Are you curious about the ins and outs of infrastructure investment? In today's ever-evolving landscape, understanding the nuances of funding and planning for public projects has never been more critical. This article will break down the essential elements of infrastructure investment inquiries, helping you navigate through the complex world of financing and development. So, let's dive in and explore all the opportunities that await you!

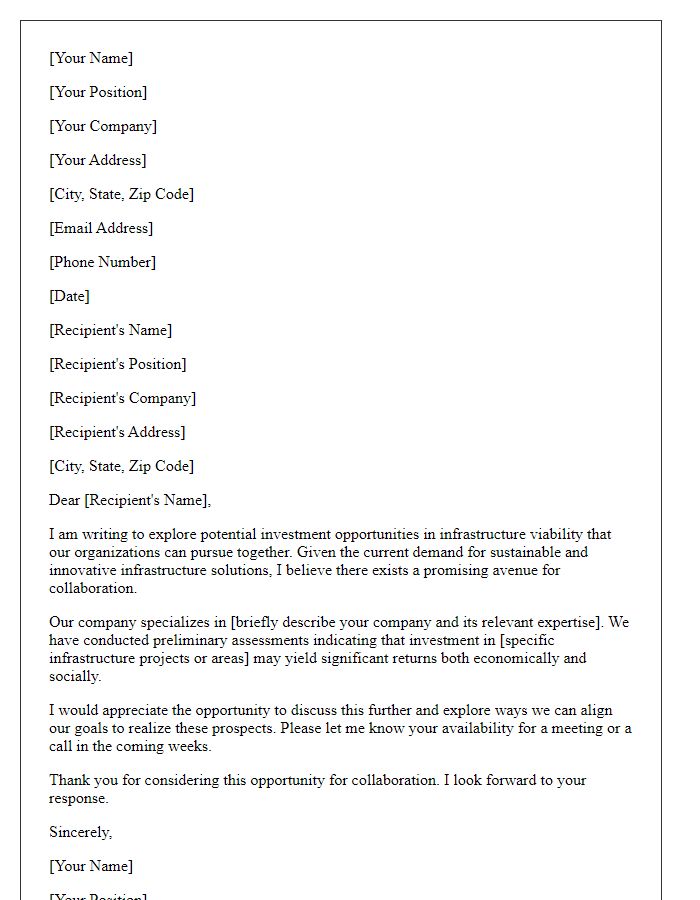

Purpose of Inquiry

Infrastructure investment plays a crucial role in economic development and sustainability. Inquiries concerning infrastructure investment typically center on major projects like roads, bridges, and public transit systems, often requiring large sums of capital, sometimes exceeding millions of dollars. Stakeholders, including government entities, private investors, and non-profit organizations, seek clarification on potential returns, project feasibility, and socio-economic impacts. Furthermore, aspects such as environmental assessments (to evaluate ecological impact), regulatory compliance (adherence to local and federal regulations), and community engagement (to ensure public support) are vital in understanding the overall benefits of investment. Evaluating these factors allows for informed decision-making and strategic planning essential for successful infrastructure initiatives.

Project Details

Infrastructure investment inquiries often focus on large-scale projects, including transportation systems, energy facilities, and communication networks. A well-defined scope may involve funding requirements, projected timelines, and stakeholder engagement. Projects typically span various urban areas such as metropolitan hubs and rural regions, impacting local economies and job creation. Detailed documentation includes feasibility studies that analyze potential risks and return on investment (ROI) estimates based on market trends. Key performance indicators (KPIs) highlight successful benchmarks such as completion rates, budget adherence, and community satisfaction. Engaging public-private partnerships (PPPs) can streamline funding options, engaging both government entities and private investors to leverage resources effectively.

Investment Benefits

Infrastructure investment can significantly enhance economic growth in urban areas, boosting public services and private sector activity. Enhanced road networks could reduce travel times by up to 30% in major cities, improving accessibility. Efficient public transport systems, like the High-Speed Rail projects in countries such as Japan, can increase commuter capacity while decreasing carbon emissions. Investment in renewable energy infrastructure could potentially generate thousands of jobs, leading to a 15% rise in local employment rates. Furthermore, upgrading water supply systems could improve public health, reducing waterborne diseases by approximately 60%, providing a better quality of life for residents in affected regions. Overall, infrastructure investments can yield substantial returns in productivity, health, and sustainability, driving long-term community development.

Risk Assessment

Infrastructure investment strategies require comprehensive risk assessments to ensure the viability and sustainability of projects. Factors such as project location, demographic trends, and economic indicators play crucial roles in evaluating potential risks. Environmental concerns, including climate change impacts, demand careful consideration, especially in vulnerable areas like coastal regions or flood-prone zones. Legal and regulatory frameworks, such as zoning laws and local government policies, significantly influence project feasibility. Financial stability of stakeholders, including public-private partnerships, can affect funding availability and project timelines. Technological advancements, particularly in construction materials and methods, introduce both opportunities and risks that merit thorough analysis. Effective risk management strategies can mitigate potential setbacks, ensuring successful infrastructure outcomes.

Contact Information

Infrastructure investment inquiries typically involve significant financial allocations for public works projects such as roads, bridges, and utilities. Investors often seek details on specific projects, which may include construction timelines, estimated costs, and projected economic impacts. Effective communication with entities like local governments or private developers requires concise contact information, such as names of project managers, email addresses, phone numbers, and relevant titles. Knowing the project's location, like the urban areas or regions targeted for development, is crucial for understanding community benefits and potential returns on investment.

Comments