Are you looking to streamline your invoicing process? Sending an invoice via email doesn't have to be a daunting task; it can be quick and professional with the right approach. In this article, we'll guide you through a simple and effective letter template to accompany your invoice attachment, ensuring your clients receive all the necessary information without any hassle. Keep reading to discover the best practices for crafting a polished invoice email that leaves a lasting impression!

Subject Line

An email titled "Invoice #12345 from [Your Company Name]" serves as a direct notification to the recipient regarding the attached financial document. This subject line includes the invoice number (12345) for easy identification and tracking. The inclusion of the company name ensures the recipient recognizes the sender and relates the document to prior communications or transactions. This straightforward subject line prompts the recipient to review both the email content and the attached invoice expeditiously.

Greeting

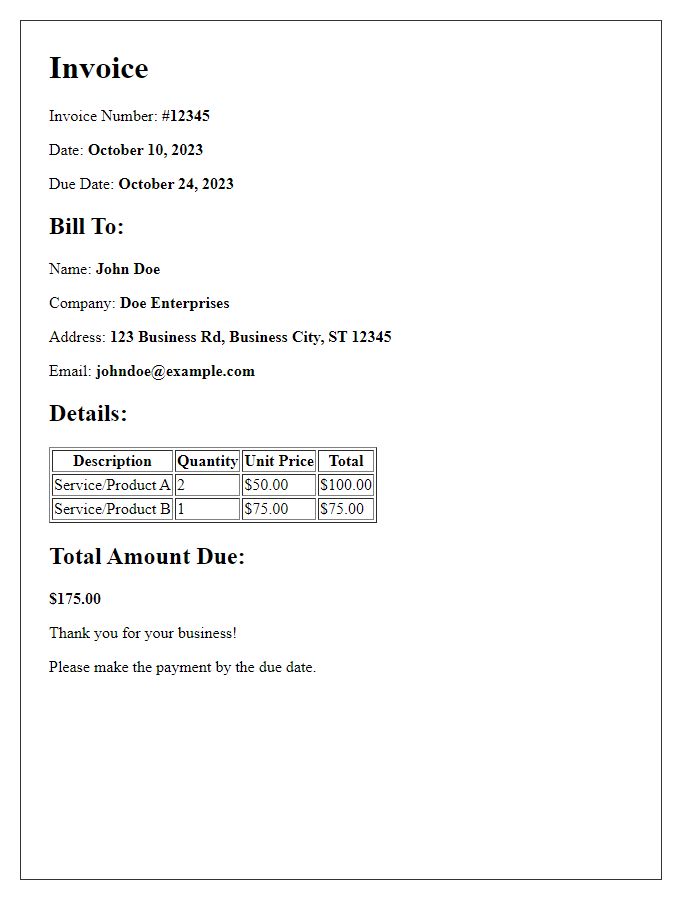

Invoicing is an essential part of business operations, often involving clear communication regarding services rendered and payment expectations. An invoice typically includes details such as transaction date, invoice number, service description, total amount due, and payment instructions. For example, a landscaping service might issue an invoice for $300 after completing a project on September 15, 2023, outlining the specific improvements made to a client's garden in Chicago. Timely invoicing ensures prompt payments, which are crucial for maintaining cash flow in small businesses or freelance operations. Additionally, invoices serve as record-keeping tools for taxation purposes and financial management.

