Welcome to our guide on writing an effective letter for reminding homeowners about overdue HOA fees! We understand that maintaining clear communication with your neighbors is essential for fostering a positive community. In this article, we'll provide you with a simple, yet effective template that ensures your message is both respectful and firm. So, let's dive in and help you craft the perfect reminder letter!

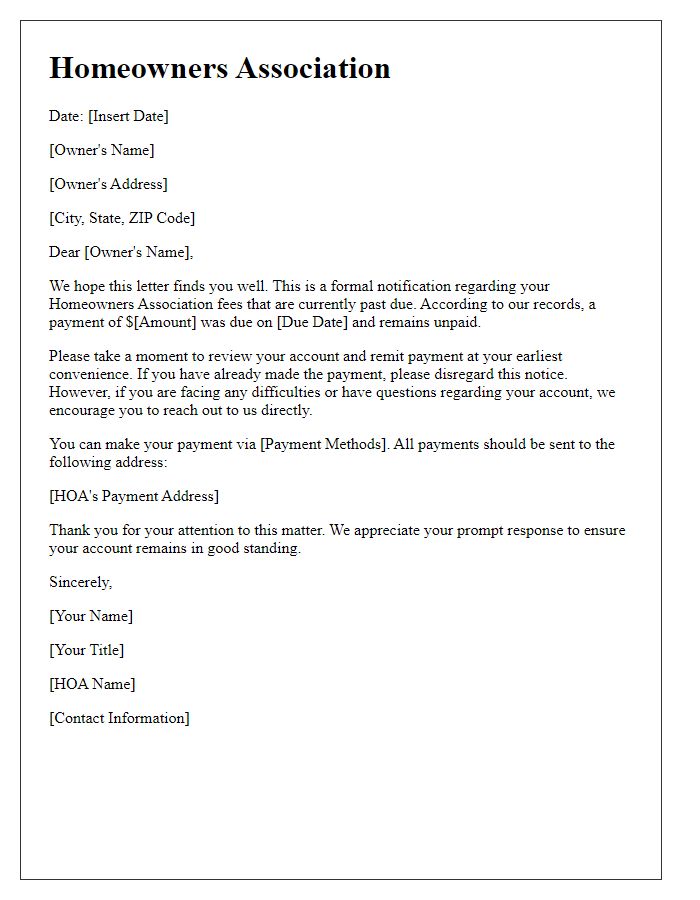

