When life throws us a curveball, accidents can happen to the best of us, and that's where accident forgiveness comes into play. This important safety net can help keep your insurance premiums from skyrocketing after a mishap. In today's world, understanding how to request accident forgiveness is crucial for maintaining financial stability and peace of mind. Ready to learn how to navigate this process? Let's dive in!

Personal Information

Accident forgiveness programs provided by insurance companies can greatly benefit drivers, particularly those with a clean driving history. Such programs allow individuals to avoid rate increases after their first at-fault accident, typically offering peace of mind and financial relief. Many major insurance providers, including Allstate and Geico, often implement these policies, allowing for this leniency regardless of state regulations. Applicants typically need to provide personal information, including full name, contact number, policy number, and details of the accident. This documentation helps streamline the claims process, ensuring customers receive timely assistance. Additionally, it is essential to verify eligibility criteria, since not all policies automatically include accident forgiveness, influencing the overall insurance premium.

Incident Details

Accident forgiveness programs offer drivers protection against rate increases after their first at-fault accident. Many insurance providers, such as State Farm and Allstate, offer these incentives to promote safe driving habits. When requesting accident forgiveness, it's essential to include specific details about the incident, such as the date of the accident (e.g., March 5, 2023), location of the incident (e.g., Main Street, Springfield), types of vehicles involved (e.g., a red Honda Accord and a blue Ford F-150), and the severity of damages incurred. Provide relevant policy information (e.g., policy number 123456789) and your clean driving history prior to the incident, emphasizing years without claims or violations. Additionally, mention any proactive measures taken since the accident, such as completing a defensive driving course, to demonstrate commitment to safe driving practices.

Apology Statement

Accident forgiveness programs offered by auto insurance companies provide policyholders an opportunity to avoid premium increases following their first at-fault accident. Many major insurers like Progressive and Allstate aim to reward safe driving behaviors. This feature typically becomes available after a certain period of accident-free driving, often three to five years. Requesting accident forgiveness usually involves submitting a formal statement expressing regret for the accident, an acknowledgment of improved driving habits since the incident, and a request for consideration under the forgiveness policy. Additionally, including relevant policy information such as the policy number and date of the accident can assist in the review process.

Justification or Explanation

Accident forgiveness, a feature offered by numerous automobile insurers, allows drivers a one-time reprieve from increased insurance premiums following a single accident. Typically, this benefit becomes available after a certain period, such as three years of continuous good driving, without any claims. Insurers often consider factors like the driver's history, severity of the accident, and whether the driver was at fault. In multiple regions, such as California or Texas, state regulations can also influence the terms and conditions of this forgiveness policy. Drivers may articulate their appeal to an insurance company by detailing their exemplary past behavior and emphasizing that the incident occurred under extenuating circumstances, seeking a reconsideration of premium adjustments.

Request for Forgiveness

Accident forgiveness programs, typically offered by auto insurance companies, allow drivers to avoid a premium increase after their first at-fault accident. These programs are often designed to reward safe driving habits and reduce financial burdens following an unfortunate incident. Statistically, a significant percentage of drivers experience at least one accident within their driving lifetime, making forgiveness programs increasingly popular. When requesting forgiveness, it is essential to provide details such as the accident date, circumstances, and any relevant police reports (from local authorities if applicable) to support the claim. Additionally, many insurance companies have specific eligibility criteria, including a minimum number of years of continuous coverage without a claim, which should be highlighted in the request.

