Hello there! If you've recently received a notice about an increase in your insurance premium, you're not aloneâthis is a common scenario faced by many policyholders. It's essential to understand what factors contribute to this rise and how it can affect your overall financial planning. In our upcoming article, we'll break down the reasons behind premium increases and provide tips for managing costs effectively. So stick around, and let's dive deeper into this topic together!

Policyholder Information

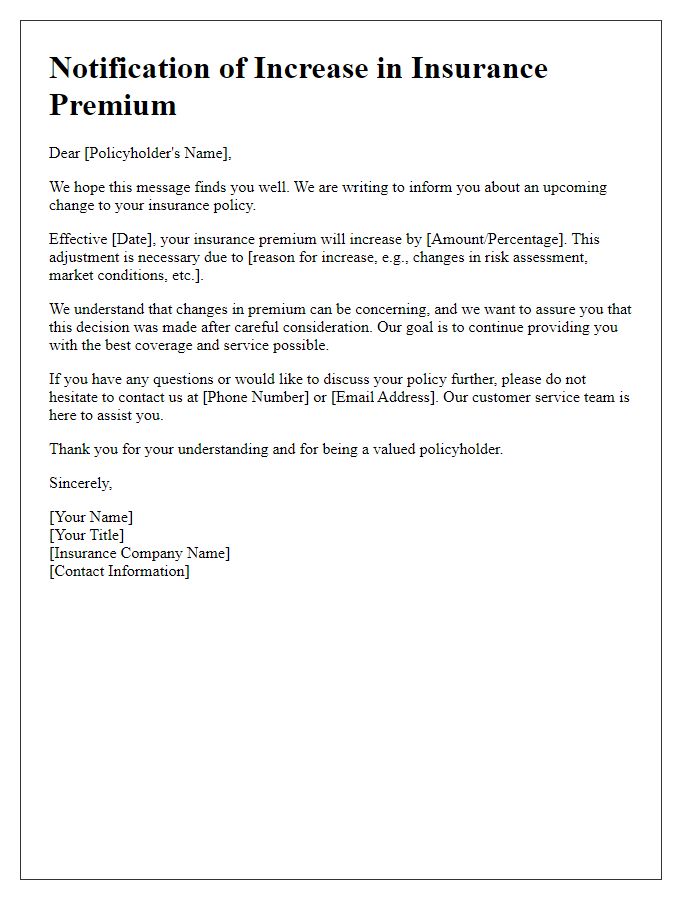

Insurance premium increases can impact policyholders significantly, affecting their budget and coverage options. Policyholders, individuals or entities holding an insurance policy with a particular company, may receive notifications regarding adjustments in their premium amounts. Such increases can vary based on several factors, including changes in risk assessment, claims history, and market conditions. Policies can include auto insurance, homeowners insurance, or health insurance, each influenced by specific criteria related to the insured asset or individual. In some cases, regulatory changes may also lead to premium adjustments, prompting insurers to communicate these changes effectively to maintain transparency and understanding among clients.

Reason for Premium Increase

Insurance premium increases can occur due to various factors impacting policyholders. A significant reason for these adjustments includes rising claim costs, which have escalated due to catastrophic events, such as hurricanes or wildfires, leading to increased payouts by insurance companies. Another contributing factor is changes in underwriting guidelines; for instance, insurers might reassess risk levels based on emerging hazards or shifts in the local economy. Lastly, regulatory changes within the insurance industry may require companies to adjust their rates to maintain solvency and comply with state requirements, ensuring they can fulfill future claims.

Effective Date of Change

Insurance companies may implement premium increases based on various factors, such as policy changes, claims history, or risk assessments. A typical notice might indicate the effective date of change, giving policyholders sufficient time to understand the new rates and adjust their budgeting accordingly. A common practice is to provide at least 30 days' notice before the increase takes effect, ensuring transparency and compliance with regulatory requirements. Clearly outlining the reasons behind the increase, along with any policy modifications or coverage adjustments, helps to maintain trust between the insurer and the insured. This communication is essential in the context of financial planning for individuals and families relying on these insurance services for protection against unforeseen circumstances.

Summary of New Coverage Terms

Insurance premium adjustments frequently occur when policy conditions change or when external factors, such as inflation, impact operational costs. Increased coverage limits enhance financial protection against potential losses, with new terms defined in policy amendments. For example, homeowner's insurance may raise premiums by 10% due to increased material costs (up 15% over the past year) and heightened claim frequency post-natural disasters. Additionally, automobile insurance might introduce new risk assessments, correlating premium increases with higher accident rates in urban areas, such as New York City (showing a 20% rise in vehicle collisions). Notably, additional endorsements can provide specialized coverage for high-value items like jewelry (coverage limits may increase to $15,000), reflecting the need for more comprehensive safeguarding against unforeseen events.

