Are you considering requesting a credit line increase? Many individuals find themselves in need of more purchasing power as their financial situations evolve. Whether it's for an unexpected expense or simply to improve your credit utilization ratio, knowing how to effectively request an increase can be pivotal. Join us as we explore the essential elements of a credit line increase letter and how to maximize your chances of approval!

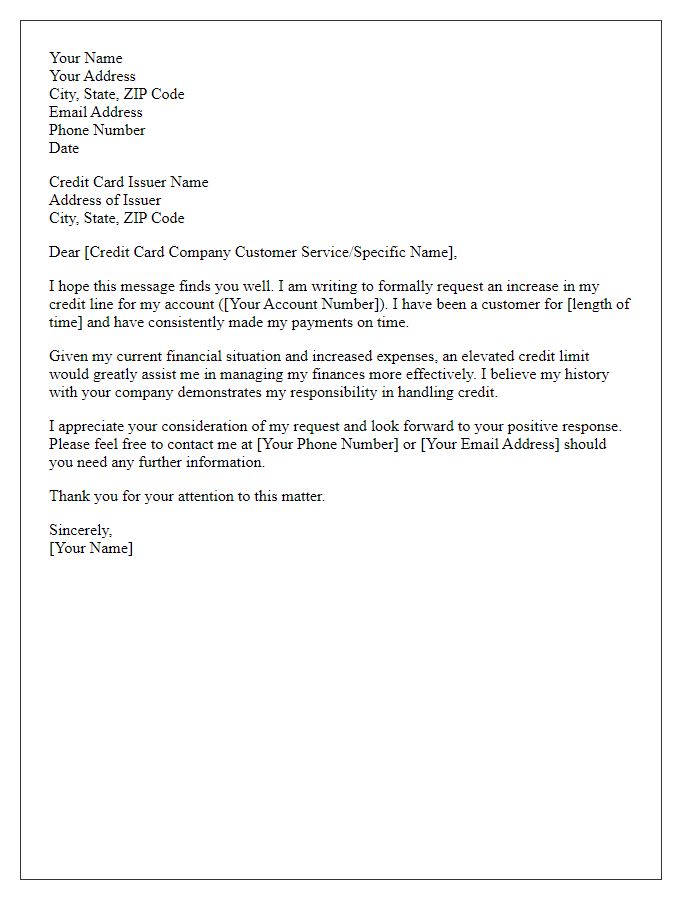

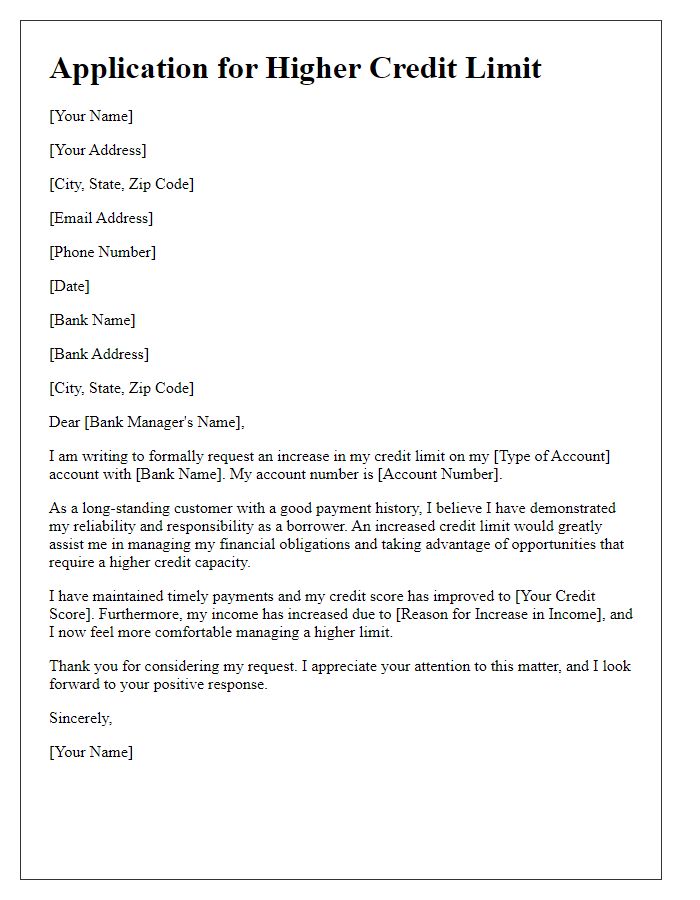

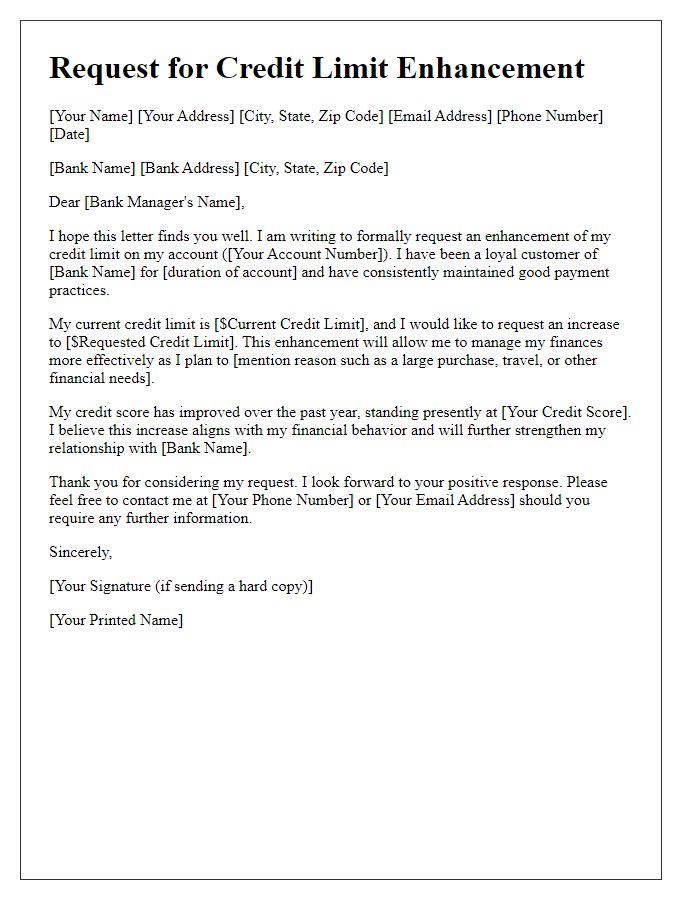

Personal Information

A credit line increase application can enhance financial flexibility, allowing individuals to manage unexpected expenses more effectively. Personal information such as full name, which identifies the applicant, and social security number (SSN), providing unique identification, is essential for processing the request. Moreover, current address signifies the applicant's residence status, impacting creditworthiness assessments conducted by financial institutions. Employment status, detailing current position and employer, provides insight into income stability. Annual income amounts, reflecting financial capability, play a decisive role in determining eligibility for a higher credit limit. Furthermore, credit score calculated based on credit history can significantly influence the outcome of the increase request, as lenders evaluate risk through this metric. Overall, compiling accurate personal information is a crucial step toward obtaining a credit line increase.

Account Details

To request a credit line increase, it is essential to provide specific account details that demonstrate financial responsibility and stability. Include the account number, which identifies the specific credit account with the financial institution. Mention the current credit limit, which serves as a basis for the request. Provide recent payment history, highlighting timely payments to emphasize creditworthiness. Include your income level, which reassures lenders of your ability to manage higher credit. Additionally, mention the length of the account tenure, as longer relationships with the credit issuer typically reflect reliability. Lastly, cite credit utilization ratios, calculated by dividing current balances by the credit limit, ideally keeping this below 30% to show prudent use of credit.

Increase Request Amount

