Are you feeling a bit confused about the ins and outs of international invoicing? You're not alone! Many businesses face challenges when it comes to understanding the nuances of invoices across borders, from currency conversions to tax regulations. Don't worry, we've got you coveredâkeep reading for a simple guide to clarify your international invoicing process!

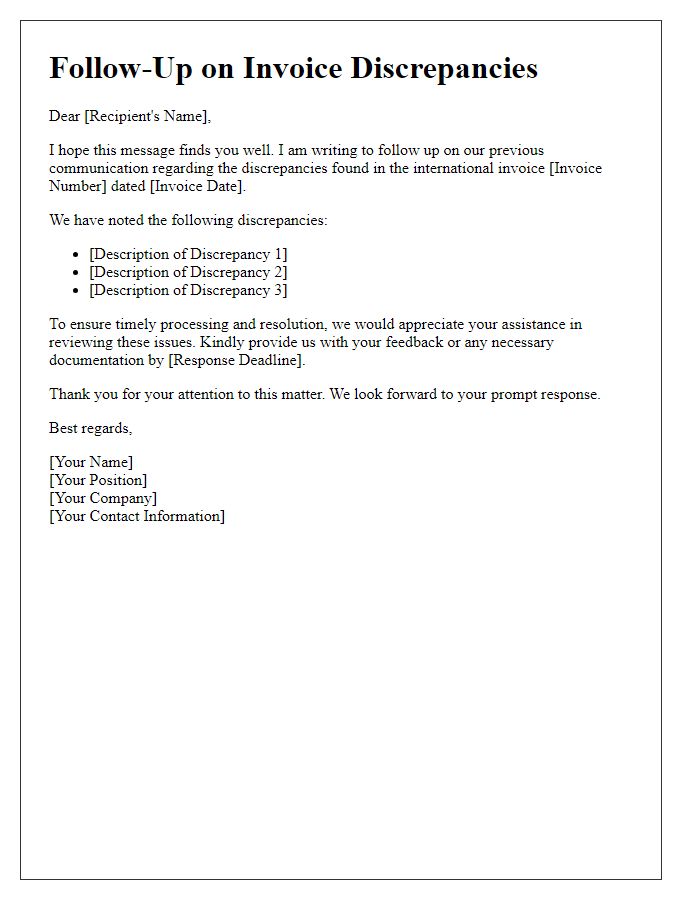

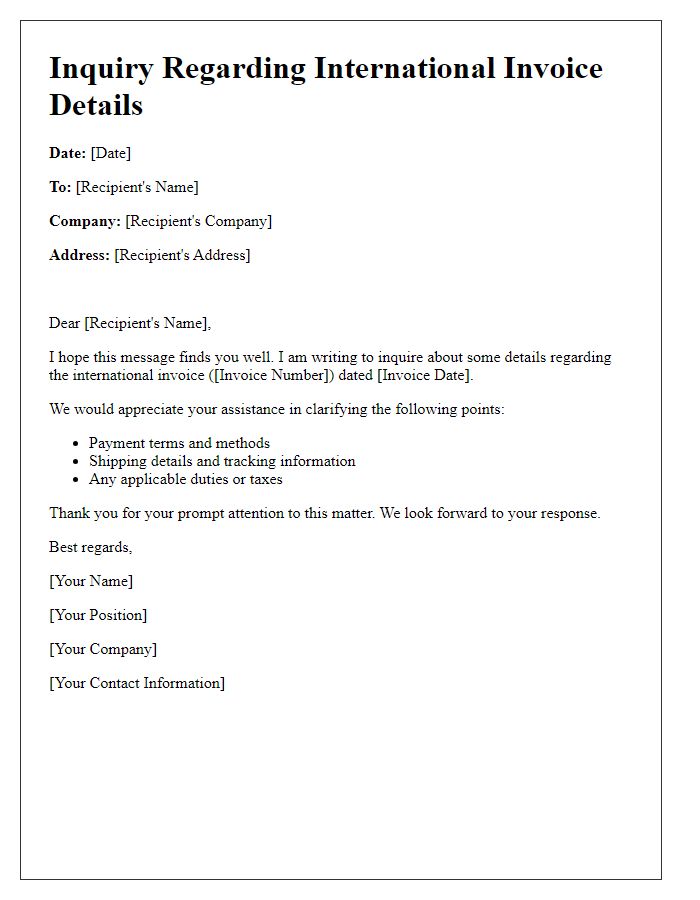

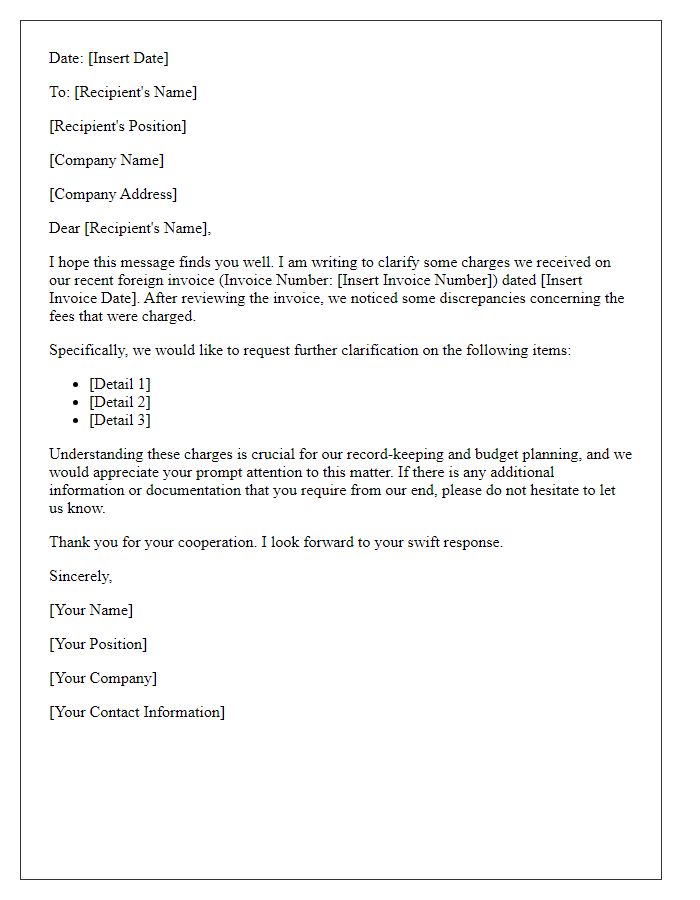

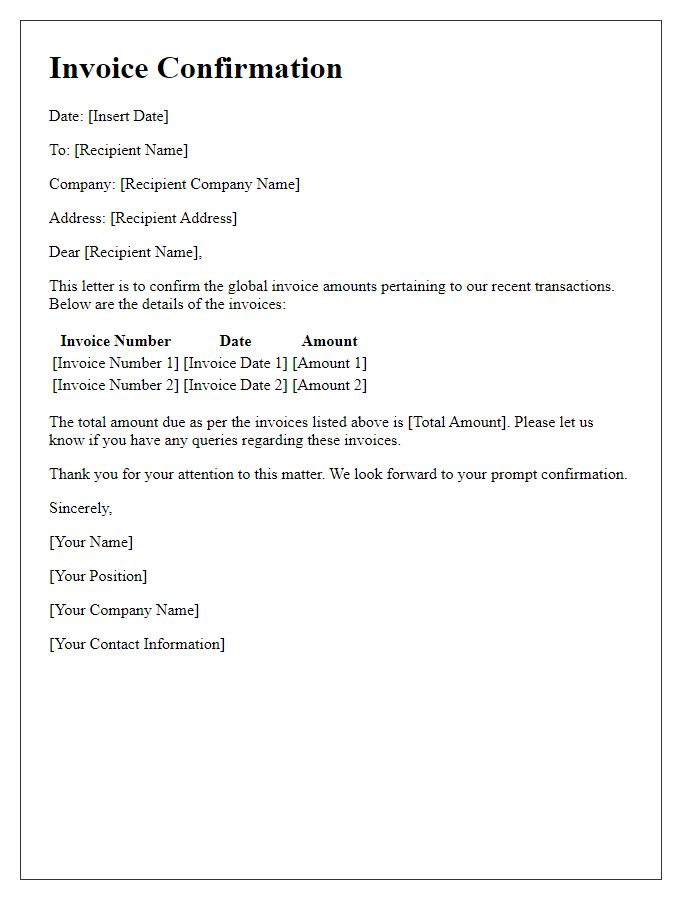

Clear subject line

International invoices often require clarity in terms of itemization and tax implications for various regions. Discrepancies in the invoice can lead to payment delays, especially with customs in places like the European Union or Canada, where specific tariff codes must be adhered to. Invoice details, such as total amounts, currency conversion rates, and payment terms, need to be precise to ensure compliance with international trade laws. Payment methods and banking information, such as SWIFT codes, are crucial for smooth transactions across borders, reducing the risk of financial penalties or misunderstandings.

