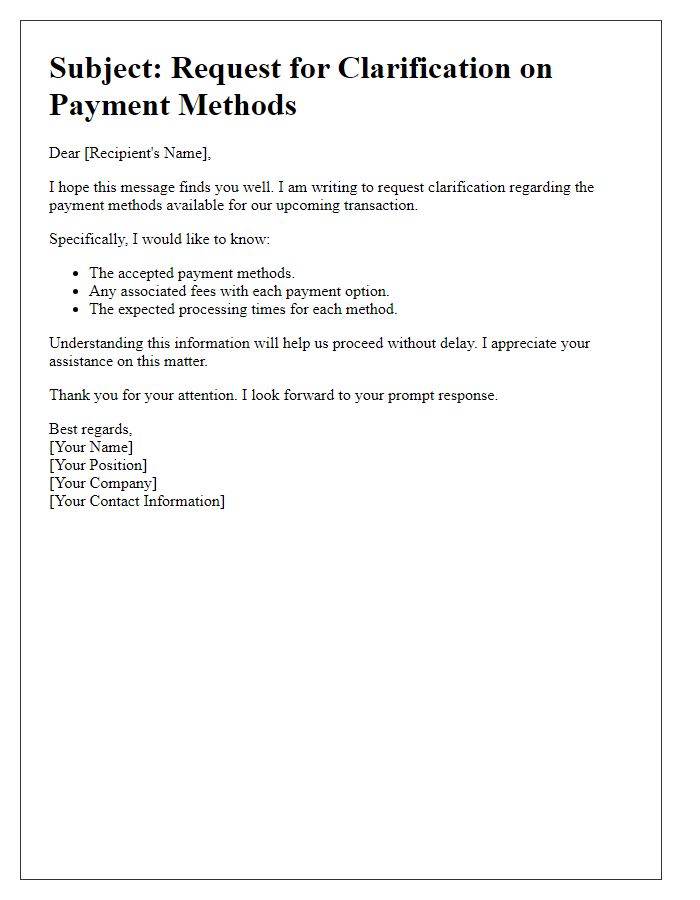

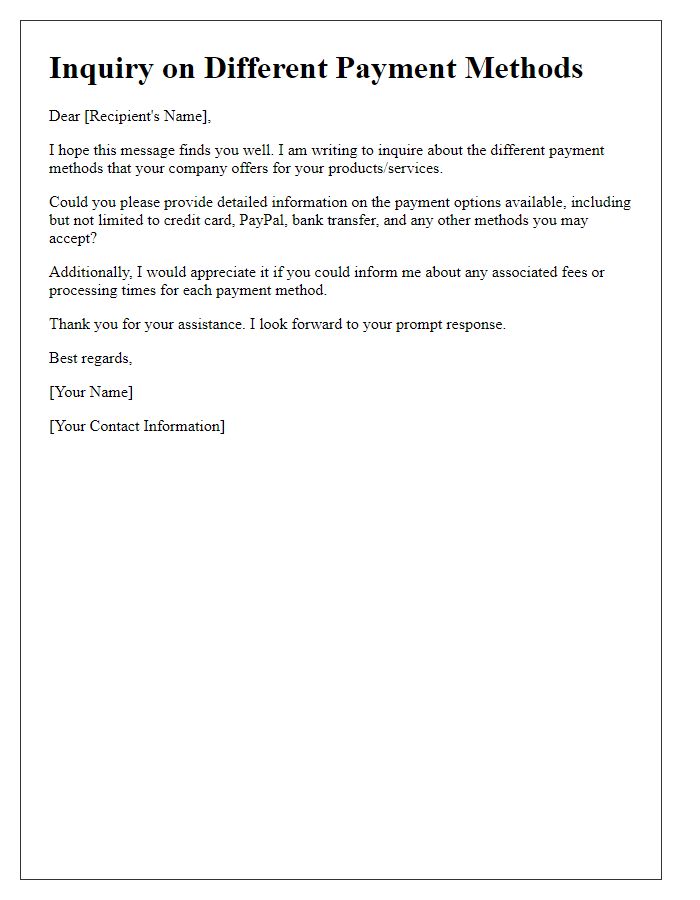

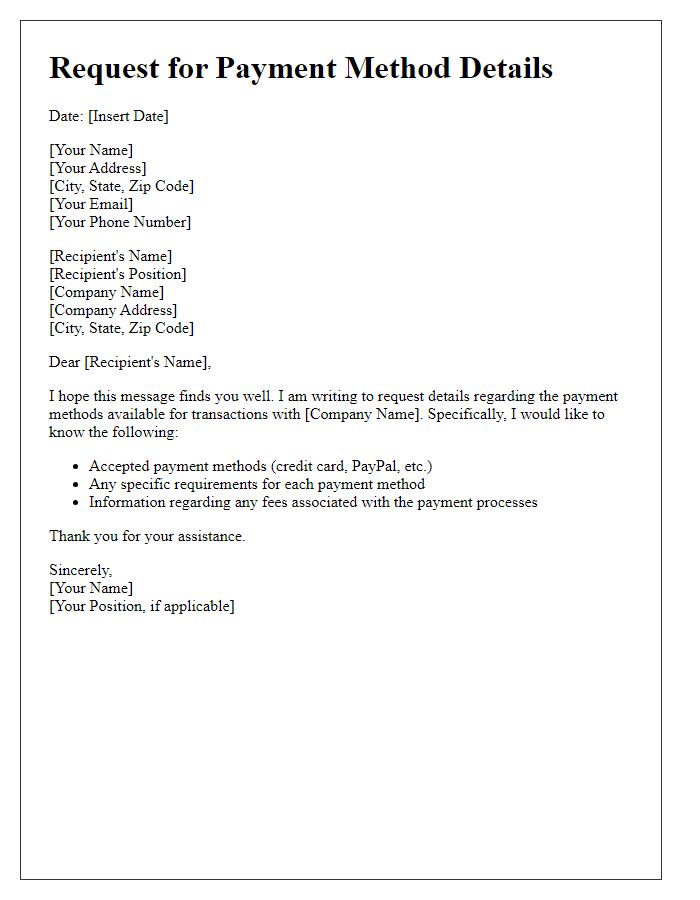

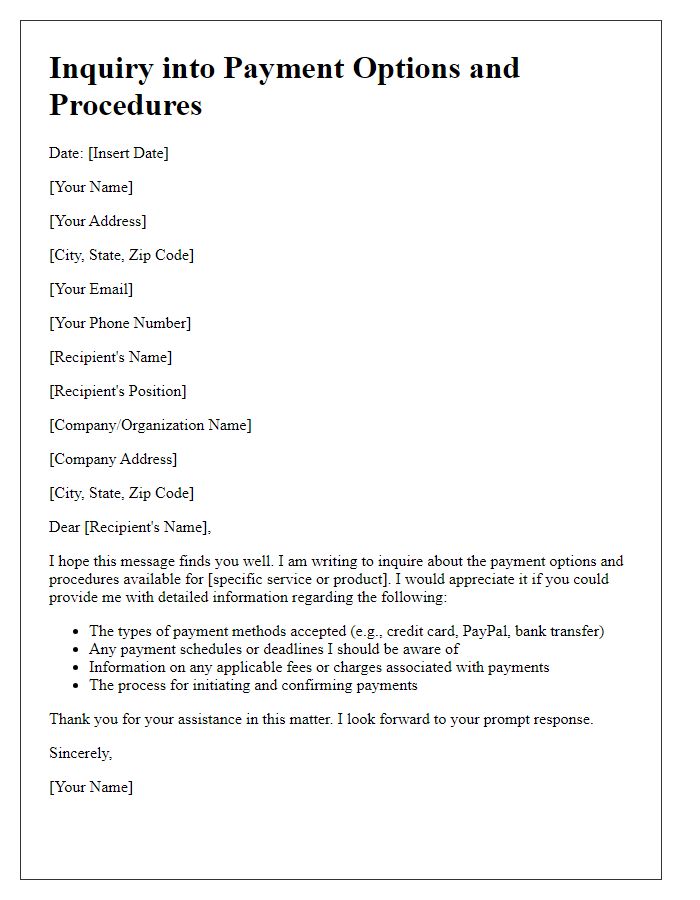

Are you curious about the various payment methods available to you? Whether you're navigating online shopping or setting up a subscription service, understanding these options can make all the difference. From traditional credit cards to newer digital wallets, each method comes with its own set of benefits and considerations. Join us as we dive deeper into the world of payment methods and explore the best choices for your needs!