Letter Template For Requesting Accident Forgiveness Samples

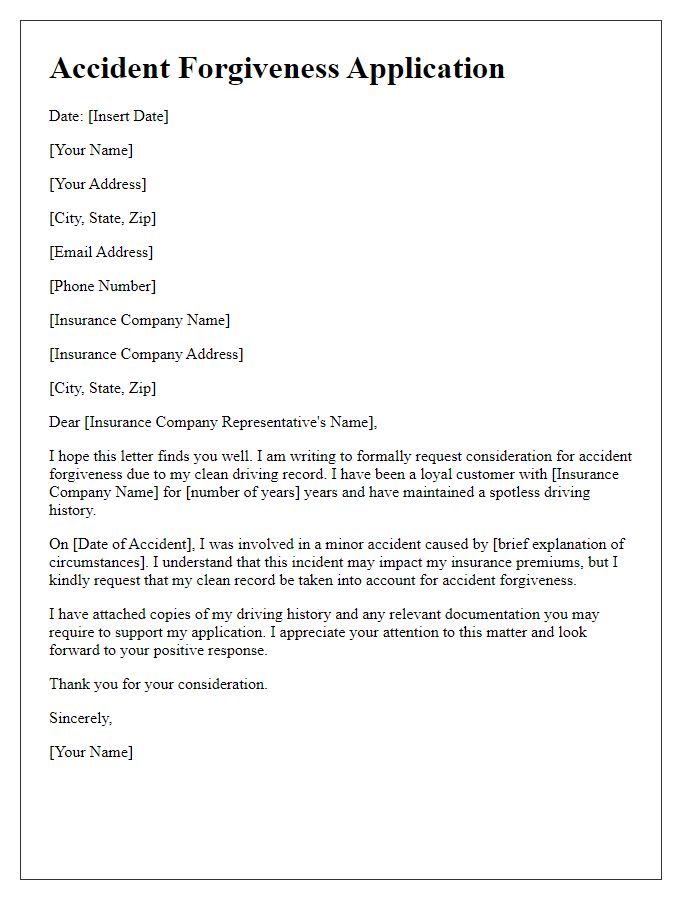

Letter template of accident forgiveness application due to clean driving record.

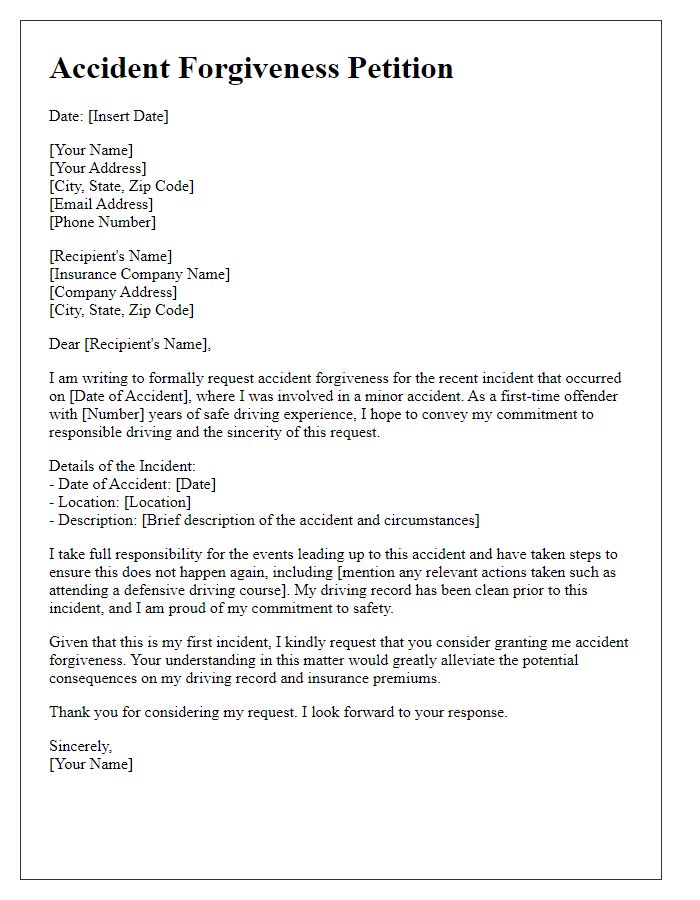

Letter template of accident forgiveness petition for first-time offenders.