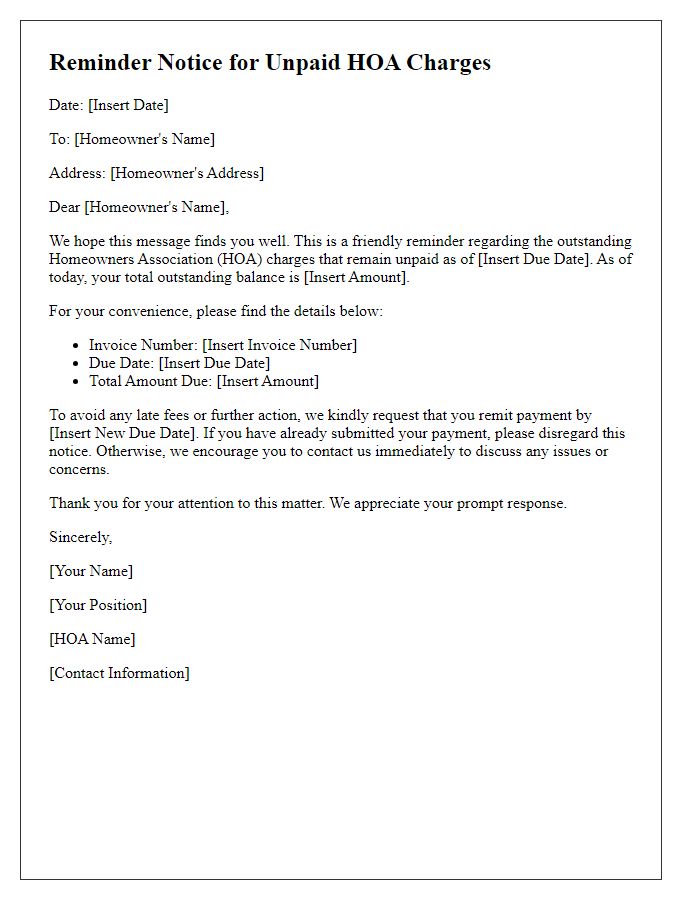

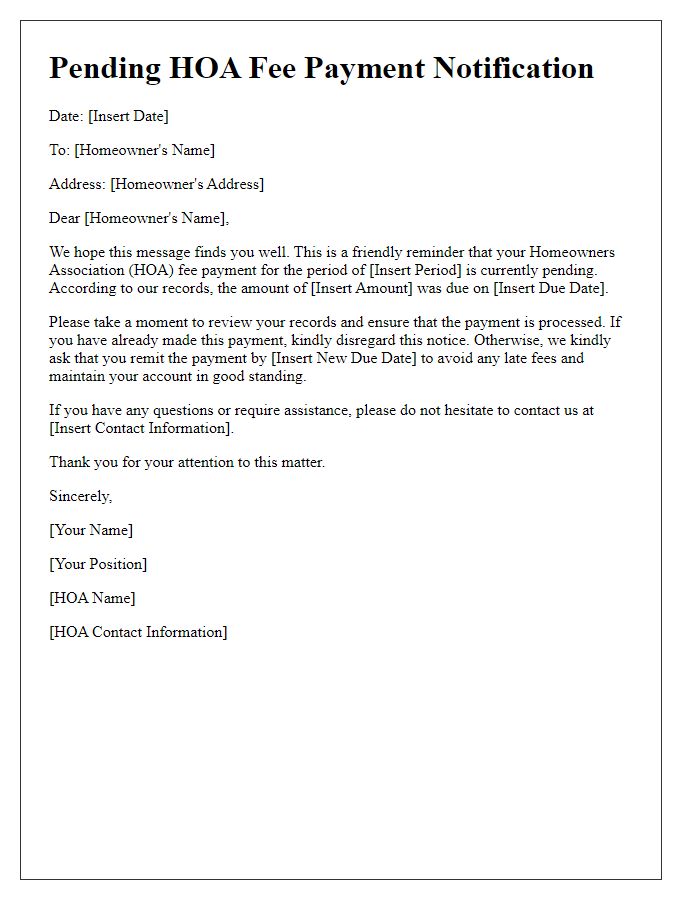

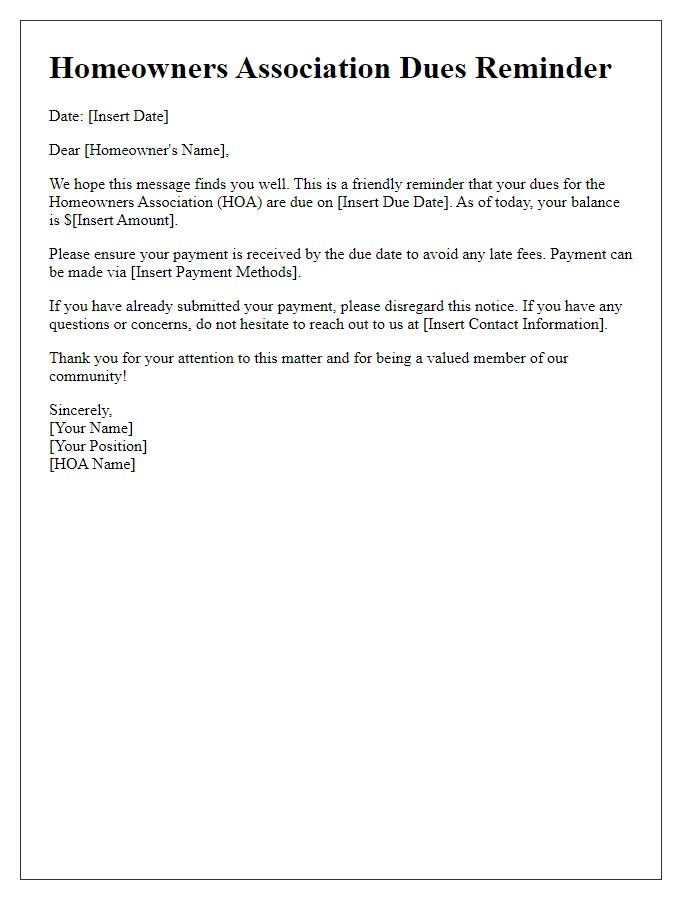

Clear subject line

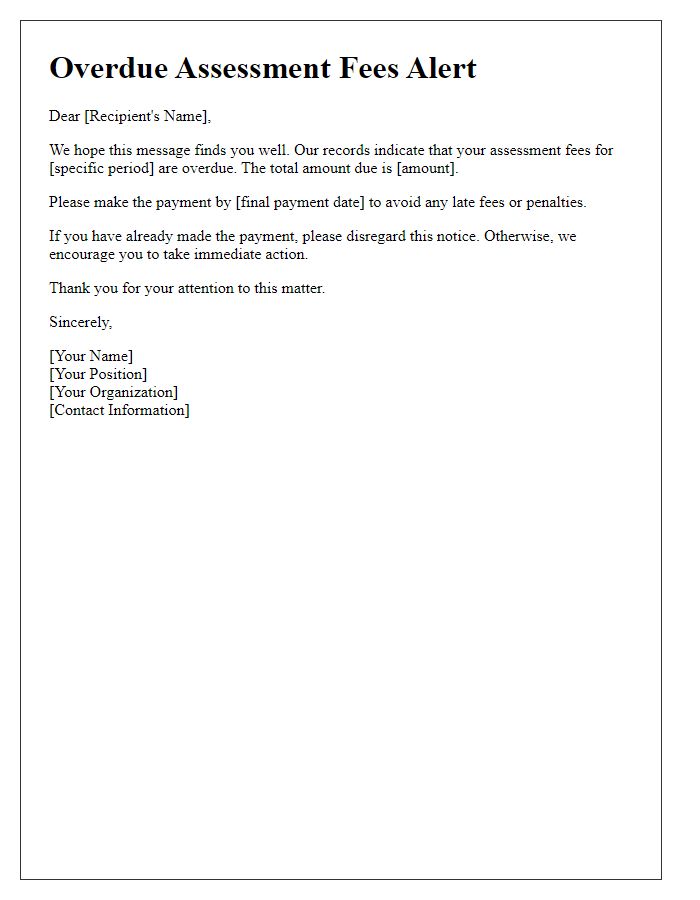

The overdue payment of Homeowners Association (HOA) fees incurs additional assessments for late charges, affecting community funding. Regular fees typically contribute to maintenance costs, landscaping, and community amenities, such as a swimming pool or clubhouse. Prompt payment is essential for sustaining neighborhood services. If payments remain outstanding beyond the grace period (usually 30 days), further action may be required, including potential legal referrals or liens on property. Residents are encouraged to review account statements for clarity on amounts due. Communication with the HOA office should be prioritized to discuss any payment issues or set up a payment plan to avoid escalating penalties or impact on community services.

