Are you looking to get your policy reinstated but unsure how to craft the perfect request? Navigating the details of such a letter can feel overwhelming, but it doesn't have to be! In this article, we'll break down a simple and effective template that ensures your request stands out and gets the attention it deserves. So, are you ready to take the first step towards reinstating your policy? Read on to find the details!

Contact Information

Policy reinstatement requests often require clear contact information for effective communication. Including essential details such as full name, which ensures proper identification of account holder. Next, a current mailing address, such as 123 Main Street, Springfield, IL 62704, is crucial for any correspondence. A primary phone number, such as (555) 123-4567, enables quick, direct communication regarding the request. An email address, like user@example.com, offers an alternative method for updates or confirmations. Clarity in providing this information enhances the efficiency of the reinstatement process and prevents potential delays.

Detailed Reason for Reinstatement

Reinstating an insurance policy often requires a detailed explanation of circumstances that led to its cancellation. Providing context can strengthen the request. A detailed reason for reinstatement includes the specific event or situation, such as financial hardship, medical issues, or misunderstanding regarding premium payments. It's essential to mention policy details, such as policy number, effective dates, and the name of the insurance company, to offer clarity. Additionally, include any corrective actions taken, like settling overdue payments or rectifying misunderstandings, to demonstrate commitment. This concrete approach aids the insurance provider in evaluating the reinstatement request effectively.

Policy Details

A policy reinstatement request involves the reinstatement of an insurance policy (such as life, health, or auto insurance) that has lapsed due to non-payment or other reasons. The policy details typically include the policy number (a unique identifier assigned by the insurance company), the name of the insured (the individual covered by the insurance policy), the effective date (the date the policy initially started), and the coverage type (the specific areas of protection provided, such as comprehensive or liability). Additionally, the policy premium amount (the cost of maintaining the policy), and the specific reasons for lapsation (such as missed payments or cancellation) are crucial for context. Reinstatement may be subject to certain conditions, such as payment of back premiums or changes in terms, depending on the insurance provider's guidelines.

Compliant Documentation

A policy reinstatement request requires compliant documentation, essential for ensuring the reinstatement of insurance policies, such as life insurance or auto insurance. This documentation typically includes a signed request form detailing policy information, a copy of the premium payment receipt, and any required identification verification, such as a government-issued ID. Additional supporting documents may involve medical records for life insurance or accident reports for auto insurance claims. Timeliness is critical, as some insurers mandate submission within a specific grace period, often 30 days from the policy lapse date. Furthermore, policies may include terms for reinstatement, such as evidence of insurable interest or payment of outstanding premiums.

Expression of Assurance

The process of requesting a policy reinstatement can be complex and requires careful attention. A reinstatement request often follows an event such as a lapse in policy due to non-payment or a change in circumstances. Important details include the policy number, the specific insurance provider, and the date of lapsation which is crucial for record-keeping. In these cases, clients might express assurance regarding future premium payments, demonstrating active interest in maintaining coverage. Providing a clear rationale for the reinstatement, such as improved financial stability or recent changes in risk factors, can significantly improve the chances of a successful application. It is also beneficial to mention any supporting documents, such as financial statements or updated health information, to bolster the request.

