Are you a small business owner looking for funding opportunities? In today's dynamic marketplace, securing the right financial support can be a game-changer for your growth and innovation. Whether you're seeking a loan, grant, or investment, it's essential to present your inquiry in a professional and compelling way. Join us as we explore a practical letter template that can help you make a strong impression and connect with potential funders. Read on to discover how to craft the perfect funding inquiry letter!

Clear business introduction

A clear business introduction outlines the core functions and objectives of a small business, emphasizing its unique value proposition in the market. For instance, a bakery specializing in organic, artisanal breads may highlight its commitment to sustainable sourcing, local partnerships with farmers, and a menu reflecting seasonal ingredients. This bakery operates in a bustling urban area known for its vibrant food culture, which includes a growing demand for health-conscious offerings. Establishing credibility through demonstrations of previous successes, such as local awards or community engagement events, further enhances its appeal for funding. Engaging storytelling about the founders' passion for baking and their vision for creating a community hub can also resonate with potential investors.

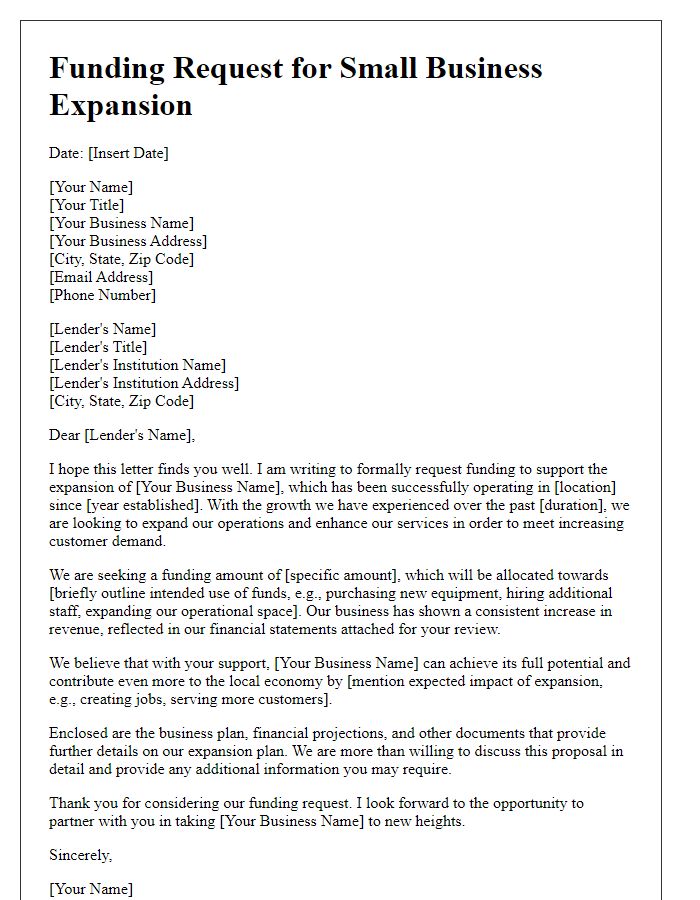

Detailed funding request

Small businesses often face challenges in securing funding to support growth and expansion initiatives. A detailed funding request should include the specific amount needed, typically ranging from $10,000 to $500,000, tailored to the business's size and scope. Perhaps a restaurant in downtown Seattle is seeking funding for equipment upgrades and a marketing campaign to attract more customers. The request must clearly outline the intended use of funds, such as purchasing new kitchen appliances, enhancing the dining experience, or driving awareness through social media advertising. Additionally, discussing projected financial outcomes, like a 20% increase in revenue over the next year, provides lenders with a clear vision. Highlighting unique selling points, such as locally sourced ingredients or award-winning menus, can strengthen the proposal by showcasing the business's potential in a competitive market. Providing historical financial statements and a detailed business plan with timelines can further substantiate the funding request.

