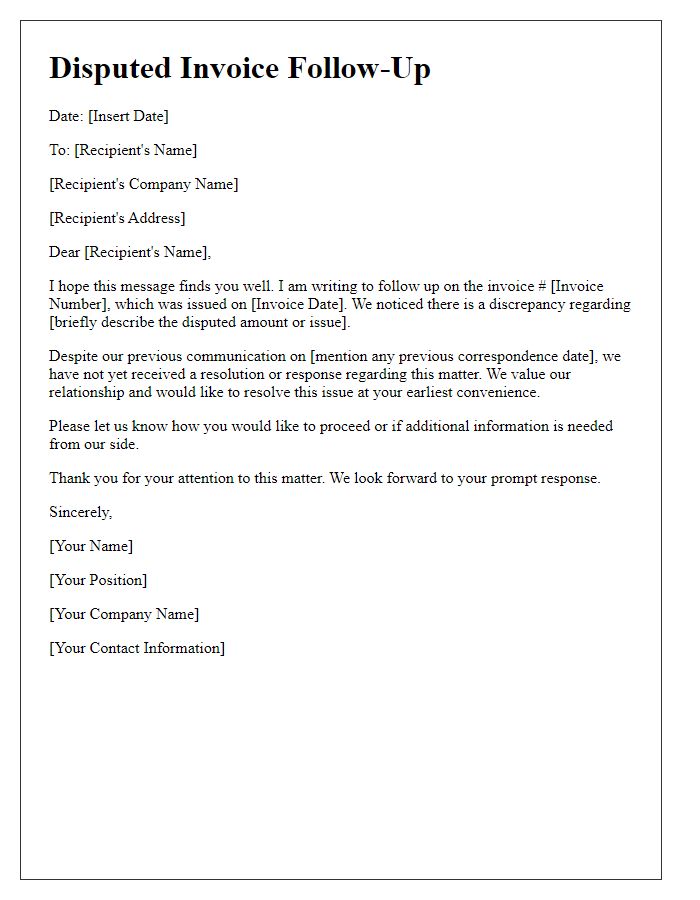

Have you ever found yourself puzzled by an unexpected discrepancy on an invoice? You're not alone; many people face this issue at some point in their dealings. Addressing these discrepancies promptly can save you time and alleviate stress in the long run. Join us as we explore how to effectively communicate your concerns and resolve invoice issues with ease.

