Hey there! As we venture into exciting new opportunities, we want to ensure our valued investors are informed and engaged. This capital call notice outlines the specifics of our upcoming investment round and what it means for your continued participation. We invite you to read more about the details and implications of this exciting phase in our journey!

Clear and Concise Subject Line

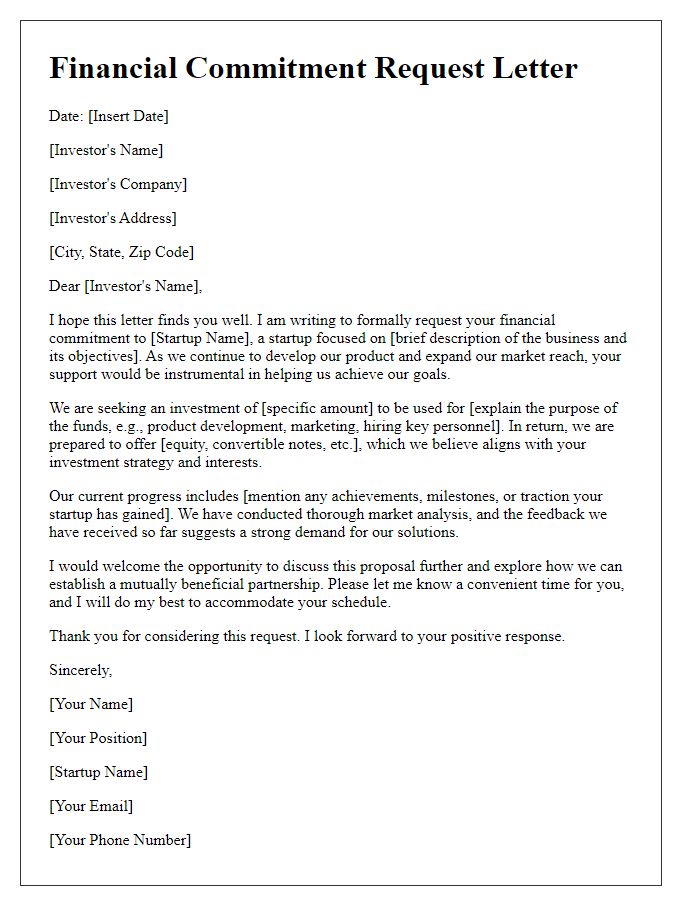

Investor capital call notices require direct communication regarding financial commitments from stakeholders. A well-defined subject line clearly indicates the purpose of the email. For example, "Capital Call Notice: Investment Commitment Due [Date]". This subject line specifies the nature of the notice, emphasizes the urgency related to the due date, and provides immediate context for the investor regarding the action required. Such clarity fosters better engagement and ensures timely responses, essential for maintaining investment schedules and project timelines.

Detailed Capital Call Amount and Purpose

Capital call notices serve to inform investors of their financial obligations in investment funds. The detailed capital call amount, often outlined in dollars, reflects the specific contribution requested to support ongoing projects or operational needs. Purpose of the capital call may include funding for new developments, acquisitions, debt repayments, or enhancing liquidity. Each capital call is tied to distinct investment opportunities, fostering more robust portfolio growth within the fund's strategy. Investors are typically provided with deadlines for compliance, ensuring timely execution of capital deployment. Transparency regarding the use of funds is critical in maintaining investor trust and confidence.

Payment Instructions and Deadline

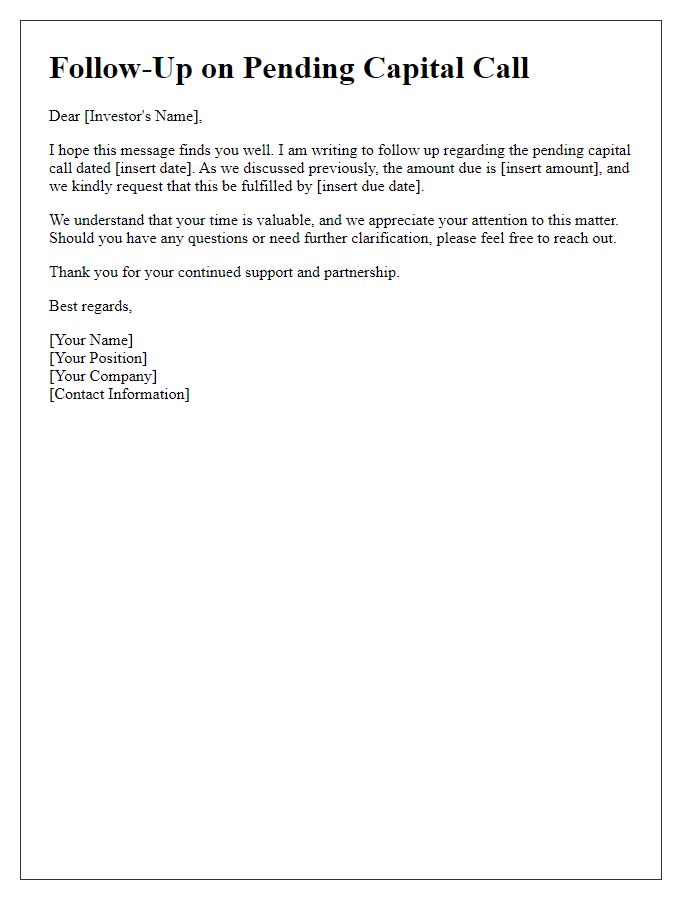

A capital call notice serves as an important communication to investors regarding payment instructions and deadlines. This formal notification typically includes specific details such as the total amount required, due date (often 30 days from the notice), and acceptable payment methods (e.g., wire transfer, checks). Investors should be informed of the receiving bank's details, including account number and routing information. An emphasis on timely payments is crucial, as late payments may incur penalties or interest fees. Clear guidelines help ensure full compliance with the terms outlined in the investment agreement. Additionally, providing contact information for any questions regarding the process facilitates communication and reassures investors of available support.

Contact Information for Queries

Investors may reach out to the designated contact point for any inquiries regarding the capital call notice, ensuring clarity and transparency during the investment process. It is essential to include the full name (such as James Smith), title (like Chief Financial Officer), and phone number (for example, +1-555-123-4567) for direct communication. The email address (e.g., investorrelations@investmentfirm.com) should also be provided for convenient written correspondence. Timely responses to queries can enhance investor confidence and foster a positive relationship between the investment firm and its stakeholders.

Legal Disclaimers and Obligations

Legal disclaimers are essential for investor capital call notices, outlining the obligations and rights of both parties involved. Such disclaimers often highlight the fiduciary responsibility of the fund managers in compliance with the Securities and Exchange Commission (SEC) regulations. Investors must acknowledge that the capital contributions are subject to the terms stipulated in the governing documents, typically the Limited Partnership Agreement (LPA), and that failure to comply might result in penalties or loss of partnership rights. Additionally, the notice usually includes disclaimers regarding potential market risks, emphasizing that past performance does not guarantee future results, and that capital is at risk. It is imperative for investors to review all relevant documentation thoroughly to ensure they understand their commitments and the legal implications involved.

Comments