Are you tired of waiting for payment confirmations that never seem to arrive? It can be frustrating chasing down those elusive updates, especially when you need to keep your finances in order. In this article, we'll explore effective ways to communicate your payment confirmation requests clearly and professionally. So let's dive in and learn how you can streamline this processâread more to get started!

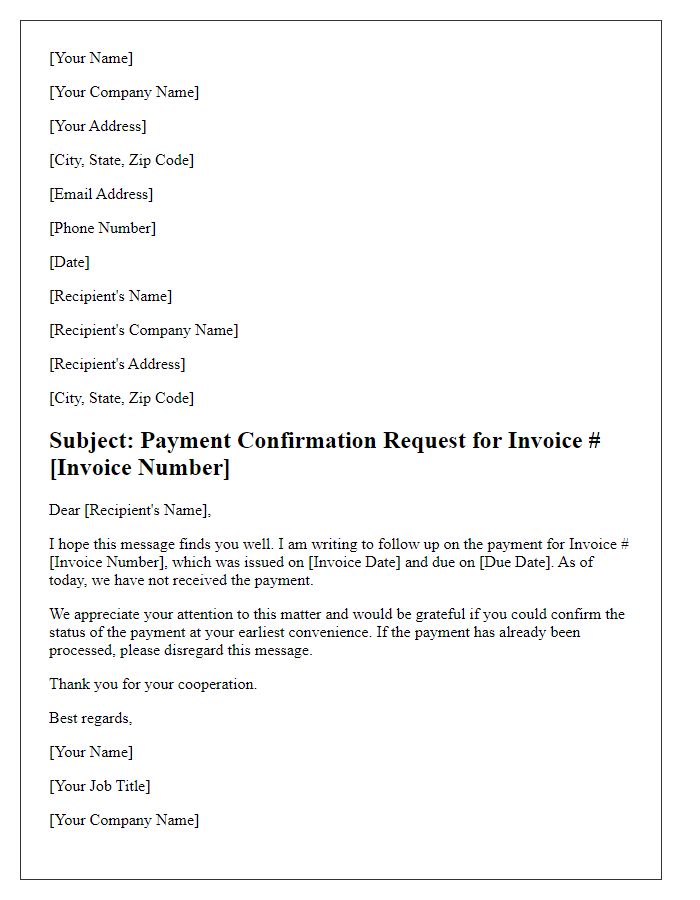

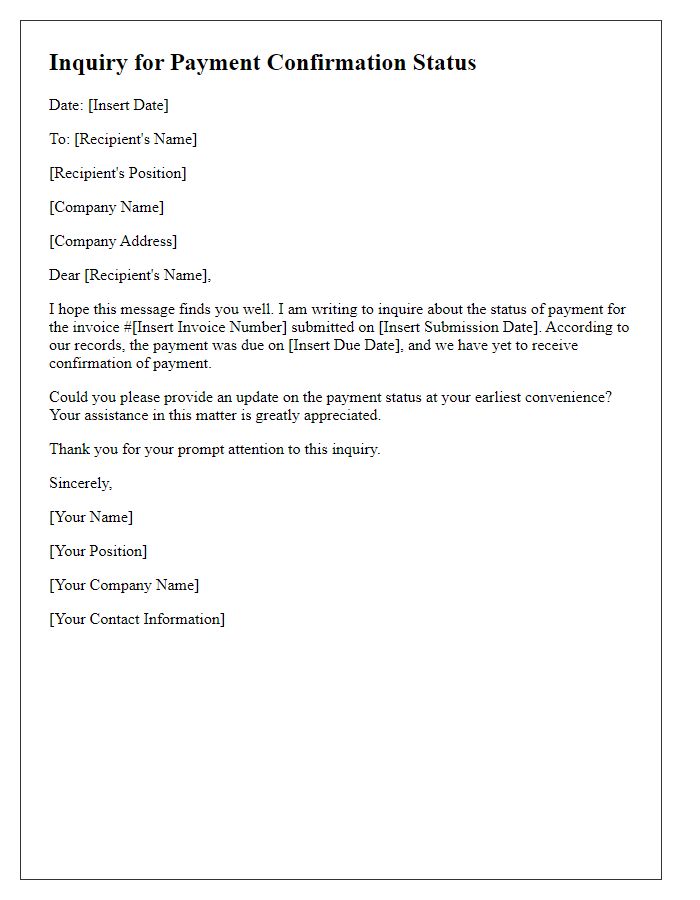

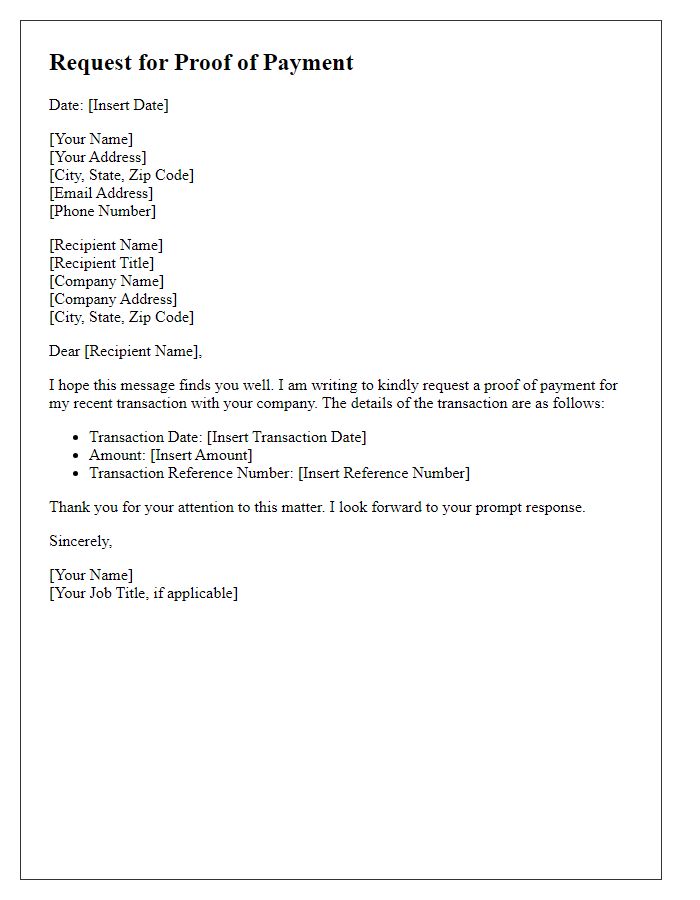

Sender's Contact Information

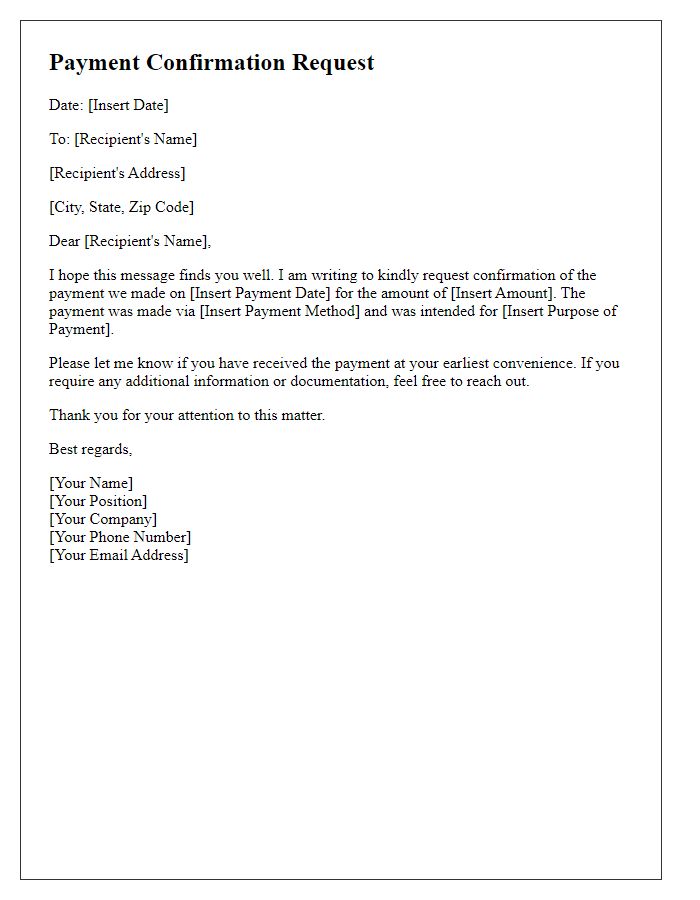

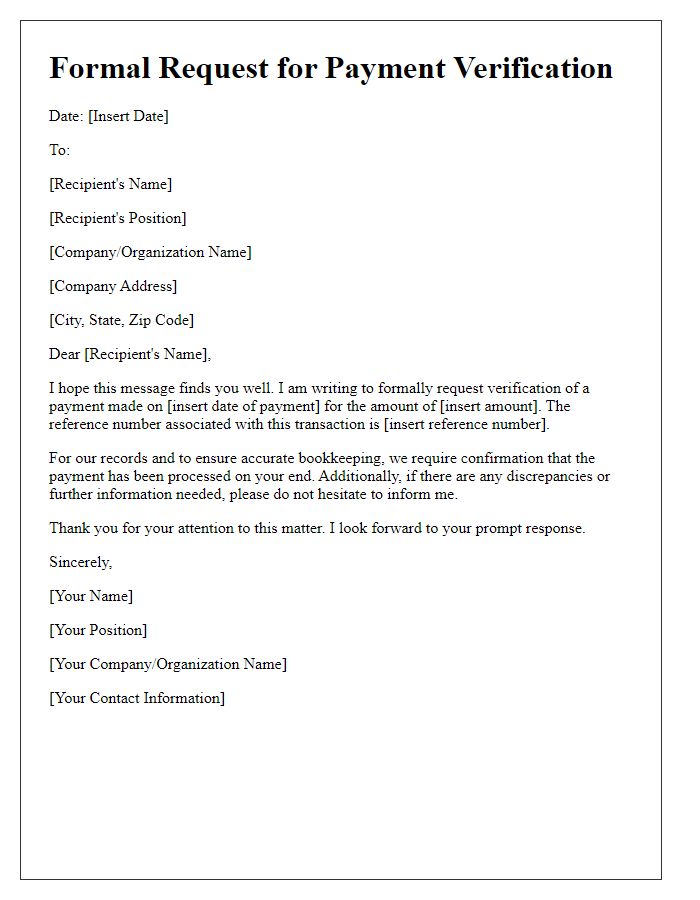

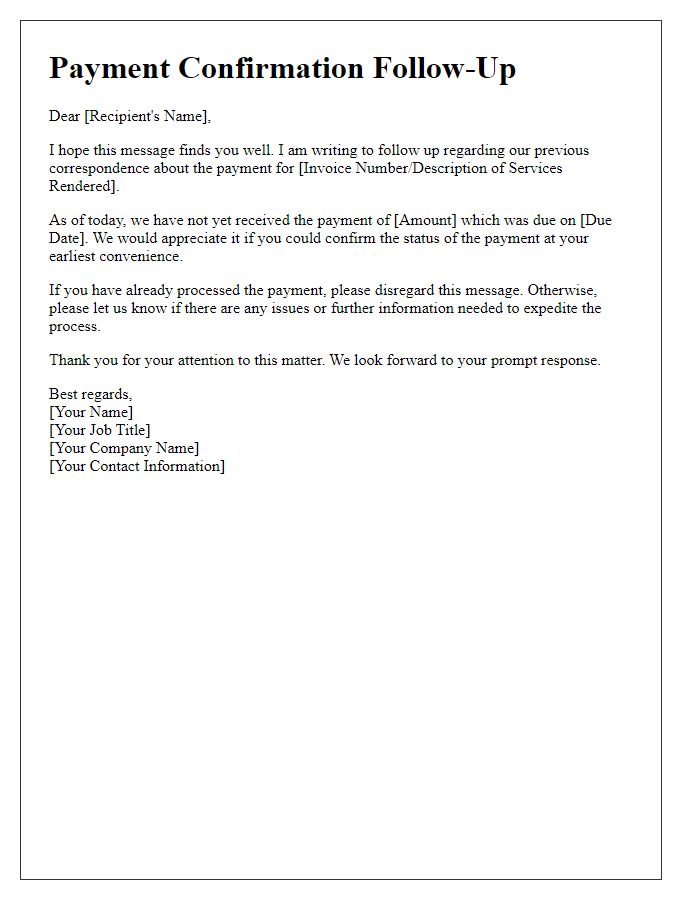

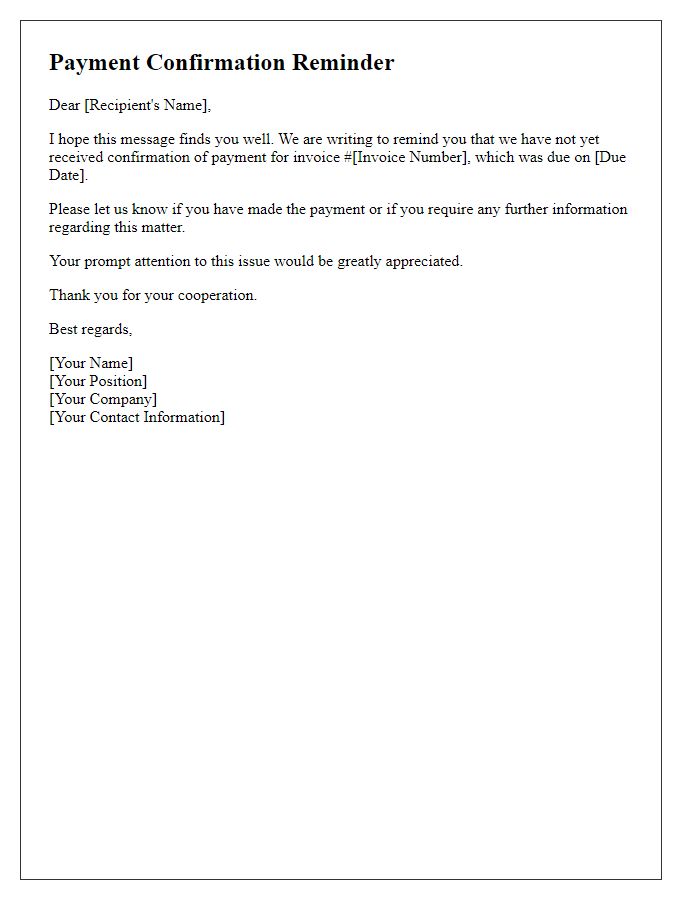

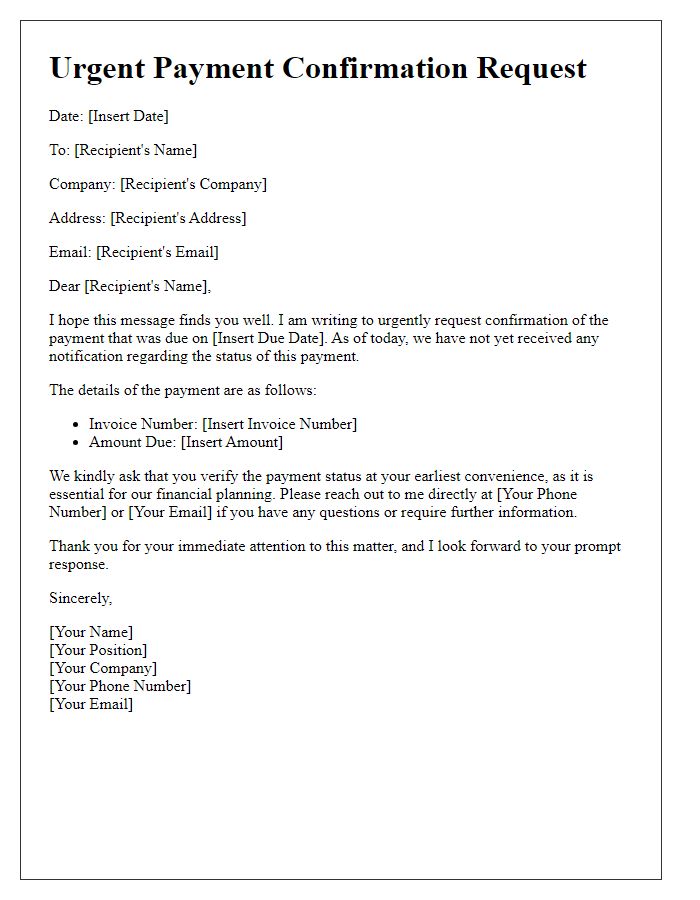

Delayed payment confirmation can adversely impact cash flow for small businesses, often leading to financial strain. Unsettled invoices, typically issued within 30 days of service completion, hinder future growth opportunities. Payment terms, such as Net 30 or Net 60, dictate the timeframe for clients to settle accounts, and reminders may sometimes be necessary. Furthermore, the payment confirmation process can involve various methods, including bank transfers or online payment platforms like PayPal or Stripe, each requiring verification steps to ensure security and accuracy for both parties involved.

Date of the Request

A payment confirmation request is crucial after a transaction. This process ensures that both parties acknowledge the financial exchange. The date of the request plays an important role in accounting and tracking records. It often marks the deadline for payment processing, impacting cash flow management. Financial documents should include details such as invoice numbers, transaction amounts, and sender-receiver information. A prompt response can foster good relationships and streamline business operations. Regular follow-ups within predetermined timeframes can enhance efficiency and accountability.