Demonstration of financial need

Many small businesses face significant financial challenges, especially during critical growth phases. For instance, a local bakery in Austin, Texas, may require $50,000 to expand its operations and increase production capacity to meet growing demand, especially during the holiday season, which can boost sales by up to 30%. Financial projections indicate that operational costs, including rent increases and ingredient price hikes, may rise by 20% over the next year. Additionally, the potential for hiring two new employees could enhance service efficiency, estimated to improve customer satisfaction ratings from 75% to 90%. Demonstrating financial need not only reflects the urgency for funds but also outlines a clear plan to use the funding effectively to drive business growth and stability.

Explanation of fund usage

Small businesses often seek funding to enhance operations, expand product lines, or boost marketing efforts. The allocated funds will be pivotal for upgrading equipment, specifically advanced machinery for production lines that increases efficiency by up to 30%--vital for meeting growing customer demand. Additionally, investment in digital marketing campaigns, targeting social media platforms like Facebook and Instagram, will aim to increase brand visibility and attract a broader demographic, potentially raising sales by 20% within the first quarter. Inventory expansion is also on the agenda, allowing for a more diverse product offering; this could lead to a projected revenue increase of $50,000 annually. Overall, the strategic application of these funds is crucial for achieving sustainable growth and long-term success in a competitive market.

Evidence of business viability

A funding inquiry often highlights the viability of small businesses through various key components. Business plans should clearly demonstrate market analysis statistics, including target demographic numbers, competitor benchmarks, and projected growth rates within the specific industry, like technology or food service, over the next five years. Financial statements, such as balance sheets and income statements, should provide insights into cash flow, profitability margins, and operational costs. Additionally, customer testimonials or case studies can showcase satisfaction levels and repeat business rates, while detailed product descriptions or service offerings illustrate unique selling propositions. Furthermore, any awards or recognitions received by the business, such as local business awards or community engagement accolades in specific regions, can further reinforce viability and trustworthiness to potential investors.

