Are you looking for a way to effectively communicate your investment opportunity? Creating a private placement memorandum (PPM) can seem daunting, but with the right letter template, it can become a seamless process. This key document not only outlines the details of your offering but also helps to build trust and transparency with potential investors. Curious about how to craft the perfect PPM letter? Let's dive in!

Executive Summary

Private placement memorandums serve as comprehensive documents outlining investment opportunities. An executive summary encapsulates essential information regarding the investment, targeting potential investors. The memorandum includes details on the company (XYZ Corporation), located in Silicon Valley, California. The investment opportunity entails raising $10 million in capital to fund the expansion of a cutting-edge technology platform focused on artificial intelligence. The projected revenue growth stands at 150% over the next three years, driven by increasing demand in the healthcare sector. Key management team members possess extensive experience, including over 25 years in technology and finance. The summary also outlines the competitive landscape, showcasing the unique value proposition that differentiates XYZ Corporation from competitors. Investors are presented with the anticipated exit strategy, hoping for a 3x return on investment within five years through acquisition or public offering.

Investment Opportunity

Private placement memorandums (PPMs) are critical documents presenting investment opportunities to potential investors, encapsulating essential details meticulously. Investment opportunities typically highlight specific sectors such as technology, renewable energy, or real estate, appealing to strategic investors. Financial projections, including estimated returns, cash flow analysis, and valuation multiples, serve to outline potential profitability, backed by market research indicating industry growth rates often exceeding 10% annually. Details regarding the management team's expertise, including educational backgrounds and prior successes in relevant ventures, enhance credibility. Legal considerations, such as compliance with the Securities Act of 1933, underscore regulatory obligations protecting investors. Furthermore, risk factors, including market volatility and economic downturns, are disclosed, ensuring transparency and fostering informed decision-making.

Company Background

Company background information outlines the history and foundational details related to an enterprise, such as established year (e.g., 2010), founding members, and significant milestones, including product launches or key partnerships. This section can also highlight the business's industry focus, such as technology, finance, or healthcare, and geographical presence, like operations in North America, Europe, or Asia, emphasizing market reach and expansion strategies. Noteworthy achievements, such as awards or recognitions, provide credibility and showcase the company's performance within its sector. Financial information is critical, including revenue figures, profit margins, and growth percentages (e.g., 20% annual growth rate in the past three years), reflecting the company's stability and prospects. Additionally, the vision and mission statements communicate the company's long-term goals and values, creating a narrative for potential investors while illustrating the company's commitment to innovation and sustainability.

Risk Factors

Private placement memorandums often outline various risk factors associated with investment opportunities. These risks can include market volatility, regulatory changes, liquidity concerns, and business-specific challenges. Market volatility pertains to fluctuations in the value of investments, which can be influenced by economic conditions in regions such as the United States, Europe, or Asia. Regulatory changes refer to new laws or amendments that could impact industry operations, especially in sectors like finance or healthcare. Liquidity concerns involve the potential difficulty of selling investments quickly without significant loss, an issue pertinent in markets like real estate or private equity. Business-specific challenges can include operational inefficiencies, competition, or reliance on key personnel, factors that can affect the stability of companies within an investment portfolio. Each of these risks should be thoroughly evaluated before making a financial commitment.

Financial Projections

Financial projections play a crucial role in a Private Placement Memorandum (PPM), providing potential investors with insights into the anticipated financial performance of the business. These projections typically include a detailed forecast covering three to five years, showcasing projected revenue growth, gross margins, operating expenses, and net income. In addition, a cash flow statement provides clarity on expected cash inflows and outflows, highlighting the company's ability to sustain operations. Key assumptions underpinning these projections should also be articulated, such as market growth rates (e.g., a projected CAGR of 10% in the biotech sector) or customer acquisition costs based on historical data. Break-even analysis demonstrates the point at which total revenue equals total costs, essential for understanding risk and profitability timelines. Additionally, sensitivity analysis can be included to illustrate how variations in key assumptions, such as changes in sales volume or pricing strategies, may impact the overall financial outcomes, equipping investors with a comprehensive view of potential returns on investment.

