Are you feeling overwhelmed by the complexities of your health insurance policy? You're not aloneâmany people find the fine print and coverage details daunting. In this article, we'll break down the essential components of health insurance, making it easier for you to understand your rights and benefits. So, let's dive in and simplify the world of health insurance together!

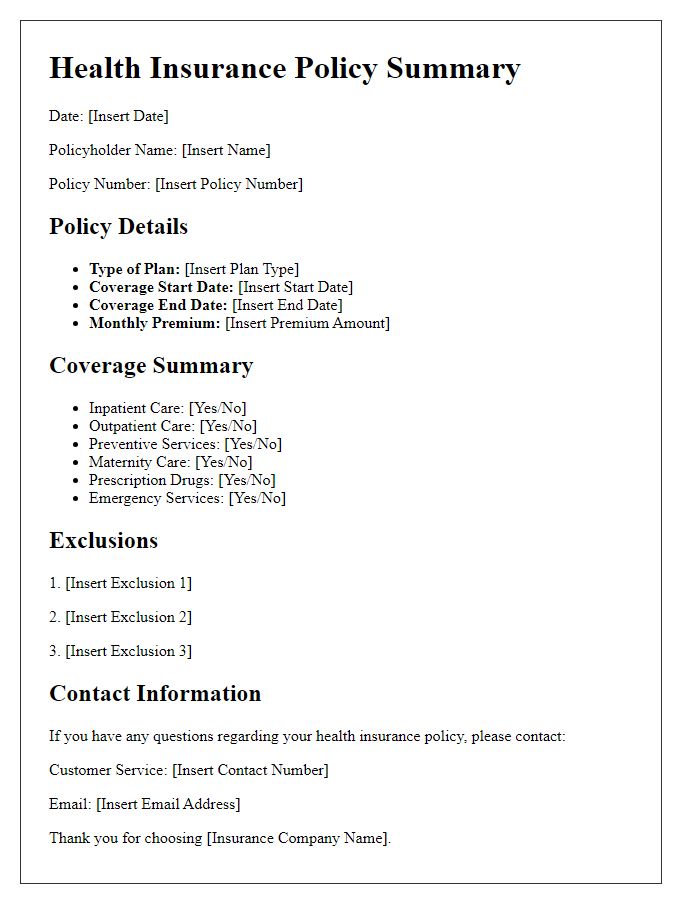

Policy Details Overview

Health insurance policies provide essential coverage for medical expenses, protecting individuals against high healthcare costs. A typical policy includes various components such as premiums, co-pays, deductibles, and out-of-pocket maximums, which influence the overall affordability of care. For instance, the average premium for an individual plan in the United States was approximately $440 monthly in 2021, while family plans averaged $1,200. Coverage options might encompass hospitalization, outpatient services, preventive care, and prescription medications. Networks--provider arrangements for policies--vary significantly among insurers, impacting access to preferred doctors and specialists. Policyholders should also consider the terms of network networks like HMO versus PPO, which dictate flexibility and provider choice. Understanding coverage limitations and exclusions, particularly for pre-existing conditions as defined by the Affordable Care Act, ensures effective utilization of benefits. Annual enrollment periods typically occur in October and November, providing opportunities for policy adjustments.

