Navigating the world of medical insurance can feel like decoding a complex puzzle, especially when seeking approval for necessary treatments. Many of us have faced the challenge of having our claims denied or delayed, leaving us unsure about our next steps. But fear not, this article is here to guide you through the process of crafting the perfect letter for medical insurance approval. So, if you're ready to take charge of your healthcare journey, dive in and read more!

Patient's Full Name and Personal Details

Appropriate medical insurance approval processes require detailed documentation. Patient's full name, including first, middle, and last names, is essential for identification. Date of birth, typically formatted as MM/DD/YYYY, helps establish age-related coverage. Social Security number, if applicable, assists insurers in uniquely identifying individuals within their system. Address includes street, city, state, and ZIP code, ensuring accurate correspondence. Contact number, often a mobile or home phone, provides a way to reach the patient for further inquiries. Policy number identifies the specific insurance plan under which the patient seeks approval. Group number, if applicable, links the individual to employer-sponsored coverage options, streamlining the approval process. All these personal details form the foundation of medical insurance requests, ensuring a thorough and efficient assessment.

Treatment Description and Medical Necessity

Treatment descriptions for medical insurance approval often include essential details about the patient's condition, the proposed medical intervention, and the rationale behind its necessity. For instance, a cardiac stent placement (a procedure to insert a small mesh tube into narrowed arteries) may be justified due to the patient's diagnosis of coronary artery disease, characterized by a blockage of over 70% in a specific artery (such as the left anterior descending artery). Clinical guidelines recommend this procedure when traditional medications fail to alleviate symptoms like chest pain or shortness of breath, ensuring improved blood flow and reducing the risk of heart attack. Documentation should reference supporting documents, including imaging studies (such as coronary angiography) and previous treatment plans, to validate the medical necessity of the intervention requested.

Healthcare Provider Information

The healthcare provider information section plays a crucial role in the medical insurance approval process, detailing key aspects such as the provider's name, specialty, and contact information. Accurate documentation of the healthcare provider's credentials, such as board certifications (for instance, American Board of Medical Specialties) and affiliations with hospitals or clinics (like the Mayo Clinic or Cleveland Clinic), is essential for demonstrating the provider's qualifications. Additionally, including the National Provider Identifier (NPI) number streamlines the verification process. Clear demonstration of the provider's experience in specific medical fields, especially when requesting specialty care or advanced treatment options, greatly enhances the likelihood of insurance approval. Proper formatting with precise details ensures efficient communication with insurance companies, ultimately facilitating timely patient care.

Policy Number and Insurance Details

A medical insurance approval often hinges on specific details regarding the policyholder's information and the associated medical plan. The insurance policy number serves as a unique identifier, essential for tracking claims and coverage details. Policies might include provisions for outpatient services, hospital stays, and specialized treatments, which detail the scope of care provided. Critical parameters include the deductibles, co-payments, and out-of-pocket maximums, alongside the network of preferred healthcare providers. Insurance details such as the primary insured's name, dependent coverage, and effective dates ensure that all parties understand the terms of the insurance agreement. Accurate documentation facilitates timely approvals and efficient processing of medical claims within the healthcare system.

Compliance with Insurance Policy Terms and Conditions

Medical insurance approval requires strict adherence to the specific terms and conditions outlined in the insurance policy. Each policy typically details eligibility criteria, including pre-existing conditions, treatment limitations, and coverage percentages, which can vary significantly among providers such as Blue Cross Blue Shield or Aetna. Submissions for approval must include comprehensive documentation, including diagnosis codes (ICD-10), procedure codes (CPT), and relevant medical records that validate the necessity of the treatment or procedure sought. Timeliness is critical, as many policies stipulate a limit on the timeframe for claims submission following treatment, often ranging from 30 to 180 days. Denials can occur due to lack of compliance, inadequate documentation, or non-covered services, emphasizing the importance of a thorough understanding of policy terms.

