Are you facing issues with your bank that just aren't getting resolved? Writing a formal complaint letter to the bank manager might be your best course of action to ensure your concerns are heard. This process not only helps you express your grievances clearly but also sets the stage for a potential resolution. If you're ready to take the next step, join us as we explore how to craft the perfect complaint letter.

Clear subject line

A formal complaint regarding unsatisfactory customer service at XYZ Bank branches can highlight issues faced during a recent visit. Unprofessional behavior by staff and lack of assistance with account discrepancies contributed to frustration. Specific dates, such as October 5th, 2023, should be mentioned to provide a clear timeline. The location, XYZ Bank branch on Main Street, will identify the particular venue of concern. Additionally, referencing inadequate response times for customer inquiries and unresolved issues regarding account balance discrepancies can emphasize the negative experience. This complaint seeks acknowledgment and resolution to prevent recurrence.

Formal salutation

The process of filing a formal complaint against a bank involves presenting one's case clearly and respectfully. Writer's personal details, including name, address, and account number, should be stated at the beginning. The bank name and address must also be included, followed by a formal greeting to the bank manager. The main body should outline the specific issue encountered, such as unauthorized fees or poor customer service, using precise dates and details of interactions. A request for resolution or action should be clearly articulated, emphasizing a desire for a timely response. A formal closing should follow, expressing appreciation for the manager's attention and assistance.

Precise account details

A formal complaint regarding banking services often involves specific account details and issues experienced. A bank customer may face problems such as unauthorized transactions (which may amount to thousands of dollars) or sudden account freezes that disrupt personal financial management. Including details like a specific account number (for identification purposes, often formatted as a 12-digit sequence) and transaction dates (to narrow down issues, which could span the last month or even several weeks) is essential for the bank manager. Additionally, mentioning the branch location (for example, Downtown Branch, 123 Main Street) provides context about where the account is held. Highlighting the urgency and the impact on daily expenses (like rent payments or bill deadlines) can also bolster the effectiveness of the complaint.

Specific issue description

A significant issue has arisen regarding unauthorized transactions on my account at XYZ Bank, located in New York City. On October 10, 2023, I noticed three transactions, summing to $750, that I did not authorize, including withdrawals from ATMs in Los Angeles. Despite my immediate report to customer service, no resolution has been achieved. The unapproved transactions occurred within 24 hours, raising concerns about potential security breaches in the bank's systems. Furthermore, my request for a temporary freeze on my account remains unattended, which exposes my finances to further risks. This situation necessitates urgent intervention by management to address the discrepancies and investigate the potential vulnerabilities of your banking systems.

Desired resolution and closing statement

A formal complaint to a bank manager should clearly outline specific issues experienced, the desired resolution, and a closing statement reiterating the importance of the matter. The complaint may highlight delayed loan processing times or incorrect account charges. It's crucial to specify a resolution such as immediate account adjustment or expedited loan approval. In the closing statement, express appreciation for the manager's attention to the matter, and include a request for a timely response to ensure the issues are resolved promptly.