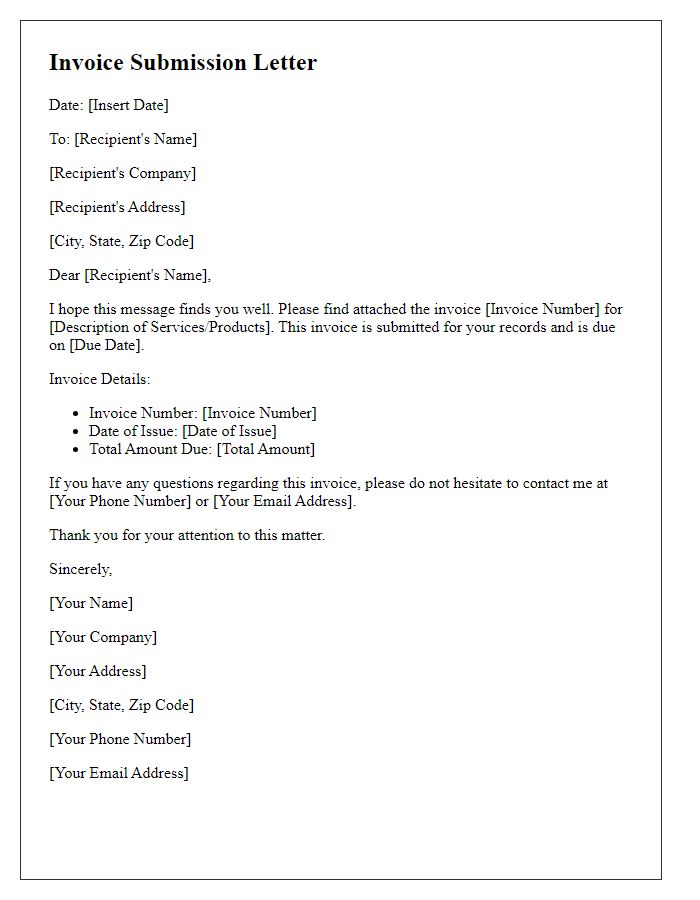

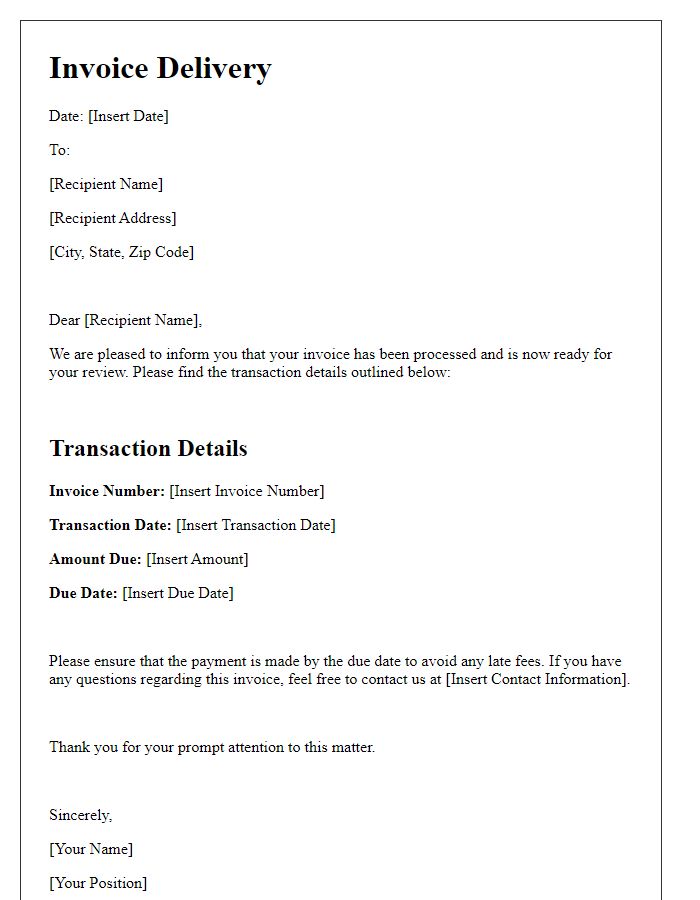

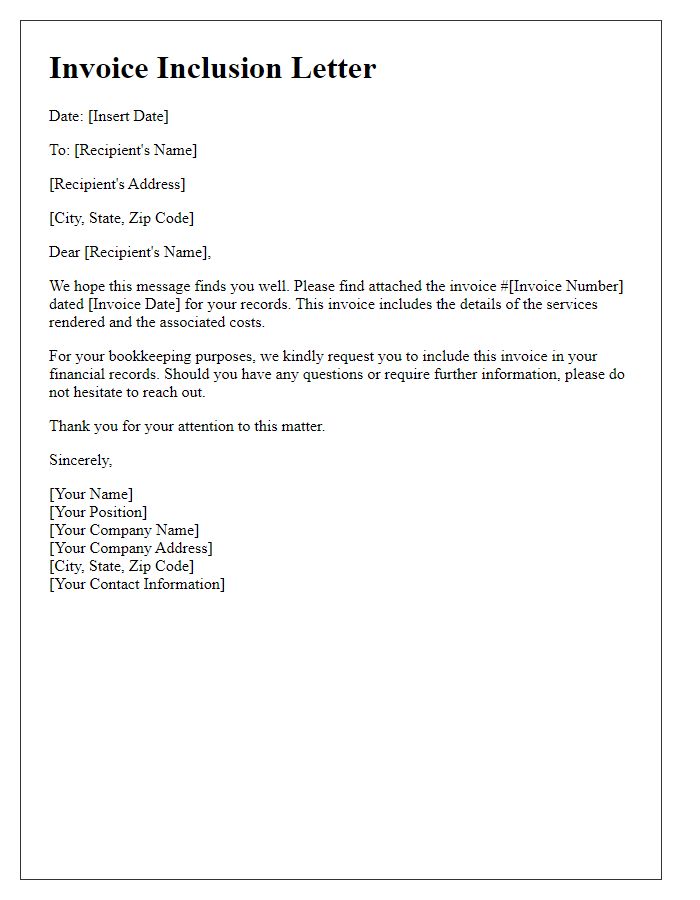

Invoice Details

Invoicing procedures are crucial for maintaining cash flow within businesses, particularly in the services sector. Each invoice typically includes critical information such as invoice number, client details, and a detailed breakdown of services rendered. The invoice date may align with the end of a project, while the due date establishes payment expectations, often set to 30 days post-invoice issuance. Payment methods can vary, with options like bank transfer, credit card, or PayPal being commonly accepted. Accurate invoicing promotes transparency and ensures timely payments, which are vital for the financial health of small to medium-sized enterprises.

