Have you ever found yourself in a frustrating situation where payment communication breaks down, leaving both you and the other party in a lurch? It's more common than you might think! In this article, we'll explore practical tips for addressing these miscommunications and ensuring smoother transactions in the future. So, if you're ready to regain control of your payment processes, keep reading!

Concise Subject Line

Payment communication breakdowns can lead to significant disruptions in business operations, impacting financial workflows and trust between parties. Frequent issues occur in scenarios involving late invoice submissions or discrepancies in billing amounts. For example, a company may experience delayed payments due to mismatched records between accounts payable and accounts receivable departments. To address these issues, it is essential to establish clear protocols and utilize reliable payment platforms, ensuring timely communication and reducing the likelihood of misunderstandings. Additionally, maintaining consistent updates and providing detailed invoices can enhance transparency and facilitate smoother transactions.

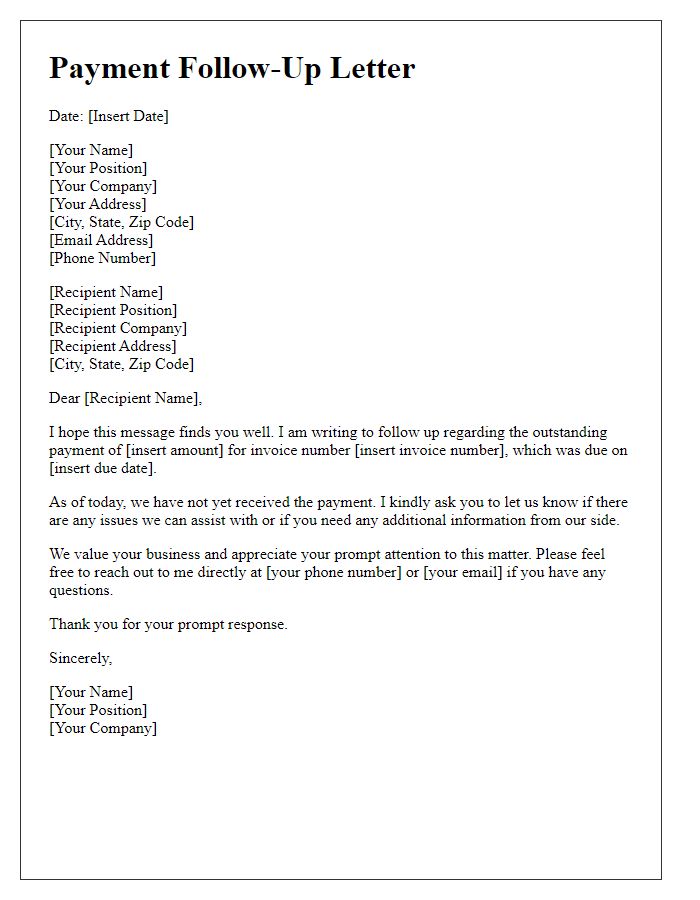

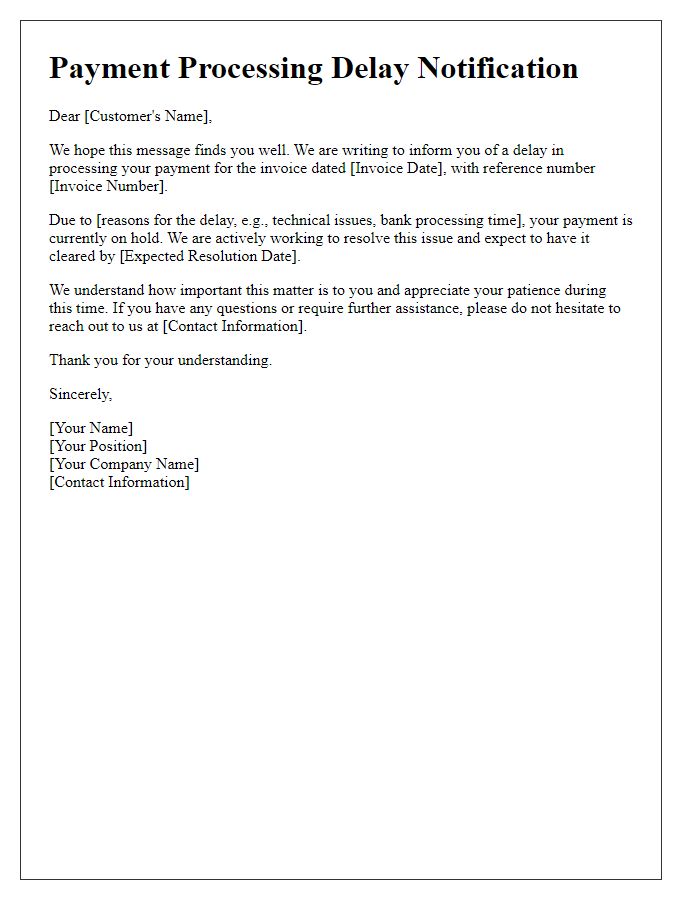

Clear Introduction

