Are you finding it challenging to manage your payment schedule for invoices? You're not alone, as many businesses experience the need to adjust their payment terms from time to time. It's essential to communicate effectively with your clients about these changes to maintain a positive relationship and ensure clarity. Dive in deeper to explore tips on crafting the perfect letter for an invoice payment schedule change!

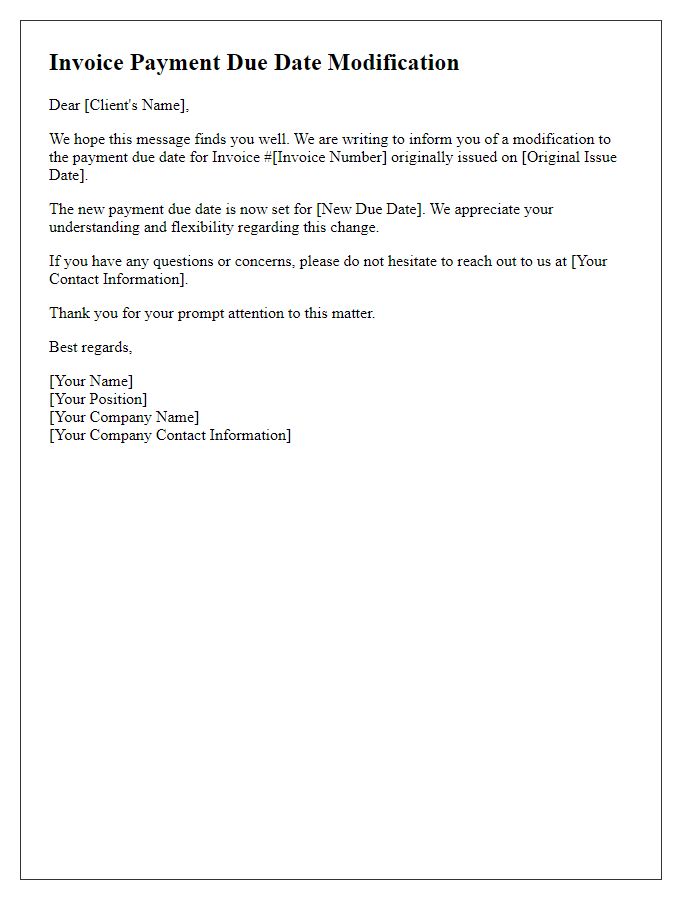

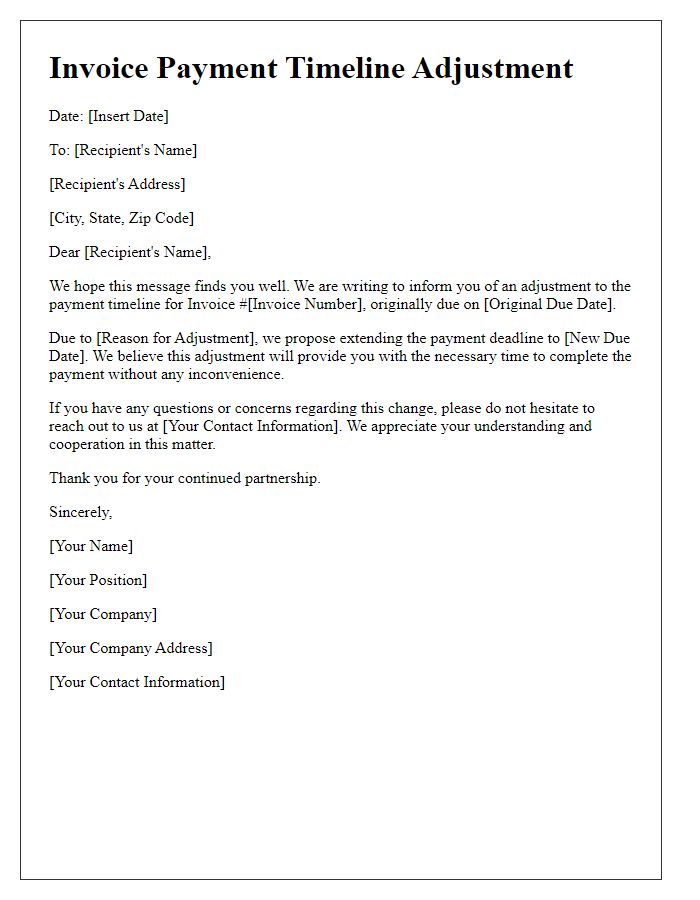

Clarity and specificity of new payment terms

Invoicing enhancements can significantly improve cash flow management for businesses. A revised payment schedule enhances clarity, ensuring customers understand new terms. For instance, a transition from a Net 30 to a Net 15 payment term can accelerate cash inflow, allowing for quicker reinvestment in operations. Specificity in due dates such as the 15th of each month, alongside penalties for late payments, reinforces accountability. Detailed instructions on acceptable payment methods, including bank transfers or credit card payments, streamline the process. Effective communication about these changes fosters transparency and strengthens client relationships, essential for long-term business success.

