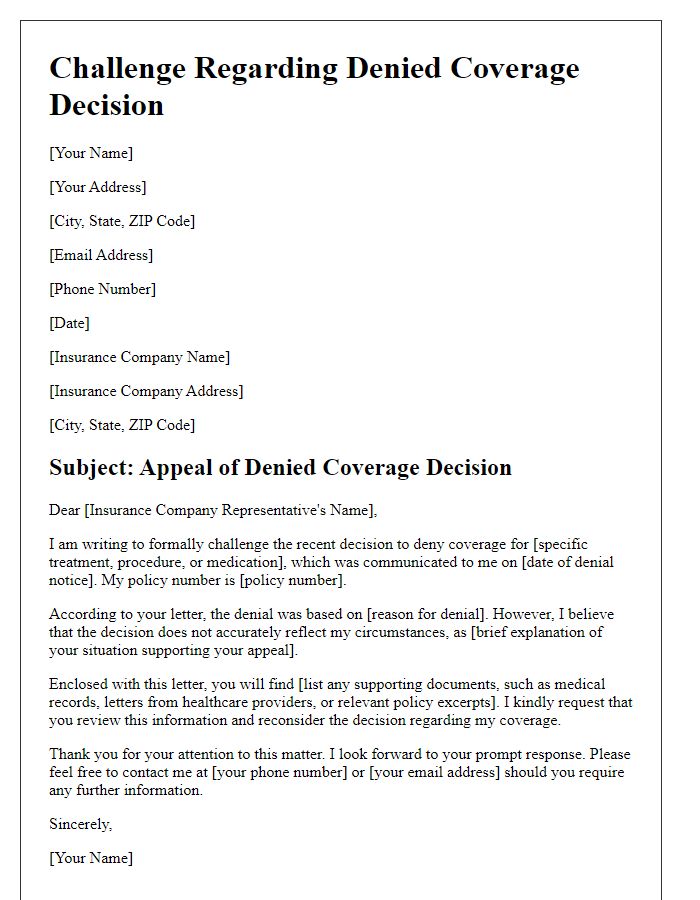

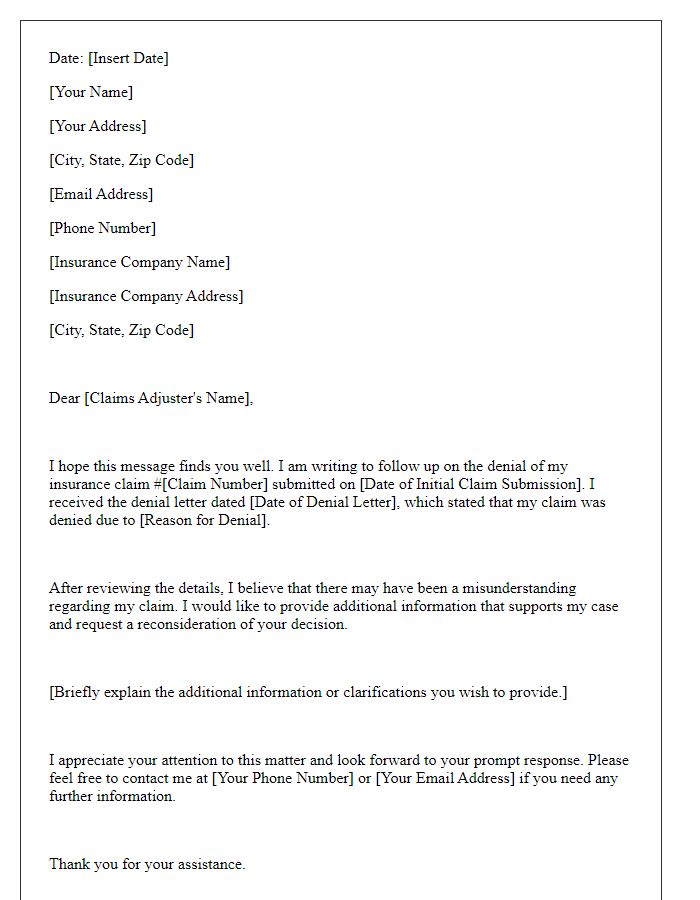

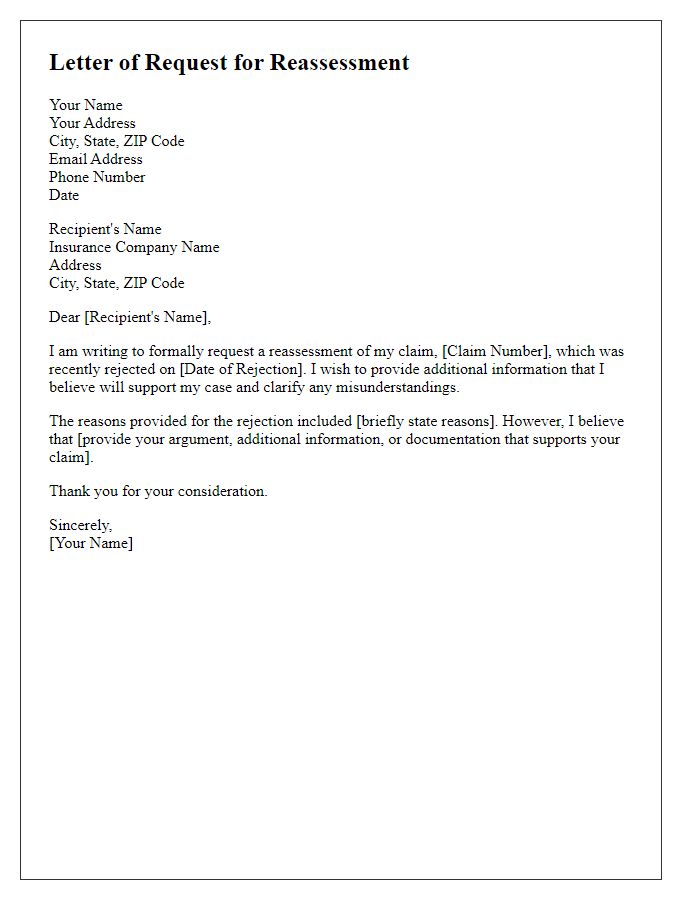

Have you ever faced the frustrating experience of having your insurance claim denied? It can feel disheartening, especially when you know you deserve the coverage. But don't lose hope just yet; there's a way to appeal those decisions and get the support you need. Dive into this article to discover a helpful letter template for re-evaluating your denied coverage, and reclaim the benefits entitled to you!

