Are you considering a government bond investment but feel uncertain about where to begin? Understanding the ins and outs of government bonds can seem daunting, but it's a smart way to secure your financial future. In this article, we'll break down the key benefits, potential risks, and the steps required to get started with your investment journey. So, grab a cup of coffee and let's dive into the world of government bondsâyou won't want to miss it!

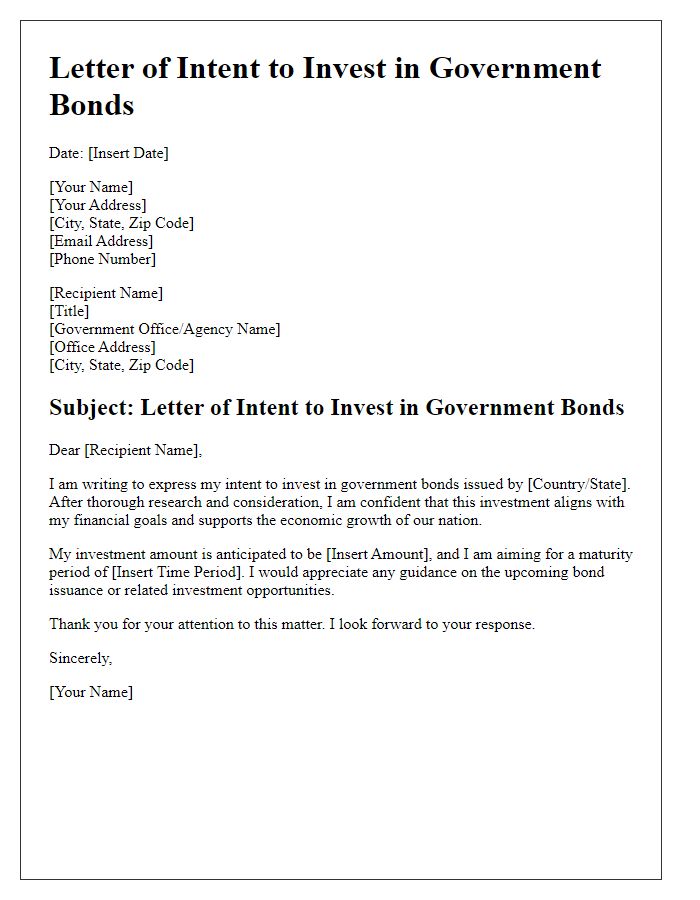

Investor's personal and contact information

Government bonds, often referred to as Treasury bonds, serve as a low-risk investment option for individuals seeking stable income. These bonds typically have maturities ranging from 10 to 30 years and pay interest every six months. In the United States, bonds are issued by the Department of the Treasury and are backed by the full faith and credit of the U.S. government. An investor may provide personal information, including full name, Social Security number, and address, alongside contact details such as phone number and email address for communication purposes. This identification process ensures security and compliance with financial regulations, allowing consumers to confidently invest in government securities. Investors often consider reasons such as capital preservation, stable returns, and portfolio diversification when allocating funds to government bonds.

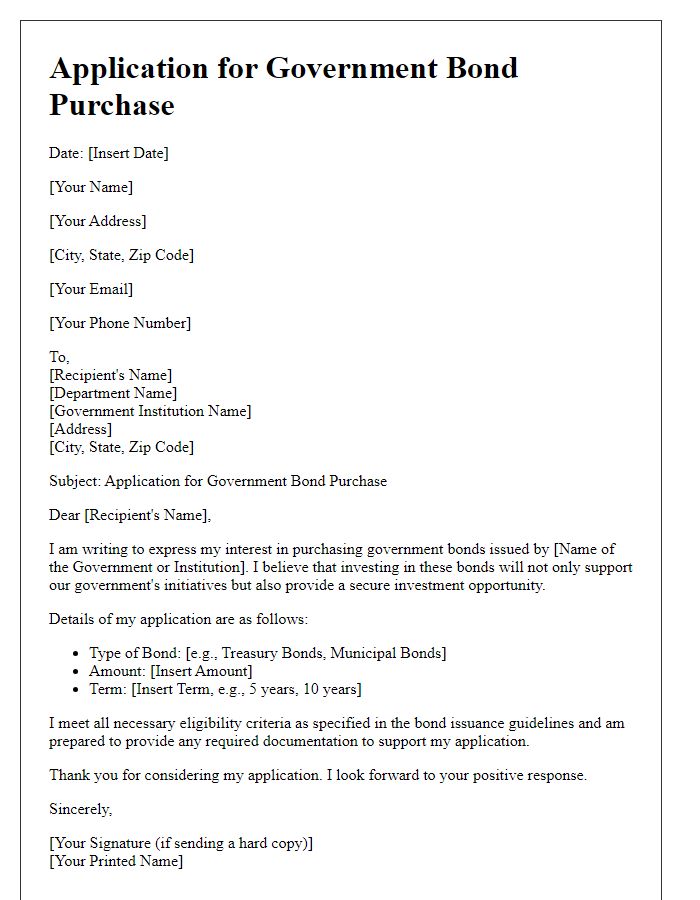

Purpose of investment and financial goals

Government bonds represent a stable investment option, typically issued by national governments to finance various projects and reduce national debt. Investors often seek these bonds for their reliability, as they are generally backed by the government's full faith and credit. The purpose of investing in government bonds includes achieving long-term financial goals, such as funding retirement plans, obtaining a steady income stream, or preserving capital in a low-risk vehicle. Specific financial goals may vary from individuals aiming for savings accumulation (often targeting a 4-6% annual return), to institutions managing cash reserves or endowments, which may require a more conservative growth strategy. Additionally, the predictable interest payments, known as coupon payments, provide a dependable cash flow, generally appealing to risk-averse investors.

