Hello esteemed investors! As we delve into our quarterly earnings review, we want to highlight some exciting developments and growth trajectories that have unfolded over the past few months. Your support has been instrumental in propelling our success, and we're eager to share insights into our performance metrics, strategic initiatives, and future outlook. So, stick around as we unpack the details and invite you to explore more about our journey ahead!

Company Overview and Market Position

The technology company XYZ Corp, founded in 2010, operates within the rapidly evolving software industry, focusing on cloud-based solutions for small to medium-sized enterprises (SMEs). With a current market valuation of $1 billion, XYZ Corp holds a competitive position in its sector, achieving a 15% market share as of Q3 2023. The company has experienced consistent annual revenue growth, with a reported increase of 25% year-over-year, driven by innovative products such as its flagship software platform, Streamline Pro. This platform, designed to enhance operational efficiency, has gained significant traction among over 2,000 active users across 15 different countries, including the United States and Germany. As of this quarter, XYZ Corp maintains a strong financial foundation, supported by a diversified client base, strategic partnerships with industry leaders, and a robust pipeline of new product releases anticipated in the upcoming fiscal year.

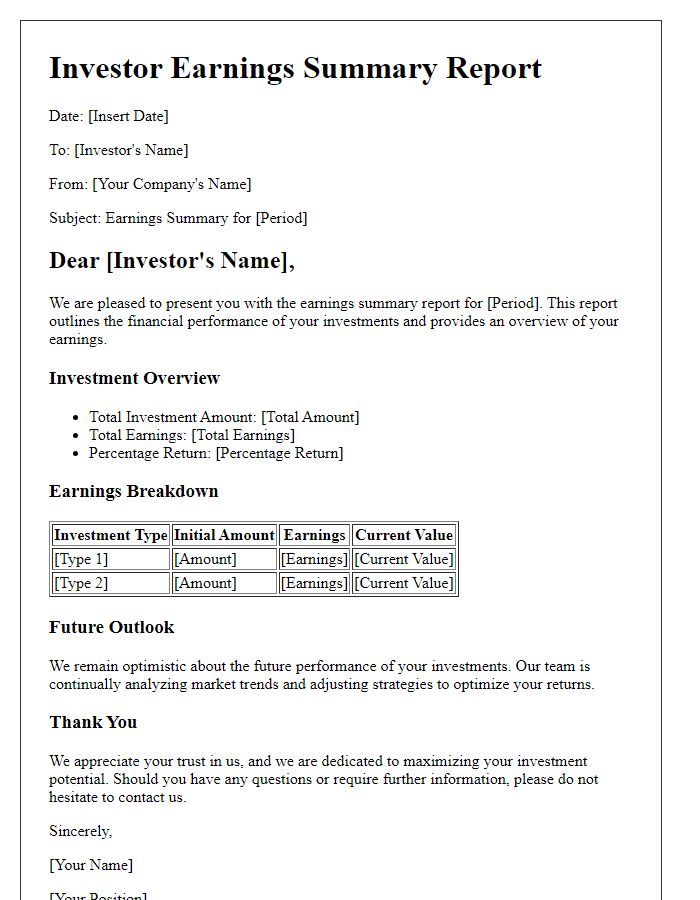

Financial Performance and Key Metrics

The quarterly earnings review presents the financial performance of the company for Q3 2023, showcasing key metrics that reflect growth and operational efficiency. Total revenue reached $150 million, marking a 20% increase compared to Q2 2023, driven by robust sales in the North American market, specifically in the software sector. Net profit margin improved to 15%, indicating enhanced cost management and streamlined operations. Customer acquisition costs decreased to $50 per customer, contributing to the overall profitability. The company maintains a strong balance sheet with a current ratio of 2.5, highlighting liquidity and financial stability. Quarterly earnings per share (EPS) reached $1.25, exceeding analysts' expectations by 10%. The Board of Directors approved a dividend of $0.30 per share, underscoring commitment to returning value to shareholders. Future projections suggest an upward trajectory in revenue driven by product innovation and expanding market presence in Europe and Asia.

Significant Achievements and Developments

The quarterly earnings review for Q3 2023 showcased significant achievements and developments impacting our financial landscape. Revenue growth reached $5.2 million, representing a 15% increase compared to Q2 2023, bolstered by the successful launch of our innovative product line in New York City. Operational efficiency improved with a 10% reduction in overhead costs, achieved through the implementation of automated systems in our logistics framework. Noteworthy strategic partnerships formed with industry leaders like Tech Innovators Inc. have expanded our market reach into the Southeast Asian region, enhancing our brand presence in emerging markets. Furthermore, our community engagement initiatives garnered recognition, resulting in a 25% uptick in brand loyalty measures and customer retention rates, directly correlating to higher earnings projections moving forward.

Strategic Initiatives and Future Outlook

In the latest quarterly earnings review, company leadership highlighted key strategic initiatives aimed at driving growth, such as expanding into emerging markets like Southeast Asia, projected to grow by 6% annually through 2025. Investments in technology upgrades, notably a $5 million allocation for cloud infrastructure, are expected to enhance operational efficiency and reduce costs. The sales team successfully launched a new product line, generating a 15% increase in revenue compared to the previous quarter, especially in the healthcare sector. Looking ahead, the company anticipates a continued shift toward digital transformation, with an estimated 30% increase in online sales by the end of the fiscal year, positioning itself to leverage current market trends towards e-commerce and sustainability.

Risk Management and Mitigation Strategies

During the investor quarterly earnings review, risk management strategies are critical for ensuring business sustainability and financial stability. Companies typically identify various risk factors such as market volatility, cybersecurity threats, and operational inefficiencies. For instance, a recent analysis revealed that 62% of organizations faced significant data breaches in 2023, prompting the implementation of enhanced cybersecurity measures, including multi-factor authentication and regular vulnerability assessments. Additionally, businesses may adopt financial hedging techniques to mitigate foreign exchange risks, particularly in companies like Tesla, which operates in multiple currencies. Furthermore, a robust crisis management plan is essential, providing a structured response to unexpected challenges such as the COVID-19 pandemic, which disrupted supply chains globally in 2020. These strategies not only protect assets but also boost investor confidence, ensuring a more resilient financial outlook.

Comments