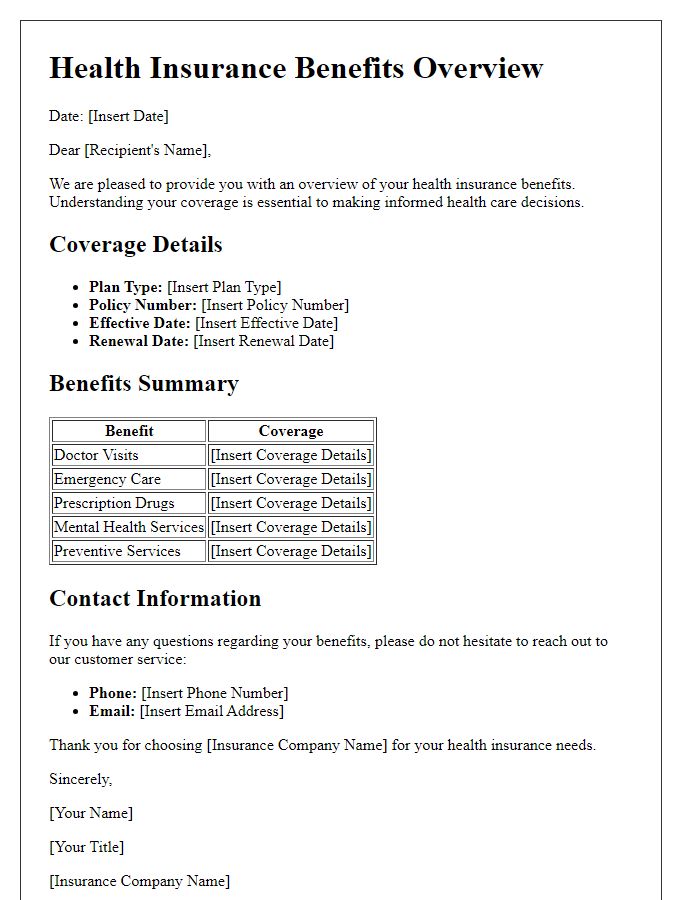

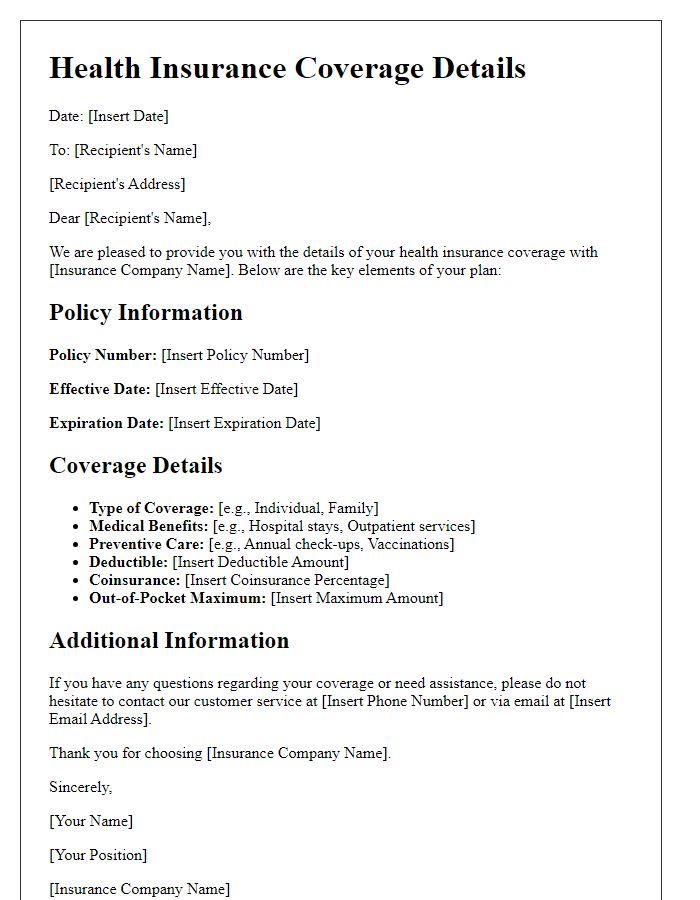

Coverage and Benefits Breakdown

Understanding health insurance policies is essential for maximizing coverage and benefits. A comprehensive health insurance policy typically includes various aspects such as inpatient care, outpatient services, preventive care, prescription drugs, and emergency services. Inpatient care refers to medical treatment that requires hospitalization, while outpatient services allow patients to receive care without an overnight stay. Preventive care encompasses routine check-ups and screenings aimed at preventing illnesses. Prescription drugs coverage includes a formulary, outlining which medications are covered and their associated copayments. Emergency services provide immediate medical treatment in critical situations, often with specific network hospital provisions. Familiarity with these components can help policyholders make informed healthcare decisions and avoid unexpected expenses.

