Are you seeking feedback on your fiscal policy review? Crafting a well-structured letter can significantly enhance communication and foster constructive dialogue. In this article, we'll explore a streamlined template that allows you to convey your insights effectively while inviting collaboration. So, let's dive in and discover how you can share your thoughts in a clear and impactful manner!

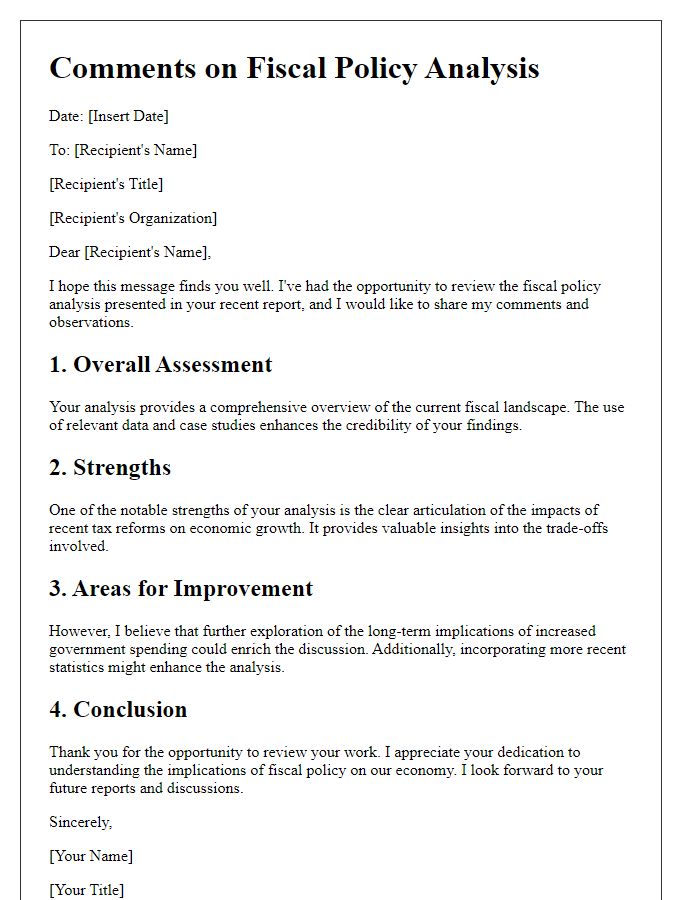

Clarity and precision of language

In fiscal policy reviews, clarity and precision in language are essential for effective communication of complex economic concepts. Clear definitions of terms, such as "fiscal deficit" and "monetary stimulus," ensure all stakeholders understand key components. Specific numerical data, such as GDP growth rates or unemployment figures, must be accurately presented to support the analysis. Additionally, structured organization of content, including headings and bullet points, enhances readability. Utilizing concise language minimizes ambiguity, allowing for straightforward interpretation of policy recommendations. Effective visual aids, such as graphs illustrating tax revenue trends or inflation rates, can further clarify critical information for policymakers and the public.

Conciseness and organization

Fiscal policy reviews encompass government strategies regarding taxation, spending, and budget allocations, aimed at influencing national economic health. Effective conciseness in fiscal policies ensures clear communication of objectives, allowing stakeholders to grasp complex economic forecasts. For instance, a well-organized fiscal review should provide succinct summaries of proposed tax reforms, such as changes to corporate tax rates, or adjustments in public spending initiatives like infrastructure projects. Organization aids in presenting data--like projected economic growth rates or deficit levels--as well as highlighting significant past events, such as economic downturns or recovery plans, thus enhancing the overall understanding of policy implications. Clear formatting of fiscal documents, including bullet points and charts, can improve readability, ensuring that critical information is conveyed efficiently and effectively.

Alignment with current fiscal objectives

An effective fiscal policy review must align closely with the current fiscal objectives set by government entities, such as the Department of Treasury. These objectives often involve targets like reducing national debt (aiming for a decrease of 2% in the fiscal year), increasing public investment, and optimizing tax revenue (with a proposed increase of 5% in collections). The review process should evaluate key metrics, including GDP growth rates (projected at 3% for the next quarter) and unemployment rates (currently at 4.5%), to ensure they reflect desired outcomes. Furthermore, the policy must consider inflation targets (around 2% annual growth), necessary economic stimuli during downturns, and the implications of interest rate adjustments set by central banks, which can influence borrowing costs and overall economic activity. Such alignment enhances fiscal stability and promotes sustainable growth within the economy.

Evidence-based recommendations

Fiscal policy reviews rely on evidence-based recommendations to inform decision-making effectively. Data-driven insights from sources like the International Monetary Fund (IMF) or the World Bank highlight the impact of fiscal policies on economic growth, employment, and poverty reduction. For instance, countries like Sweden experienced significant growth (over 4% annually) after implementing comprehensive tax reforms and increased public spending on education and healthcare. Furthermore, empirical studies from academic institutions, such as the National Bureau of Economic Research, suggest that targeted fiscal stimulus during economic downturns can result in GDP growth of approximately 1.5 times the initial investment. An examination of case studies from emerging economies like Brazil illustrates the importance of maintaining a balanced budget while investing in infrastructure, which leads to enhanced productivity and long-term economic stability. Enhancing the collection of tax revenue through streamlined processes can also yield substantial gains, as demonstrated by the experiences of OECD countries. These recommendations underscore the need for tailored fiscal approaches that address specific economic conditions while promoting sustainable growth.

Tone and professionalism

A fiscal policy review serves as a critical assessment of government spending, taxation plans, and budgetary allocations. Engaging in a thorough evaluation, stakeholders analyze economic indicators, such as Gross Domestic Product (GDP), inflation rates, and employment figures. Feedback focuses on the effectiveness of current policies and their impacts on various sectors, including healthcare, education, and infrastructure. Consideration of long-term sustainability and potential fiscal deficits guides recommendations for adjustments aimed at economic stability and growth. Collaboration among policymakers, economists, and the public fosters transparency and ensures diverse perspectives in shaping future fiscal strategies, influencing overall governmental performance.

Comments