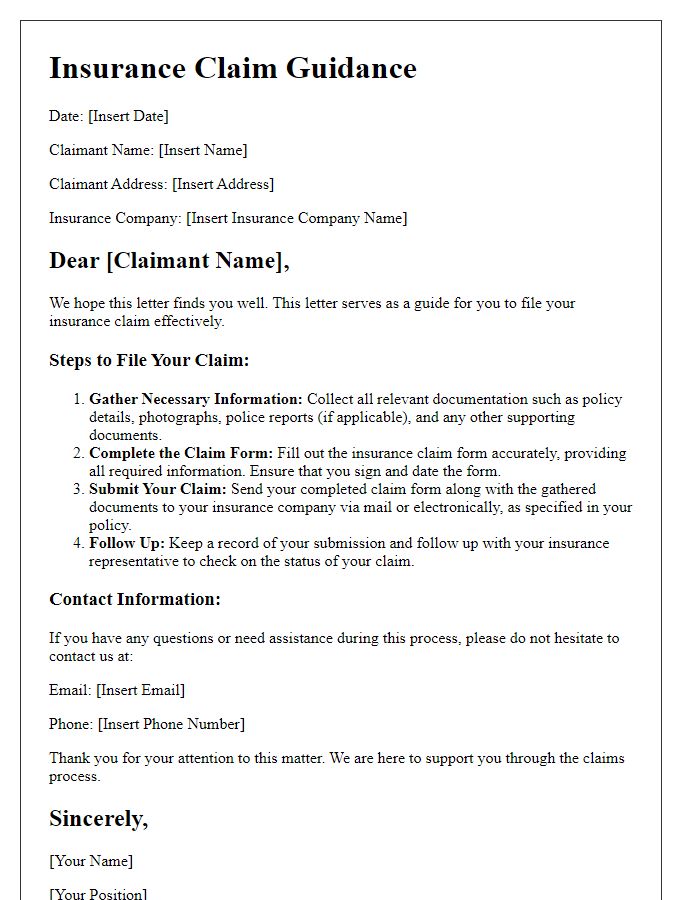

Navigating the insurance claim process can often feel overwhelming, but it doesn't have to be that way! Whether you're dealing with a sudden accident or unexpected damage, knowing the right steps to take can make all the difference in successfully obtaining your insurance benefits. In this article, we'll break down a simple letter template that you can use to seek assistance with your claim, ensuring you communicate effectively with your provider. So, if you're ready to streamline your claim experience, read on to discover tips and examples to help you get started!

Policy Details

Submitting an insurance claim requires accurate documentation of policy details. Policy Number serves as a unique identifier, allowing insurers to quickly access relevant information. Insured Entity refers to the individual or organization covered under the policy, which could be a homeowner, business, or vehicle owner. Effective Date indicates when the coverage begins, while Expiration Date signifies the end of the policy period. Coverage Limits define the maximum amount the insurer will pay for certain types of claims, which is critical for determining potential compensation. Additionally, understanding any Specific Exclusions within the policy, such as natural disasters or pre-existing conditions, is vital when preparing the claim. All of these elements contribute significantly to a successful claim process, ensuring all necessary details are aligned for a timely resolution.