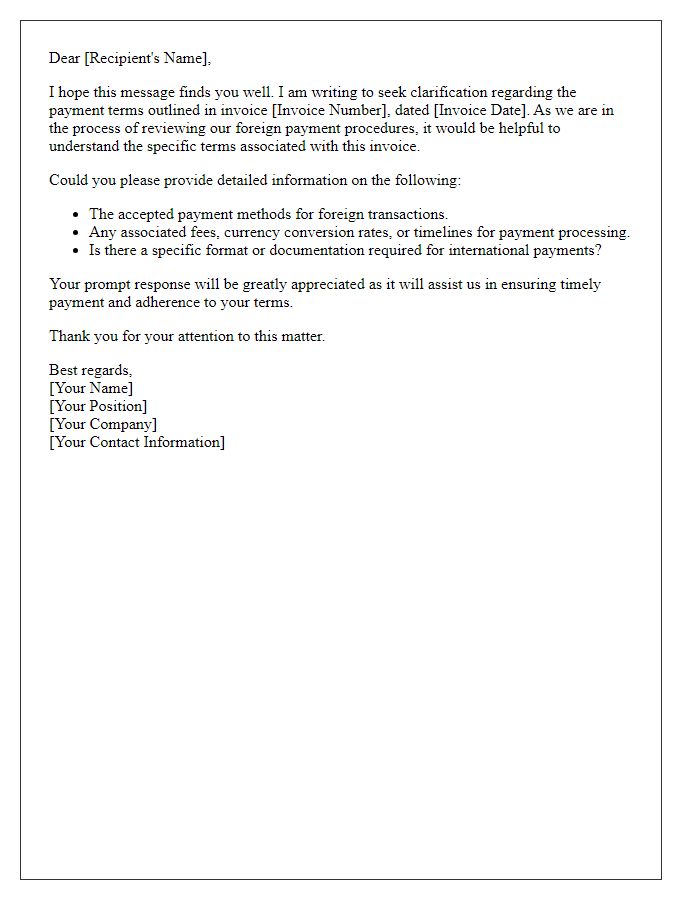

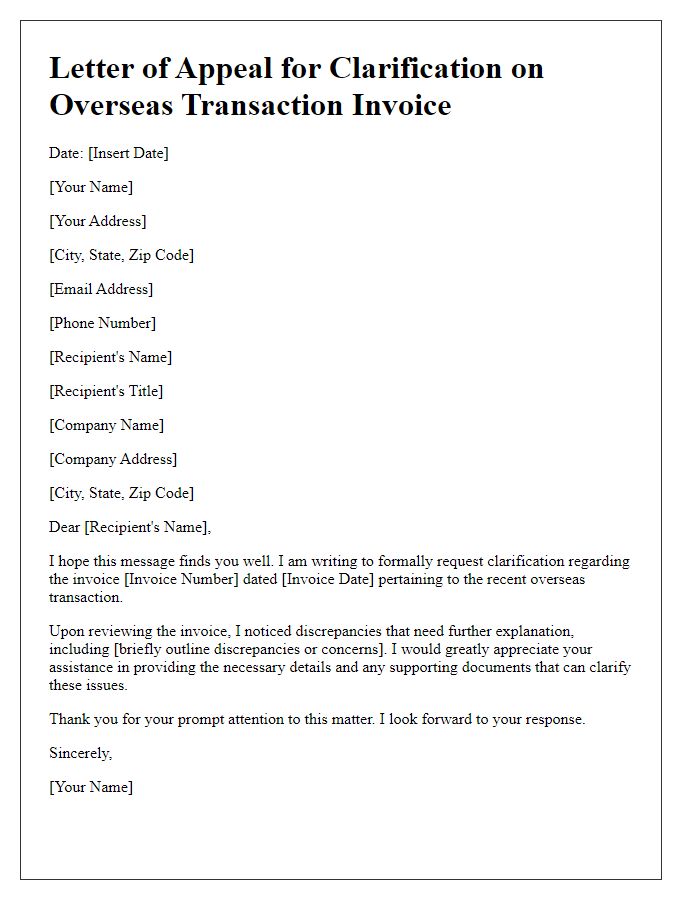

Formal greeting

A formal greeting in a professional context, especially in international invoicing, establishes a courteous tone. For example, "Dear [Recipient's Name or Title]" serves as a respectful salutation, while "To Whom It May Concern" is suitable for situations where the recipient's name is unknown. Maintaining a polite and professional demeanor is essential for effective communication.

Invoice details and specifics

Invoices serve as essential financial documents in international trade, providing clarity on transactions. Specific invoice details may include the invoice number, which uniquely identifies the transaction, and the date of issuance, often entailing a reference to the shipment date. The buyer and seller's names along with their addresses, typically including country information, establish the parties involved. Itemized lists specify quantities, descriptions, unit prices, and total amounts due, often including currency specifications such as USD or EUR. Other specifics might encompass shipping terms outlined by Incoterms (like FOB or CIF), which dictate responsibilities regarding transportation and risk, as well as payment terms, which detail when payments are due and acceptable methods. Customs codes, required for tariff classification, may also be noted, ensuring compliance with international trade regulations.

Request for clarification or action

International invoices often require careful attention to detail to ensure accuracy and compliance with different regulations. A common issue is discrepancies in amounts or missing information on invoices from various countries. For instance, an invoice for $10,000 from a supplier in Germany may lack specific tariff codes required by U.S. Customs, leading to potential delays in shipments. Additionally, exchange rates might fluctuate; therefore, documenting the exchange rate at the time of the transaction is crucial for transparency and should be included in the invoice. Accurate terms of payment, alongside clearly stated delivery dates, help avoid misunderstandings. Immediate clarification on these points ensures timely processing of payments and maintains smooth international trade relations.

Contact information and closing remarks

An international invoice clarification often requires clear contact information for effective communication. Include the sender's name, address, phone number, and email address prominently at the top. For the recipient, provide their company name, address, and contact details to ensure the message reaches the right contacts. It's crucial to specify the details of the invoice in question, such as the invoice number, date issued, and any associated purchase order numbers. In closing remarks, invite the recipient to reach out with any questions or additional information needed. End with a courteous closing statement, expressing appreciation for their attention to this matter and the expectation of their prompt response.