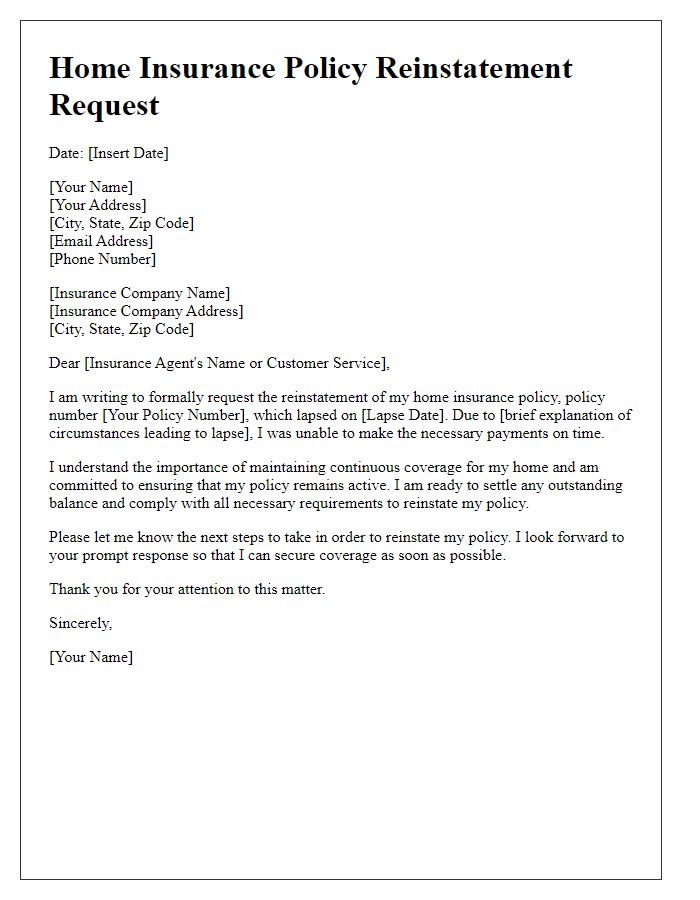

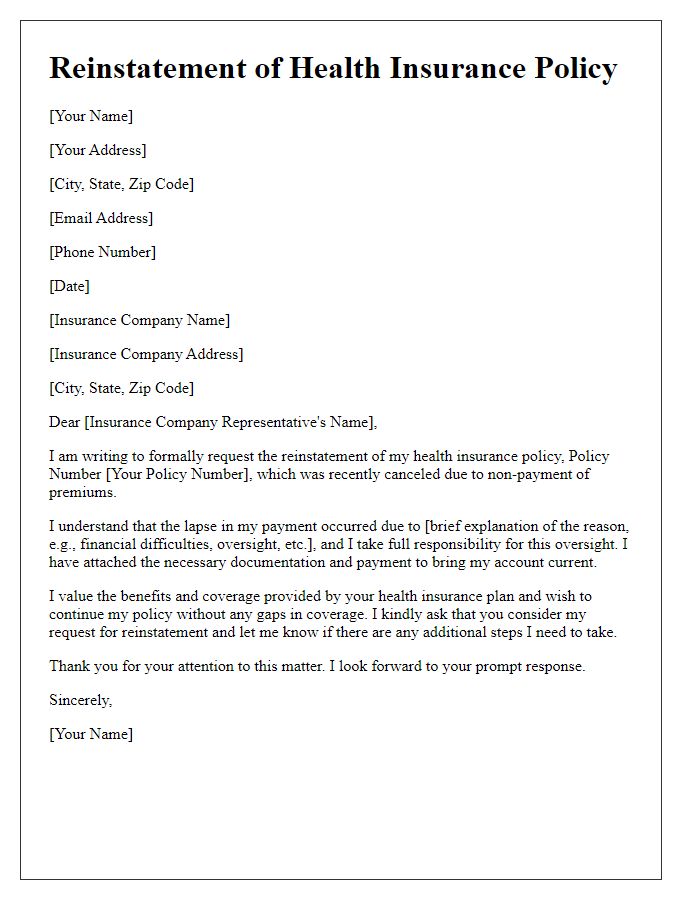

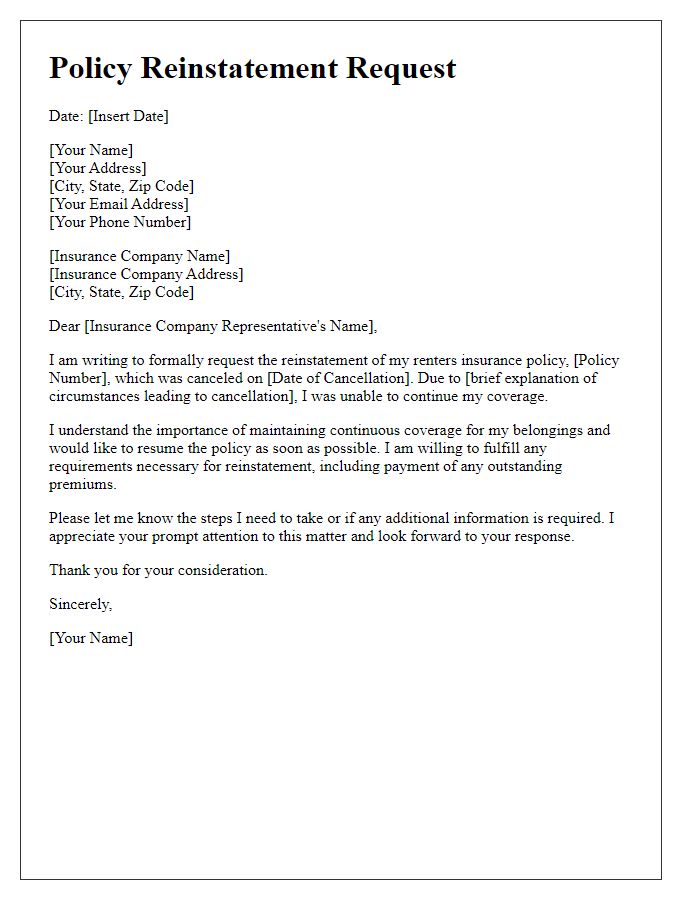

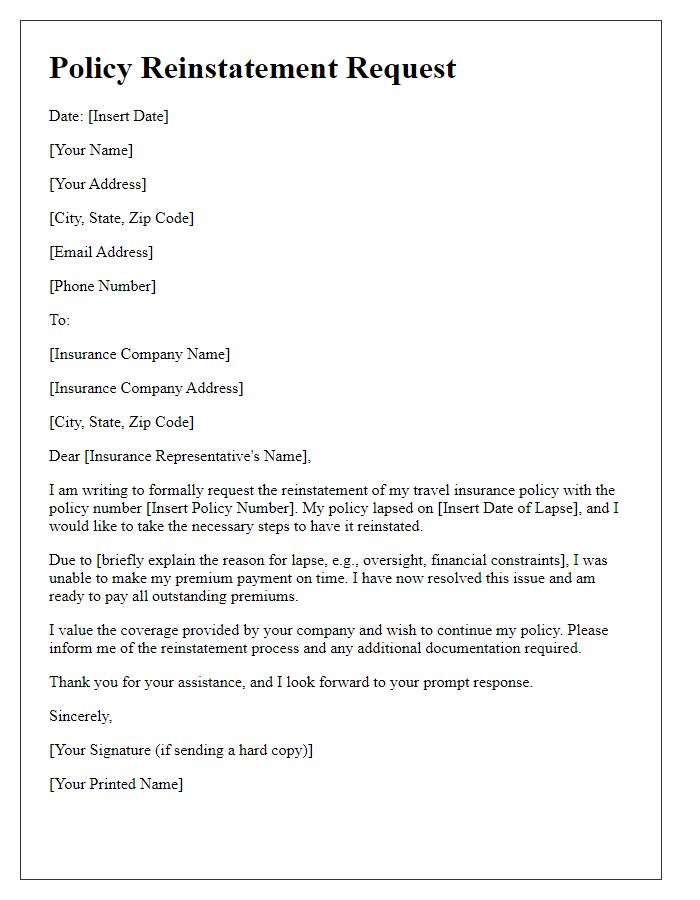