Bond details (type, maturity, interest rate)

Government bonds, a secure investment vehicle, offer various types, such as Treasury Bonds (T-Bonds) and Treasury Notes (T-Notes). Treasury Bonds typically have maturities ranging from 10 to 30 years with interest rates around 2-3 percent, providing fixed semiannual interest payments. Treasury Notes, on the other hand, have shorter maturities of 2, 5, or 10 years and feature interest rates that similarly range from 1.5 to 2.5 percent. Investors seeking to diversify their portfolios may find these options appealing due to the perceived low risk associated with government-backed securities issued by the United States Department of the Treasury.

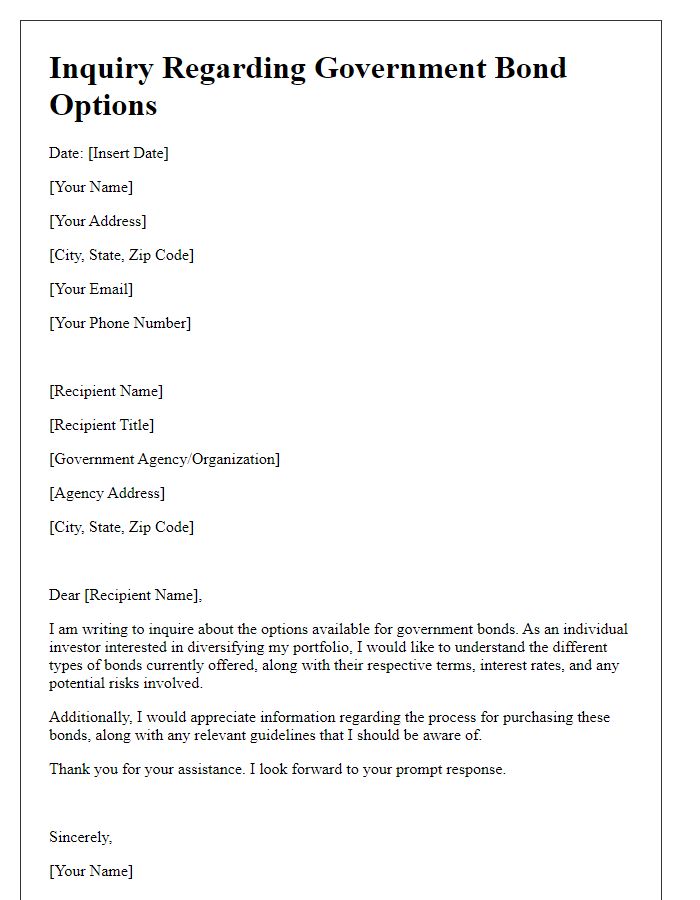

Government bond investment advantages

Investing in government bonds, such as U.S. Treasury bonds or UK Gilts, offers several advantages for investors seeking stability and security in their financial portfolios. These bonds are backed by the full faith and credit of the issuing government, making them one of the safest investment options available, with default rates historically near zero. Government bonds typically provide predictable income through fixed interest payments, known as coupon payments, which can be appealing for retirees or income-focused investors. Interest rates on government bonds can vary, but they generally tend to be lower than other high-risk investments, reflecting their lower risk profile. Furthermore, during periods of economic uncertainty or market volatility, government bonds often act as a safe haven, as investors flock to their stability, which can lead to capital appreciation. Additionally, government bonds can provide tax advantages; interest earned on certain government bonds may be exempt from state and local taxes. With maturities ranging from short-term to long-term, these bonds also offer flexibility for investors' financial strategies.

Compliance and regulatory considerations

Government bond investments often require a thorough understanding of compliance and regulatory considerations. Regulations established by the Securities and Exchange Commission (SEC) mandate adherence to specific guidelines, including accurate disclosure of investment risks and obligations. The Investment Company Act of 1940 stipulates requirements for mutual funds investing in government bonds, ensuring transparency for investors. Compliance officers must conduct regular audits to guarantee adherence to anti-money laundering (AML) provisions, especially in light of the Financial Crimes Enforcement Network (FinCEN) regulations. Additionally, the Dodd-Frank Wall Street Reform and Consumer Protection Act imposes stringent reporting requirements that enhance accountability and protect investors from fraudulent activities. Understanding these frameworks is crucial for both institutional and individual investors to ensure lawful participation in the bond market.

Comments