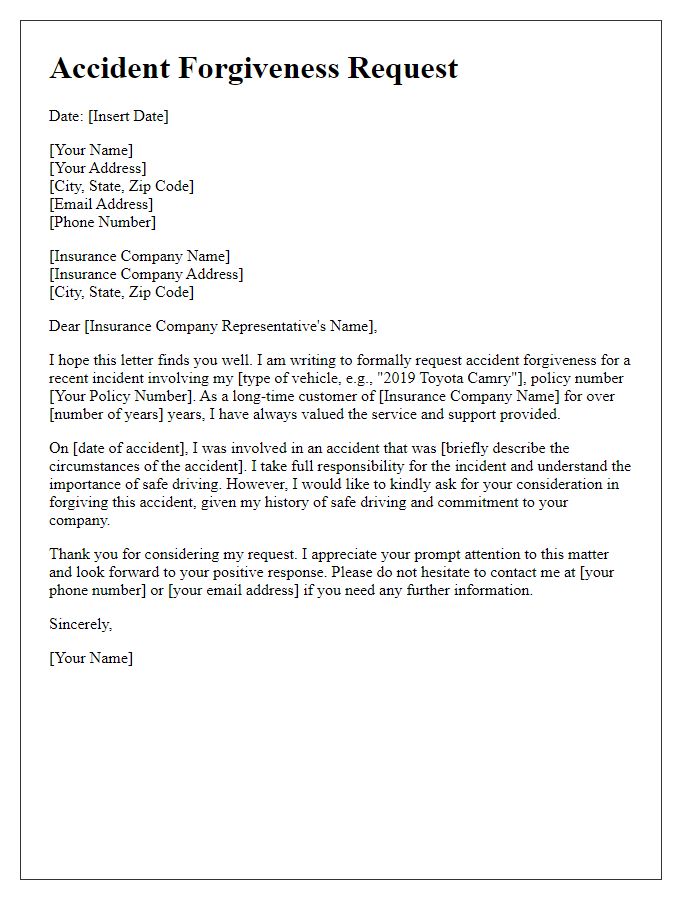

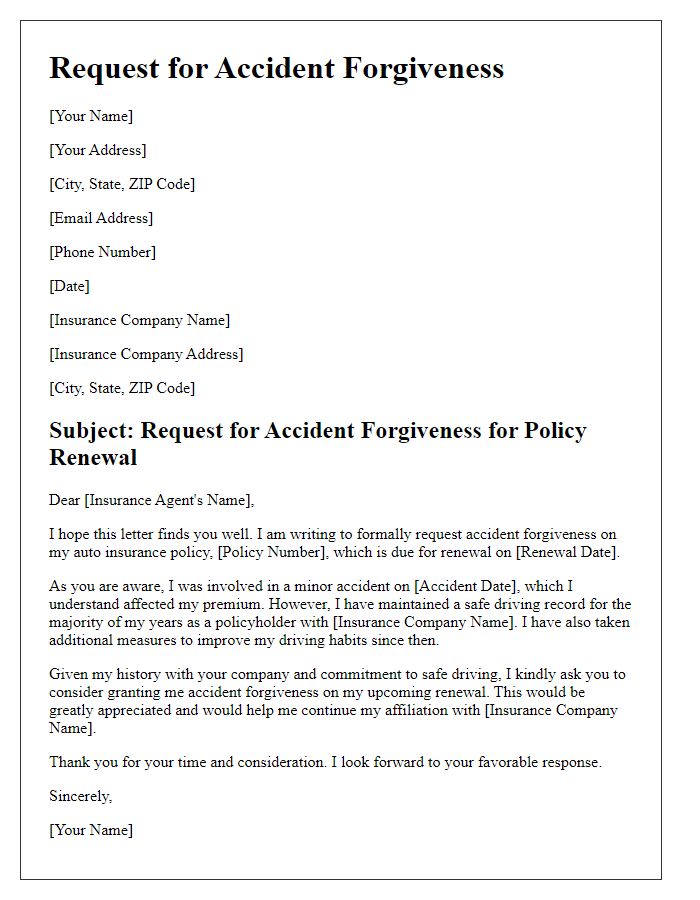

Letter template of accident forgiveness request for long-time customers.