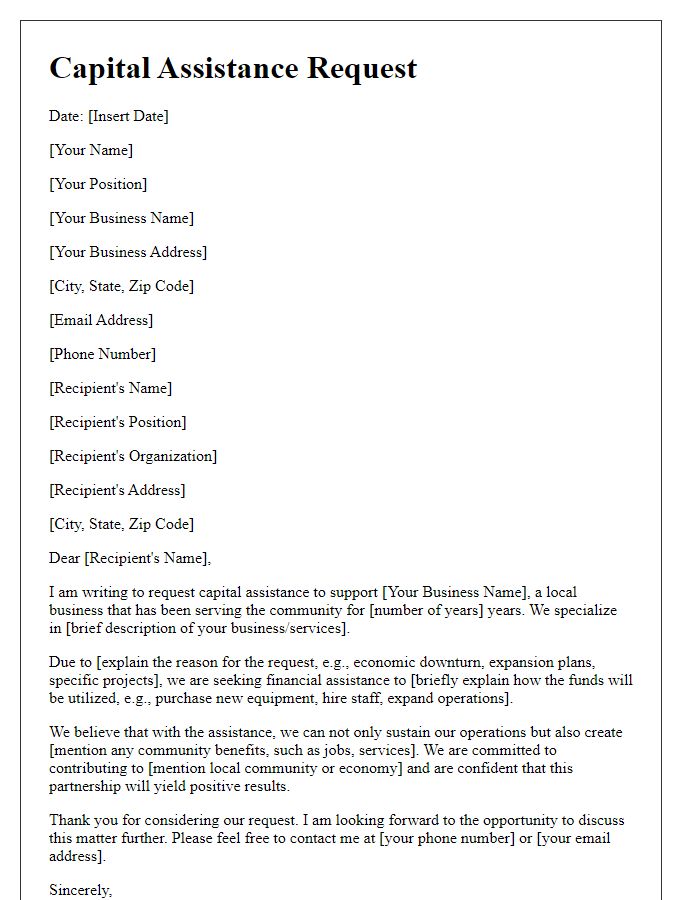

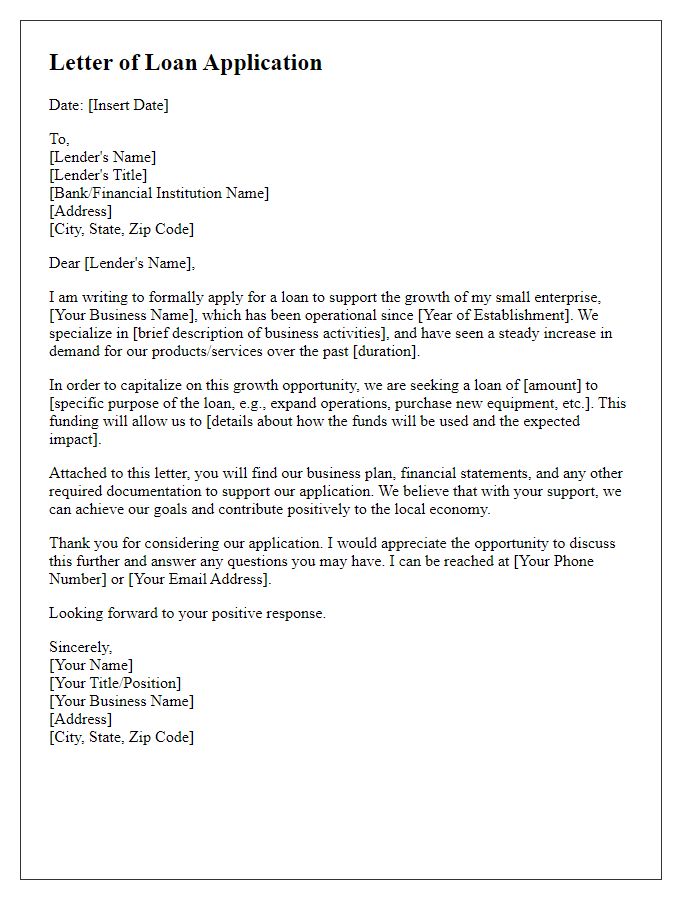

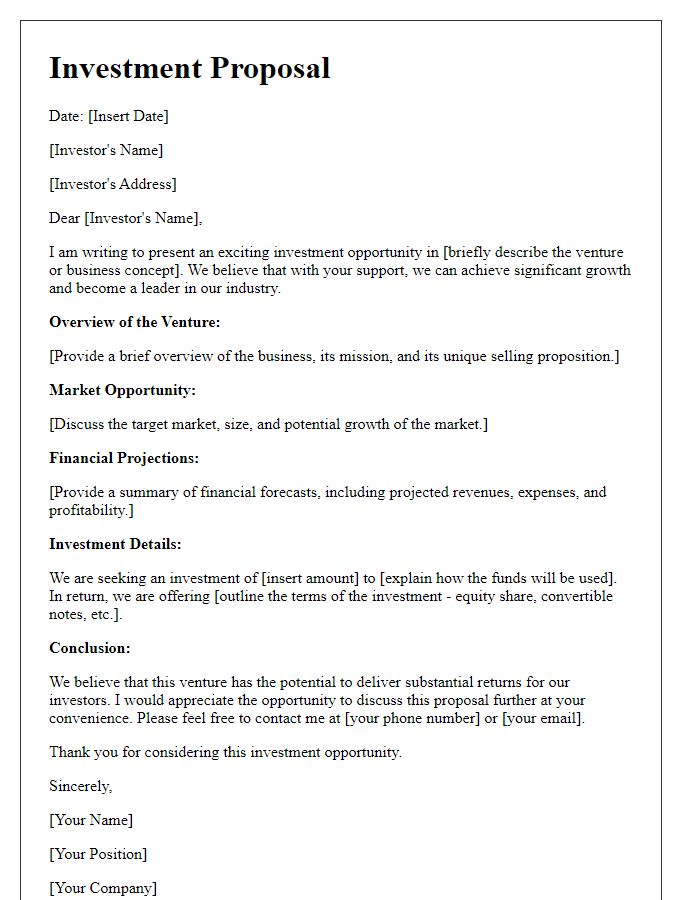

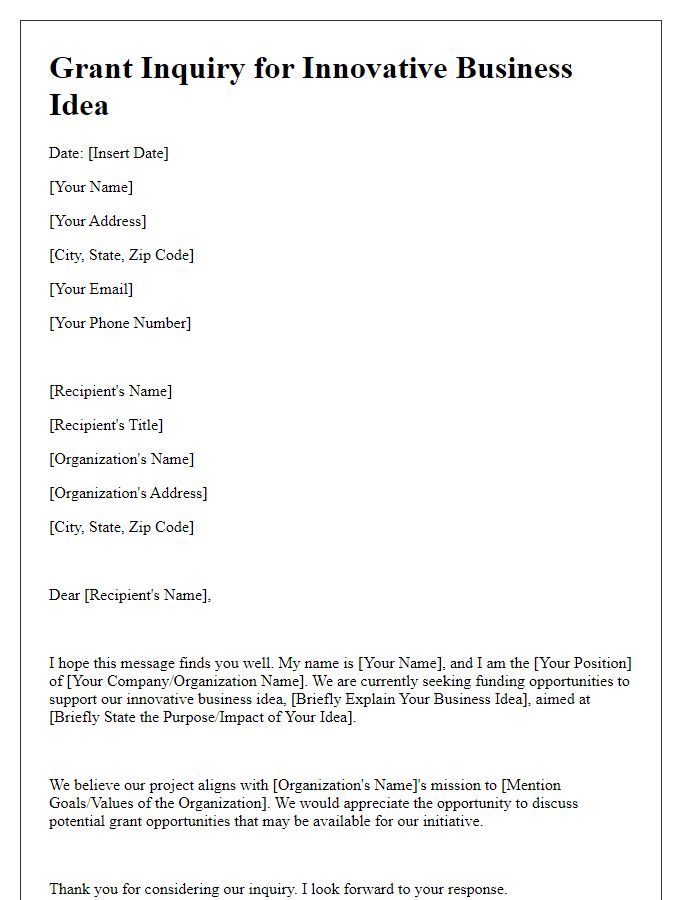