Letter Template For Formal Complaint To Bank Manager Samples

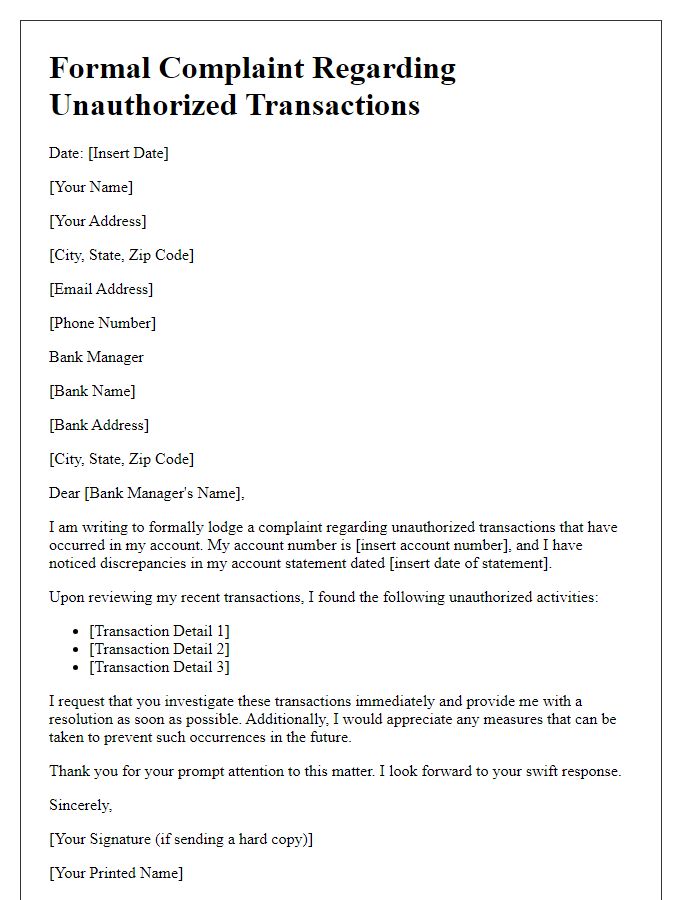

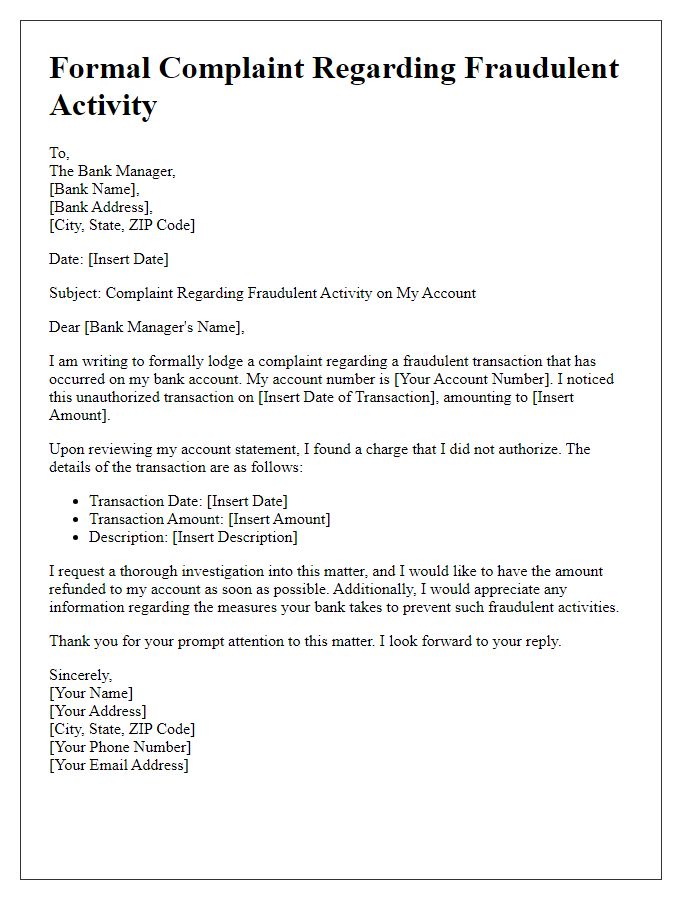

Letter template of formal complaint regarding unauthorized transactions to bank manager