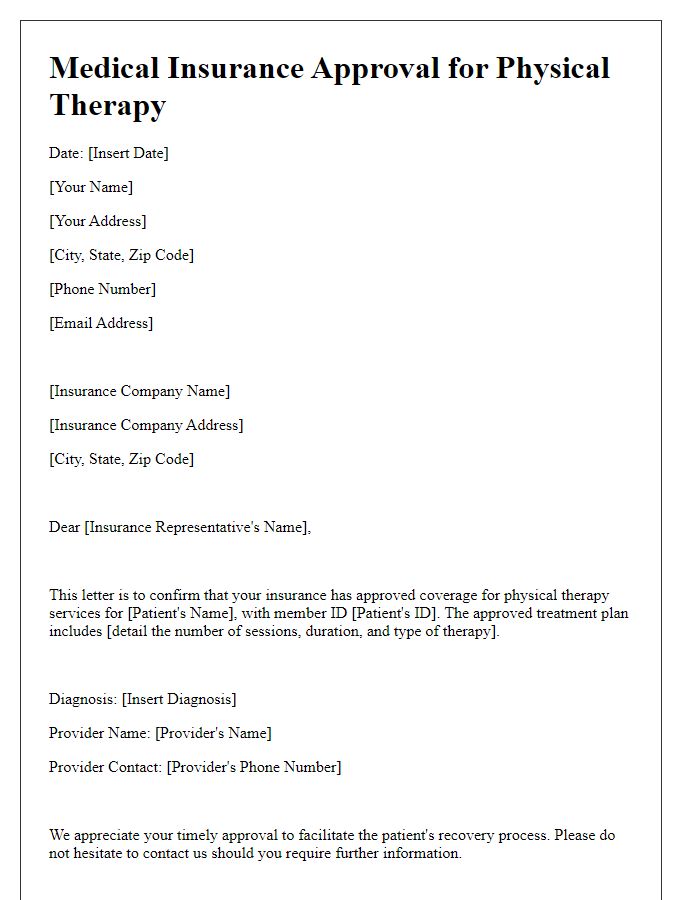

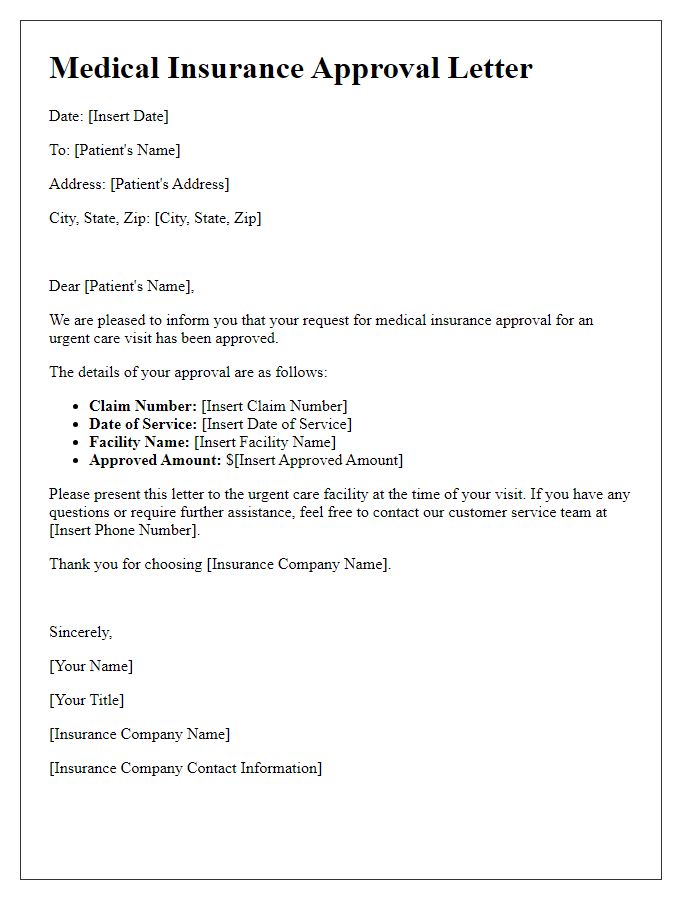

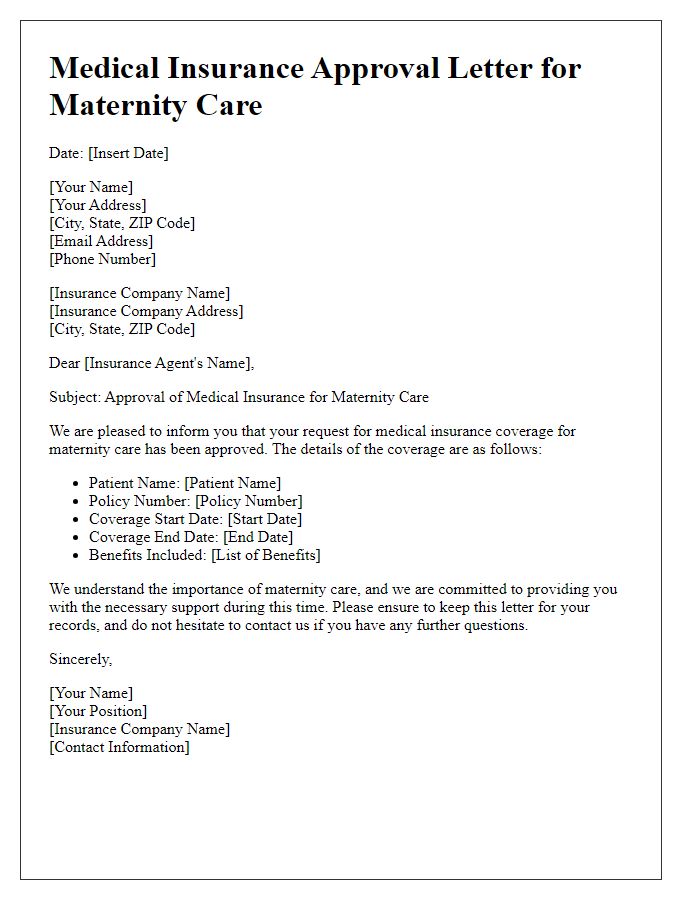

Letter Template For Medical