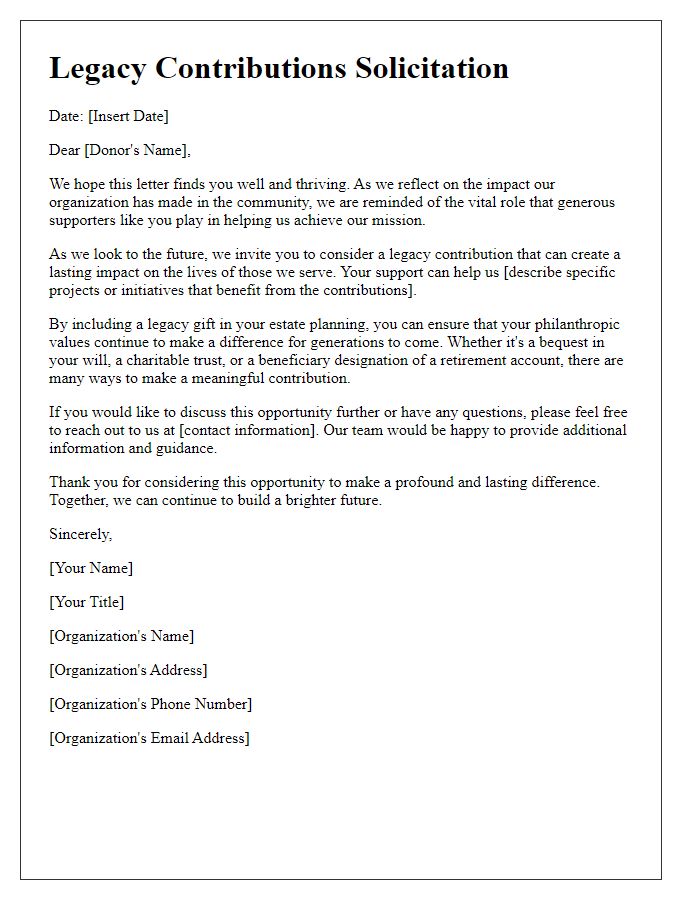

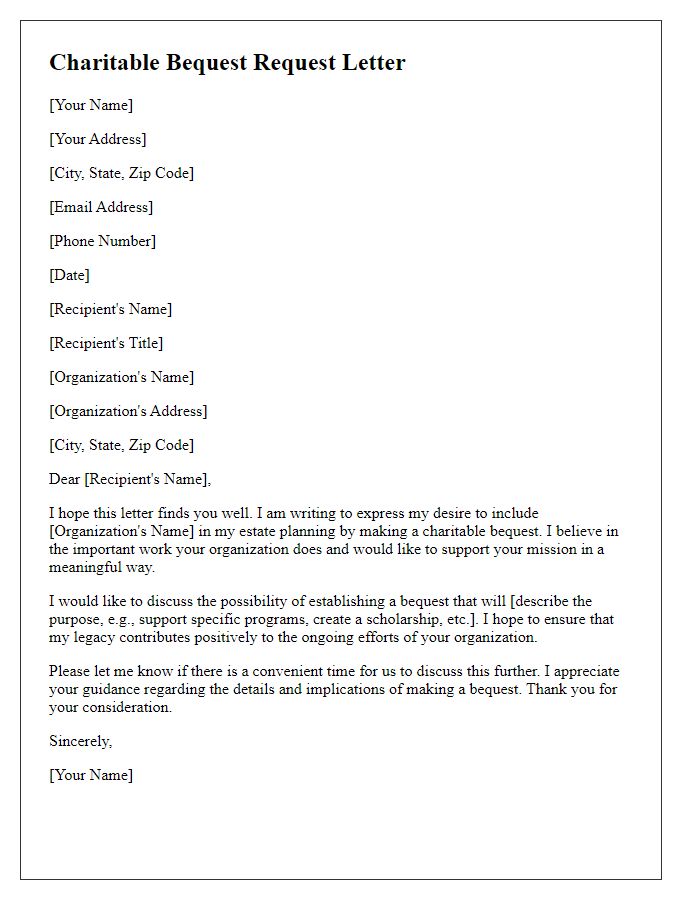

Are you considering a meaningful way to leave a lasting impact on your favorite charity? Planned giving is a thoughtful approach that not only supports organizations you care about but can also provide you with financial benefits. Whether through bequests, trusts, or other methods, your generosity can create a legacy that inspires future generations. Read on to discover how easy it is to get started with your planned giving journey and make a difference today!

Purpose and Impact

Planned giving initiatives significantly enhance nonprofit organizations' ability to fulfill their mission. By designating funds through bequests, charitable gift annuities, or trusts, donors cement their legacy while providing long-term support for projects such as community outreach programs or educational scholarships. Organizations such as the American Red Cross or Habitat for Humanity often utilize these contributions to expand their vital services, addressing crises or housing shortages. A well-structured planned giving strategy not only facilitates immediate impact but also ensures sustained growth and resilience against future challenges, ultimately shaping the futures of countless beneficiaries.