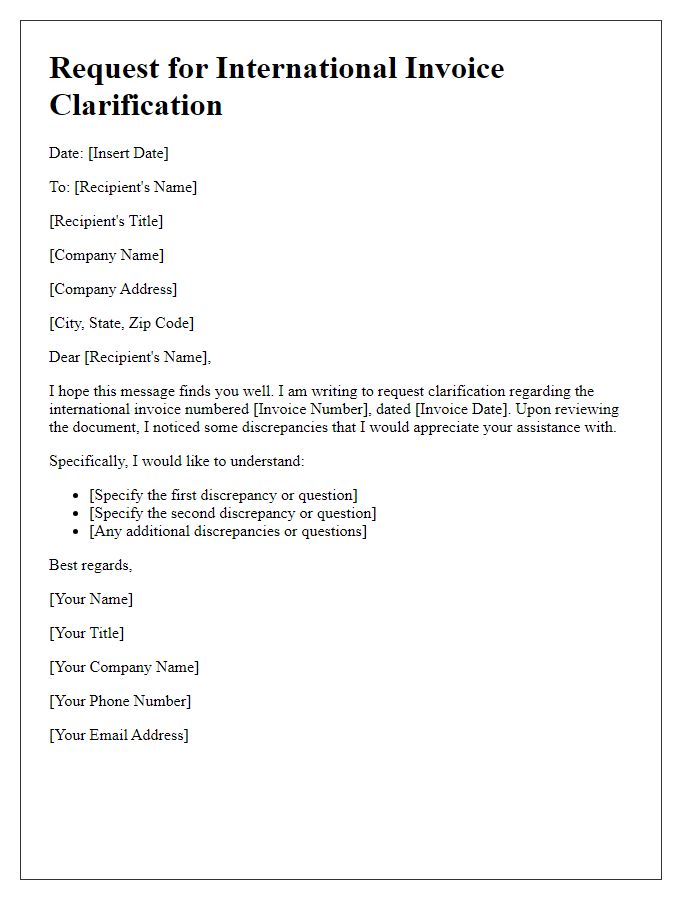

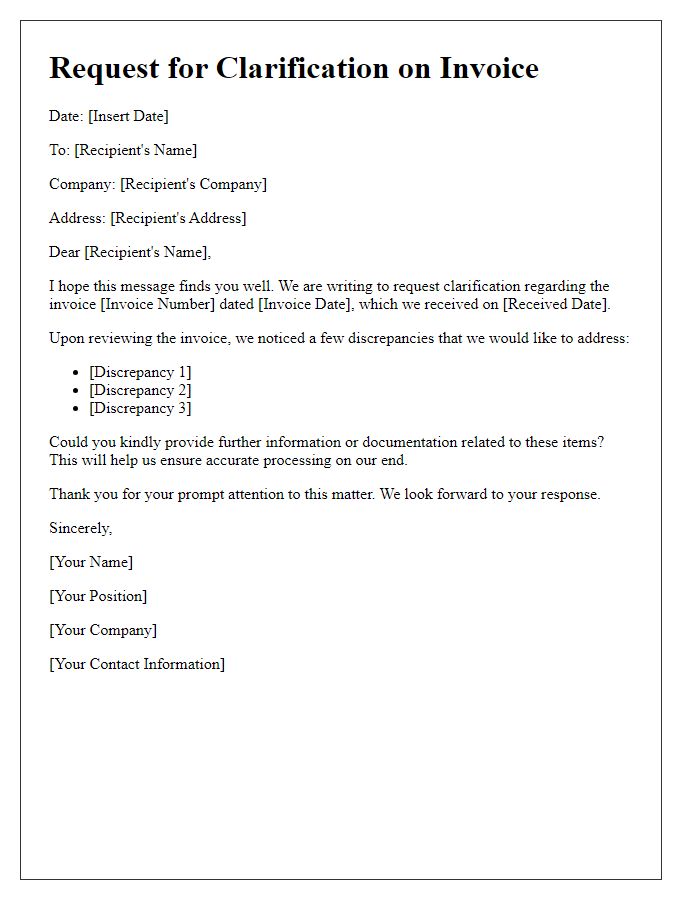

Letter Template For International Invoice Clarification Samples

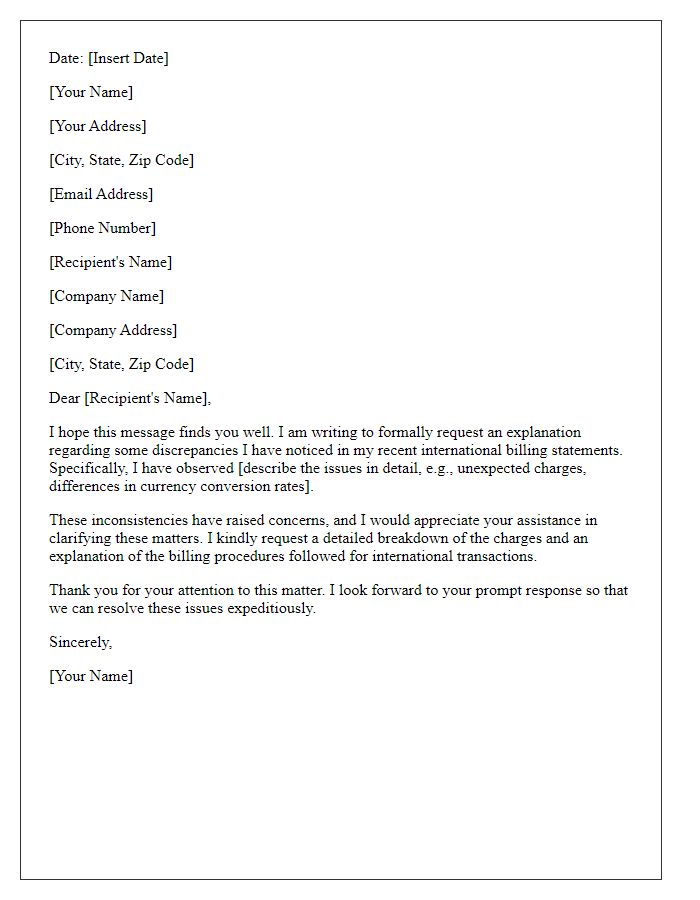

