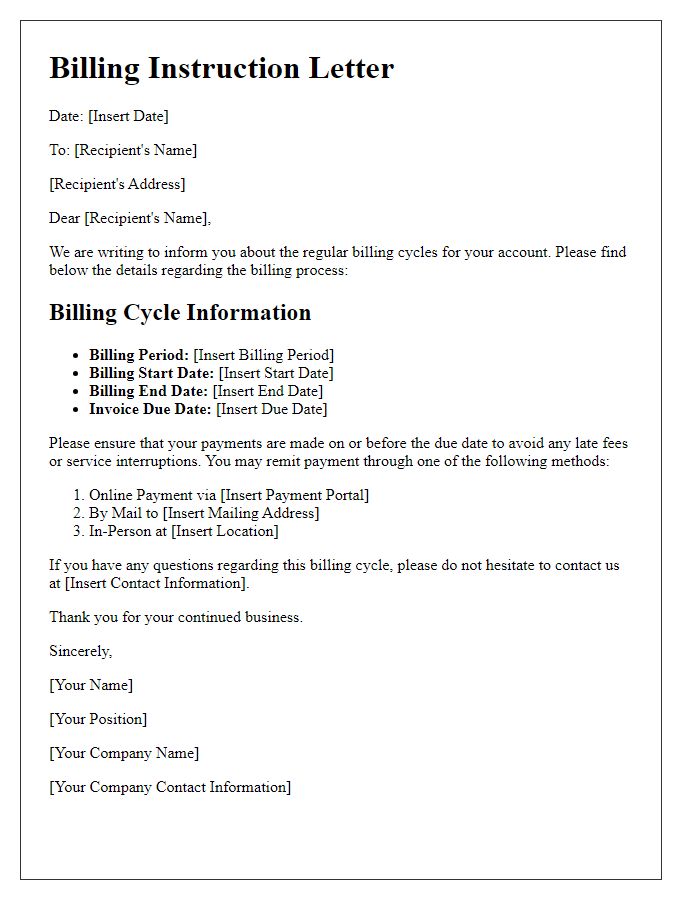

Payment Method and Instructions

Recurring invoices facilitate consistent payment relationships, especially in subscription services or regular contract agreements. Payment methods like bank transfers, credit cards, and digital wallets (e.g., PayPal, Stripe) simplify transactions, enhancing customer convenience. Clear instructions such as billing frequency (monthly, quarterly) and due dates (e.g., 1st of each month) help maintain payment consistency. Providing contact information for billing inquiries ensures prompt communication, fostering strong business relationships. Implementing automated reminders can significantly reduce overdue payments, further streamlining cash flow management for businesses.

Contact Information for Queries

For recurring invoice setups, it is crucial to provide clear contact information for queries, ensuring smooth communication between the service provider and the client. A designated email address, such as support@companyname.com, can facilitate quick responses to any invoicing questions. Additionally, a dedicated phone number, for example, (123) 456-7890, allows for direct communication, enhancing customer satisfaction. Including operational hours, like Monday to Friday, 9 AM to 5 PM, ensures clients are aware of when they can expect assistance. Incorporating a support ticket system can also streamline inquiries, providing an organized approach to addressing issues promptly.

Comments