Have you ever found unexpected charges on your bank statement that left you scratching your head? It's a frustrating situation that can quickly spiral into confusion and stress. In this article, we'll explore how to draft a formal complaint letter for those unauthorized charges, ensuring you're equipped to tackle the issue effectively. Join us as we provide the tools and tips you need to take back control over your finances!

Sender's contact information

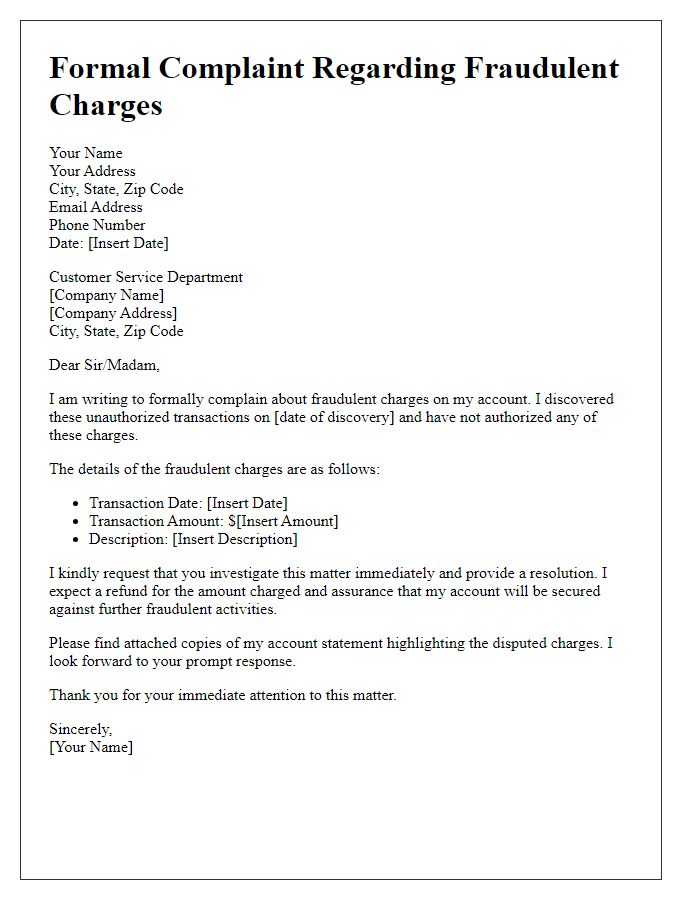

Unauthorized charges on credit card statements can lead to significant financial stress for victims. Commonly, fraudulent transactions appear unexpectedly, often no prior notification from financial institutions like banks or credit card companies. For instance, a victim might find a $200 charge from an unfamiliar online retailer, prompting immediate concern regarding identity theft. Timely reporting to the relevant financial institution is crucial to mitigate further unauthorized transactions. Additionally, documenting all related communications, including dates and representatives' names, is essential for the resolution process. Consumers can also benefit from placing fraud alerts with credit reporting agencies such as Experian, Equifax, and TransUnion, providing an extra layer of protection against further financial harm.

Recipient's contact details

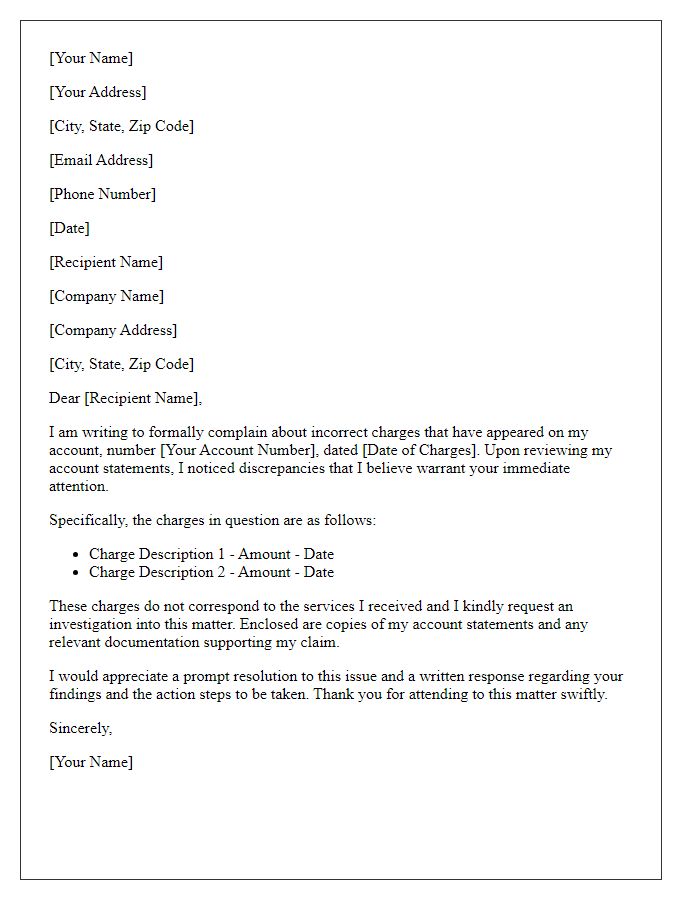

Unauthorized charges on credit statements can lead to significant financial distress for consumers. Details include potential fraudulent transactions that may appear on monthly billing statements from credit issuers, such as Visa or Mastercard. These charges can stem from data breaches involving a merchant's payment system or identity theft resulting in online purchases without consent. It is essential to report the incident to the financial institution immediately, as federal regulations under the Fair Credit Billing Act (FCBA) provide consumers protection against unauthorized transactions, limiting liability to $50 if reported promptly. Ensuring thorough documentation, including transaction dates, amounts, and merchant names, enhances the effectiveness of the investigation process.