Submitting a request for a credit line increase can positively impact financial flexibility. This process often involves specifying the desired increase amount, such as a $5,000 adjustment for better utilization of available credit. Lenders consider various factors, including current income levels, maintaining a good payment history on existing credit accounts, and lower debt-to-income ratios, ideally under 30%. Providing supporting documents, such as recent pay stubs or tax returns, may strengthen the case. Maintaining low credit utilization ratios, ideally below 30%, is crucial for the approval process, enhancing the likelihood of a successful request with financial institutions like banks or credit unions.

Justification for Request

A credit line increase can significantly enhance financial flexibility for consumers aiming to manage unexpected expenses. Individuals seeking additional credit might present a compelling case, supported by factors such as improved credit scores, demonstrating responsible financial behavior, timely bill payments over the past 12 months, and a stable income source, such as a full-time job at a company like Google or a similar organization, where an annual salary exceeds $80,000. Additionally, highlighting changes in personal circumstances, such as a recent marriage or the birth of a child, can illustrate potential increases in household expenses. The request can also mention current debt-to-income ratios, ideally under 30%, to showcase the ability to manage additional credit responsibly. Providing a clear rationale and emphasizing financial stability can help facilitate the approval process for a credit line increase.

Financial Stability Evidence

A well-documented request for a credit line increase can significantly impact financial institutions' decisions. Providing evidence of financial stability strengthens the application. Important documents include recent bank statements showcasing consistent savings patterns, tax returns for the past two years reflecting stable income levels, and pay stubs indicating ongoing employment or salary increases. Additionally, a credit report illustrating a good credit score (typically above 680) along with a low debt-to-income ratio (preferably below 30%) enhances the case. Highlighting a history of timely payments on existing debts and any significant assets, such as real estate properties or investments in diversified portfolios, further demonstrates financial reliability and responsible credit management to the lender.

Comments