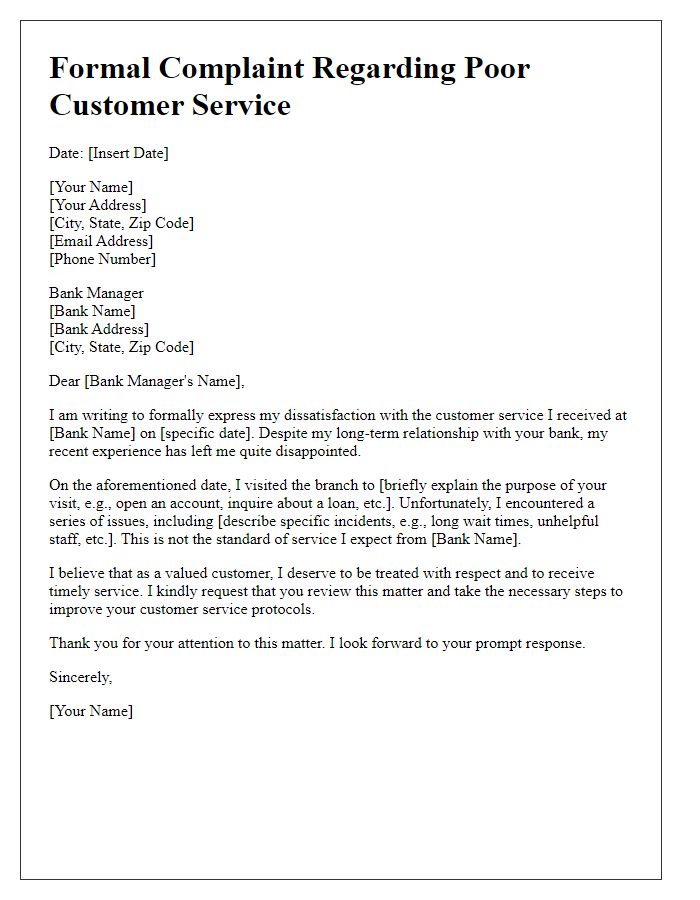

Letter template of formal complaint concerning poor customer service to bank manager

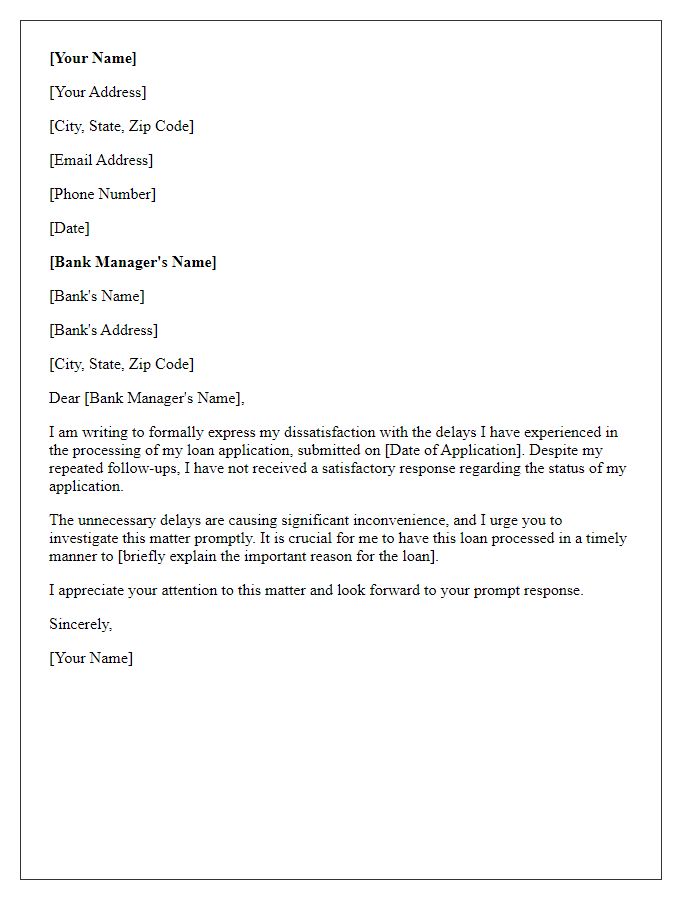

Letter template of formal complaint about delays in loan processing to bank manager