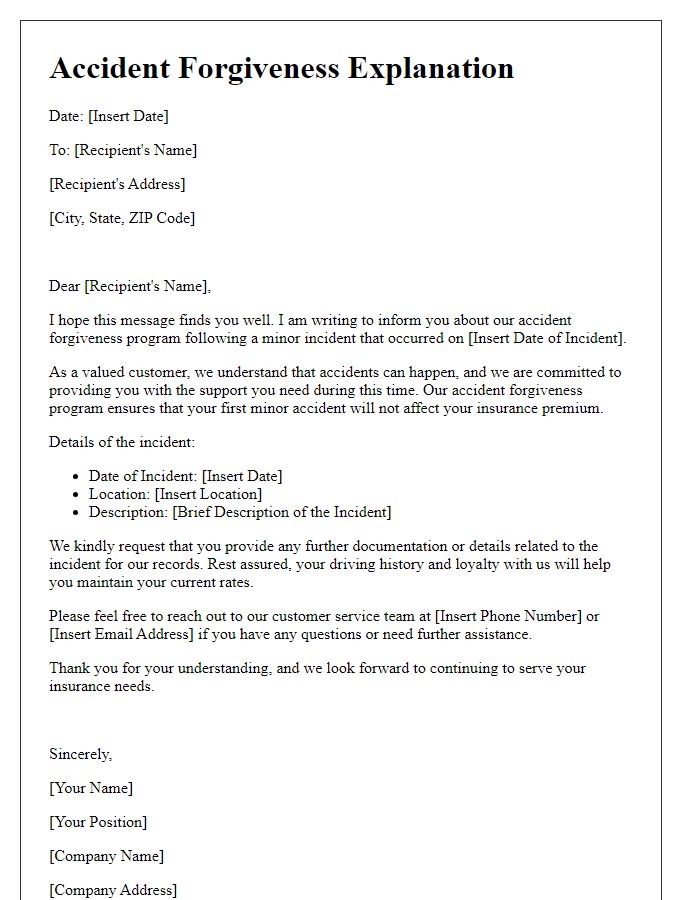

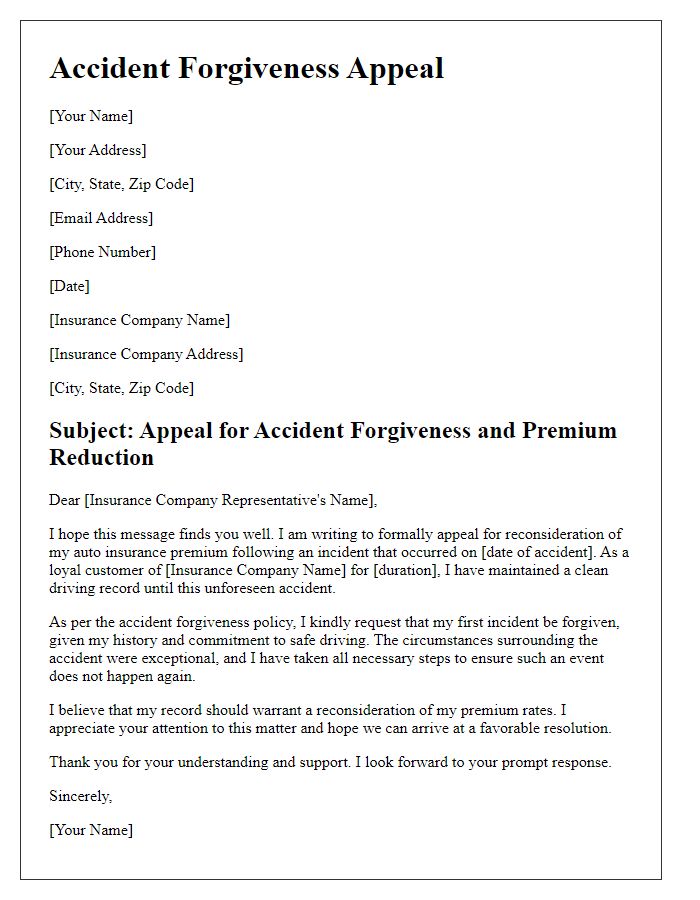

Letter template of accident forgiveness explanation after minor incident.