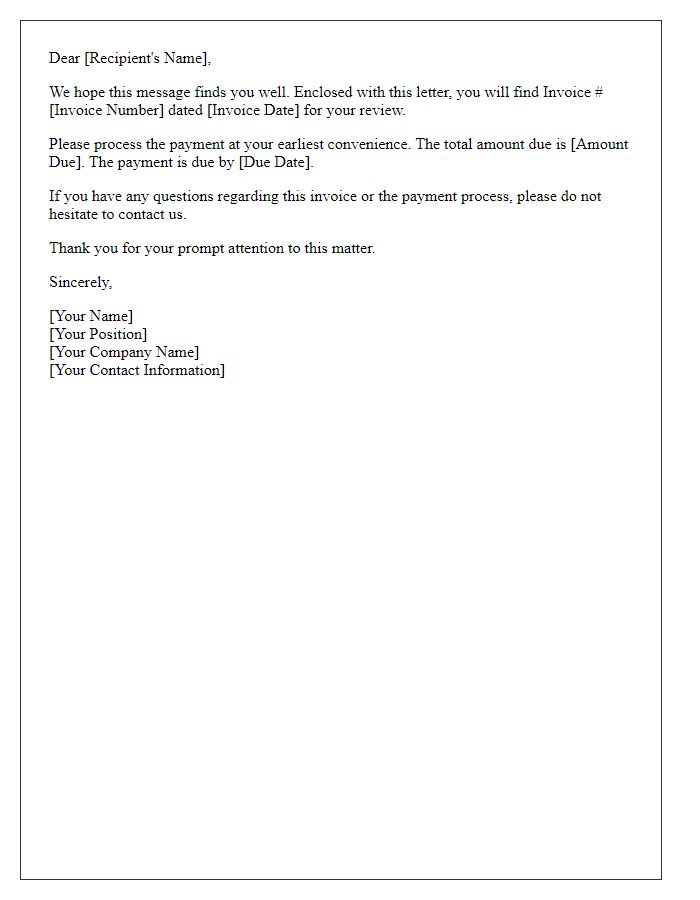

Payment Information

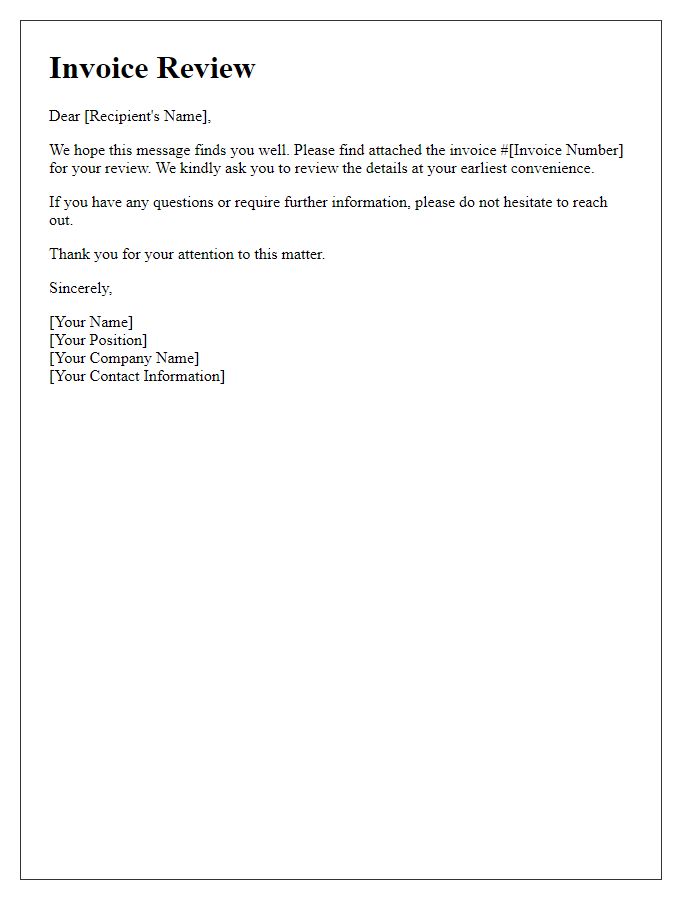

Invoicing plays a critical role in business transactions, establishing formal documentation for services or products provided. Accurate invoices contain essential elements, including invoice number, date of issue, and due dates, ensuring timely payments. Payment information should detail accepted methods, such as credit cards or bank transfers, along with necessary account details, facilitating a smooth transaction process. Including tax identification numbers and payment terms can provide clarity, while adding contact information for inquiries assures clients that assistance is readily available. Overall, invoices serve as a vital touch point in maintaining professional relationships and ensuring financial accountability.

Closing and Contact Information

The closing of an email regarding an invoice can be succinct yet professional. For instance, sign off with "Best regards" or "Sincerely," followed by your name. Including your title, such as "Accounts Manager," adds clarity to the role in the organization. Furthermore, contact details are vital; provide your phone number, like "+1 (555) 123-4567," and a professional email address for direct communication. Additionally, listing the company's physical address, for example, "123 Business Lane, Suite 100, Cityville, CA 90210," is important for reference. This ensures prompt follow-up and reinforces a professional tone in the correspondence.

Comments