When it comes to managing franchise relationships, communication is key, especially when it involves financial matters. A debt collection notice can be a delicate document, but it's also an opportunity to strengthen your business ties. By clearly outlining the situation and next steps, you can remind your franchisee of their obligations while maintaining a professional tone. Curious to learn more about crafting an effective collection notice? Read on!

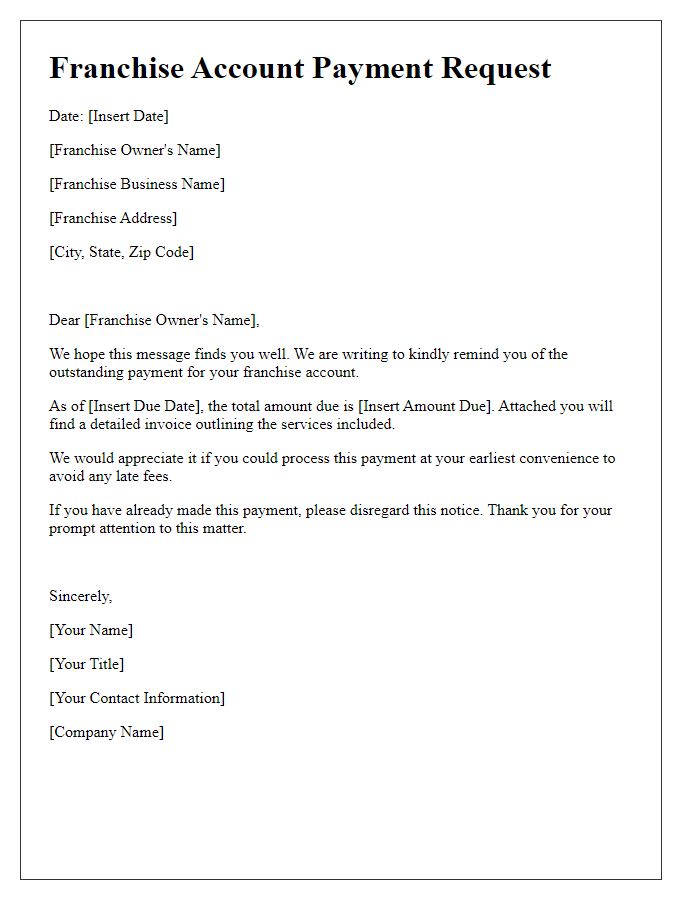

Clear Subject Line

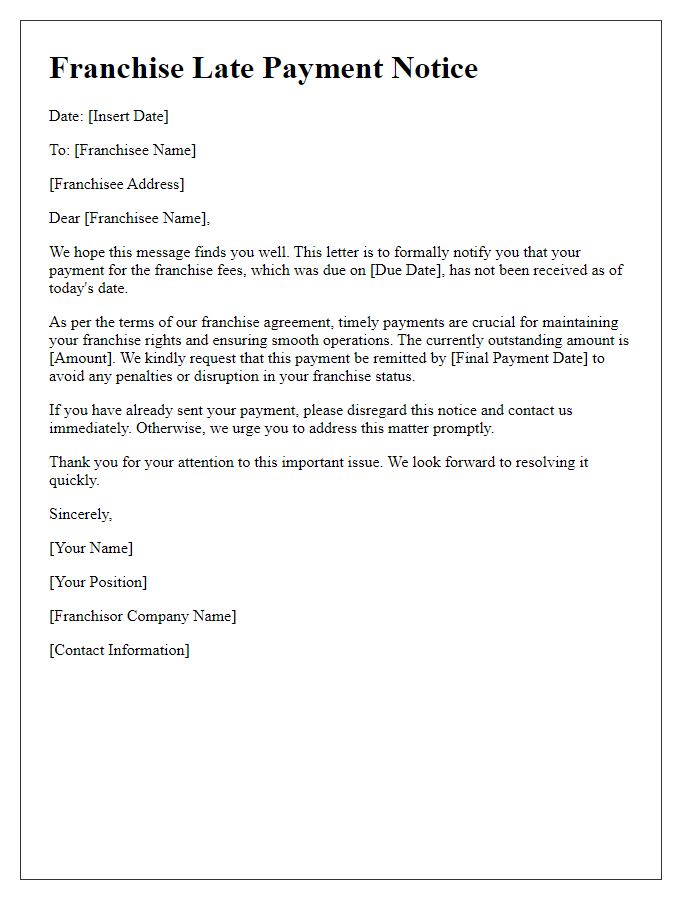

Franchise debt collection notices require clear and direct communication to ensure effective recovery of owed amounts. A concise subject line, like "Urgent: Outstanding Franchise Debt Collection Notice," immediately informs the recipient of the gravity of the matter. This notice should detail the total amount owed (including any late fees), relevant franchise agreement dates (initial signing and due dates), and payment instructions. Clear documentation of the original debt agreement outlines the franchisee's obligations. Contact information for both collection agencies and the franchisor should facilitate prompt responses. Clear expectations for next steps, including deadlines for payment, can foster urgency in resolution.