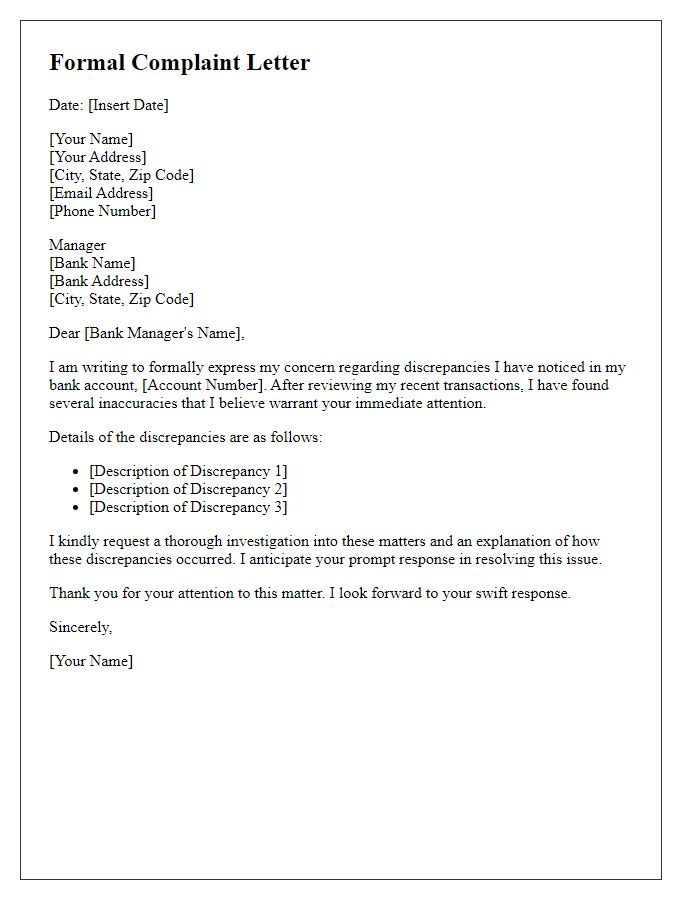

Letter template of formal complaint for account discrepancies to bank manager

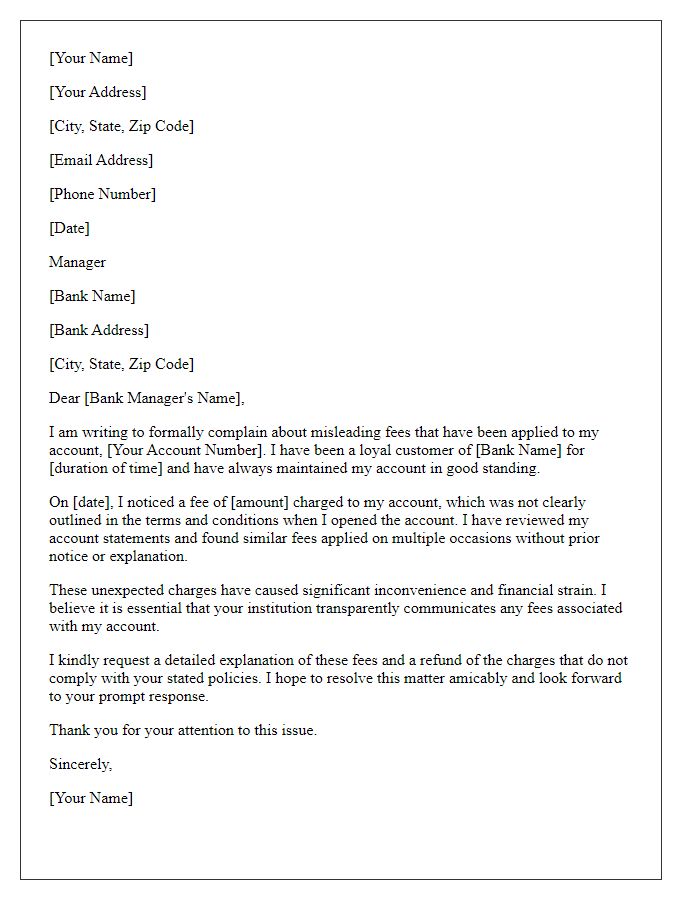

Letter template of formal complaint about misleading fees to bank manager