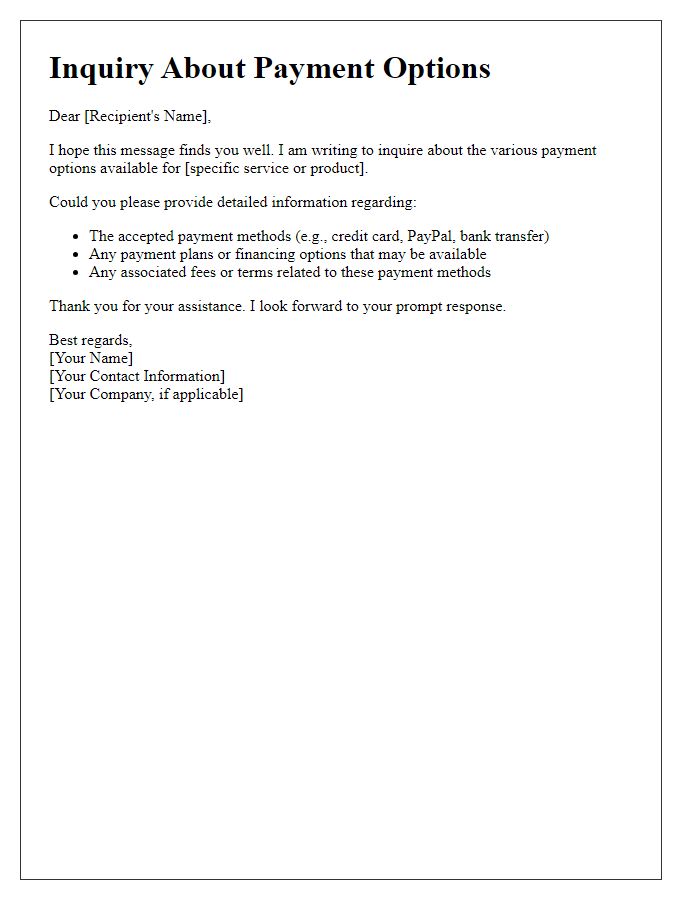

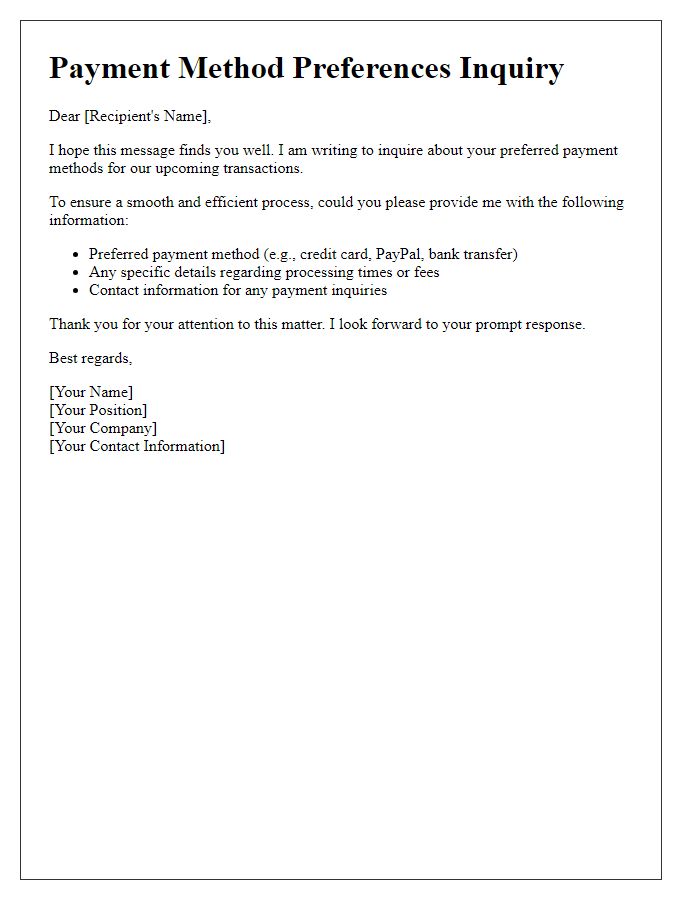

Payment options available

Numerous payment options are available for online transactions, including credit cards, debit cards, and digital wallets like PayPal or Venmo. In 2022, over 2.5 billion people utilized digital payment platforms, reflecting a significant shift towards cashless transactions. Popular credit card options include Visa, MasterCard, and American Express, each with unique benefits such as rewards programs or purchase protection. Cryptocurrencies like Bitcoin and Ethereum are also gaining traction, with over 300 million users worldwide. Additionally, services like Buy Now Pay Later (BNPL), exemplified by companies like Afterpay and Klarna, provide consumers the ability to make purchases and pay in installments. Understanding these payment methods can improve user experience and ensure security during financial transactions.

Transaction fees

Transaction fees are costs incurred during financial exchanges, particularly in electronic payments such as credit card processing or online transfers. For example, payment processors like PayPal and Stripe typically charge fees ranging from 2.9% to 3.5% per transaction, which can impact businesses significantly over large volumes. Merchant service providers may also apply additional flat-rate fees for each transaction, often between $0.30 and $0.50, depending on the service agreement. Understanding these fees is crucial for small businesses, especially in the e-commerce sector, where profit margins can be slim. The structure of transaction fees can vary widely based on factors like the type of transaction (domestic vs. international), the payment method used (credit vs. debit), and the specific contractual terms negotiated with service providers.

Security measures

