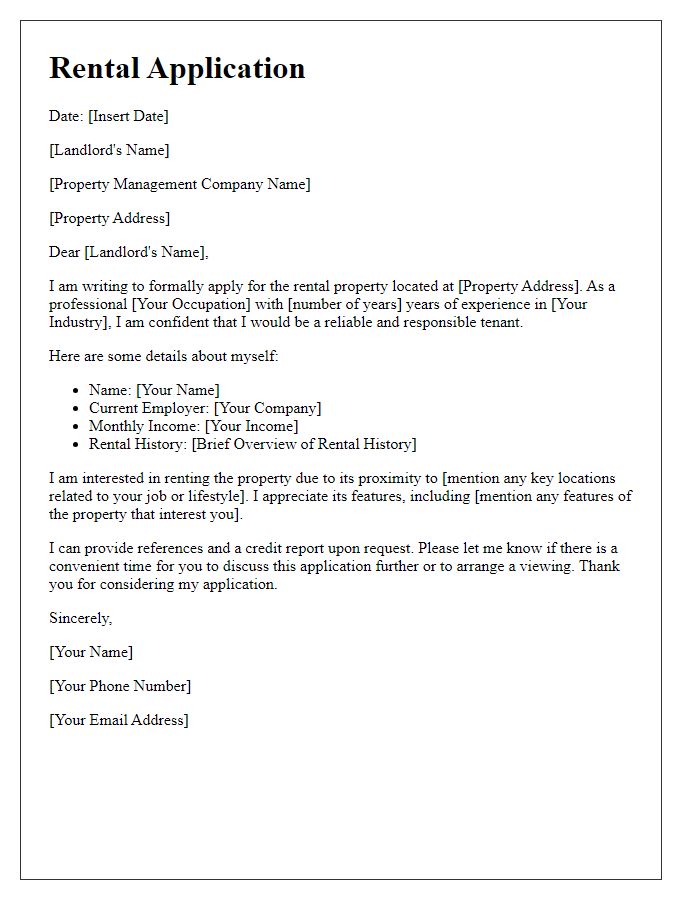

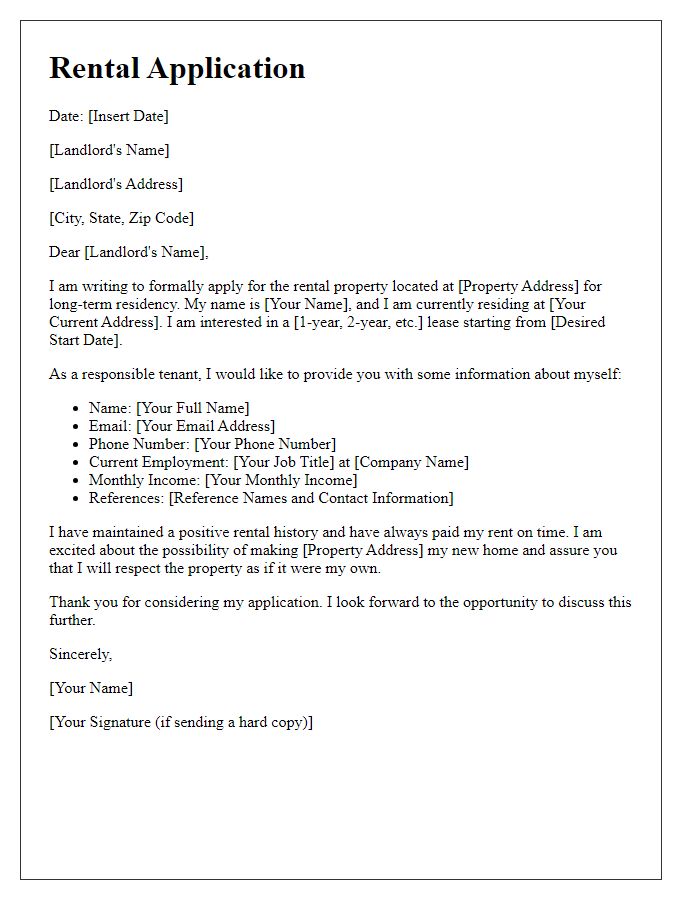

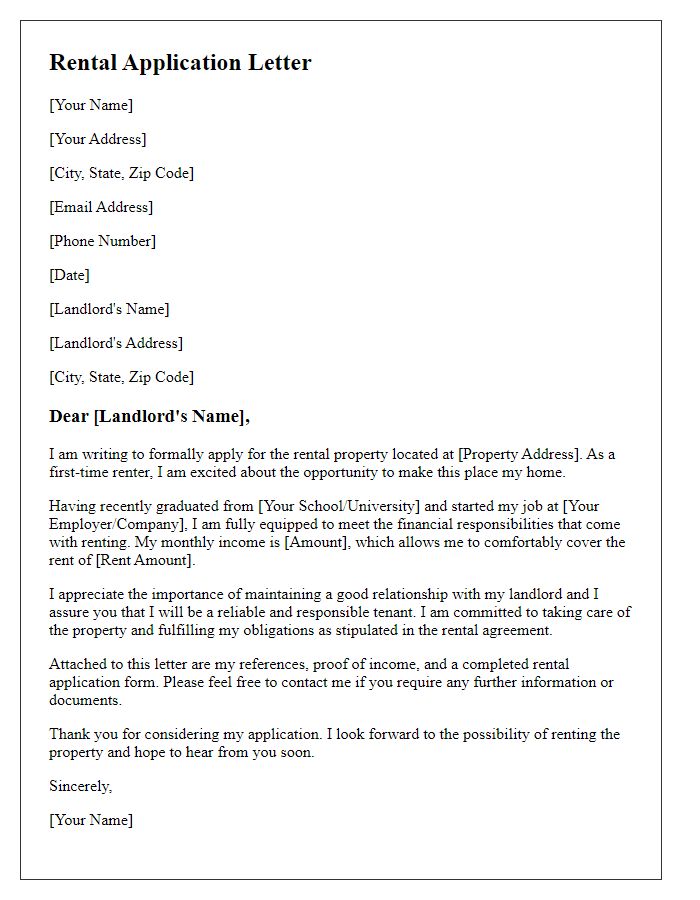

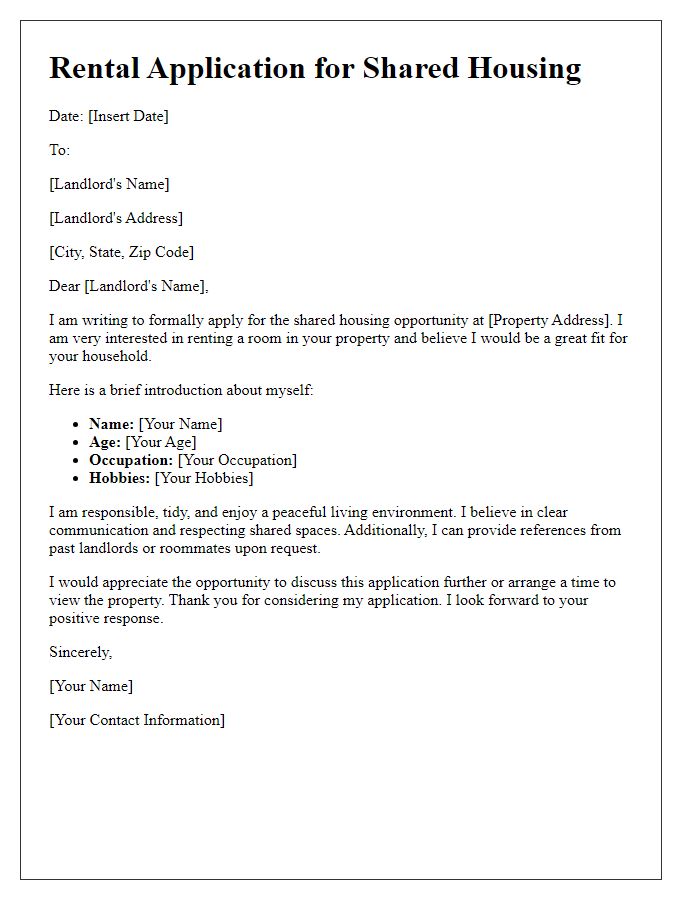

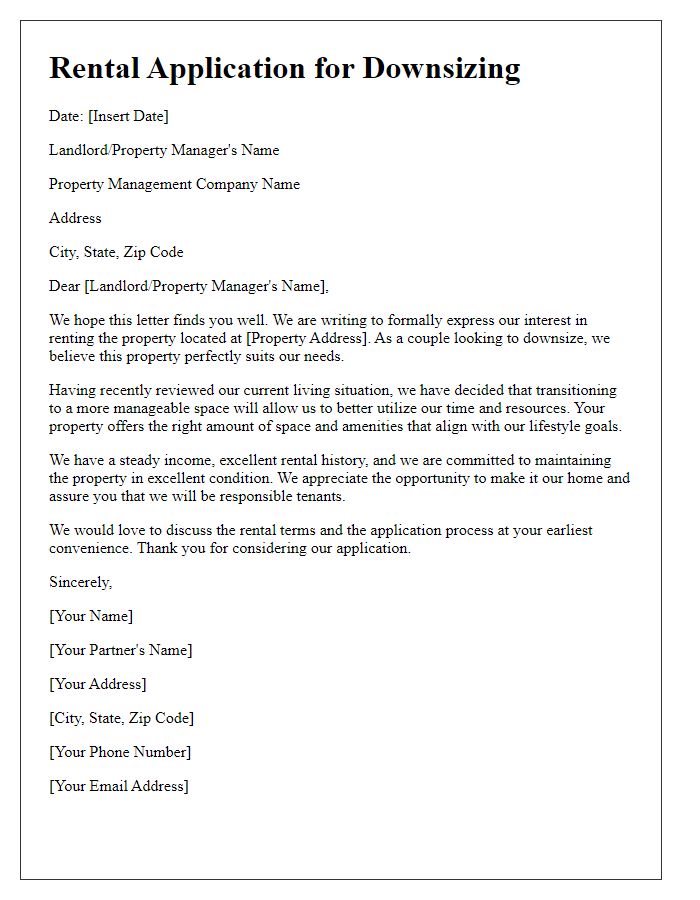

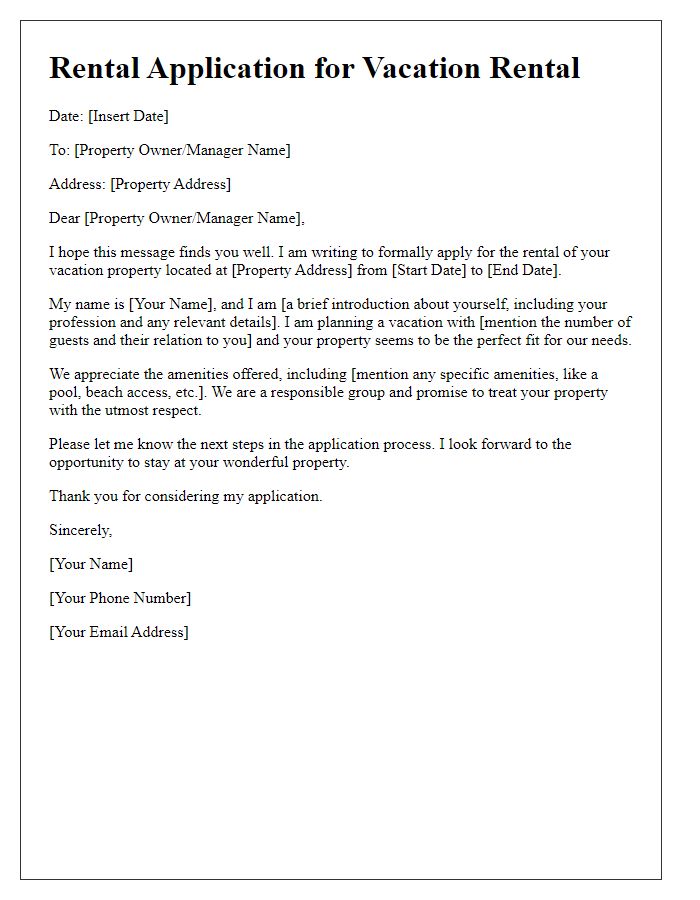

Are you ready to take the leap into a new rental property but unsure how to make your application stand out? Crafting the perfect letter can be your secret weapon in impressing potential landlords and securing that dream space. In this article, we'll break down essential elements to include in your rental property application letter and share tips for showcasing your best qualities as a tenant. So, grab your notepad and let's dive into how to elevate your rental game!

