Are you an investor looking to navigate the complexities of risk assessment? Understanding potential pitfalls before committing your hard-earned money is crucial in today's ever-changing financial landscape. In this article, we'll explore essential strategies and insights that can help you evaluate risk effectively, ensuring that your investments align with your financial goals. So, join us as we delve deeper into the world of investor risk assessment and discover practical tips to safeguard your investments!

Clear Investment Objectives

Clear investment objectives serve as the foundation of a successful investment strategy, guiding investors through the complexities of financial markets. These objectives should be specific, measurable, attainable, relevant, and time-bound (SMART), ensuring clarity in financial goals. For instance, an investor may target a 7% annual return on investment within a five-year period, which aligns with both personal financial aspirations and market conditions. Understanding risk tolerance is essential, as it distinguishes between conservative, moderate, and aggressive investment approaches, thereby aiding in the selection of appropriate asset classes such as equities, fixed income, or alternative investments. Additionally, geographic focus, such as investing in emerging markets in Asia or established markets in North America, can diversify risk and optimize potential returns. Regularly reviewing these objectives is crucial, allowing investors to adapt to changing financial landscapes and personal circumstances, ultimately fostering disciplined decision-making and long-term success.

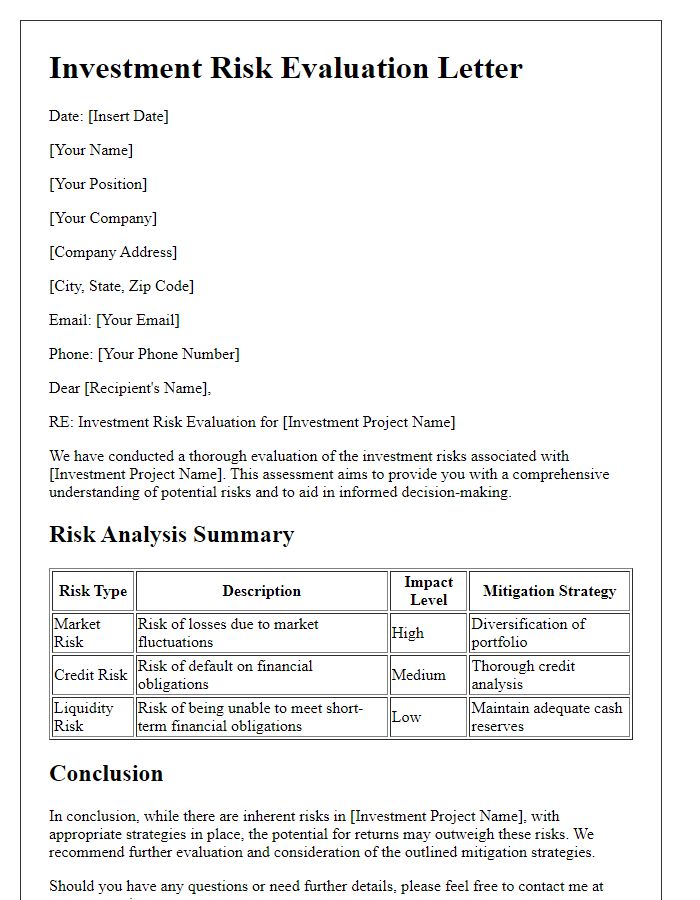

Comprehensive Risk Analysis

A comprehensive risk analysis involves evaluating potential threats and uncertainties that could impact the investment's performance. Key elements include identifying market risks, such as fluctuations in stock prices or real estate values that can lead to significant losses, assessing credit risks associated with borrowers' likelihood of default, and examining operational risks stemming from internal processes, people, and systems. Regulatory risks should also be analyzed, considering changes in laws or regulations that may affect business operations or profitability. Additionally, geopolitical risks, including instability in regions where the investment is located, can pose threats to returns. Quantitative measures like Value at Risk (VaR) can help gauge potential losses in investment portfolios under normal market conditions, while scenario analysis can explore extreme market conditions. Finally, understanding liquidity risks, which refer to the ease of converting an investment into cash without affecting its market price, is essential for ensuring enough access to funds when needed.