Payment communication breakdowns can lead to misunderstandings and delays in transactions involving various stakeholders. A clear understanding of the payment process is crucial for maintaining relationships with clients and suppliers, as it helps avoid significant financial repercussions. This breakdown often occurs due to miscommunication regarding payment terms, such as net 30 or net 60 agreements, which outlines the timeframe for payments. Additionally, discrepancies in invoicing details, such as item descriptions and amounts, can exacerbate the issue. Ensuring clarity in communication and establishing a reliable follow-up method is essential for resolving these payment challenges and maintaining smooth business operations.

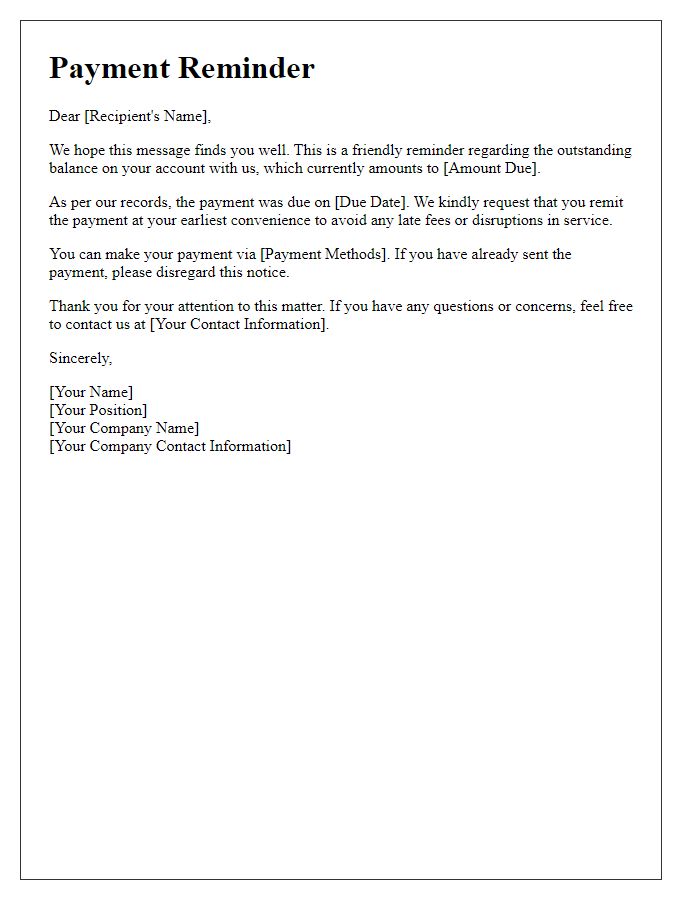

Explanation of Payment Issue

Communication breakdowns in payment processing often occur due to various factors like incorrect billing information, outdated payment methods, or clerical errors in transaction details. When customers fail to receive invoices or confirmations, confusion ensues, leading to potential payment delays. Specific instances include frequent payment gateway failures, which can hinder transactions between merchants and customers. Ensuring accurate email addresses and updated financial information can mitigate issues. Additionally, implementing automated notifications for payment confirmations and reminders can enhance transparency, ultimately fostering better relationships between businesses and clients.

