Navigating the complexities of healthcare billing can often feel like an overwhelming task, especially when unexpected charges come into play. In today's ever-evolving healthcare landscape, understanding your billing statement should be a seamless process, not a source of frustration. If you've found yourself confused or upset by discrepancies in your medical bills, you're certainly not alone. Join me as we explore how to effectively address these issues through a formal complaint letter and empower yourself in the process.

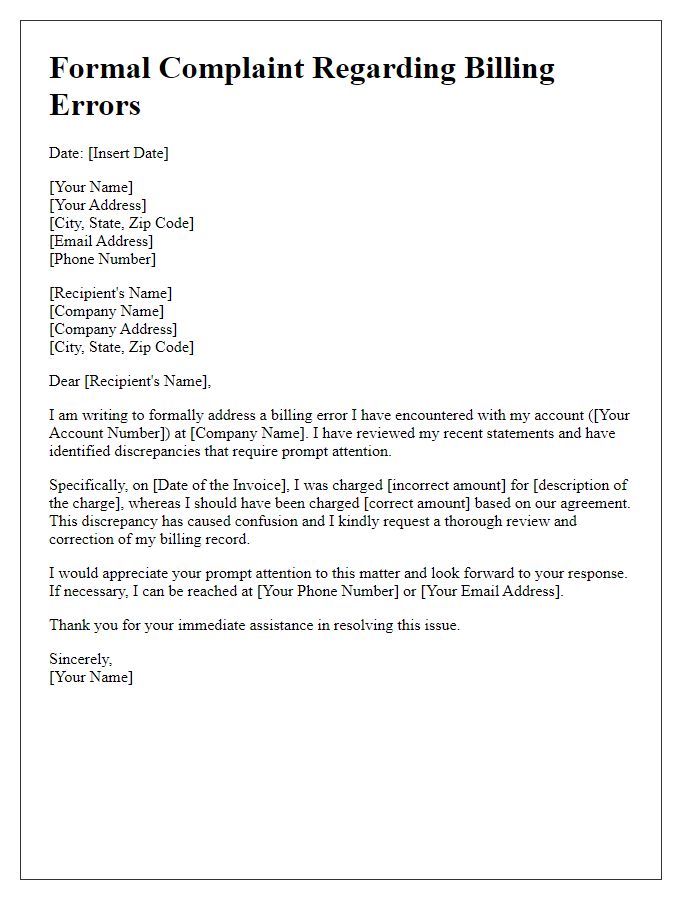

Clear identification of the recipient and sender

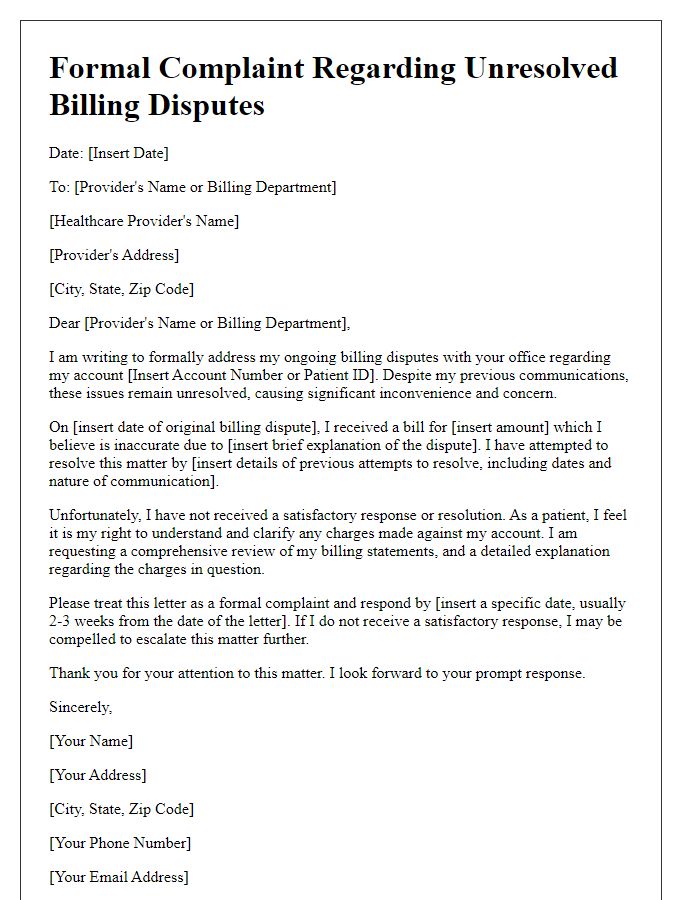

The healthcare billing process often leads to confusion and frustration for consumers. Detailed invoices from healthcare providers can include unexpected charges, confusing codes, and unclear descriptions of services rendered, complicating the understanding of costs. For instance, a visit to a hospital, such as Mercy Hospital in St. Louis, may show a variety of billed procedures, like X-rays and consultations, along with separate fees for each item, leading to an overall bill of several thousand dollars. Errors in billing can arise from miscommunication between the healthcare provider and insurance companies, potentially resulting in inflated charges or denied claims. Timely resolution of these billing issues is crucial, as unresolved disputes can lead to persistent collection actions and negatively impact credit scores. Proper dispute resolution channels involve engaging with both the billing department of the provider and the insurance company to clarify discrepancies and seek corrections.

Detailed account of the billing issue

When examining healthcare billing discrepancies, patients often encounter confusing statements from various providers, such as hospitals (e.g., City General Hospital), laboratories (e.g., LabCorp), and specialist clinics (e.g., ABC Orthopedics). Inaccurate charges can arise from unexpected services, duplicate billing (such as for a single visit), or insurance claim rejections, often linked to inadequate communication with providers or insurers (e.g., Blue Cross Blue Shield). Notable errors might include charges for unapproved procedures, which can exceed significant amounts (e.g., $5,000), leading to financial distress. Patients may also experience delays in receiving itemized statements, causing further frustration. Clarifying these issues typically requires careful documentation, including policy numbers, claim IDs, and communication records, to effectively address the errors and seek timely resolution.

Reference to relevant invoice numbers and dates