Insurance Approval Samples

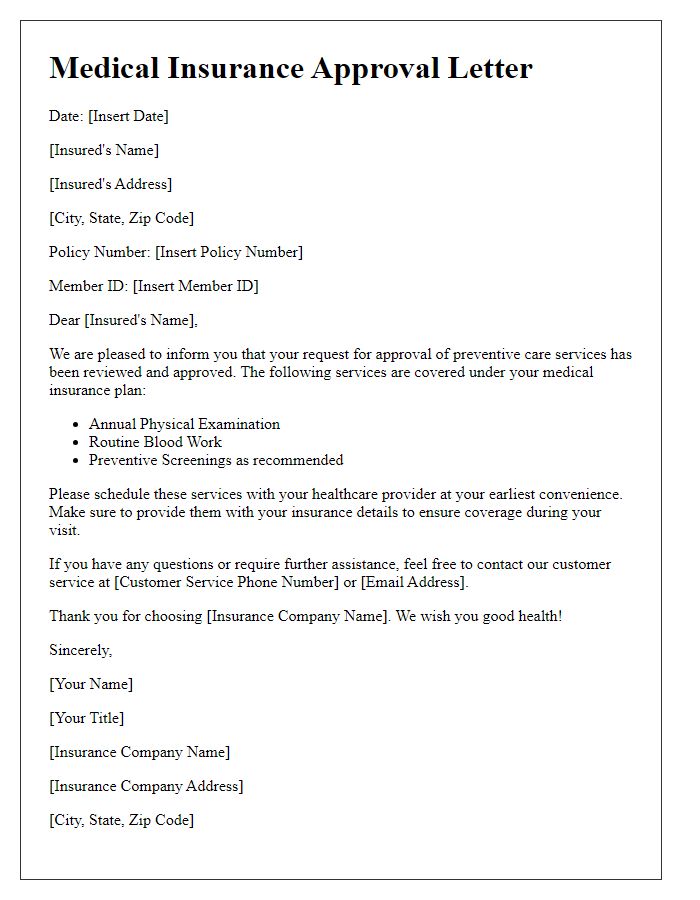

Letter template of medical insurance approval for preventive care services.