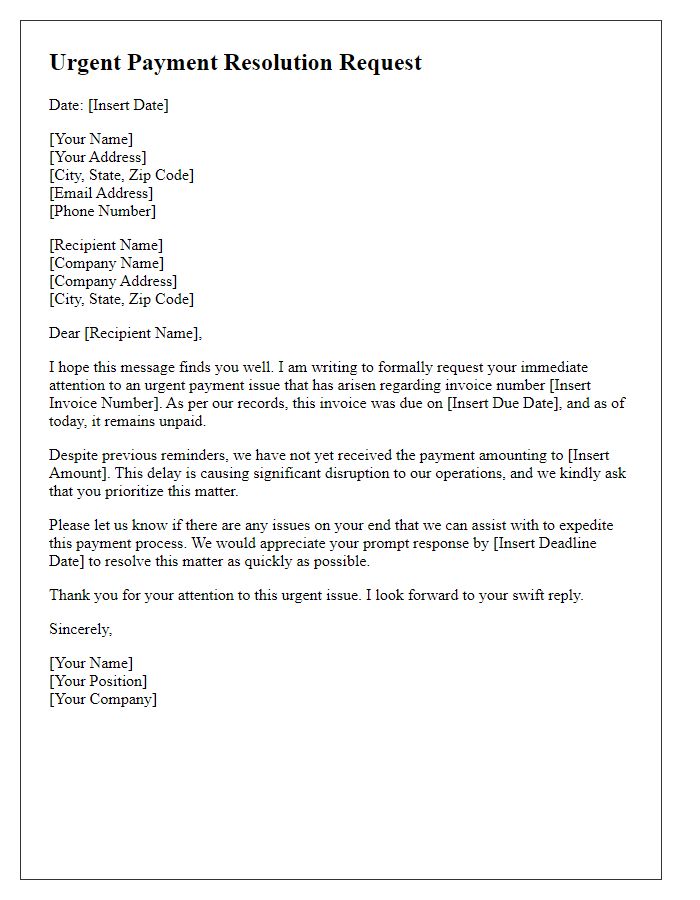

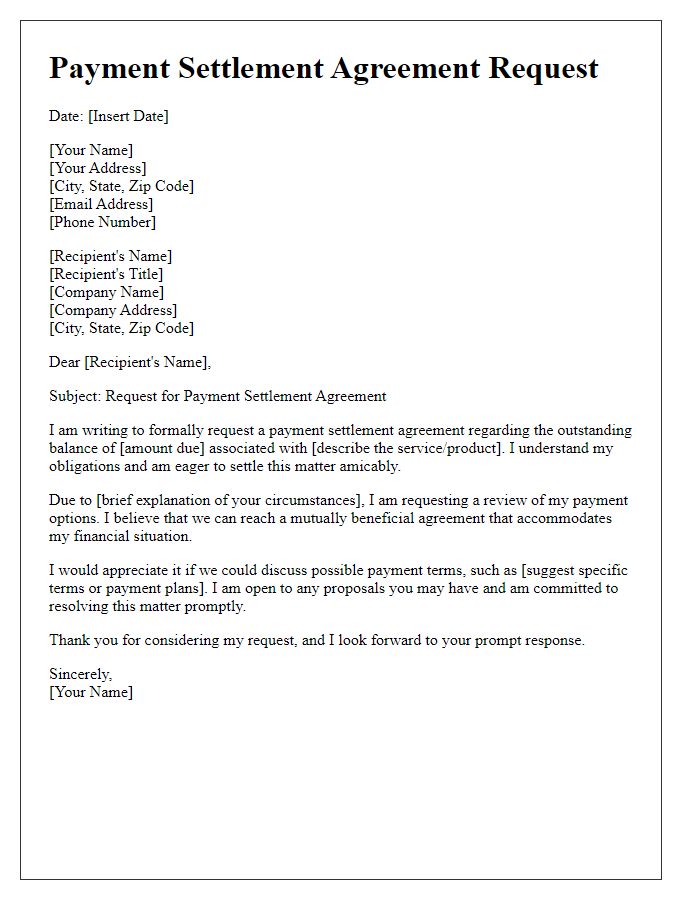

Proposed Solution and Next Steps

Payment communication breakdowns can significantly impact business operations and client relationships. Issues often arise when payment processing systems, like credit card networks or online payment platforms (e.g., PayPal), fail or experience delays. Identifying the root cause is crucial; it could involve analyzing transaction logs or contacting service providers. Proposed solutions include implementing automated notification systems to alert clients of payment processing statuses and enhancing internal training programs for staff to manage payment inquiries effectively. Next steps involve scheduling a follow-up meeting within the next week to review system performance, establishing a dedicated support line for immediate payment issues, and possibly considering alternative payment solutions to mitigate future disruptions.

