Navigating the world of private equity investments can feel daunting, but it doesn't have to be! In this article, we'll break down the key components of a compelling investment proposal that captures attention and drives results. Whether you're a seasoned investor or just dipping your toes into the market, we've got you covered with insights and strategies to elevate your pitch. So, let's dive in and explore how you can craft a winning letter that speaks directly to potential partners!

Executive Summary

Private equity investment offers substantial opportunities for growth in targeted sectors such as technology, healthcare, and renewable energy. With a projected annual growth rate of 12% over the next five years in the tech sector alone, strategies focused on distressed assets and undervalued companies can yield significant returns. Key players in the private equity landscape include firms like Blackstone and KKR, managing portfolios worth hundreds of billions. Market trends indicate increasing interest in ESG (Environmental, Social, Governance) investing, prompting a shift towards sustainable business practices. Potential investment regions, such as Southeast Asia, showcase emerging markets with rapid economic development, further enhancing the potential for capital appreciation. This proposal outlines our strategic approach to identifying and managing investments that align with high-growth opportunities while mitigating risks.

Market Opportunity

The private equity investment landscape is ripe with opportunities, particularly in emerging markets like Southeast Asia, where GDP growth rates consistently exceed 5% annually. The technology sector is burgeoning, with countries like Indonesia, home to over 270 million people, experiencing rapid digital transformation. E-commerce and fintech industries are projected to reach a market value exceeding $100 billion by 2025. Consumer behavior shifts towards online platforms create substantial demand for digital solutions and services, driving revenue growth. Furthermore, regulatory changes across the region support foreign investments, enhancing the attractiveness of potential acquisitions. Identifying scalable companies with innovative products in this space presents a compelling investment thesis, offering the potential for significant returns over a 5 to 7-year horizon.

Investment Thesis

A robust investment thesis for private equity (PE) firms outlines strategic opportunities for value creation in targeted sectors. It involves identifying potential companies, such as mid-market enterprises in technology or healthcare (both rapidly growing sectors), which exhibit strong cash flow, competitive advantages, and favorable market trends. The analysis includes assessing a company's financial performance, operational efficiency, and market positioning. Emphasis on due diligence reveals potential risks associated with market volatility or regulatory shifts. Additionally, focusing on exit strategies such as initial public offerings (IPOs) or strategic sales enhances clarity on returns. Investment horizons typically range between five to seven years, aligning investor expectations with economic cycles and industry maturation.

Financial Projections

In private equity investment proposals, financial projections serve as a crucial element, outlining anticipated revenue growth and profitability over the next five to ten years. These projections often utilize historical data from comparable companies within the industry, such as revenue multiples for firms in the technology sector, averaging around three to five times. Key performance indicators, including earnings before interest, taxes, depreciation, and amortization (EBITDA) margins and net income forecasts, provide additional context. The geographical market, like the United States, which has a projected market size of $4 trillion for technology services by 2025, also plays a significant role. Furthermore, sensitivity analyses may illustrate potential outcomes based on variables such as market conditions and operational efficiencies, offering a comprehensive risk assessment to investors.

Exit Strategy

An effective exit strategy is crucial for private equity investment proposals, particularly in the context of a firm preparing for a strategic divestment. Common exit routes include IPO (Initial Public Offering), where a private company goes public on a stock exchange, generating liquidity. M&A (Mergers and Acquisitions) involves selling the portfolio company to a larger entity, often resulting in a significant return on investment. Secondary buyouts allow private equity firms to sell portfolio companies to other investment firms, providing a viable exit option. Additionally, recapitalization enables companies to restructure their capital structure, allowing investors to recoup capital while retaining stakes. Each strategy should be detailed, emphasizing projected timelines, financial metrics, and market conditions, encapsulating the firm's vision for realizing maximum ROI (Return on Investment).

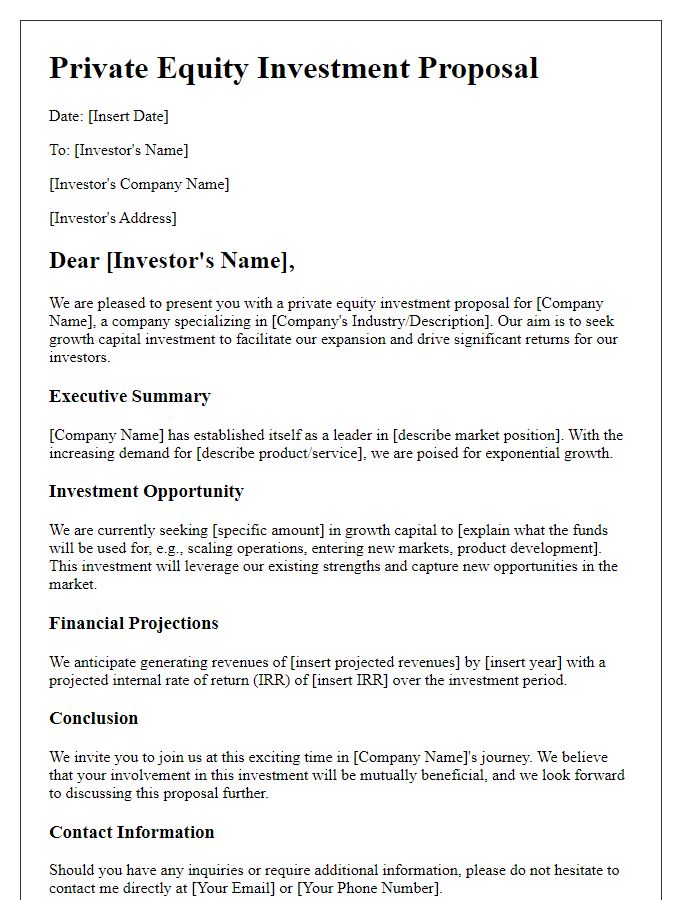

Letter Template For Private Equity Investment Proposal Samples

Letter template of private equity investment proposal for startup funding.

Letter template of private equity investment proposal for real estate development.

Letter template of private equity investment proposal for technology ventures.

Letter template of private equity investment proposal for healthcare innovation.

Letter template of private equity investment proposal for renewable energy projects.

Letter template of private equity investment proposal for consumer goods expansion.

Letter template of private equity investment proposal for distressed asset acquisition.

Letter template of private equity investment proposal for market entry strategy.

Letter template of private equity investment proposal for merger and acquisition financing.

Comments