Healthcare billing discrepancies can lead to confusion and frustration for patients. Instances of incorrect charges often arise within invoices, such as Invoice #123456 dated October 1, 2023, detailing unexpected fees for services rendered at City Medical Center. Billing errors may stem from miscommunication between healthcare providers and insurance companies, impacting the patient's financial responsibility. Furthermore, delays in corrections can exacerbate the situation, creating additional stress. Accurate billing is crucial for maintaining trust in healthcare services and ensuring that all parties involved are treated fairly. Proper documentation and timely resolution of issues, such as referencing prior agreements or pre-authorization codes, can facilitate a smoother complaints process that addresses patient concerns efficiently.

Specific requested resolution or action

Billing discrepancies in healthcare can lead to significant financial strain on patients, as evidenced by the increasing number of complaints received by insurance companies in 2023. Errors, such as incorrect charges on statements or double billing for services rendered, not only raise questions but also overwhelm patients with unexpected costs. Hospitals like Mercy Medical Center (e.g., located in Baltimore) have encountered issues related to surprise medical bills that exceed negotiated rates with insurers, resulting in disputes requiring immediate resolution. Patients often seek clarification regarding their out-of-pocket expenses and demand a detailed breakdown of charges, itemizing each service received during visits. Specific requested resolutions may include waiving erroneous charges, adjusting billing records to reflect accurate insurance coverage, or establishing a payment plan to ease financial burden. It is critical for healthcare providers to respond promptly to these inquiries to maintain trust and ensure a fair billing process.

Firm but professional tone and language

Inappropriate billing practices can result in significant financial burdens for patients seeking care within healthcare systems such as Blue Cross Blue Shield. Billing statements that include unexpected charges, such as over $1,000 for urgent care visits, can lead to confusion and frustration among consumers. Errors in coding can cause delays in insurance reimbursements, impacting patients' credit scores if left unresolved. Additionally, incorrect application of copays and deductibles can misrepresent total costs, creating unnecessary obstacles to accessing healthcare. Patients deserve transparent billing processes that accurately reflect their services and insurance coverage, ensuring compliance with regulations under the Affordable Care Act. Prompt resolution of these discrepancies is crucial for maintaining trust in healthcare providers.

Letter Template For Formal Complaint About Healthcare Billing Samples

Letter template of formal complaint regarding unexpected healthcare billing discrepancies.

Letter template of formal complaint about excessive charges on medical bills.

Letter template of formal complaint concerning unclear healthcare billing statements.

Letter template of formal complaint regarding fraudulent billing practices by a healthcare provider.