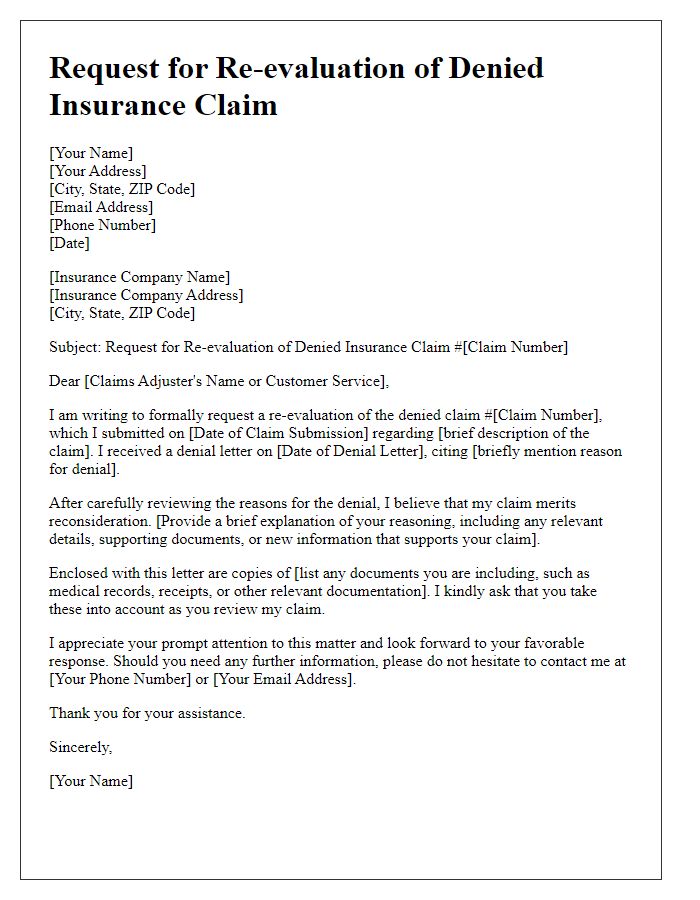

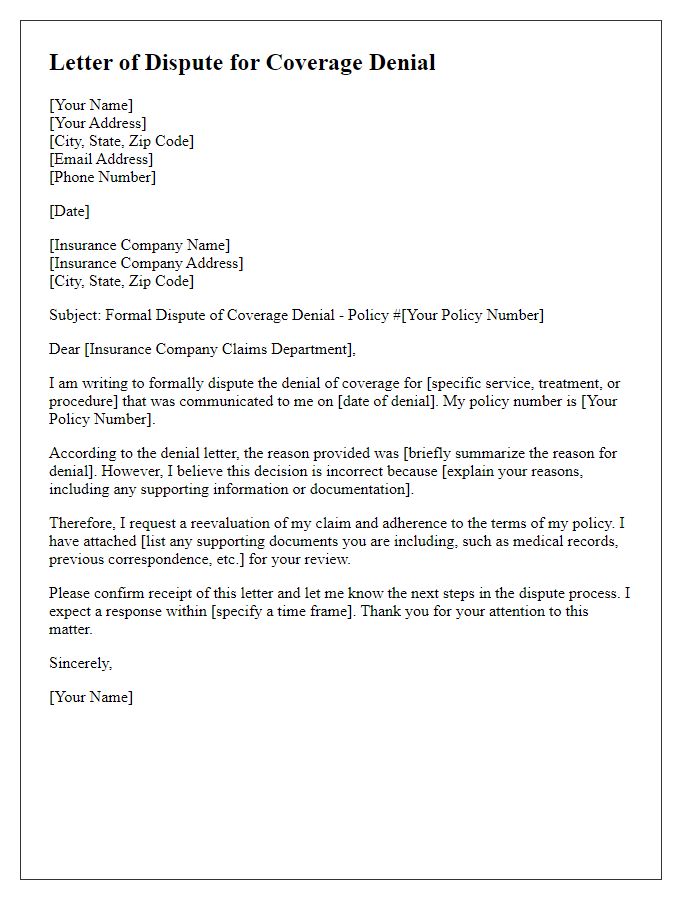

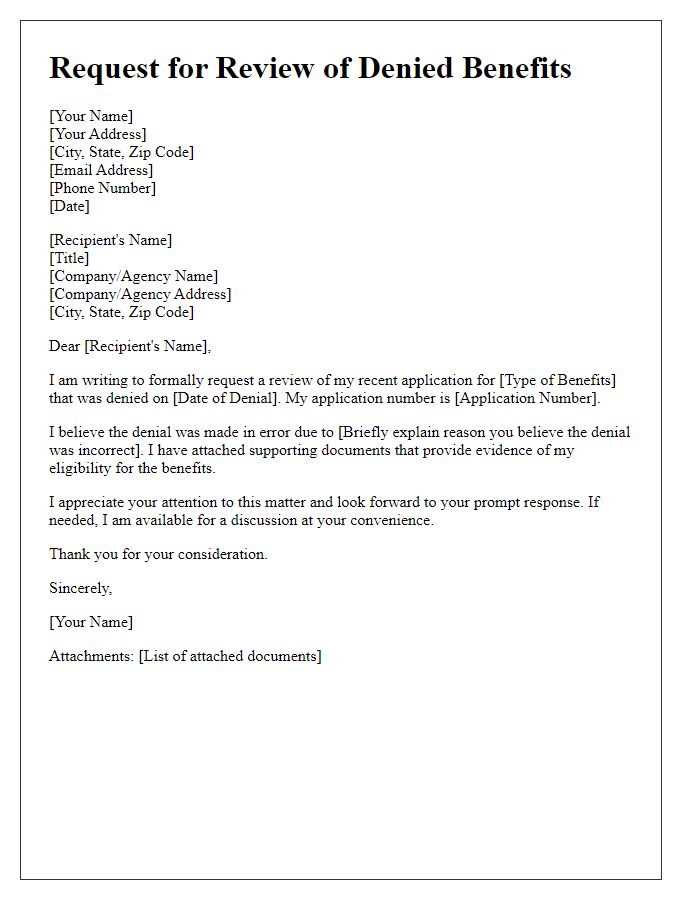

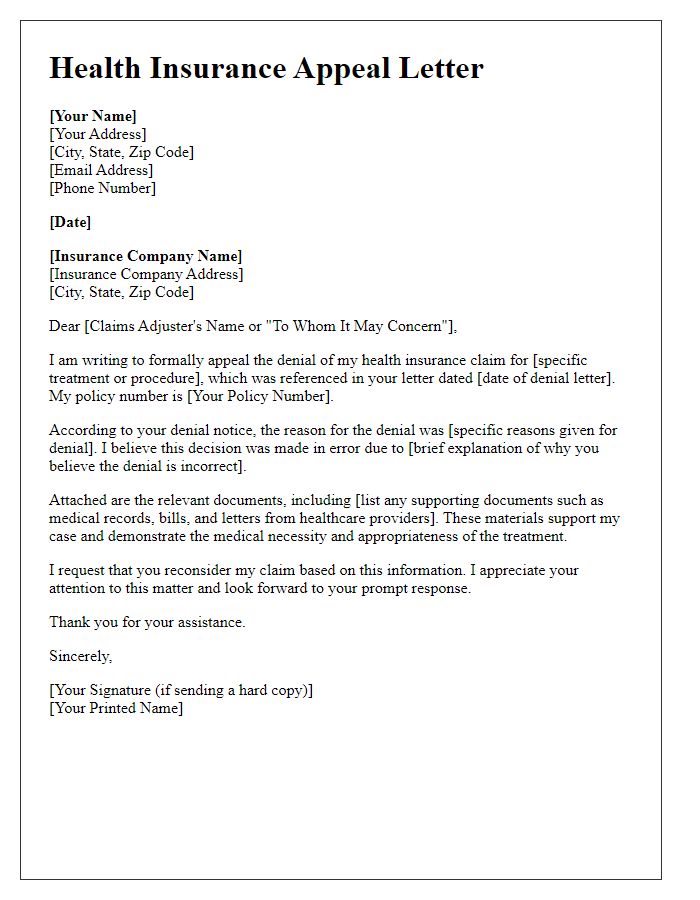

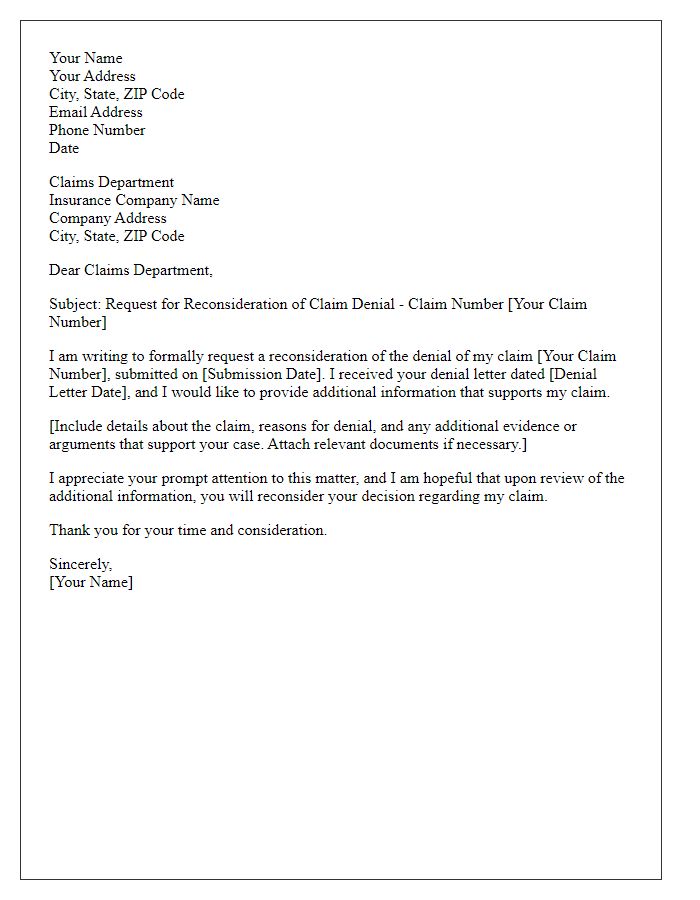

Policy details and reference numbers

Health insurance coverage often faces denials based on claim specifics. Policy details such as identification numbers and plan type significantly determine eligibility. Reference numbers are critical for tracking and identifying specific claims within the insurer's system. Documentation including medical necessity letters and