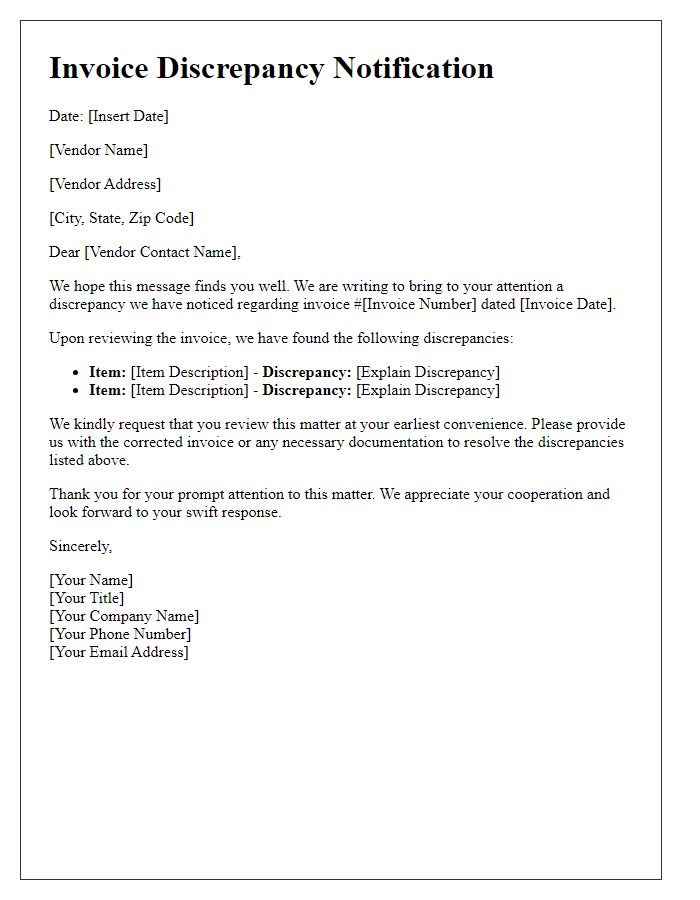

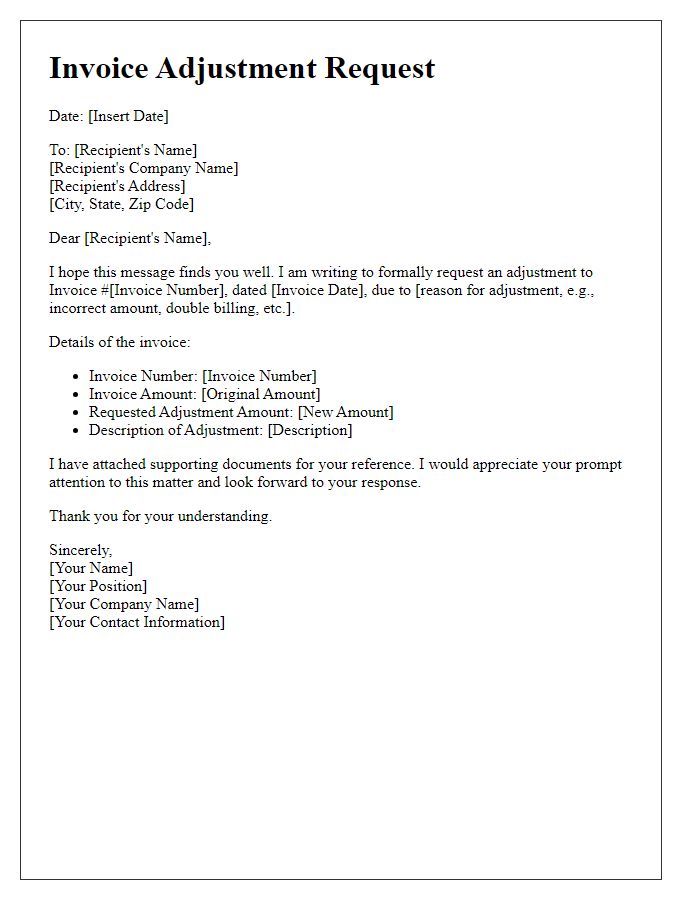

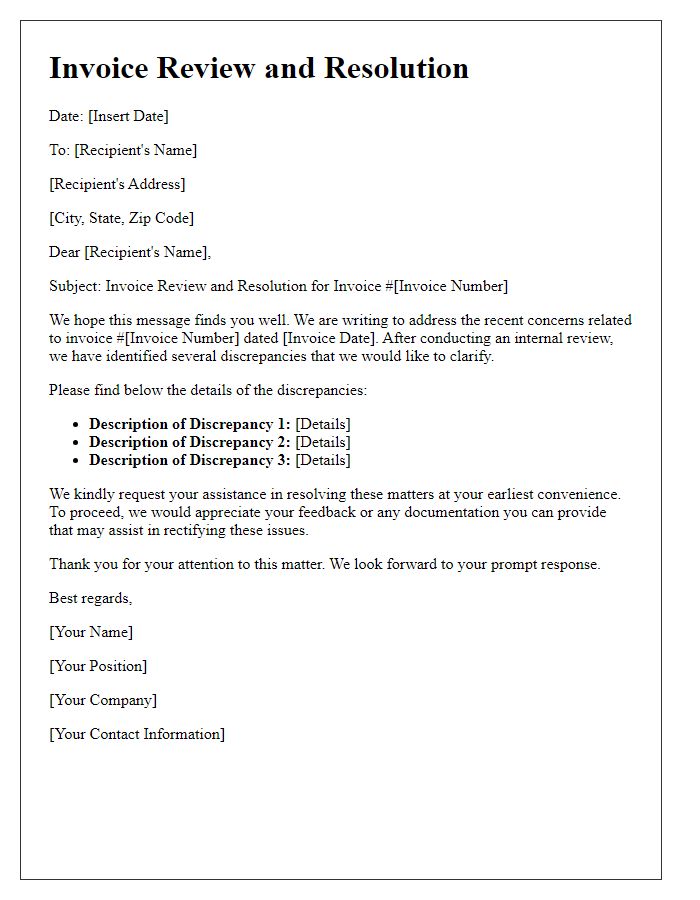

Clear subject line

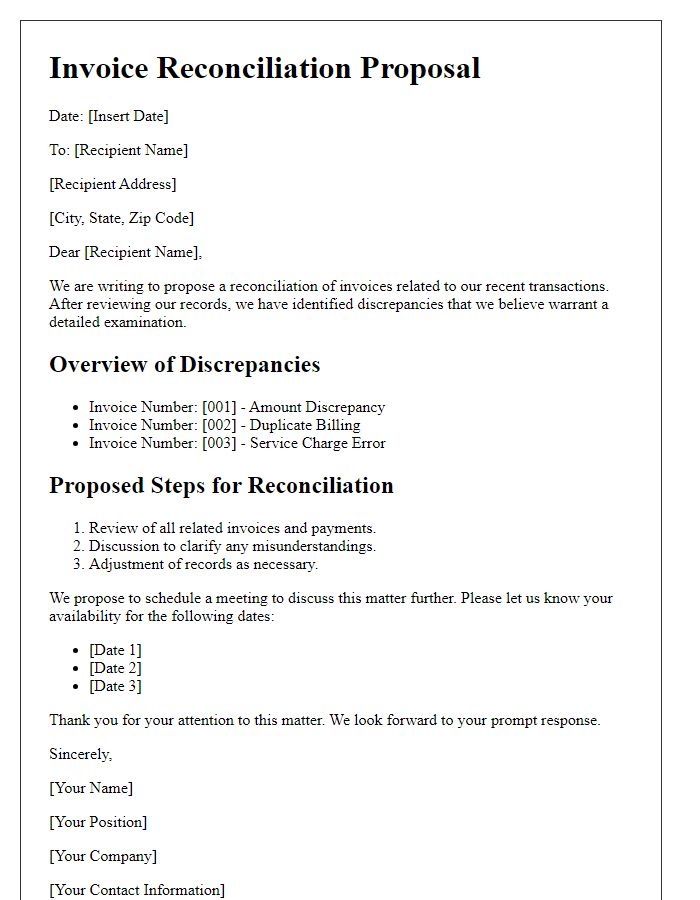

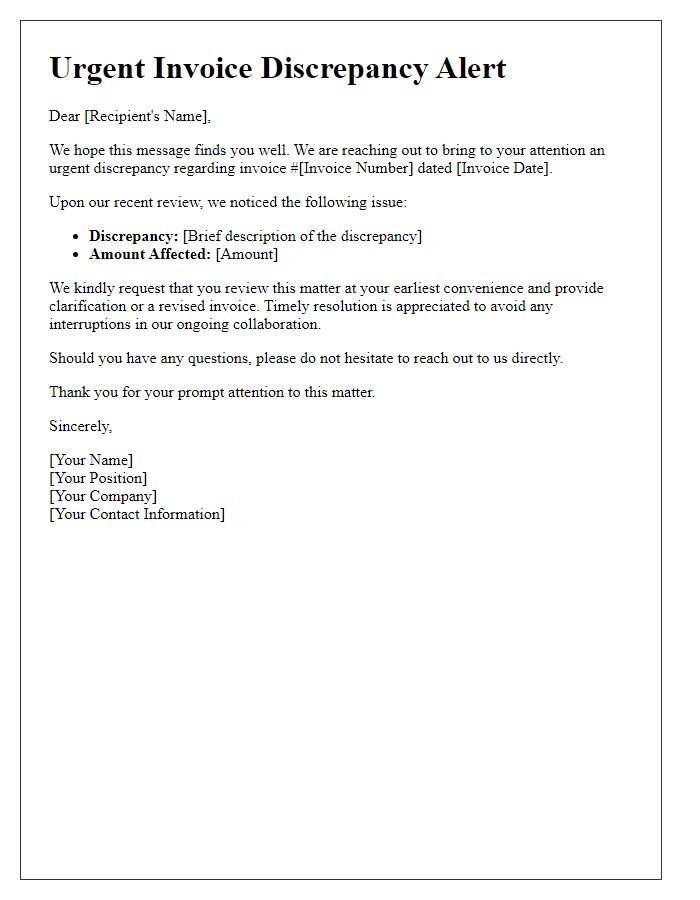

An invoice discrepancy can cause frustration and confusion, impacting business relationships. Common issues include incorrect amounts, missing charges, and inaccurate descriptions of services rendered. Effective communication is vital in resolving these discrepancies. Key details to include involve the invoice number for easy reference, the specific items or charges in question, and the expected corrections. Timely follow-up on unresolved issues aids in maintaining transparency and trust between parties. Adopting a professional tone, while clearly stating the concern, can lead to an amicable resolution.