Letter Template For Private Placement Memorandum Samples

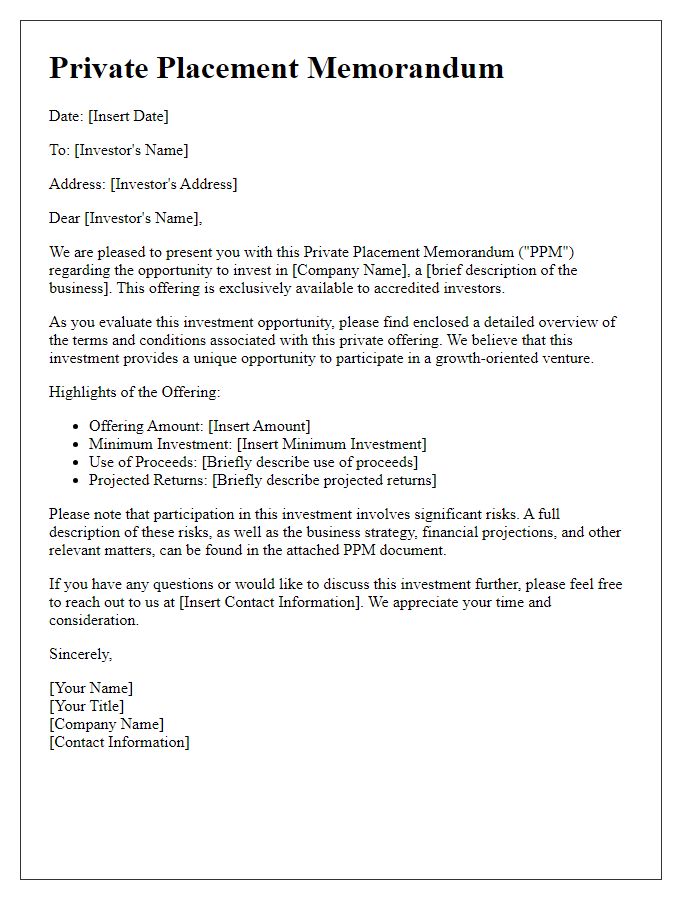

Letter template of private placement memorandum for accredited investors

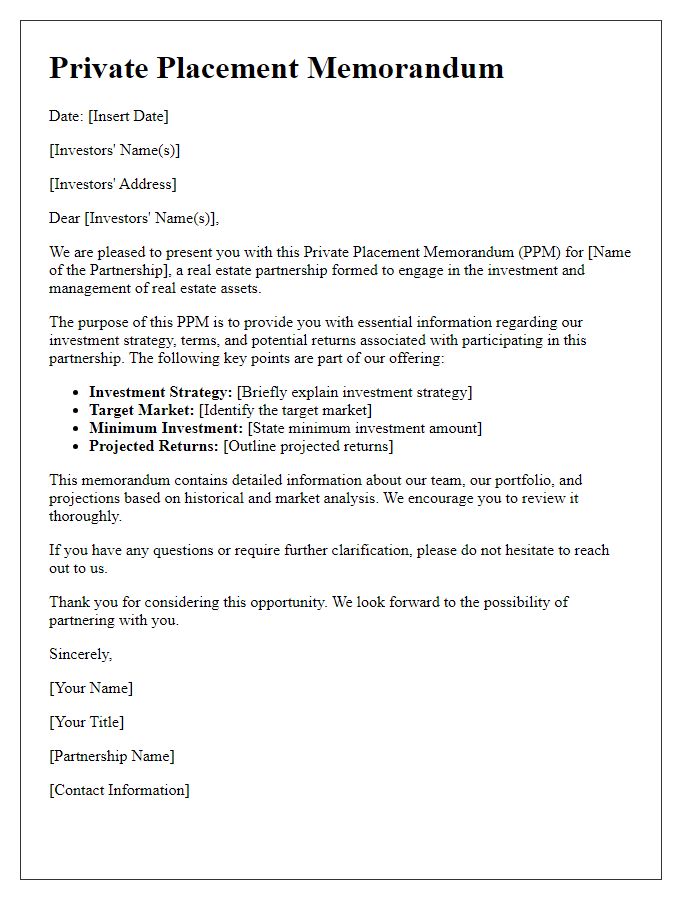

Letter template of private placement memorandum for real estate partnerships

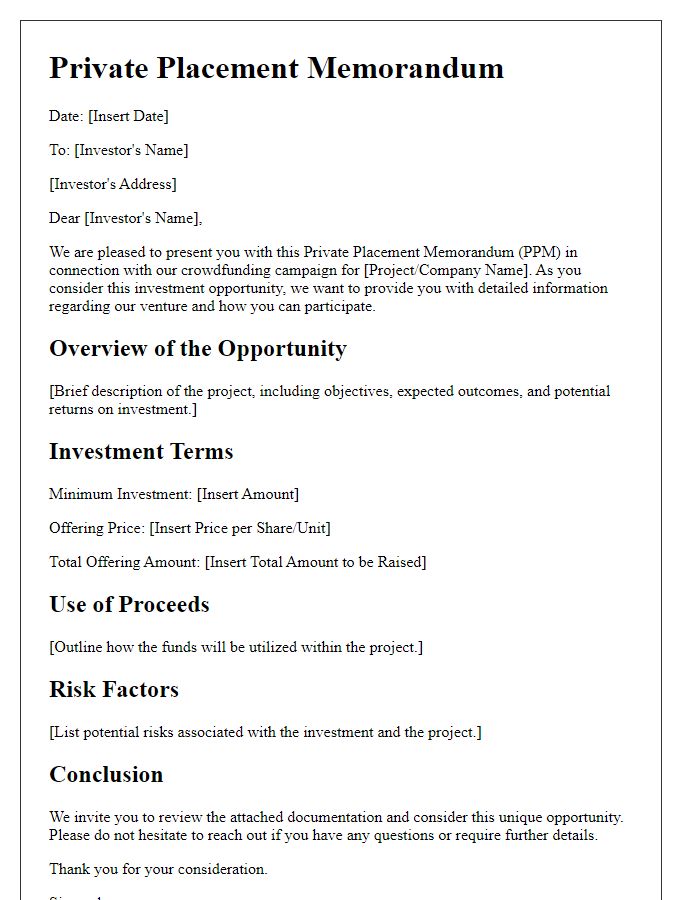

Letter template of private placement memorandum for crowdfunding campaigns

Letter template of private placement memorandum for international investors

Comments