Recipient's Contact Information

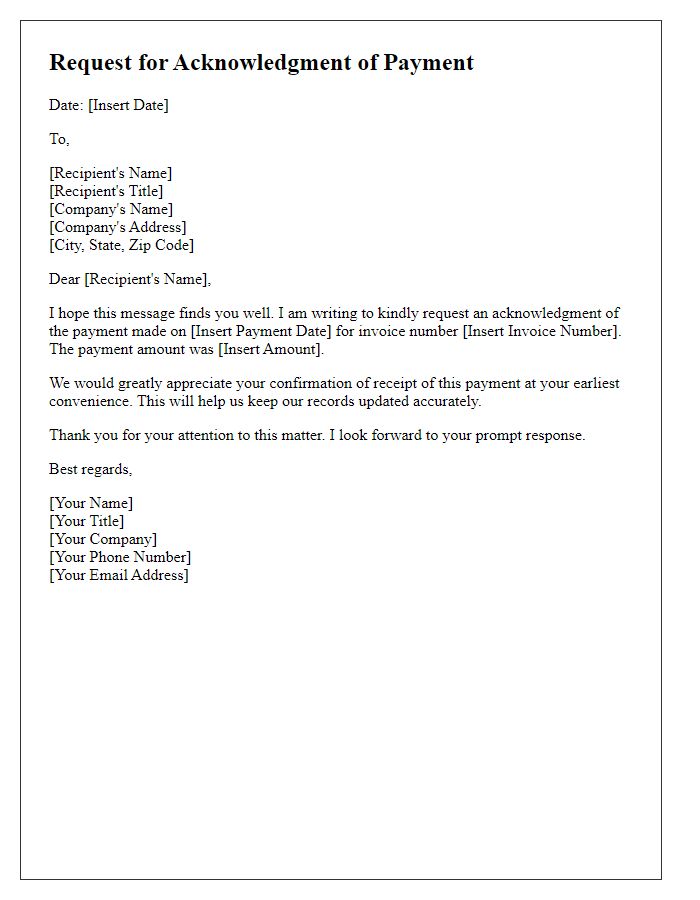

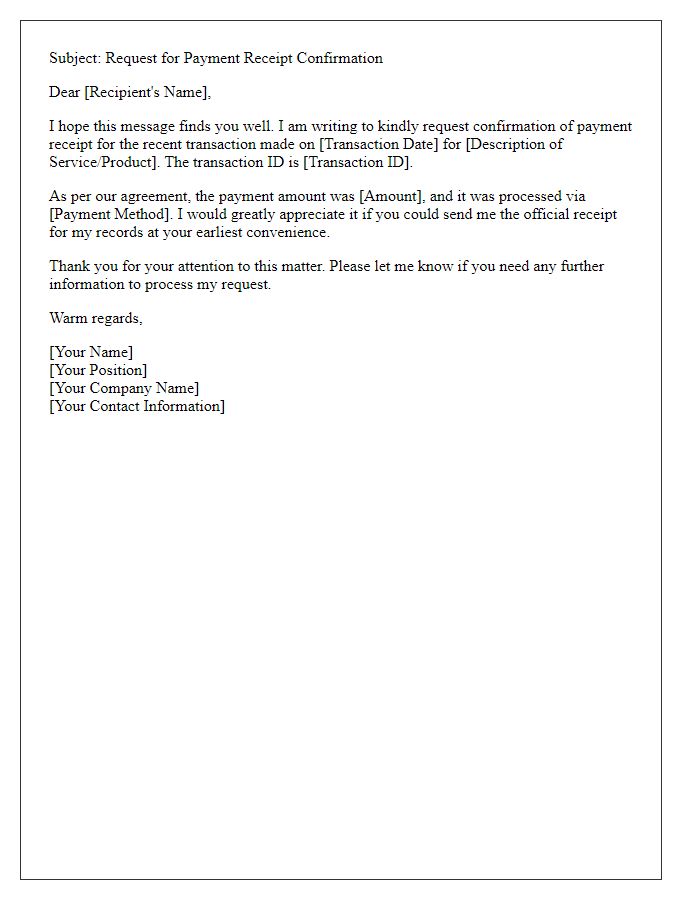

A formal request for payment confirmation aims to ensure all financial transactions are accounted for and acknowledged. The message usually includes key details such as the recipient's name, payment amount (e.g., $1,500), invoice number (e.g., #12345), and the due date (e.g., October 30, 2023). Payment methods might be referenced, such as bank transfers or credit card payments. Clear instructions on how confirmation can be provided (e.g., email or phone call) can facilitate timely responses. This ensures proper record-keeping and maintains a professional relationship between parties involved.

Subject Line: Payment Confirmation Request

In the bustling world of business transactions, timely payment confirmation is crucial. A payment confirmation serves as an official acknowledgment that a financial transaction has been completed, ensuring both parties are aligned on the status of the payment. For instance, when a company like Tech Innovations, Inc. processes a payment of $5,000 for software services provided in September 2023, it is essential to receive a confirmation email from the client, XYZ Corporation. This confirmation not only records the event but also promotes trust and transparency in financial dealings. Moreover, having a record of such payments can aid in accounting practices and assist in resolving any discrepancies should they arise in the future, ensuring a smooth operational flow between organizations.

Clear and Polite Request for Confirmation

A clear and polite request for payment confirmation can help ensure timely processing of transactions. For instance, in a business setting, organizations often send invoices totaling specific amounts, such as $1,500, to clients. Following up after a payment due date of 30 days can prompt a response. Mentioning the transaction number (e.g., #12345) and the payment method (e.g., credit card, bank transfer) can provide context. A polite reminder can help reinforce the importance of confirming the payment status, especially if it pertains to ongoing services like software subscriptions or product deliveries. This approach encourages transparent communication and fosters positive client relationships.

Comments