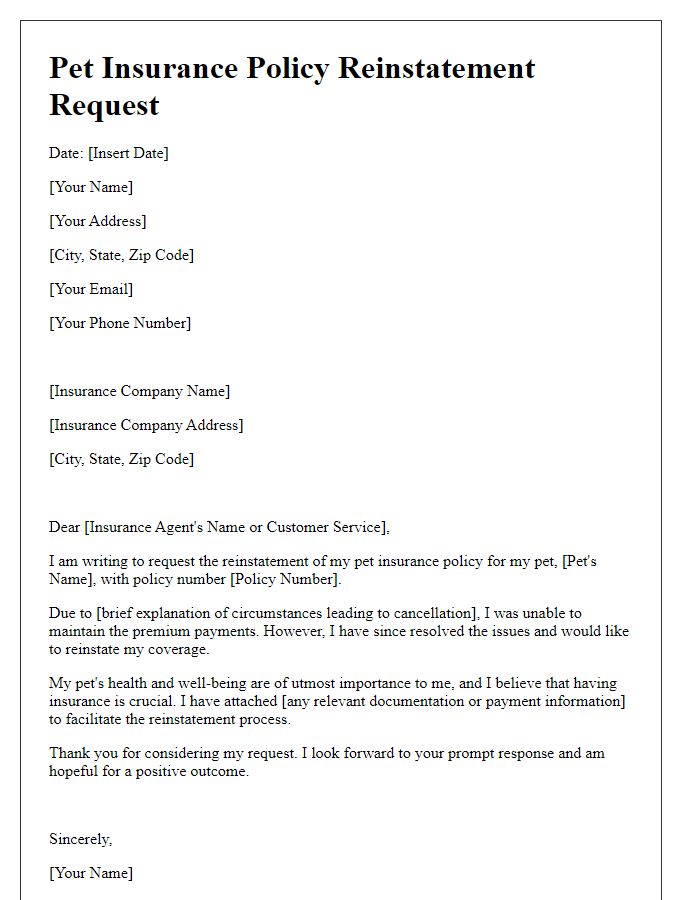

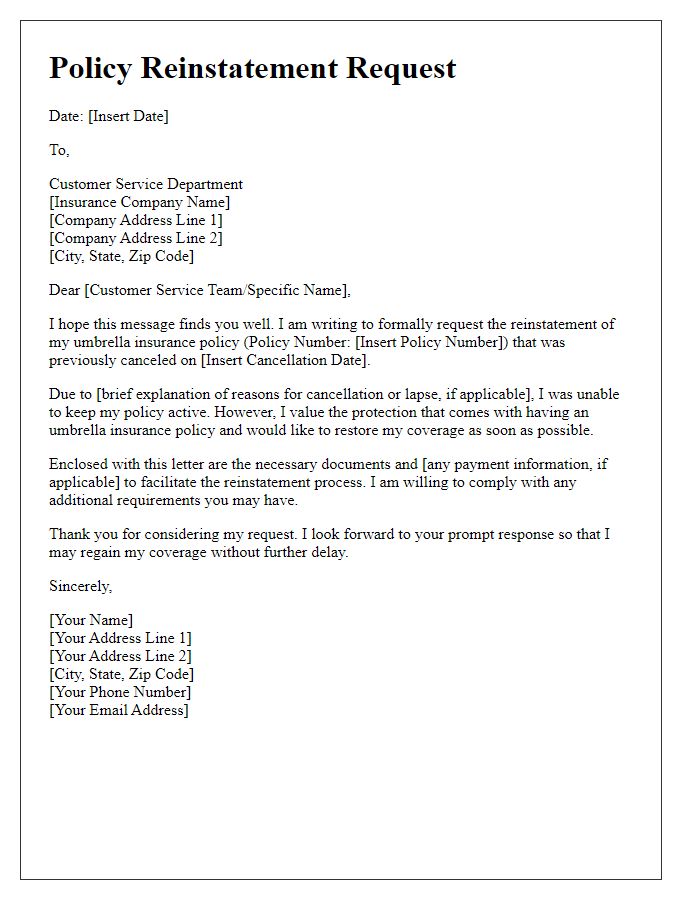

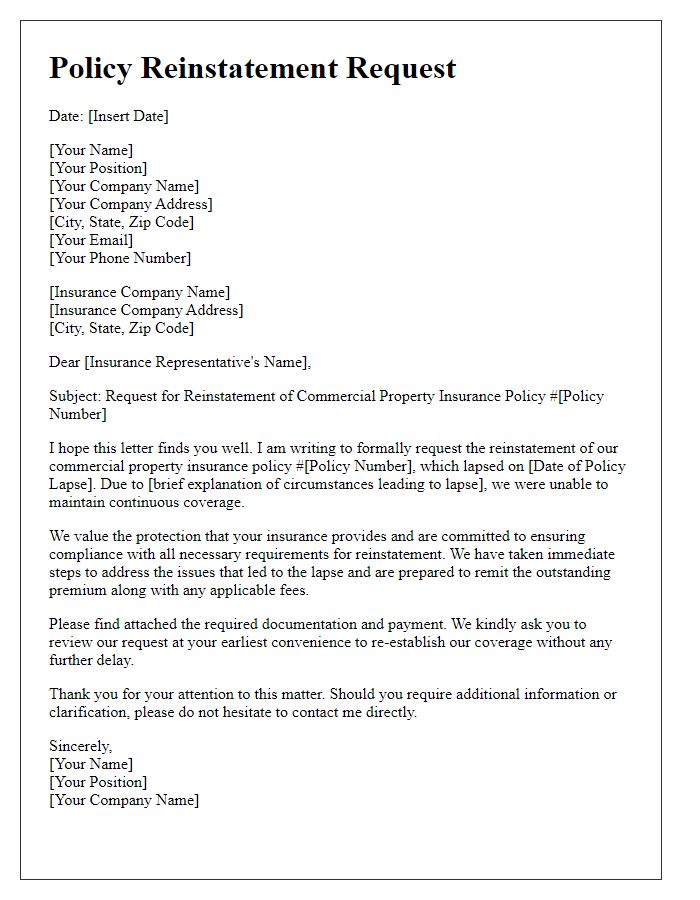