Precise identification of discrepancy

An invoice discrepancy often arises when the billed amount does not align with the agreed contract terms or delivered services. For example, an invoice dated October 15, 2023, may indicate a total charge of $5,000 while the contract for project ABC123 specifies a maximum payment of $4,500 for services rendered in September 2023. Additionally, the discrepancy could stem from line items that don't correspond to the work completed, such as unnecessary charges for materials that were not used. Prompt and organized communication regarding this discrepancy is critical for maintaining vendor relationships and achieving resolution.

Reference to original invoice

An invoice discrepancy can lead to significant delays in payment processing and can adversely impact business relationships. Reference to the original invoice number (for example, Invoice #12345) is essential for tracking the specific billing issue. Clear identification of discrepancies such as incorrect charges, missing items, or pricing errors is crucial. Accurate documentation of the transaction date (e.g., June 15, 2023) allows for verification. Providing supporting documents, like purchase orders or delivery receipts, enhances credibility and facilitates swift resolution. Timely communication regarding these discrepancies is vital to maintaining trust and ensuring timely payments in the future.

Request for corrective action

Invoice discrepancies often arise due to various factors, such as clerical errors, incorrect product pricing, or miscommunication regarding services rendered. It is essential to address these issues swiftly to maintain healthy business relationships. For instance, an invoice for services rendered by a marketing agency in New York, dated October 5, 2023, may incorrectly list the amount due as $2,500 instead of the agreed-upon $2,000. Such discrepancies can lead to delays in payment and affect cash flow. Promptly identifying and documenting the mistake, along with relevant details like invoice numbers and descriptions of the services, will aid in resolving the situation effectively and ensure that both parties remain satisfied with the outcome.

Contact information for further communication

Invoice discrepancies can arise from errors in billing amounts, missing items, or incorrect customer information, impacting financial records. Efficient resolution of these discrepancies is essential for maintaining positive vendor relationships. Contact information should include complete details for further communication, such as telephone numbers, business emails, and mailing addresses. Additionally, including the name of the designated accounts receivable representative can streamline correspondence. Providing these details ensures prompt attention to invoicing issues, facilitating clearer communication and quicker resolution.