physician notes can support requests for re-evaluation. Relevant dates linked to treatment or service may also be vital in underscoring the urgency and validity of the claim. Understanding the policy exclusions and limitations outlined in the insurance agreement provides a foundation for argumentation in appeal processes.

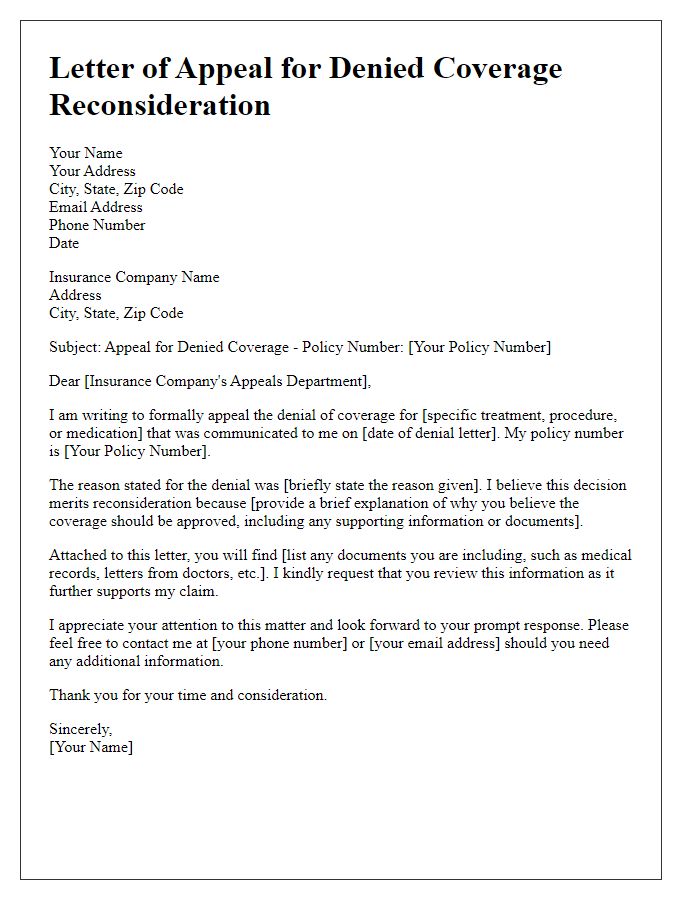

Clear explanation of denial reasons

Insurance claims can be denied for various reasons, including lack of medical necessity. One common reason is insufficient documentation or incomplete medical records that fail to demonstrate the need for a specific procedure or treatment. Other factors may include policy exclusions, such as pre-existing conditions that are not covered under specific plans. Misinterpretation of benefit details, such as out-of-network provider usage leading to lower reimbursement rates, can also contribute to denials. Clear understanding of the specific denial codes used by insurance companies can assist in addressing these concerns. Policyholders should thoroughly review their plan guidelines to ensure that they are adhering to all necessary protocols and criteria.