Letter Template For Policy Reinstatement Request Samples

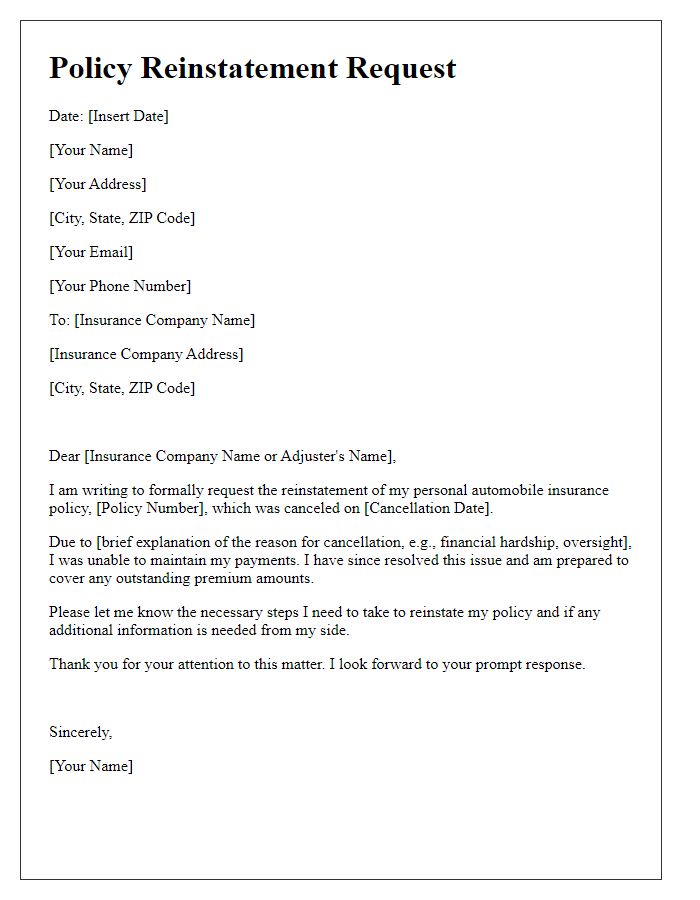

Letter template of policy reinstatement for personal