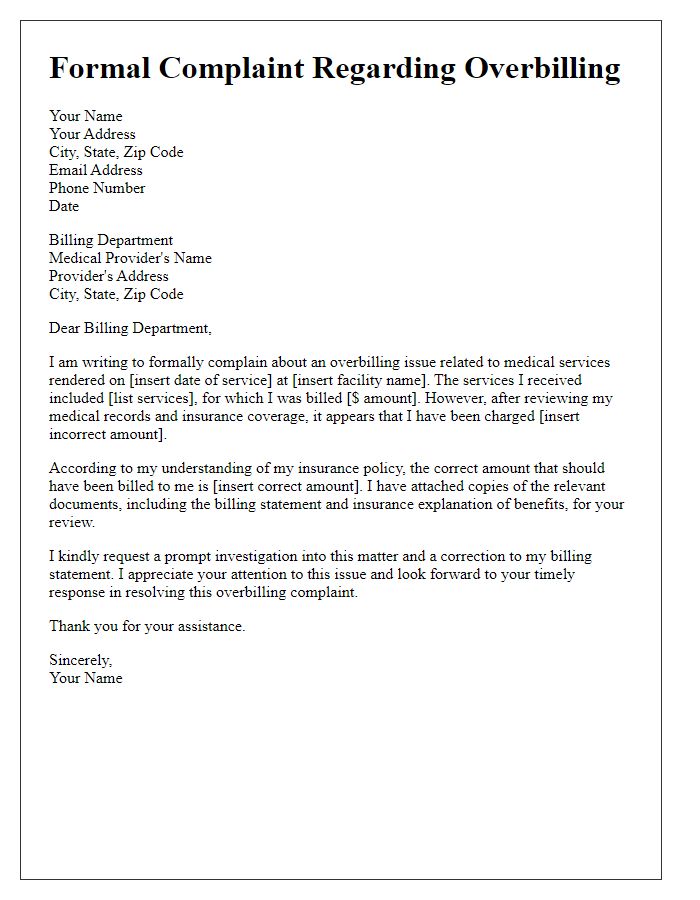

Letter template of formal complaint about overbilling for medical services rendered.

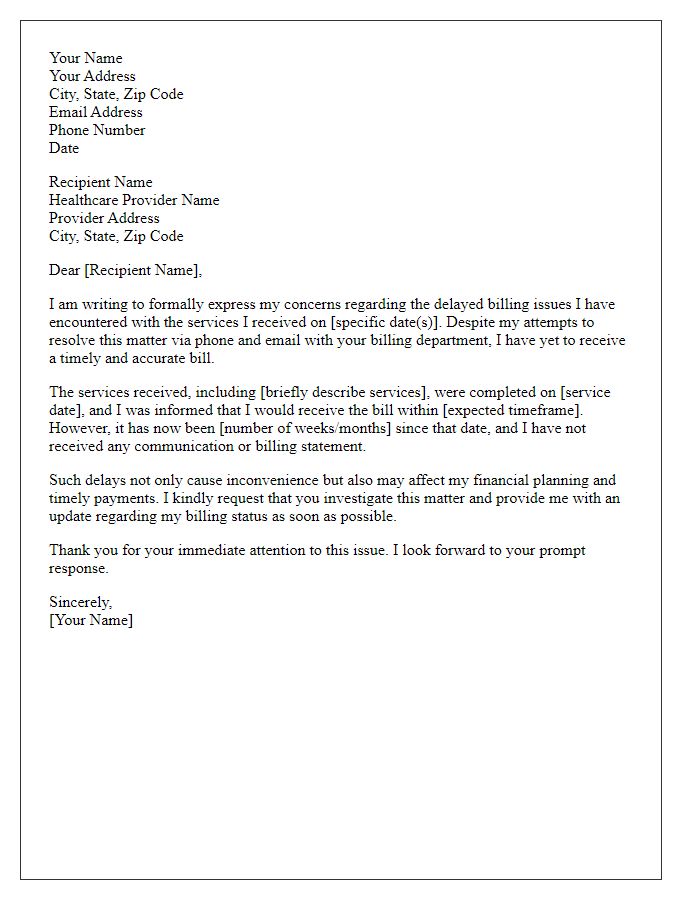

Letter template of formal complaint regarding delayed billing issues with healthcare services.