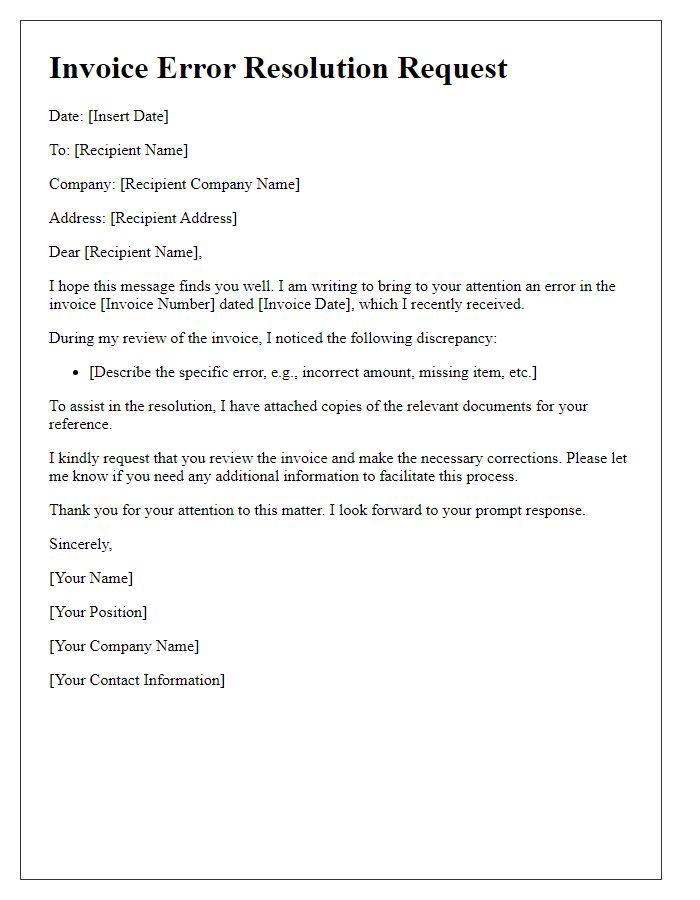

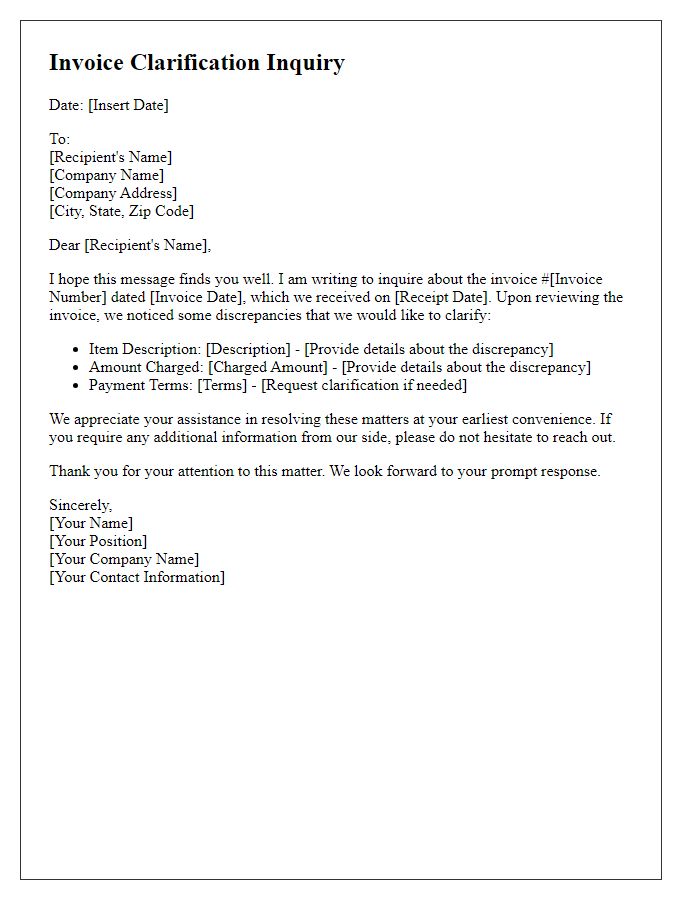

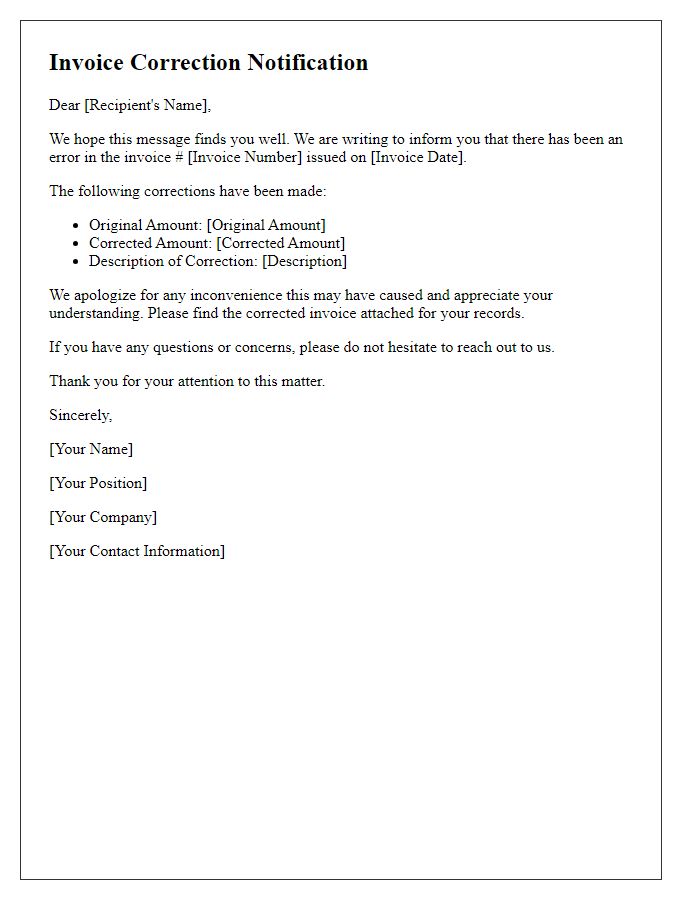

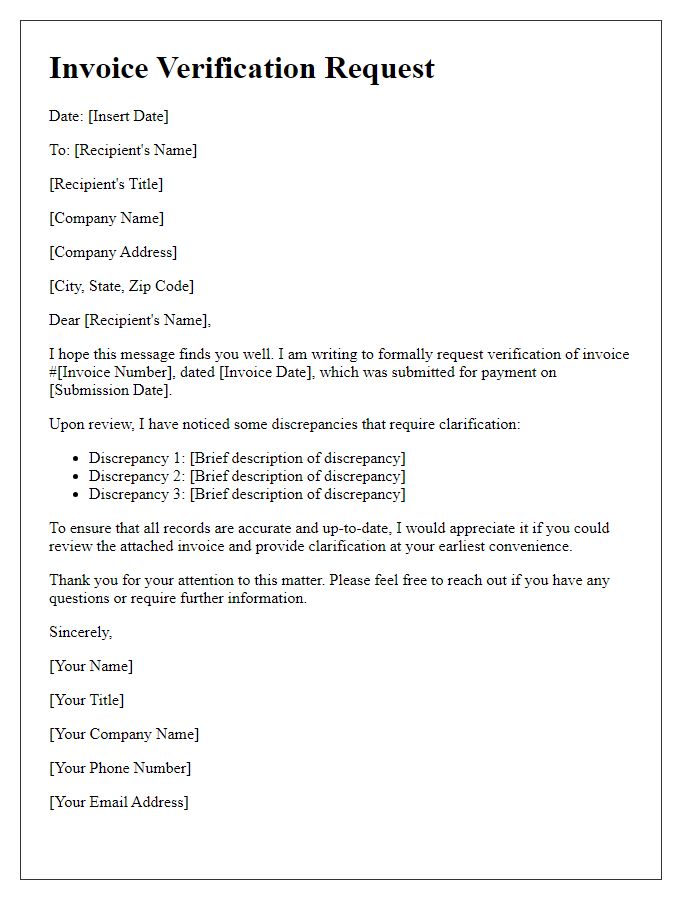

Clear subject line

Invoice discrepancies often arise from mistakes in billing or misunderstandings regarding charges. Common issues include incorrect amounts, missing services, or miscalculations in quantities. It's crucial to reference specific invoice numbers, such as Invoice #12345, and highlight discrepancies with clear details, including dates of service and relevant figures. For instance, if a service quoted at $500 is incorrectly billed as $600, that discrepancy should be noted clearly. Including supporting documents, like contracts or previous invoices for comparison, aids in resolving the issue expeditiously. Courteous language and a request for clarification can help facilitate a prompt resolution while maintaining a positive business relationship.

Detailed description of discrepancy

Invoice discrepancies frequently arise in business transactions. For instance, an invoice issued by a supplier named Apex Tech on March 15, 2023, might reflect an amount of $2,500 for 100 units of software licenses. However, upon review, the agreed-upon price was $2,250 for 100 units, as per the initial purchase order dated February 20, 2023. This error might stem from a miscommunication or clerical oversight during the invoice generation process. Furthermore, variations in tax calculations or shipping costs could contribute to discrepancies, necessitating careful analysis of both the purchase order and the invoice for accurate resolution.

Reference invoice number

Invoice discrepancies often arise from various sources, such as incorrect amounts or misapplied payments. For instance, an invoice marked as "Invoice #12345," dated July 15, 2023, for a total of $2,500, may contain a line item error reflecting an additional service charge of $300 not previously agreed upon. It is crucial