automobile insurance.

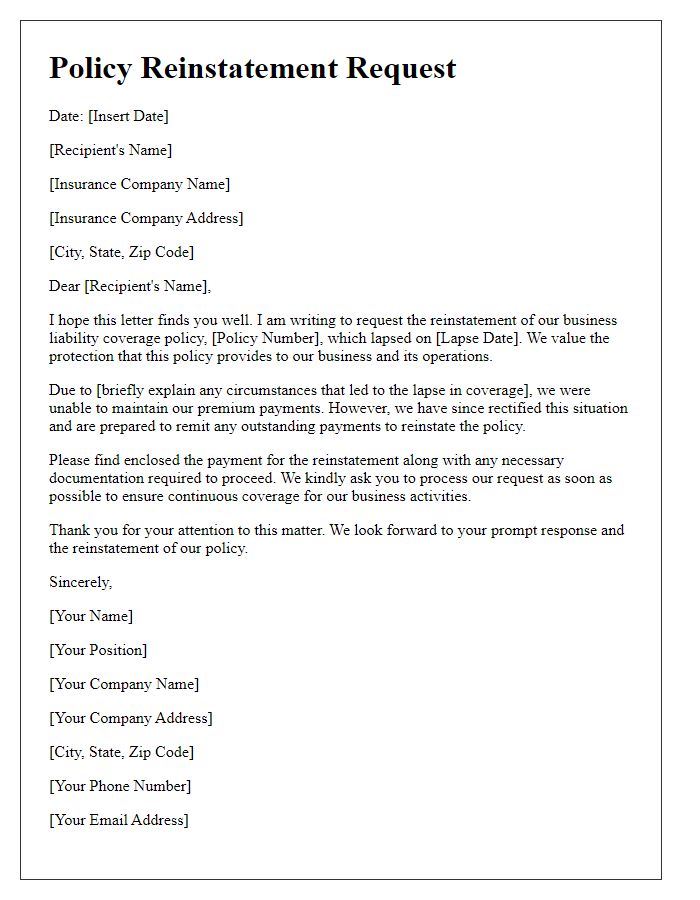

Letter template of policy reinstatement for business liability coverage.

Comments