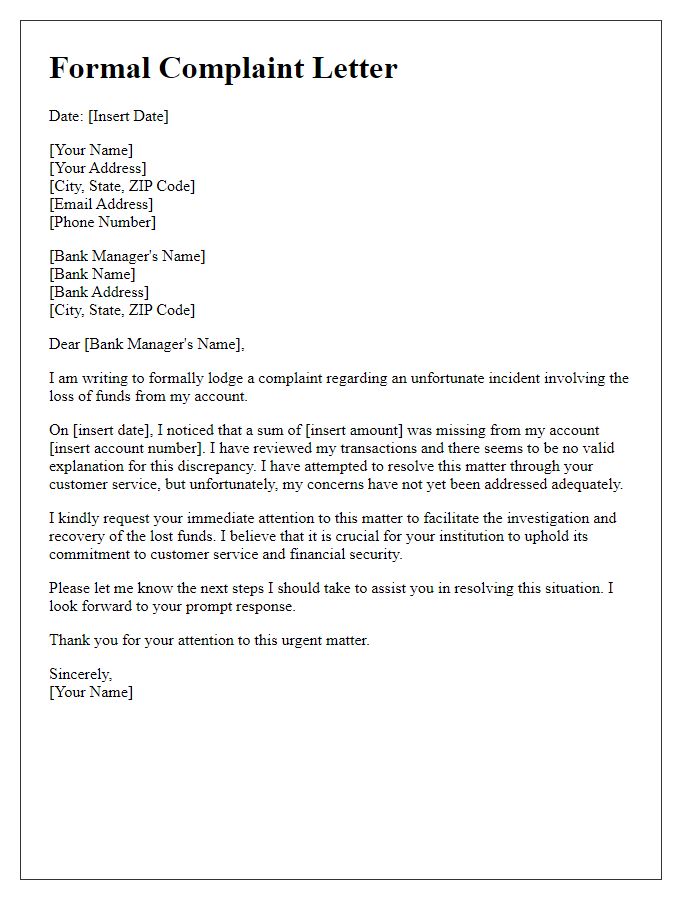

Letter template of formal complaint due to loss of funds to bank manager

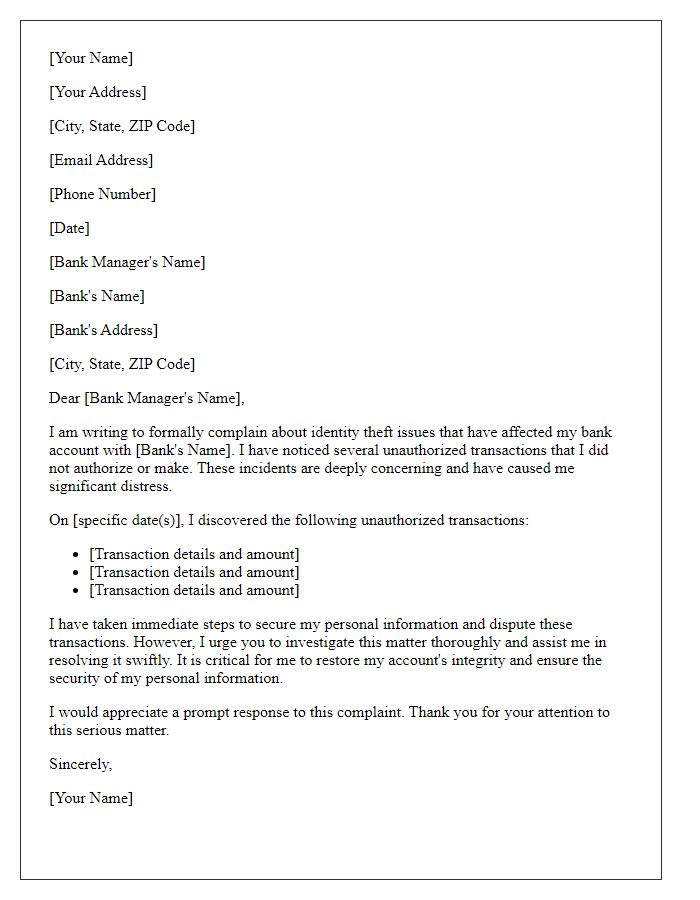

Letter template of formal complaint related to identity theft issues to bank manager