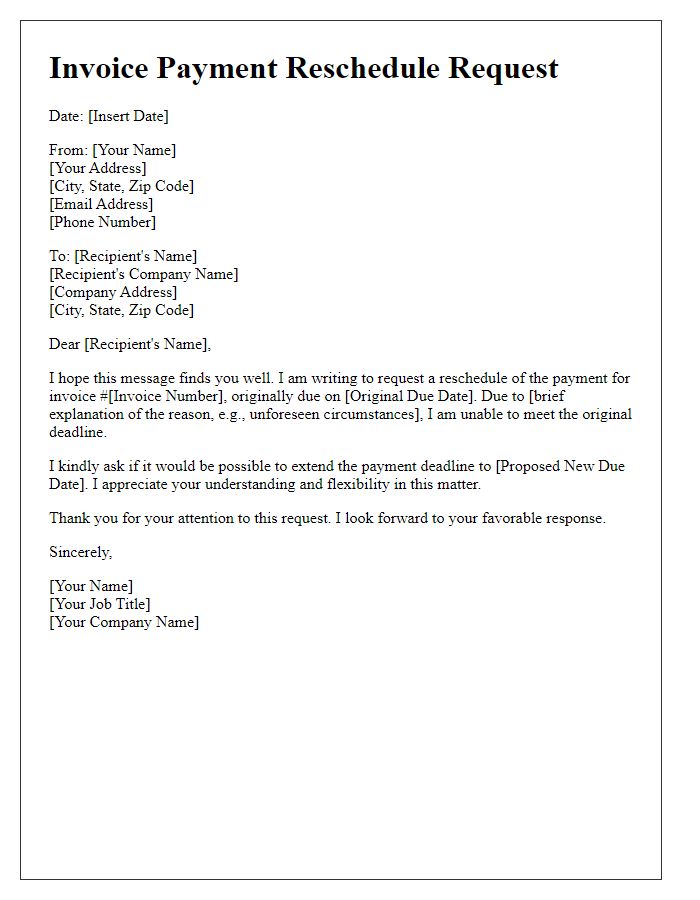

Professional and courteous tone

The adjustment of invoice payment schedules significantly impacts cash flow management for businesses. Clients often request modifications due to unforeseen expenses or economic fluctuations. A courteous and professional approach fosters goodwill and encourages open communication. Providing clear terms regarding new payment dates and possible interest penalties ensures transparency. Such adjustments may also involve a formal confirmation process, including written agreements outlining the revised schedule. In industries such as construction or consultancy, timely updates regarding cash flow can help maintain positive client relationships and streamline project financing.