Donor Recognition

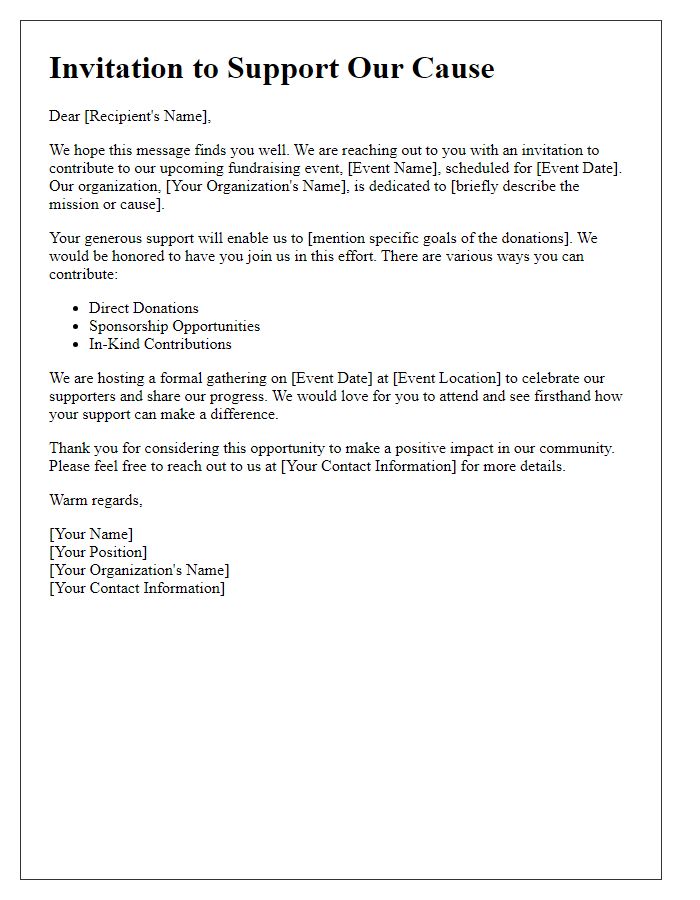

Planned giving programs enable impactful philanthropic contributions that sustain nonprofit organizations into the future, reflecting the values and passions of generous benefactors. Recognizing donors through acknowledgment programs not only honors their commitment but also fosters lasting relationships. For example, legacy circle memberships can include exclusive events, such as annual galas at the Historical Cultural Center, where donors are celebrated for their contributions toward crucial initiatives, such as educational scholarships and community health projects in underprivileged areas. Recognition can also extend to naming opportunities, allowing donors to leave a tangible mark on facilities or programs, affirming their vital role in shaping community progress.

Financial Benefits

Planned giving programs offer substantial financial benefits for both donors and charitable organizations. Contributions made through wills or trusts can provide significant tax advantages, such as income tax deductions and potentially reducing estate taxes and inheritance taxes. For instance, gifts of appreciated securities can help donors evade capital gains taxes while supporting causes close to their hearts. Charitable remainder trusts can facilitate a stream of income for donors during their lifetime while ultimately benefiting the chosen organization. Additionally, organizations like universities or healthcare charities can use planned gifts to ensure sustainable funding for initiatives such as scholarships, research projects, or community health programs, which leads to long-term improvements in their missions.

Legacy and Memory

Planned giving initiatives enable individuals to contribute significant financial support to charitable organizations, ensuring sustainable funding for future projects and programs. In 2023, many organizations, including educational institutions, healthcare facilities, and cultural nonprofits, are creating legacy funds to honor the memory of loved ones. Donors can make these contributions through estate gifts, bequests, or charitable remainder trusts. These options not only provide tax benefits but also allow donors to leave a lasting impact on communities. For instance, a legacy gift of $100,000 could fund scholarships for aspiring students at a university such as Harvard, while a contribution of $50,000 could support vital research into Alzheimer's disease at a facility like Johns Hopkins. By planning these gifts thoughtfully, individuals can ensure their memories and values continue to inspire and uplift future generations.

How to Give

Planned giving is a strategic approach to philanthropy that allows individuals to make significant contributions to charitable organizations while also benefiting from tax advantages and potentially enhancing their estate planning. This type of giving often includes mechanisms such as bequests, charitable gift annuities, and charitable trusts, which can provide donors with immediate tax deductions or income during their lifetime. The flexibility in how these gifts are structured enables supporters to leave a lasting legacy aligned with their values, all while making a meaningful impact on causes like education, healthcare, or the arts. Notable organizations, such as The American Red Cross, frequently encourage planned giving as a way to secure future funding and support ongoing initiatives that require sustained efforts and resources.

Comments