Formal Salutation

Franchise debt collection notices serve as important communication for informing franchisees about overdue payments. These documents typically include specific details such as the outstanding balance, due dates, and potential consequences of non-payment. Including notes on the original franchise agreement date, calculated late fees (often 1.5% per month), and the contact information for the collections department enhances clarity. Ensuring proper formatting and maintaining professionalism in the salutation establishes a respectful tone, crucial for encouraging prompt resolution of the financial issue.

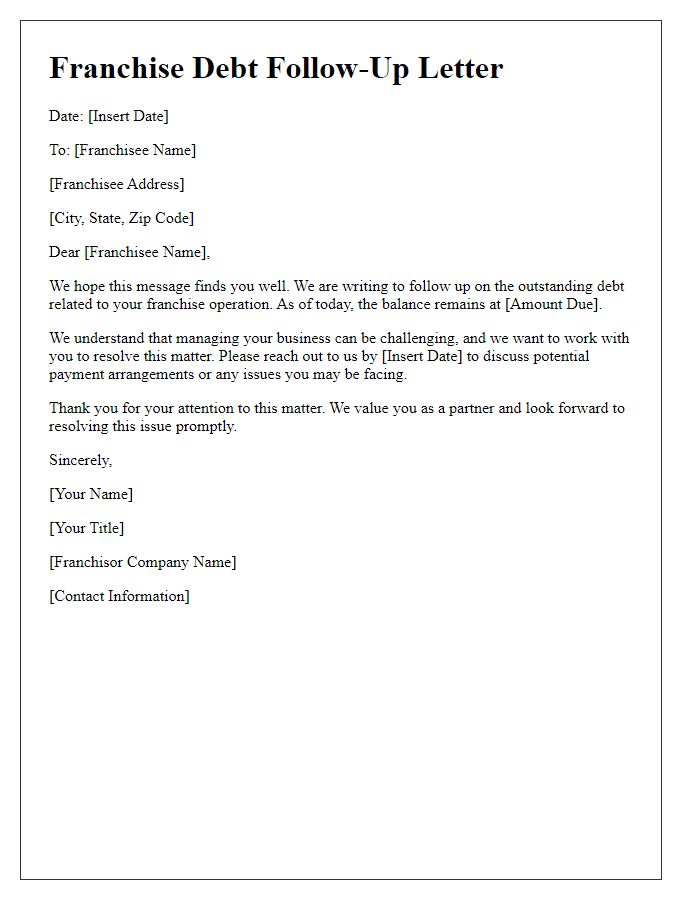

Specific Debt Details

A franchise debtor collection notice must include clear and specific debt details to ensure effective communication. The notice should state the total amount owed, including the principal (amount borrowed), accrued interest (percentage rate applicable), and any late fees (specific dollar amount). Include the due date (final day payment was expected) to emphasize the urgency of repayment. Identify the franchise (name of the business) and location (city and state of franchise's operation) to ensure the debtor recognizes the source of the debt. Provide payment options (methods such as credit card, bank transfer, or check) and instructions for addressing disputes related to the debt. All details must be concise and informative to encourage prompt action by the debtor while remaining compliant with legal requirements in notifications for collection.