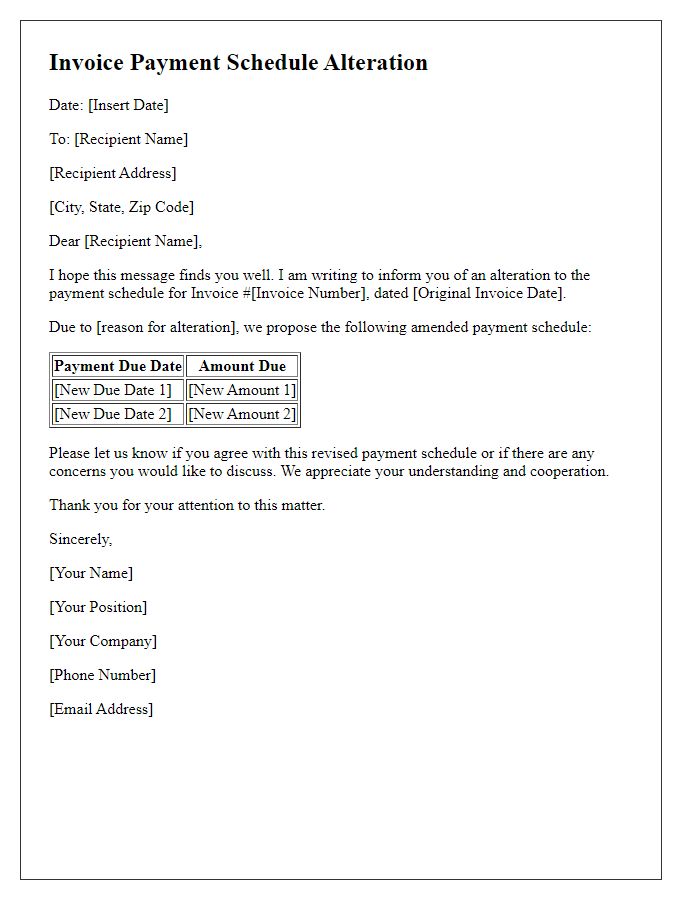

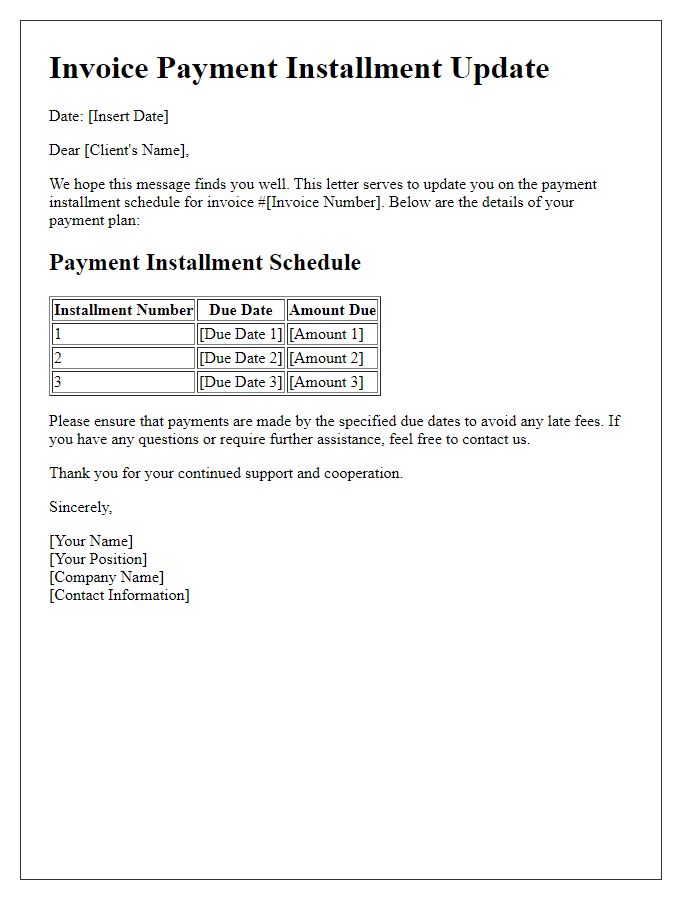

Inclusion of invoice and account details

A revised invoice payment schedule is essential for maintaining clarity in financial transactions, especially for corporate clients. The schedule should detail invoice numbers, such as INV-2023-00123, along with the corresponding account details, including bank account number 123456789 and routing number 987654321 for seamless fund transfers. Payment due dates, such as the 15th of each month, ensure timely processing and help avoid late fees. Clear communication regarding changes, such as new payment methods or adjusted due dates, is crucial for fostering trust in business relationships. Additionally, outlining penalties for late payments might be necessary to uphold accountability.

Explanation for schedule change

Changes in the invoice payment schedule can occur due to various reasons such as unexpected financial constraints, a shift in project timelines, or adjustments in cash flow management. For businesses, implementing a payment schedule alteration is crucial to maintain liquidity. A company may request a shift from a 30-day payment term to a 60-day term, allowing additional time for processing and ensuring all funds are appropriately allocated. Clients should be informed about the specific reasons behind the adjustment, emphasizing the importance of maintaining a good working relationship and ensuring that services continue without disruption. Clear communication regarding new due dates and payment methods is essential for a seamless transition.

Contact information for further inquiries

The invoice payment schedule change may require direct communication for clarification and adjustments. Businesses typically provide contact information such as phone numbers (including area codes) for immediate assistance, email addresses for written inquiries, and sometimes specific contact names (like accounts receivable managers) to enhance the efficiency of communication. Essential details can include office hours (e.g., 9 AM to 5 PM, Monday to Friday) to ensure inquiries are made during available times. Providing a physical mailing address can also be beneficial for formal correspondence.

Comments