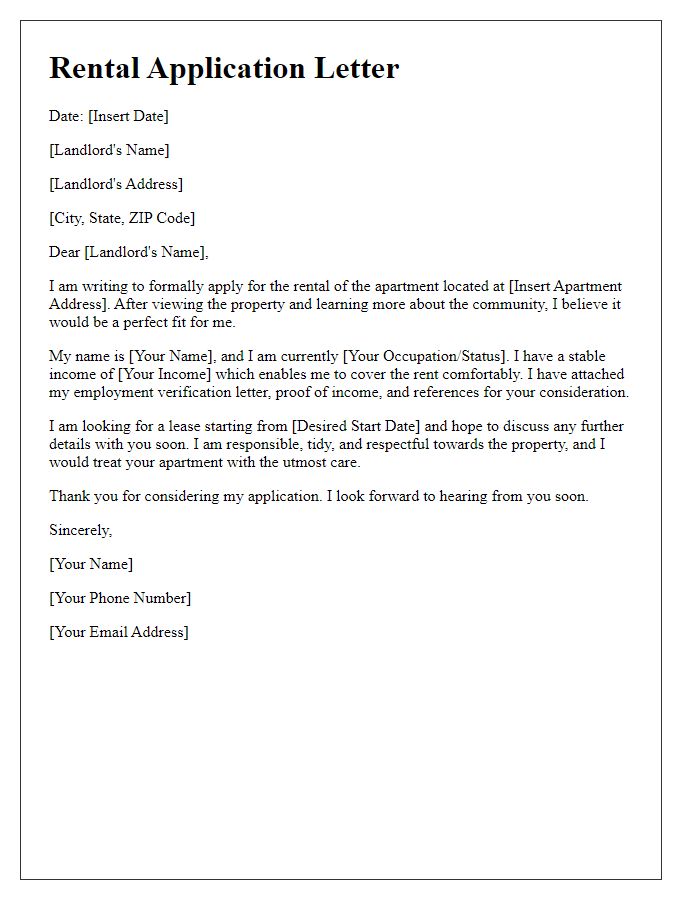

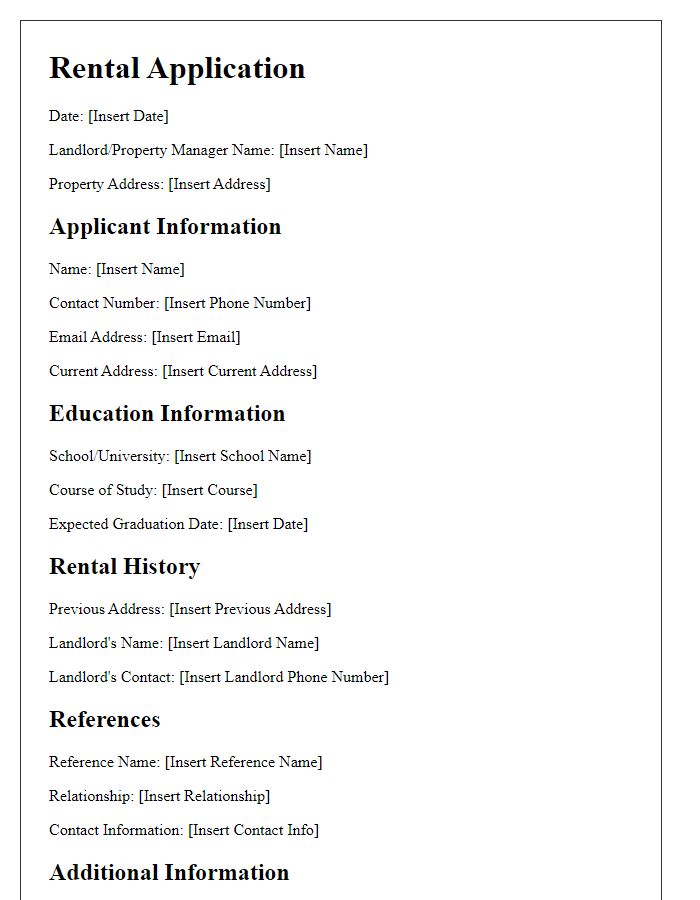

Applicant's personal information

A rental property application typically includes key personal information such as full name, current address (including street number, city, and zip code), date of birth (usually needed for identity verification), and phone number (mobile number preferred for immediate communication). Additionally, the application may require the email address for digital correspondence, employment details (such as employer name, job title, and monthly income), and references (including contact information for previous landlords or personal connections). Credit history and background check authorization are often standard requirements in such applications, facilitating the landlord's assessment of the applicant's financial reliability.