Supporting evidence and documentation

In the process of re-evaluating denied coverage for medical treatment, it is essential to provide comprehensive supporting evidence and documentation to illustrate the necessity of the procedure. Include detailed medical records (such as doctor's notes, diagnostic imaging results like MRIs, and lab tests), which highlight the severity of the condition and the recommended treatment plan. Incorporate letters from healthcare professionals, especially specialists, confirming the critical nature of the treatment and its potential benefits. If applicable, reference relevant medical guidelines or studies (published in reputable journals), which advocate for the recommended procedures in similar cases. Additionally, present a clear timeline of events, including dates of appointments and previous treatments attempted, to convey the ongoing need for successful intervention. These elements combined create a robust case for the reconsideration of coverage denial by the insurance provider.

Request for detailed review or reconsideration

Request for re-evaluation of denied insurance coverage can significantly impact health plan beneficiaries. Detailed review of policy terms, conditions, and the specific denial reasons is essential for a fair resolution. The appeals process typically involves submitting additional documentation including medical records, treatment plans, and expert opinions to support eligibility. Important deadlines for filing appeals must be adhered to ensure claims are considered, often within 180 days of notice receipt. Understanding state regulations governing appeals can also be crucial, as well as any potential involvement of the state insurance department. Comprehensive preparation for a potential hearing may be necessary, highlighting the importance of clear communication with the insurance provider throughout the process.

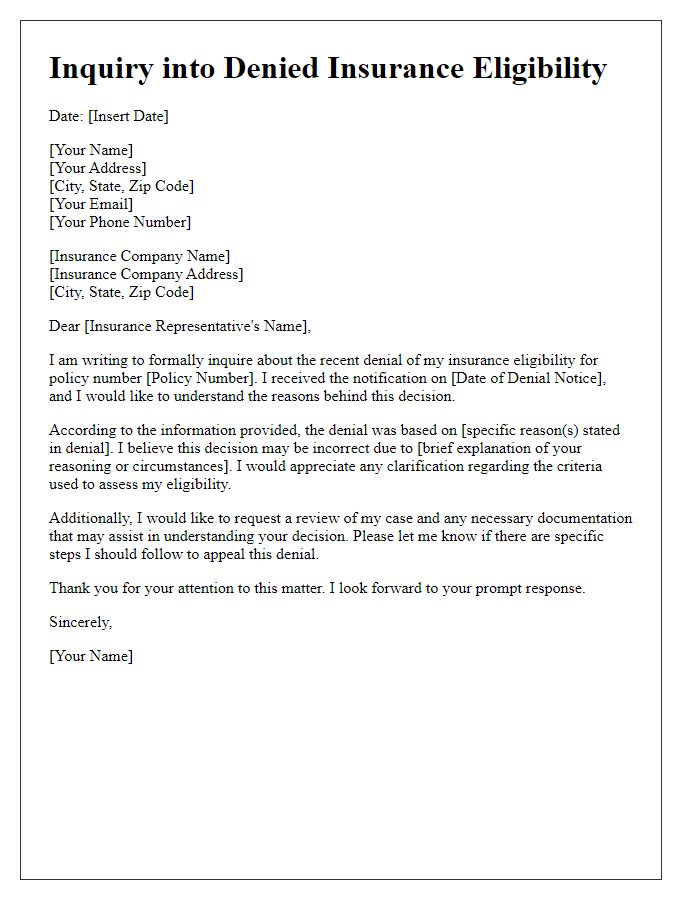

Contact information for further communication

Re-evaluating denied insurance coverage involves addressing specific details related to the denial. Patients often encounter challenges when claims are rejected by health insurance providers. The appeals process requires clear and concise communication, highlighting relevant medical information and policy details. Contact information such as phone numbers of claims representatives, email addresses for customer service, and mailing addresses for appeals submissions must be clearly stated to facilitate effective correspondence. Being precise about the timeframes for submitting appeals, often dictated by policy terms, ensures adherence to procedures, optimizing the chances for successful re-evaluation of coverage decision.

Comments