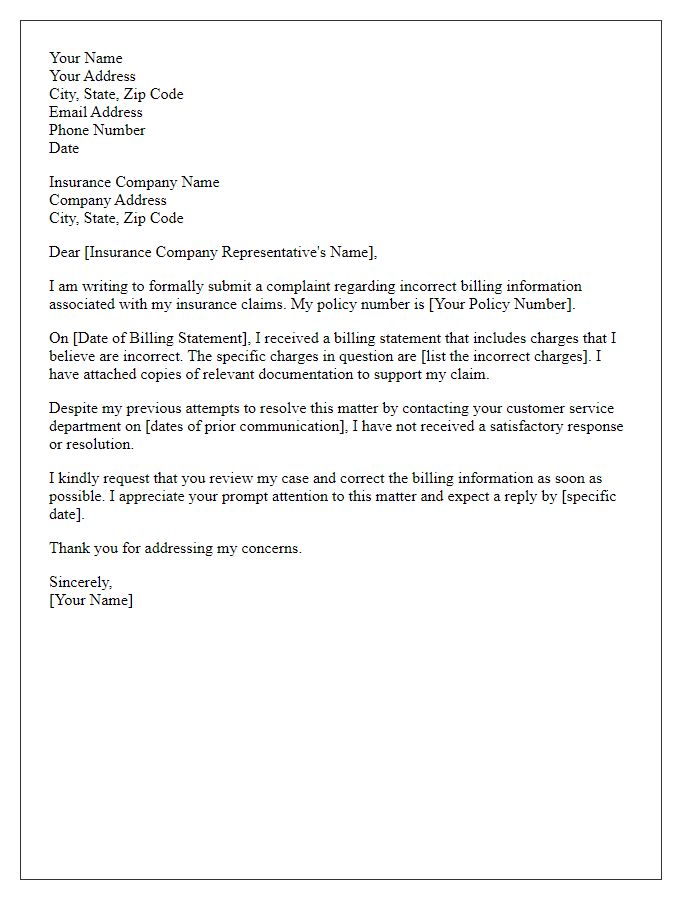

Letter template of formal complaint about incorrect billing information for insurance claims.

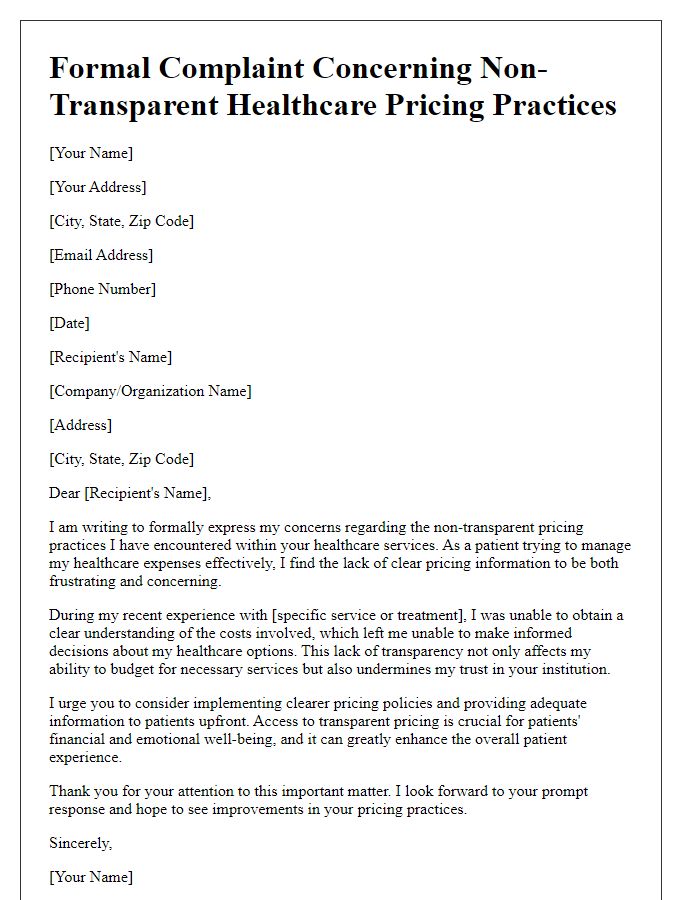

Letter template of formal complaint concerning non-transparent healthcare pricing practices.

Letter template of formal complaint about billing errors and request for correction.

Comments