Payment methods involving credit cards, digital wallets, and bank transfers often require robust security measures to protect sensitive financial information. Encryption protocols, such as AES (Advanced Encryption Standard), safeguard data during transactions, making unauthorized access difficult. Multi-factor authentication (MFA) adds an additional layer of protection by requiring users to verify identity through multiple means, such as a password and a text message code. In addition, PCI DSS (Payment Card Industry Data Security Standard) compliance mandates certain security best practices for businesses handling credit card transactions, ensuring a safe processing environment. Regular audits and monitoring can detect fraudulent activity, emphasizing the importance of security in payment transactions.

Payment processing time

Payment processing times vary significantly depending on the payment method utilized. Bank transfers, for instance, often take one to three business days, particularly when involving international transactions, due to the clearing processes mandated by financial institutions. Credit card transactions, on the other hand, typically process within a few hours, although some may take up to 24 hours to appear on bank statements. E-wallet services, like PayPal or Venmo, usually facilitate instantaneous transfers, yet potential holds may apply based on the recipient's account status. Understanding these timeframes is essential for planning financial activities, especially for businesses managing cash flow or individuals requiring timely access to funds.

Customer support contact

Many customers seek information about payment methods offered by e-commerce platforms. Common payment options include credit cards (Visa, MasterCard, American Express), digital wallets (PayPal, Apple Pay), and bank transfers. Each method has distinct advantages, such as transaction speed or security features. For inquiries, customer support channels often include email (support@ecommerceplatform.com), phone support (1-800-123-4567), or live chat options available during business hours. Detailed FAQs on official websites provide additional assistance for users navigating payment processes. Understanding these options enhances the shopping experience and ensures smoother transactions.

Comments