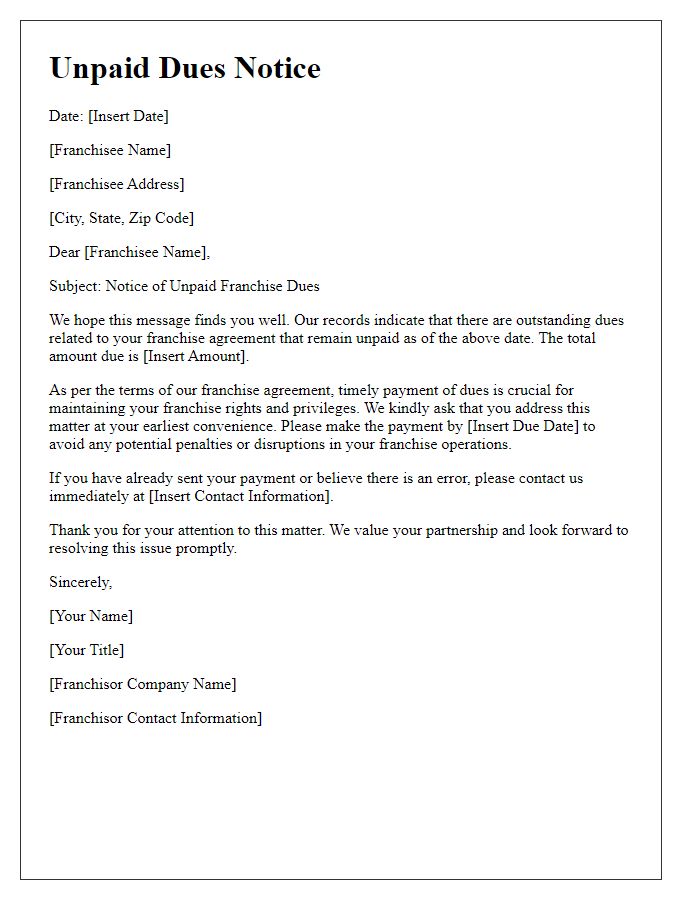

Payment Instructions

A franchise debtor collection notice provides essential payment instructions for outstanding debts. Typically, this notice includes the debtor's account number, the total amount due, and the deadline for payment, commonly 30 days from the date of the notice. For payment methods, options usually include bank transfers, credit card payments, or online payment portals specific to the franchise, such as PayPal or Stripe. The notice should clearly state any late fees that may be incurred for delayed payments as well as the contact information (including phone number and email address) for any inquiries regarding the debt. This document serves as a formal reminder of financial obligations, emphasizing the importance of prompt resolution to maintain a good standing within the franchise agreement.

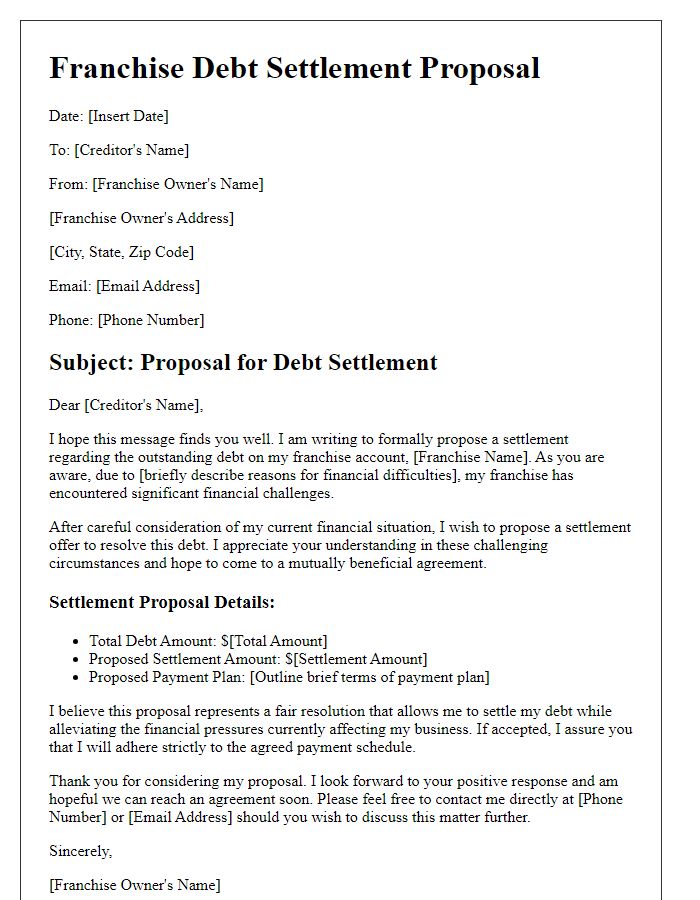

Consequences of Non-Payment

Franchisees who fail to meet payment obligations may face significant financial repercussions. Unpaid debts can lead to the initiation of collection efforts by agencies specialized in debt recovery, which are often located in regions like New York City or Los Angeles. This process may involve legal actions, including filing lawsuits that could result in additional court costs and attorney fees. Repeated defaults can damage the franchisee's credit rating, impacting future financing opportunities. Franchise agreements, such as those under the well-known McDonald's brand, often include clauses outlining termination of the franchise license, effectively putting an end to the franchisee's business operations. Additionally, non-payment could compromise supply chain relationships, leading to interruptions in product availability essential for daily operations. Overall, these consequences highlight the importance of timely payments to maintain a healthy business partnership.

Comments