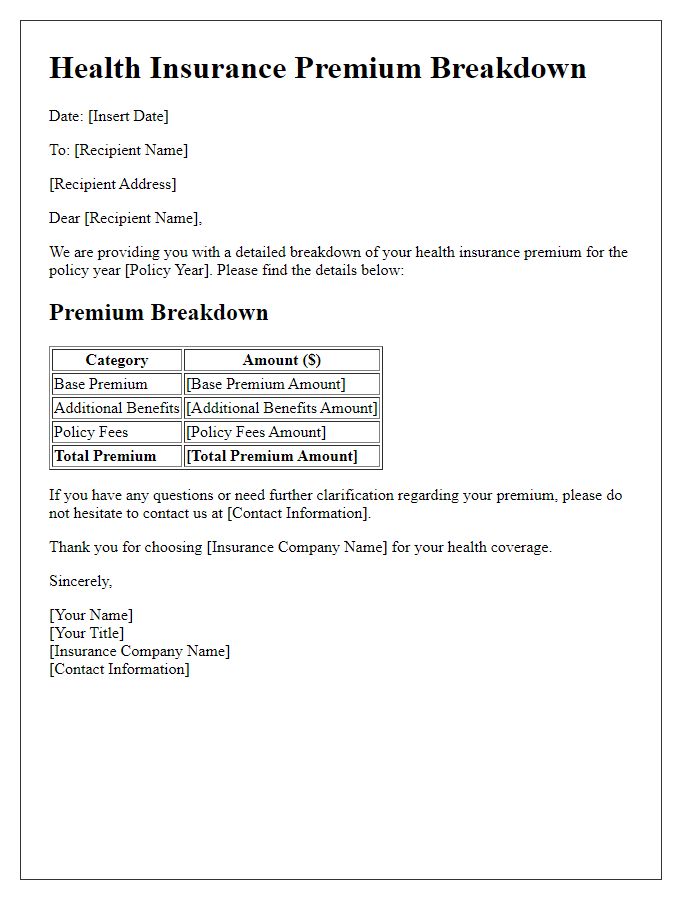

Premiums and Payment Terms

Health insurance policies require regular premium payments to maintain coverage. Premium amounts can differ based on factors like age (typically individuals aged 25-34 may see higher costs), location (urban areas can have increased premiums), and specific plan types (HMO, PPO, etc.). Payment terms often include monthly, quarterly, or annual options, providing flexibility for individuals. In certain policies, auto-payment (automatically charging bank accounts) might be available to ensure timely payments. Additionally, there are grace periods (ranging from 10 to 30 days) allowing insured individuals to make overdue payments without losing coverage. Understanding these aspects is crucial for effective financial planning regarding health insurance.

Exclusions and Limitations

Health insurance policies often include exclusions and limitations that dictate the scope of coverage. Common exclusions involve specific treatments or conditions, such as cosmetic surgery, dental procedures (except for emergencies), and certain pre-existing conditions (typically identified within a timeframe of six months prior to policy issuance). Limitations might apply to maximum coverage amounts for specific services, such as hospital stays (often capped at a certain number of days), or annual limits on outpatient services. Furthermore, preventative care may not always be covered, depending on the plan details. Policyholders must review these exclusions and limitations in their contracts to understand any out-of-pocket expenses they may incur during medical treatment.

Claims Process Instructions

Health insurance claims processing involves several critical steps to ensure efficient reimbursement for medical services rendered. The initial step requires policyholders to gather necessary documentation including itemized bills from healthcare providers, proof of payment (such as receipts), and medical records if applicable. Subsequently, it's crucial to complete a claims form, provided by the health insurance company, accurately detailing the nature of the services, dates of treatment, and any relevant codes assigned by physicians. Submission of this compiled information can often occur through an online portal, via mail, or through fax, adhering to the specific guidelines established by the insurer. Timeliness is vital, as many insurers necessitate submission within a specified period, often ranging from 30 to 180 days post-service. After submission, policyholders should anticipate a processing time, which can vary from a few days to several weeks, during which insurance representatives review the claim for authenticity and coverage eligibility. Communication regarding the status of claims is typically provided through mail or email notifications, with options for follow-up inquiries if disputes or delays arise.

Comments