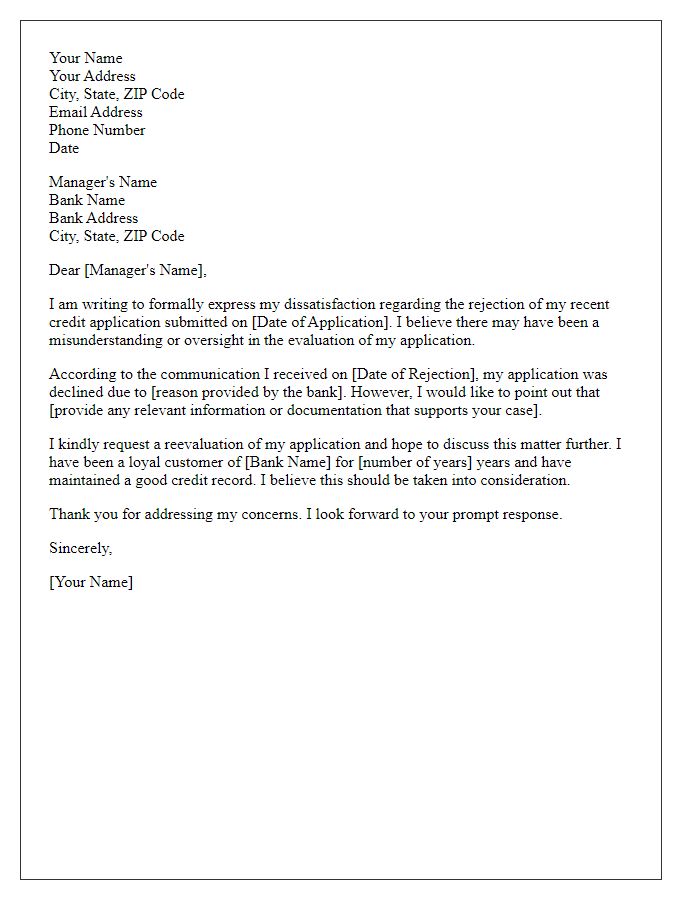

Letter template of formal complaint regarding rejected credit application to bank manager

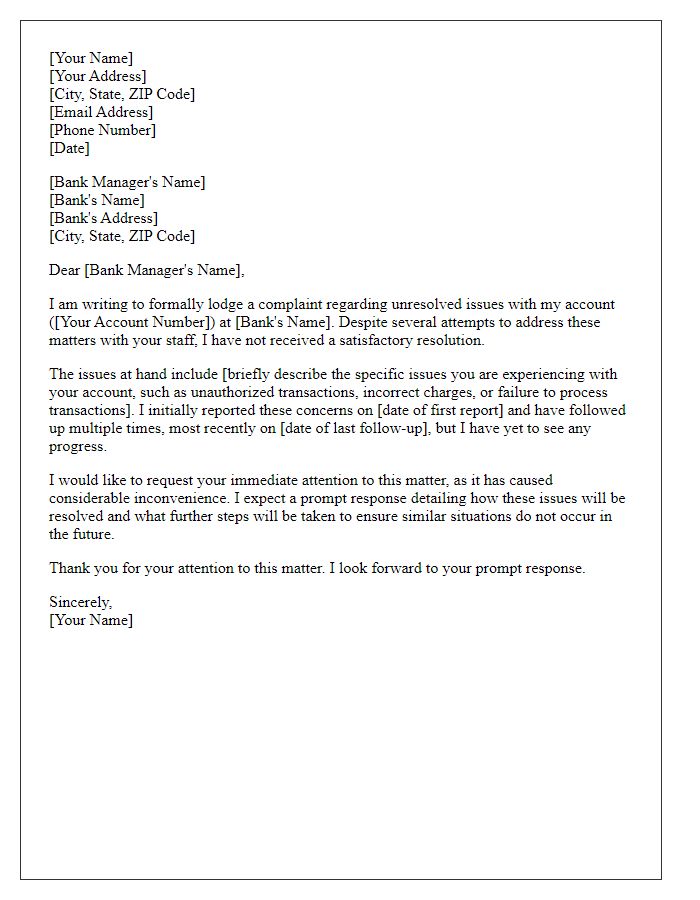

Letter template of formal complaint for unresolved account issues to bank manager

Comments