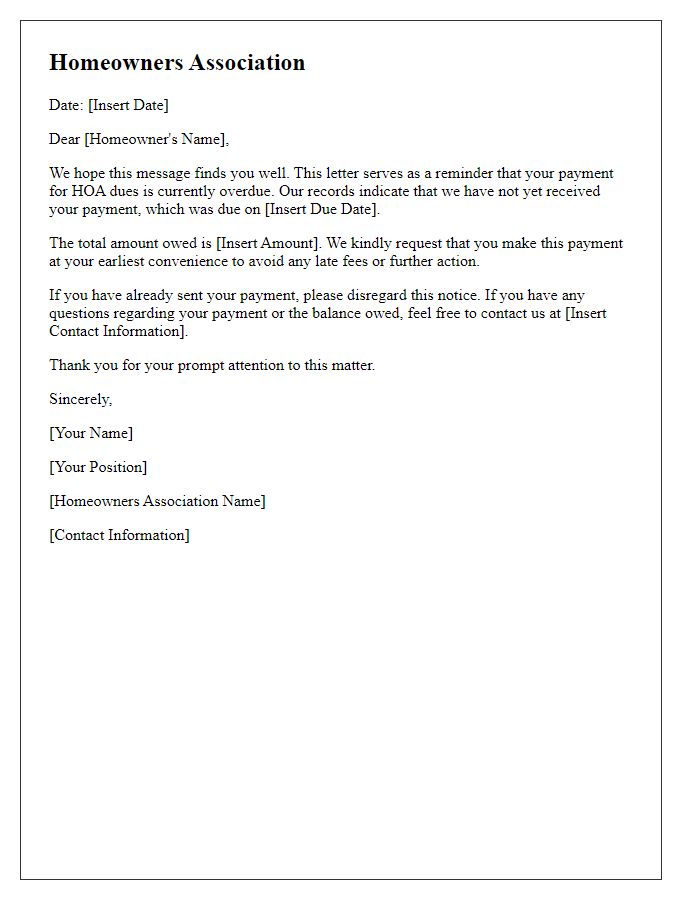

Friendly yet firm tone

Community members should stay informed about their Homeowners Association (HOA) fees to ensure neighborhood maintenance and amenities. Overdue fees often result in additional charges or restricted access to community facilities. For instance, an outstanding balance could accumulate a late fee of $25 each month, increasing financial obligations. Regular monitoring of payment schedules allows homeowners to avoid disruptions. It's essential to address overdue dues promptly, as the HOA employs policies to support community welfare and property values. Engaging with property management can clarify any misunderstandings or settle payment arrangements. Active participation strengthens community ties and upholds neighborhood standards.

Specific overdue amount and date

Overdue Homeowners Association (HOA) fees can lead to financial penalties and potential legal actions for residents in communities like Maplewood Estates. A specific overdue amount of $350, which was due on September 1, 2023, can accumulate interest at a rate of 1.5% per month if not resolved. Homeowners should be aware that consistent non-payment may result in additional fees (administrative costs and late charges) or even liens against properties. It is essential for residents to address overdue fees promptly to maintain good standing within the community and to foster a harmonious living environment.

Payment options and due date

Homeowners Associations (HOAs) often send reminders regarding overdue fees, emphasizing payment options and deadlines. The typical notice outlines the outstanding balance, often including specific amounts and any penalties incurred due to late payments. Payment methods can vary widely, ranging from online portals, such as PayPal or direct bank transfers, to traditional options like checks sent via postal mail. For instance, the due date may explicitly state September 30, 2023, urging homeowners to address any outstanding fees promptly to avoid further late fees or possible legal action. Additionally, the reminder may encourage residents to reach out to the HOA administration office for any questions or financial assistance.

Contact information for assistance

Homeowners Associations (HOA) often send overdue fee reminders to residents who have not submitted fees by the due date. The notice typically includes specific sums; for instance, a late fee of $50 may be assessed after the grace period ends. Homeowners may be required to remit annual fees, which can range from $200 to over $1,000 depending on the community's amenities. Contact information for assistance is crucial, usually comprising a dedicated email address and a phone number (e.g., (555) 123-4567) for the HOA's accounting department. Ensuring prompt communication can facilitate payment arrangements or address disputes over fees. Failure to address overdue balances may lead to more serious repercussions, such as the potential for legal action or a lien against the property.

Comments