Market and Industry Context

The global market for electric vehicles (EVs) has witnessed significant growth, valued at approximately $162 billion in 2020 with projections suggesting a surge to over $800 billion by 2027, driven by increased environmental concerns and government incentives. Major players in the automotive industry, such as Tesla in the United States and BYD in China, are expanding production capacities to meet surging demand, while legislation in Europe mandates stricter emissions standards by 2025. Electric vehicle sales accounted for about 6.6% of total vehicle sales in 2021, reflecting a shift in consumer preferences towards sustainable transportation. Major technological advancements in battery efficiency, such as the introduction of solid-state batteries, are expected to enhance vehicle range and reduce charging times, consequently influencing market dynamics. Supply chain challenges, particularly in semiconductor availability and raw material sourcing for batteries, such as lithium, cobalt, and nickel, present potential risks worth noting for investors considering this burgeoning sector.

Historical Performance Data

Historical performance data for investment portfolios, especially in the context of alternative assets, provides valuable insights into market trends and resilience. Among the noteworthy periods, the global financial crisis of 2008 drastically impacted equity markets, with the S&P 500 index dropping over 50% from its peak. By contrast, real estate investments, particularly in urban hotspots like New York City, showcased resilience, with average annual returns of around 10% during recovery phases. Additionally, commodities like gold displayed a strong correlation with economic uncertainty, with prices soaring over 25% in 2011 amidst heightened market volatility. Analysis of these performance metrics reveals potential risk factors and opportunities for diversification, informing investment strategies tailored to maximize returns while minimizing exposure during economic downturns. Evaluating historical trends assists investors in making informed decisions related to asset allocation and risk management.

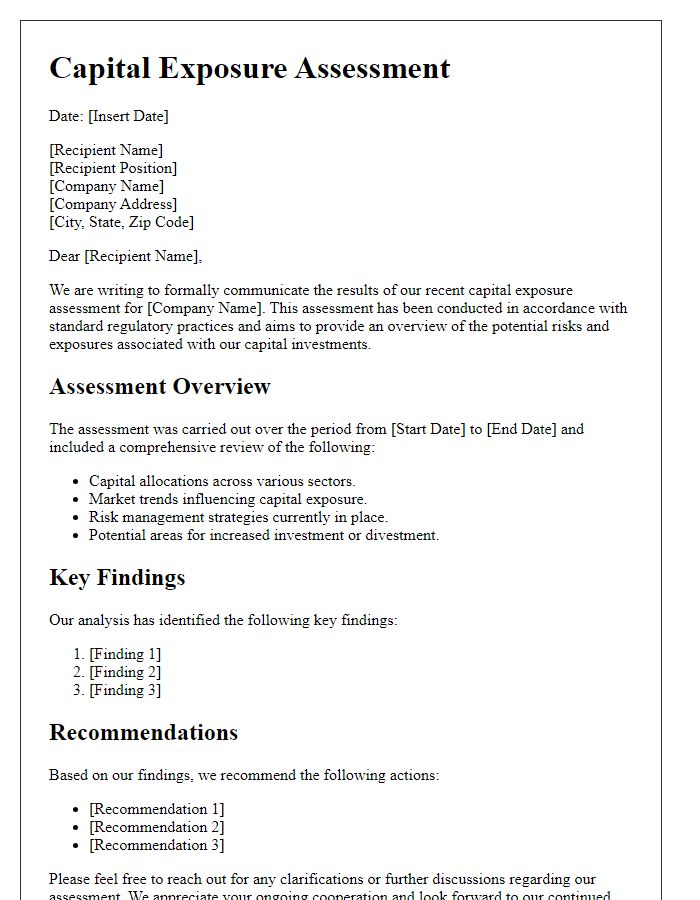

Regulatory and Compliance Considerations

Regulatory and compliance considerations play a crucial role in the risk assessment process for potential investors in various sectors, particularly in finance and healthcare. Understanding the implications of regulations such as the Sarbanes-Oxley Act (2002), which mandates strict accuracy and accountability in financial reporting, is vital for assessing financial risk. Additionally, adherence to industry-specific regulations, like the Health Insurance Portability and Accountability Act (HIPAA), safeguards sensitive patient information in the healthcare sector, influencing operational risks. Geographic factors, such as the Market Risk Assessment Framework in Europe (MRAF), established by the European Banking Authority, must also be considered as they dictate compliance requirements for institutions operating across borders. Therefore, thorough analysis of regulatory frameworks and compliance obligations is essential to identify potential legal liabilities and ensure sustainable investor confidence in the long term.

Comments