Letter Template For Small Business Funding Inquiry Samples

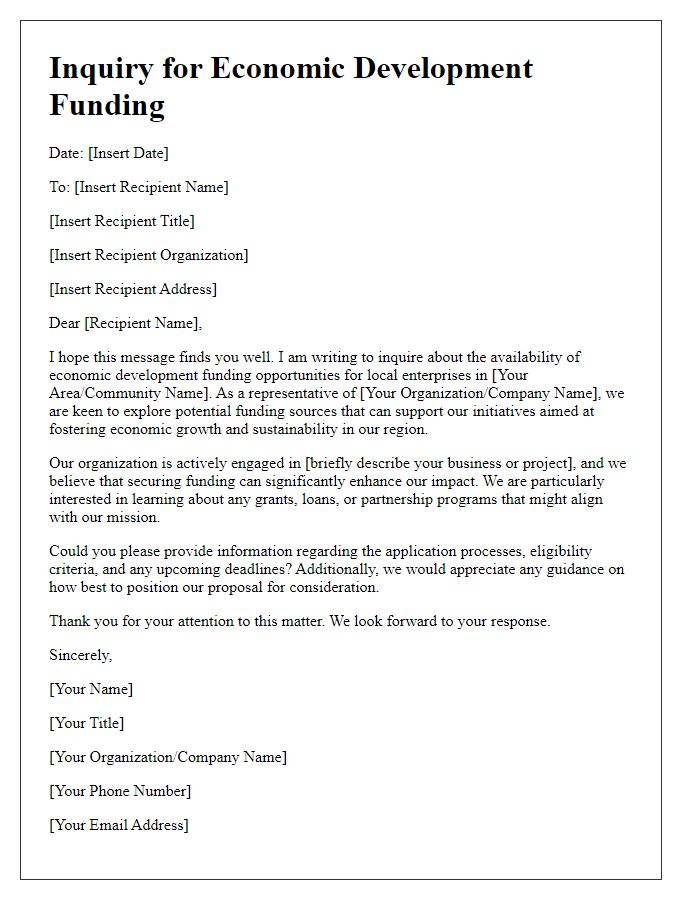

Letter template of economic development funding inquiry for local enterprise

Comments