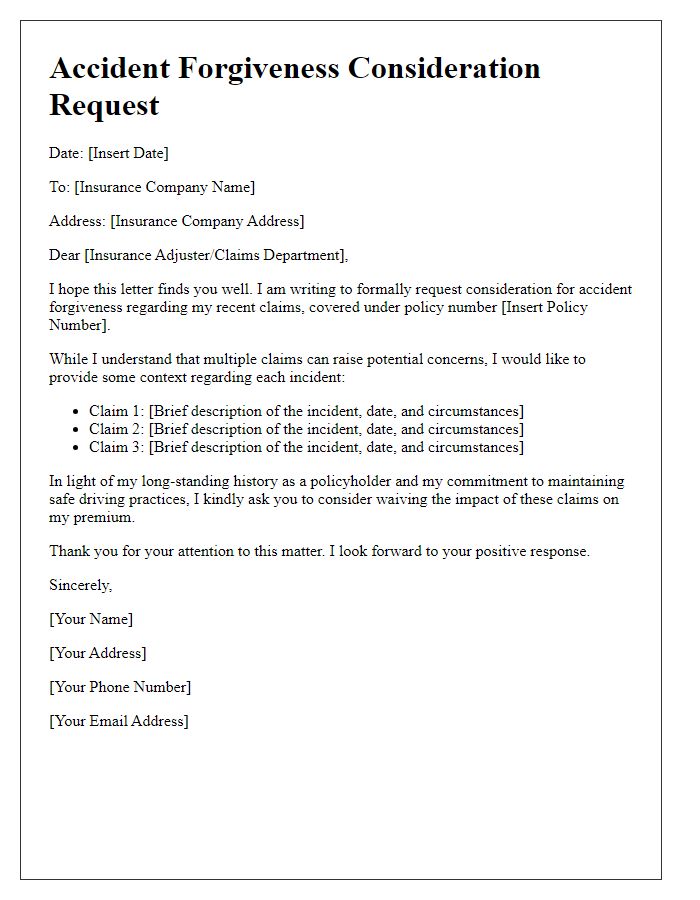

Letter template of accident forgiveness consideration for multiple claims.

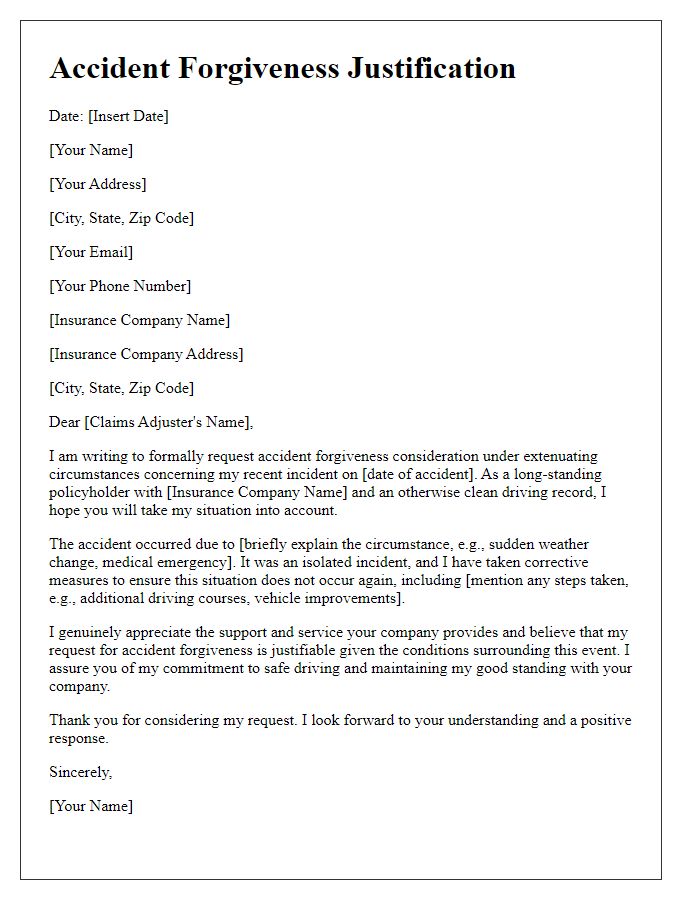

Letter template of accident forgiveness justification for extenuating circumstances.

Comments