Contact Information for Inquiries

Insurance providers often send notifications regarding premium increases to their policyholders, highlighting key details about changes in rates. Typically, insurance premiums may rise due to factors such as increased claims costs, regulatory changes, or adjustments in risk assessments. Policyholders can contact customer service representatives for inquiries, often listed via phone numbers (such as 1-800-123-4567) or email addresses (example@example.com). Additionally, correspondence addresses are usually provided to facilitate any formal communication regarding disputes or clarifications. Understanding specific reasons behind the premium increase, such as local market trends or underwriting criteria, is crucial for policyholders who wish to navigate their options effectively.

Letter Template For Insurance Premium Increase Notice Samples

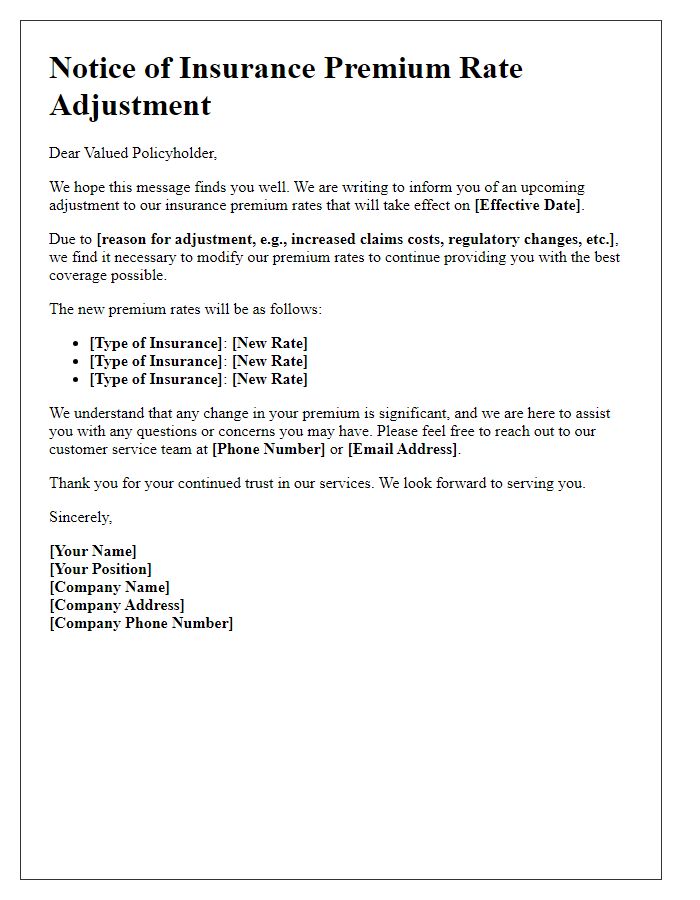

Letter template of announcement regarding adjustment in insurance premium rates

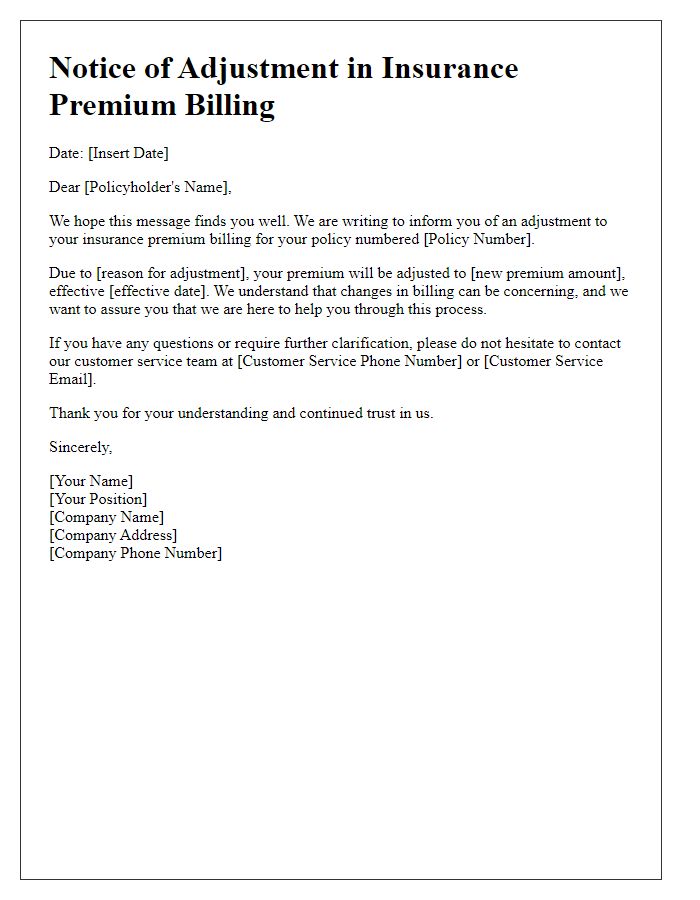

Letter template of notice for adjustment in your insurance premium billing

Comments