for accounting departments to carefully compare the invoice against original contracts or purchase orders to identify discrepancies. Addressing these issues promptly helps maintain strong business relationships and ensures timely payment processes, contributing to overall financial health within organizations.

Requested corrective action

Invoice discrepancies often arise during financial transactions, involving inconsistencies between billed amounts and expected payments. For instance, a January 2023 invoice from XYZ Corporation indicates a charge of $1,200 for consulting services, whereas the agreed amount was $1,000 per the contract signed in December 2022. This difference of $200 could stem from additional services rendered without prior approval or a clerical error. It's crucial to address such discrepancies promptly to maintain transparent business relationships and ensure accurate financial reporting. Documentation supporting the original agreement, such as signed contracts and email communications, should accompany the formal request for corrective action to facilitate resolution.

Contact information

An invoice discrepancy often arises in business transactions, particularly in the context of corporate finance. Incorrect amounts, missing items, or miscommunication regarding the payment terms can create confusion for both parties involved. It is essential to address these discrepancies promptly to maintain positive relationships with suppliers or clients. Clear and detailed contact information, including the business name, address, phone number, and email (such as support@business.com), should be included in the correspondence. By providing necessary reference numbers associated with the invoice, such as invoice number 12345 dated March 15, 2023, the resolution process can be facilitated. Proper documentation, including previous emails or conversations regarding the transaction, must accompany the inquiry for clarity.

Comments