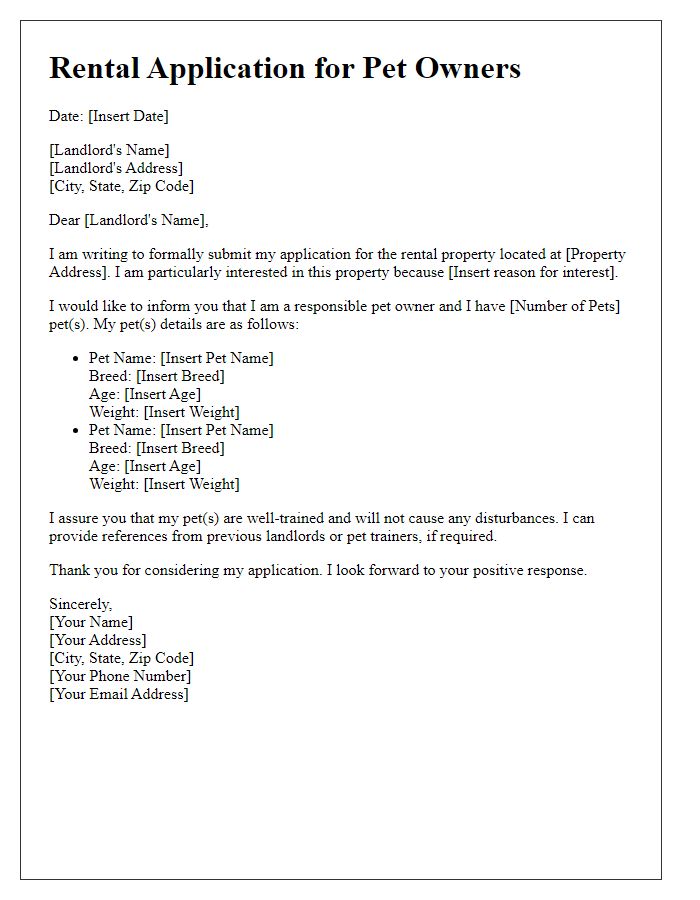

Rental property details

The rental property at 123 Maple Street, Springfield, features a modern two-bedroom layout, encompassing 1,200 square feet of living space. This spacious apartment is located in a vibrant neighborhood, just a five-minute walk from Lincoln Park and a short drive to downtown Springfield's shopping and dining district. Notable amenities include energy-efficient appliances, a private balcony with views of the landscaped garden, and access to a community swimming pool and fitness center. The property is available for lease starting November 1, 2023, with a monthly rent of $1,500, requiring a security deposit of $1,500. Public transportation options are conveniently located nearby, making it ideal for commuting professionals and families alike.