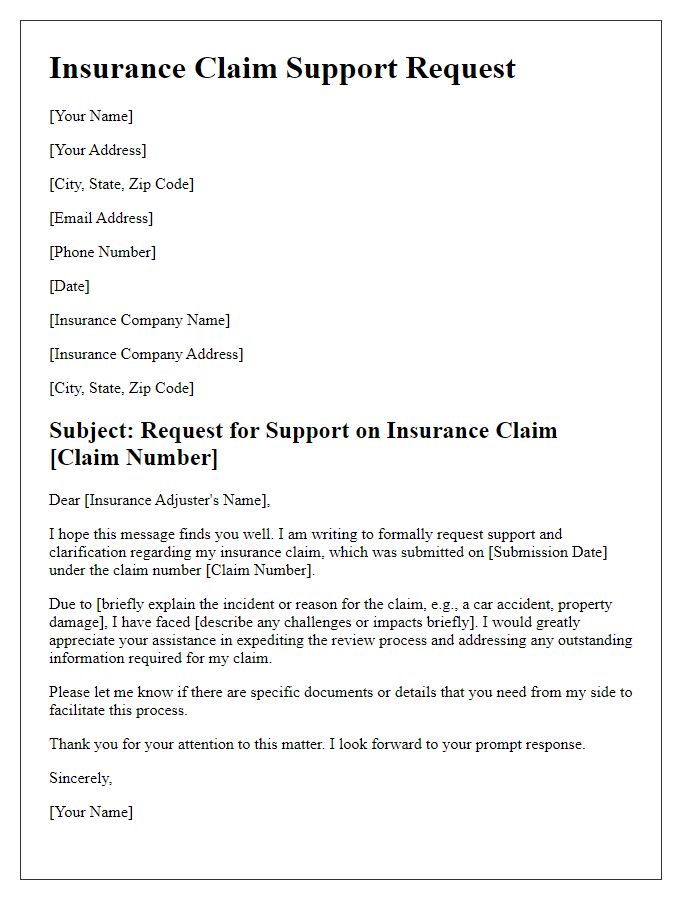

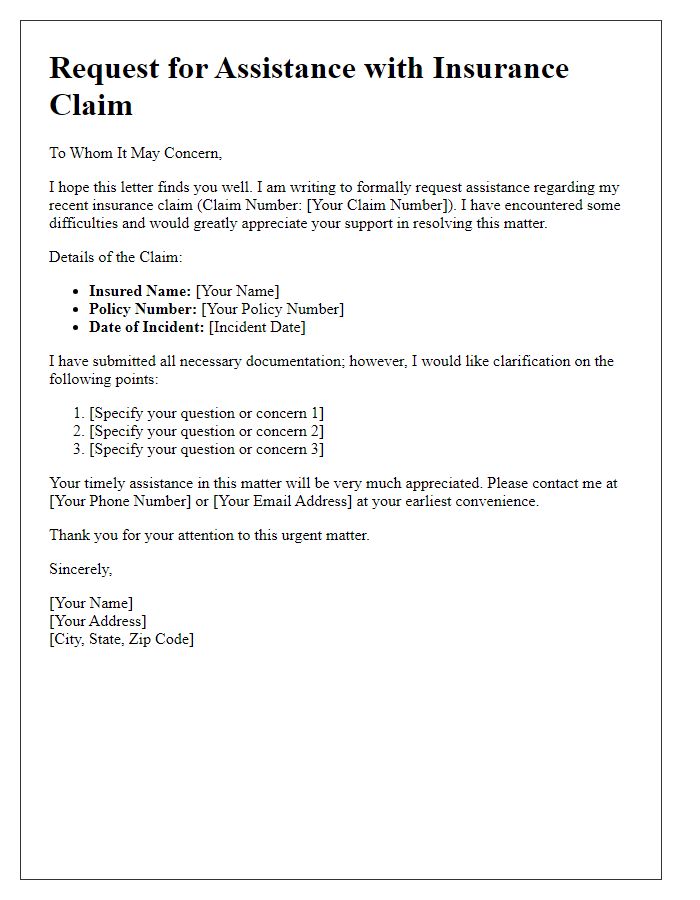

Claimant Information

Claimant Information serves as a crucial section in an insurance claim process, detailing essential personal attributes of the individual filing the claim. Important identifiers include the claimant's full name, address (including city, state, and ZIP code), phone number, and email address for communication purposes. The policy number, linked to the specific insurance policy held with the insurance provider, is vital for tracking and managing claims. The date of the incident being claimed, alongside a brief description of the event (such as an accident, theft, or damage) will allow the claims adjuster to assess the situation accurately. Additional information may include the nature of the claim, estimated costs of damages, and any relevant documentation to support the assertion, enhancing the processing efficiency of the claim.

Incident Description

The incident involving the car accident occurred on July 15, 2023, at approximately 3:45 PM on Main Street in Springfield, a location notorious for heavy traffic. A blue Honda Civic (model year 2020) collided with a red Ford F-150 (model year 2018) at the intersection near Oak Avenue. The impact resulted in significant damage to both vehicles, with the Honda sustaining a crumpled front end while the Ford displayed rear-end damage. Emergency services were called to the scene, and an accident report was filed by Officer Johnson of the Springfield Police Department. Both drivers, a 35-year-old male and a 28-year-old female, were treated for minor injuries at Springfield General Hospital. Photographic evidence of the scene, including the positions of the vehicles and road conditions, has been collected to support the insurance claim process.

Claim Amount

The importance of a comprehensive claim amount documentation is essential for the successful processing of insurance claims. For instance, policyholders should meticulously gather receipts and invoices, especially for significant expenses such as medical bills, property damage repairs, or lost wages, amounting to thousands of dollars. Insurance policies from companies like Allstate or State Farm often require specific forms to detail these expenses, accompanied by supporting evidence. Additionally, an estimated timeline for the claim resolution process can enhance understanding for both parties involved. This information can expedite the claim approval rate and ensure adequate compensation is provided in cases of extensive damage or loss.

Supporting Documentation

Supporting documentation is essential for a successful insurance claim process. Key documents include the insurance policy (specifying coverage limits and exclusions), claim form (filled with accurate details), and incident report (providing a detailed account of the event, such as an accident or theft). Additional evidence, such as photographs (showing damage or circumstances), medical records (for health-related claims), and repair estimates (from certified professionals), are critical to substantiate losses. Lastly, any correspondence with the insurance company (emails, letters, or recorded phone calls) should be included to demonstrate communication history. This comprehensive approach ensures clarity and enhances the chances of timely reimbursement.

Comments