Are you looking to grow your wealth through a strategic investment approach? Diversified investment portfolios can be an effective way to manage risks while maximizing returns over time. By spreading your investments across various asset classes, you're not only protecting yourself from market volatility but also positioning your portfolio for potential gains. If you're curious about crafting your own diversified portfolio strategy, read more to discover some expert tips and insights!

Investment diversification goals

A diversified investment portfolio strategy aims to minimize risk while maximizing potential returns through a variety of asset classes, including stocks, bonds, real estate, and alternative investments. Allocating funds across different sectors, such as technology, healthcare, and consumer goods, enables investors to shield themselves from market volatility. Historical data shows that a balanced portfolio containing 60% equities and 40% fixed-income securities often results in optimal long-term growth while maintaining a lower risk profile, particularly during economic downturns. Investments in international markets, like emerging economies in Asia and Latin America, can further enhance diversification, allowing exposure to a wider range of economic conditions and growth opportunities. Individual risk tolerance, investment horizon, and financial goals play pivotal roles in determining the appropriate diversification strategy.

Risk tolerance and management

A diversified investment portfolio strategy emphasizes the balance between risk tolerance and management to achieve long-term financial growth. Understanding risk tolerance is crucial; it refers to an investor's ability to withstand fluctuations in market value without significant distress or panic. Factors influencing risk tolerance include age, financial goals, income level, and investment time horizon. For instance, younger investors in their 30s can typically tolerate higher risk due to their longer investment timeline, while retirees may prioritize stability and capital preservation. Effective risk management techniques such as asset allocation, diversification across various sectors (e.g., technology, healthcare, real estate), and regular portfolio rebalancing can mitigate potential losses. Identifying investments with different risk profiles--including conservative bonds, balanced mutual funds, and aggressive growth stocks--can create a robust portfolio capable of navigating market volatility while aligning with individual financial objectives. Regular assessment and adjustment in response to market conditions ensure the portfolio remains well-positioned for achieving desired returns without exposing investors to undue risk.

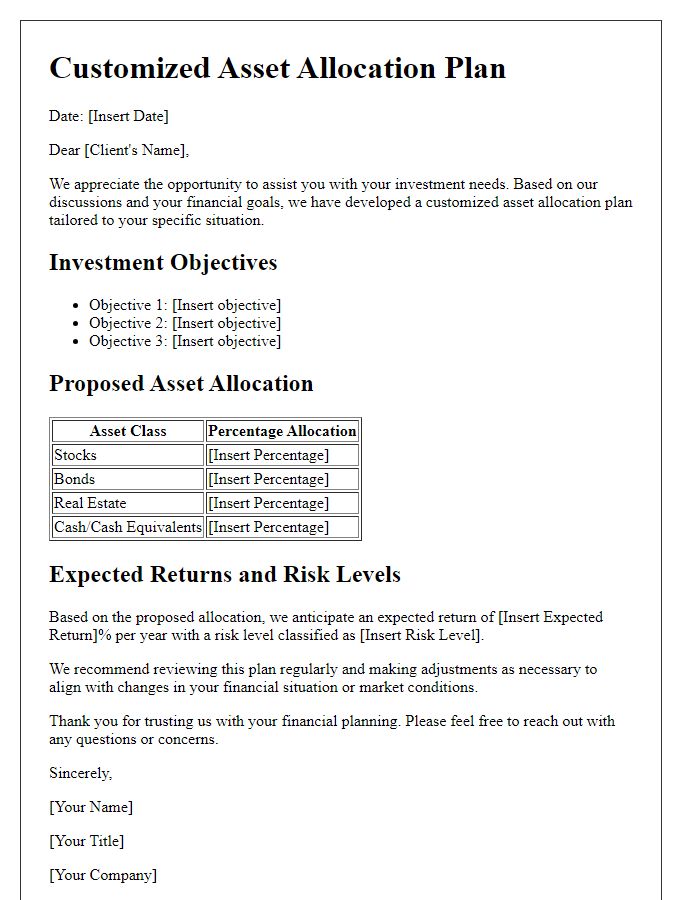

Asset allocation strategy

A diversified investment portfolio strategy involves allocating resources across various asset classes to minimize risk and optimize returns. The asset allocation strategy typically includes equities (such as large-cap stocks from the S&P 500, small-cap stocks, and international markets), fixed-income securities (such as U.S. Treasury bonds and corporate bonds with different maturities), real estate (including Real Estate Investment Trusts or REITs), and alternative investments (like commodities or cryptocurrencies). Historical performance indicates that a balanced approach, often targeting a mix of 60% stocks and 40% bonds, can provide a buffer against market volatility. Regular rebalancing, in response to changes in market conditions, ensures alignment with investment goals and risk tolerance, such as maintaining a desired level of diversification across sectors like technology, healthcare, and consumer goods. Monitoring economic indicators, geopolitical events, and interest rate fluctuations plays a critical role in adjusting the asset allocation strategy over time.

Market trends and economic forecasts

Diversified investment portfolios are designed to mitigate risks and enhance returns across various asset classes, including stocks, bonds, real estate, and commodities. Analyzing current market trends reveals increasing volatility in stock markets due to geopolitical tensions and inflation rates hovering around 8% (2023 data) in several economies like the United States. Economic forecasts indicate potential growth in technology and renewable energy sectors, driven by advancements in artificial intelligence and global initiatives toward sustainability. Investors may consider reallocating capital towards emerging markets, where GDP growth rates are projected to outpace developed economies, particularly in Asia and Africa. Furthermore, diversification strategies, including low-correlation assets, are essential for cushioning against market downturns, ensuring a balanced approach to long-term financial health.

Portfolio performance monitoring

A diversified investment portfolio strategy is crucial for optimizing financial growth and minimizing risk. Regular portfolio performance monitoring, typically conducted quarterly, allows investors to analyze asset allocation, such as equities (stocks), bonds, and alternative investments like real estate or commodities. Key performance indicators (KPIs), including return on investment (ROI), standard deviation, and Sharpe ratio, provide insights into portfolio efficiency and volatility. Market conditions, influenced by economic indicators like the unemployment rate (currently at 4.2% in the United States) and inflation figures (CPI increase of 5.4% year-over-year as of October 2023), significantly impact asset performance. Adjustments based on risk tolerance and investment goals must be considered to ensure optimal alignment with market trends and personal financial objectives.

Comments