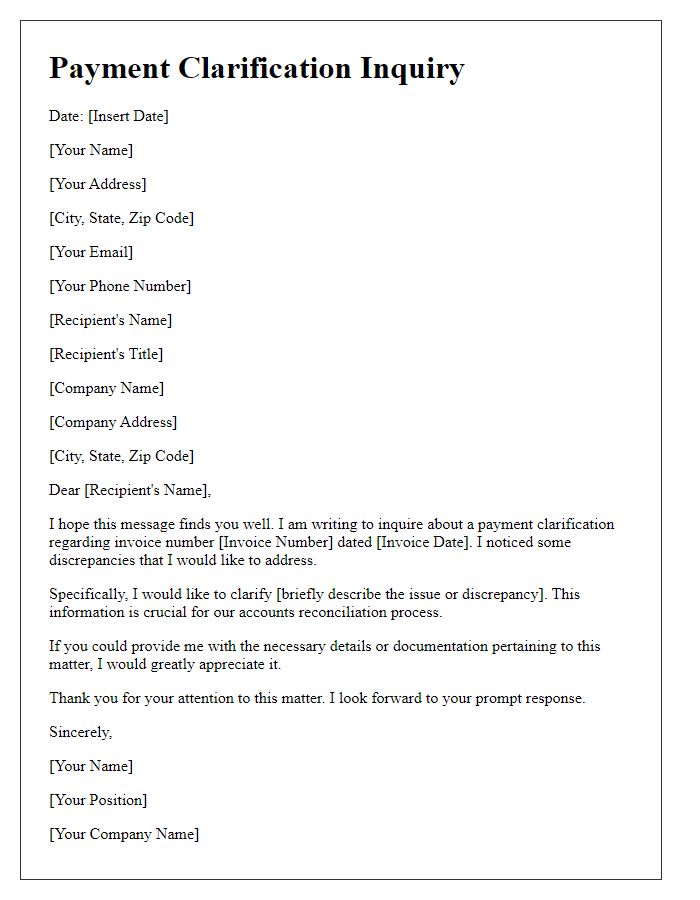

Contact Information for Further Assistance

A communication breakdown regarding payment matters can lead to significant operational delays for businesses. Typical issues such as invoice discrepancies (involving amounts, due dates, or services rendered) can result in frustration for both parties. It is essential for companies to clearly outline their contact information for further assistance (including email addresses, phone numbers, and designated contact hours) to facilitate swift resolution and improve client relationships. Additionally, setting up a dedicated support team trained in financial communications can streamline the process, ensuring that clients have a direct line to resolution resources. Enhancing communication channels, such as live chat or dedicated hotlines, can further mitigate misunderstandings and foster trust in financial dealings.

Comments