Letter template of explanation request for international billing issues.

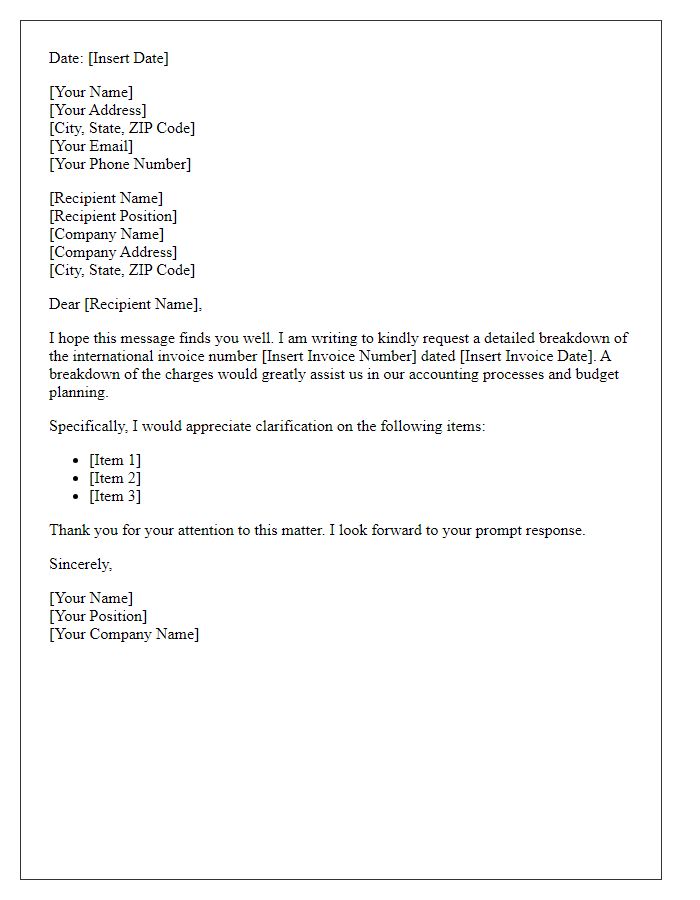

Letter template of request for detailed breakdown of international invoice.

Comments