Are you ready to take the next step in securing your financial future? In this article, we'll guide you through the essentials of an investment advisory agreement confirmation letter, a crucial document that solidifies your partnership with your financial adviser. By understanding the key components of this letter, you can ensure that your investments are in safe hands. So, grab a cup of coffee and let's dive into the details together!

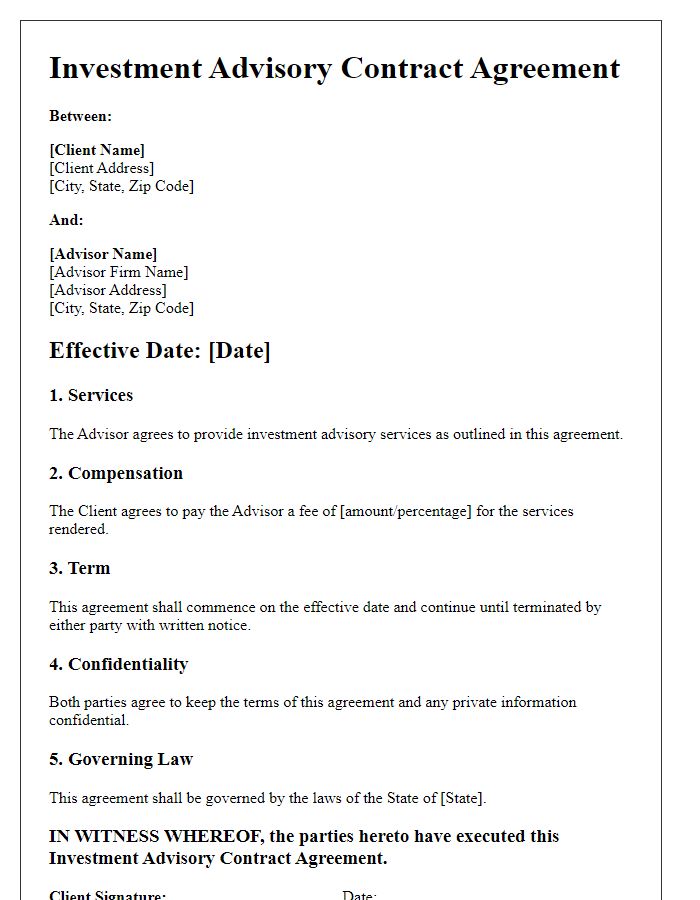

Client and Advisor Information

Investment advisory agreements outline the relationship between a client and an advisor, detailing key aspects such as services provided, fees, and responsibilities. Clients, individuals or entities seeking financial guidance, must ensure their information is accurately recorded, including full legal names and contact details. Advisors, typically registered professionals or firms, should present their qualifications, including certifications and regulatory compliance (e.g., SEC or FINRA registrations). Furthermore, the agreement must clarify the scope of investment services, such as portfolio management and financial planning, while specifying the fee structure, whether asset-based, hourly, or flat rate. Documenting these elements establishes a professional understanding that safeguards both parties involved, promoting transparency and trust.

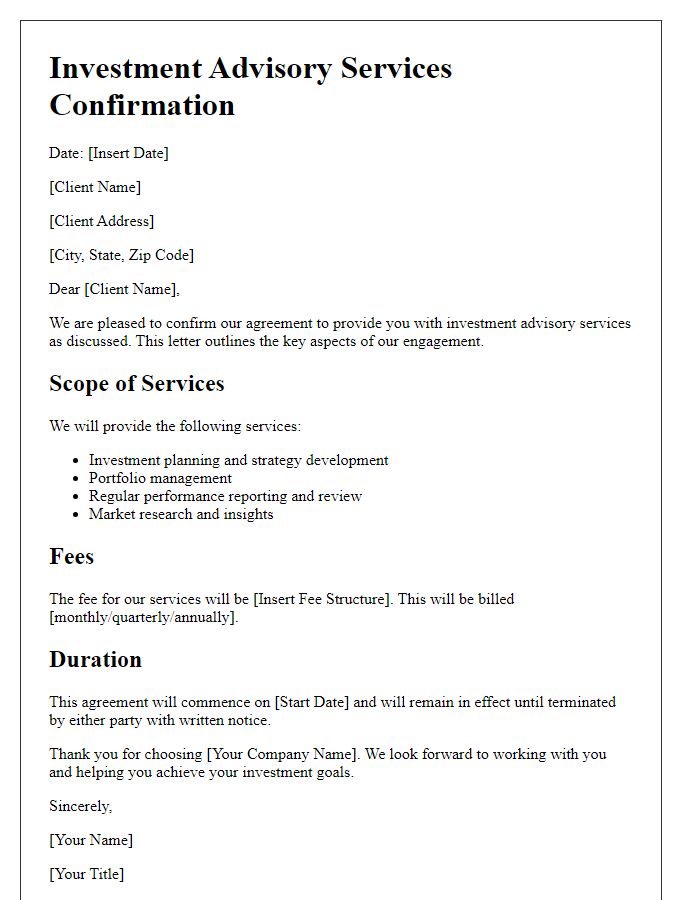

Scope of Services

An investment advisory agreement outlines the specific scope of services provided by the advisory firm to the client. This includes financial planning, investment management, market analysis, asset allocation strategies, and performance monitoring. The advisory firm may work with various asset classes, such as equities (stocks), fixed income (bonds), real estate, and alternative investments. Detailed reporting on investment performance, including risk assessments and market trends, will occur at regular intervals, typically quarterly or annually. Compliance with fiduciary standards mandates the firm to act in the best interest of the client, ensuring transparency and ethical management of assets. Setting clear expectations regarding fees, investment objectives, and communication frequency remains critical for a successful advisory relationship.

Fee Structure and Payment Terms

Investment advisory agreements outline crucial details regarding fees and payment structures. The fee structure may vary, commonly consisting of a percentage of assets under management (AUM), typically ranging from 0.5% to 2%, or a flat annual fee, which can average around $5,000 to $10,000 depending on services offered. Payment terms often specify quarterly billing cycles, with payments due at the beginning of each quarter. Clients may encounter fees for additional services, such as tax planning or financial forecasting, which can average between $150 to $400 per hour. Clear documentation regarding these terms enhances transparency and establishes mutual understanding, ensuring clients are fully aware of their financial obligations.

Agreement Duration and Termination

An investment advisory agreement outlines the relationship between a client and an investment advisor, detailing the duration of the contract and conditions for termination. Typically, the duration may span one year, with automatic renewal clauses unless notification is provided. In cases of termination, stipulations usually require notice of at least 30 days, particularly for breaches of fiduciary duties, such as mismanagement of funds or violation of regulatory standards set forth by the Securities and Exchange Commission (SEC). This structured approach ensures both parties maintain clarity and compliance throughout the investment period, aiming for a mutually beneficial outcome in portfolio management strategies.

Confidentiality and Compliance Policies

Investment advisory agreements often include clauses regarding confidentiality and compliance policies. Confidentiality ensures that sensitive financial information remains secure, protecting clients in industries such as finance and healthcare. Compliance policies uphold standards set by organizations like the Securities and Exchange Commission (SEC) in the United States, ensuring adherence to regulations that govern investment practices. Understanding these components fosters trust in the advisory relationship. Regular training on compliance protocols is crucial for advisors to effectively navigate legal obligations and uphold ethical standards in managing client investments. Documentation of adherence to these policies serves as a safeguard against potential legal issues.

Comments