Employment and income verification

Employment and income verification for rental applications provides landlords with essential information to assess a potential tenant's financial stability and reliability. An applicant typically submits documentation such as pay stubs, employment letters, or bank statements, reflecting a consistent income stream, confirming employment status at reputable organizations, and indicating sufficient monthly income (usually three times the rent) to meet rental obligations. Landlords often require contact information for direct communication with the employer to verify employment, ensuring the applicant's claims of job stability, which may include full-time positions in companies based in urban areas or specific industries. This process helps facilitate confident leasing decisions and secure rental agreements.

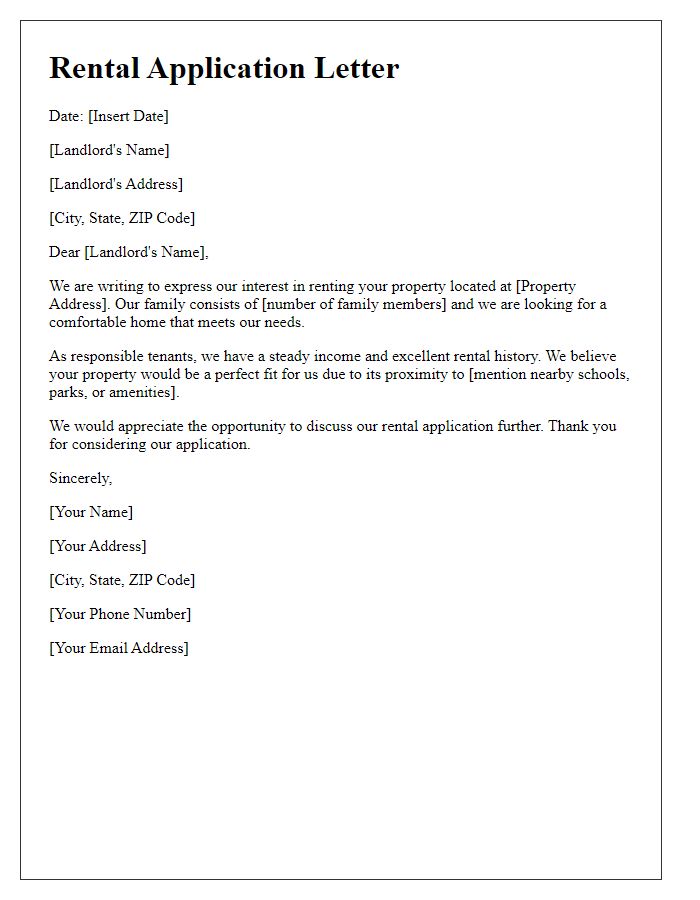

References and rental history

A rental property application typically requires candidates to provide comprehensive references and a detailed rental history to assess suitability. Previous landlords (identified by name and contact information) must be listed to confirm reliability and rental payment behavior. Additionally, inclusion of rental duration (e.g., twelve months at 123 Maple Street, Springfield) offers context regarding stability. Professional references, such as employers (with job title and company), can further support the applicant's credibility. Financial stability can also be clarified through past rental payments, highlighting punctuality or any late payment incidents, thereby reflecting the applicant's responsible behavior as a tenant.

Agreement to terms and conditions

A rental property application typically includes an acknowledgment of the terms and conditions that govern the lease agreement. Essential components of this acknowledgment can include clear stipulations regarding rental payment deadlines, security deposit amounts, maintenance responsibilities, and tenant rules. Important details such as the rental amount (e.g., $1,500 monthly for a two-bedroom apartment in Austin, Texas), lease duration (12 months), and pet policy (addendum for pets allowed with a non-refundable fee) should be explicitly stated. Prospective tenants must also agree to undergo a background check and provide their credit history to ensure reliability as a tenant. Signatures from both the applicant and the property manager signify acceptance of these terms, reinforcing the legal obligations of both parties under local housing laws.

Comments