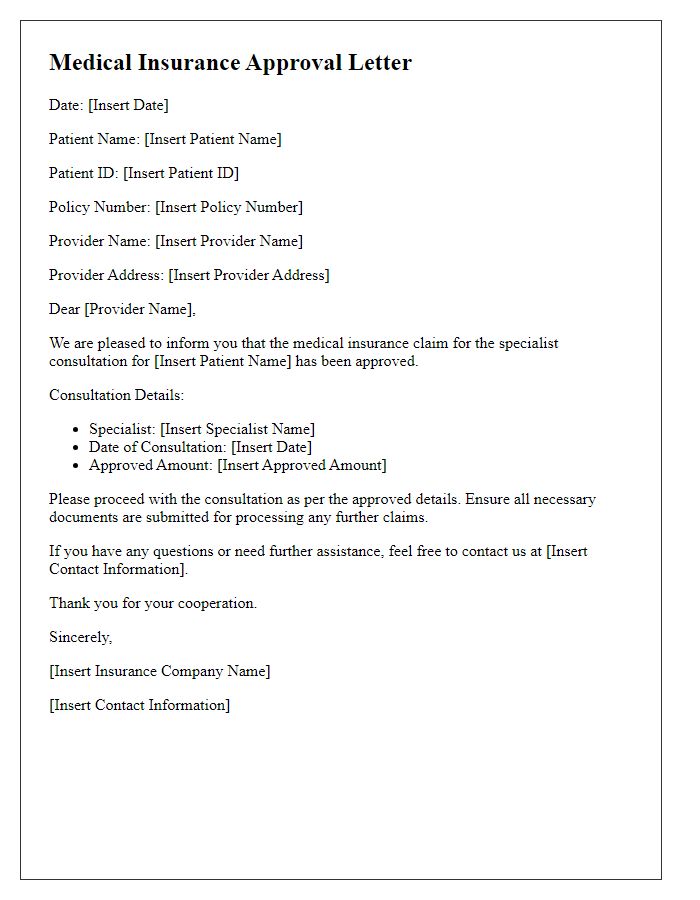

Letter template of medical insurance approval for specialist consultation.

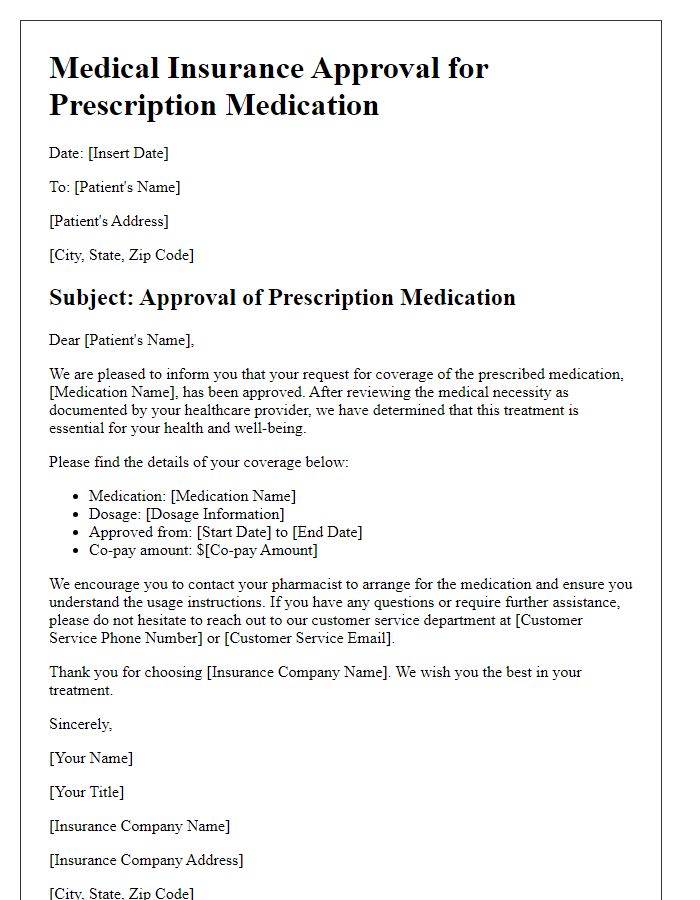

Letter template of medical insurance approval for prescription medication.

Letter template of medical insurance approval for mental health services.

Letter template of medical insurance approval for outpatient procedures.

Comments