Date of correspondence

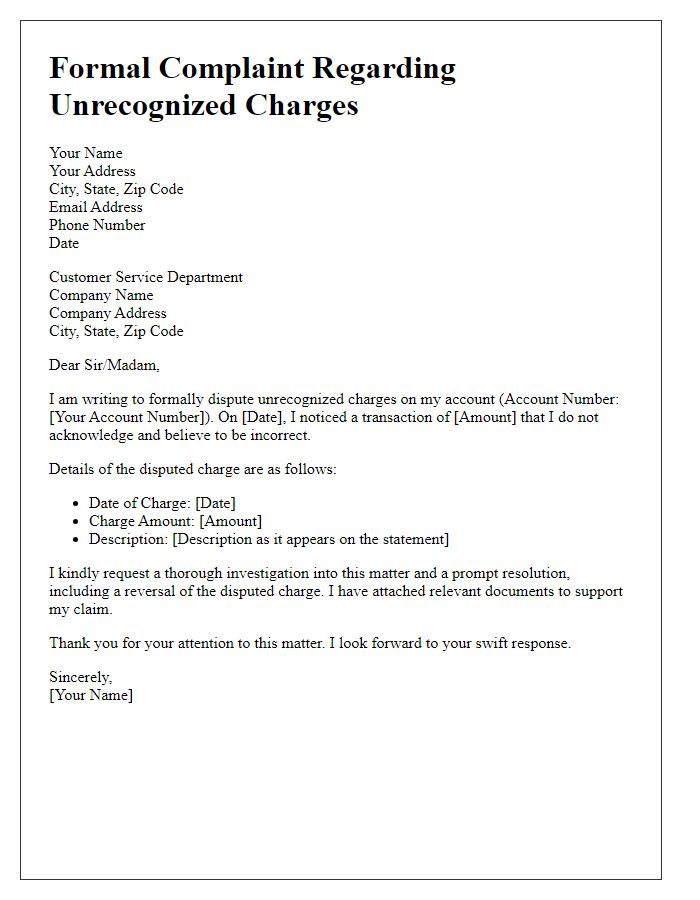

Unauthorized charges on financial accounts can lead to significant distress for consumers. The impact of such charges frequently involves unexpected deductions from bank accounts or credit cards, resulting in a potential overdraft situation or unanticipated financial strain. Notably, the Federal Trade Commission (FTC) states that consumers have the right to dispute these charges within 60 days of notice. Major financial institutions, such as Visa or MasterCard, offer protection plans that may cover fraudulent activity, provided steps are taken promptly. Proper documentation, including transaction dates and amounts, is essential for a successful resolution. Consumers are encouraged to contact customer service immediately to initiate the dispute process and safeguard their financial interests.

Clear subject line

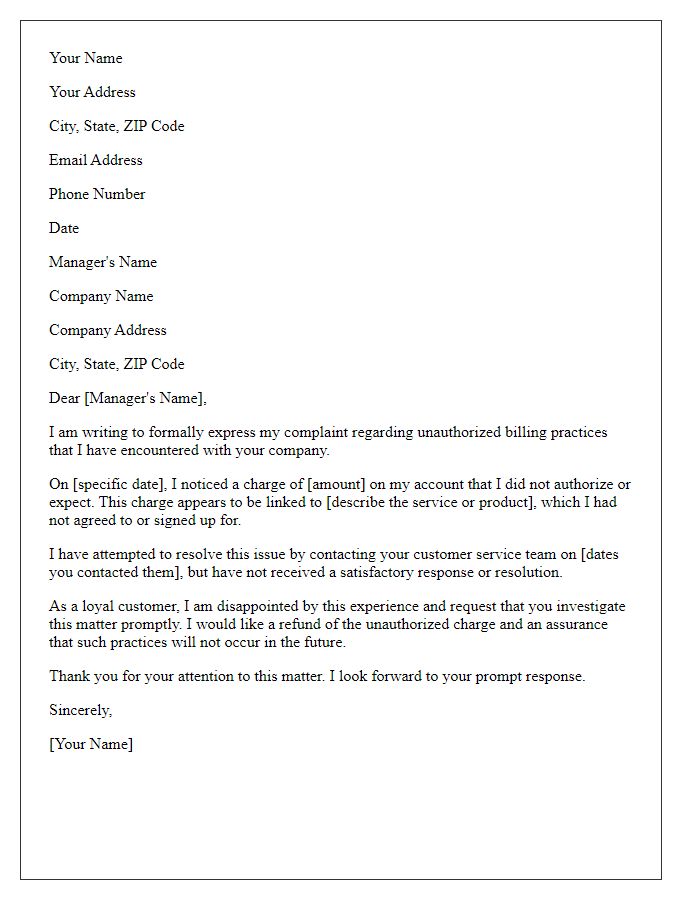

Unauthorized Charges on Account - Formal Complaint Submission I am writing to formally address unauthorized charges on my account, which have occurred without my consent. The payments, totaling $150.00 on September 15, 2023, and $75.00 on September 20, 2023, appear on my credit card statement from XYZ Bank, and I did not authorize these transactions. I request an immediate investigation into these charges and a reversal of the amount deducted. Please find attached supporting documents, including my account statement and other relevant communications. My account number is 123456789, and I can be reached at (555) 123-4567 for further clarification. Thank you for your prompt attention to this matter.

Detailed description of unauthorized charges

Unauthorized charges on credit cards have become a significant concern for many consumers. Instances of fraudulent transactions can often involve multiple charges, sometimes totaling hundreds of dollars, appearing unexpectedly. These charges typically include unfamiliar merchant names (such as "XYZ Merchandise" or "Online Retailer 123"), which can complicate tracking and reconciliation of accounts. Often, individuals notice these discrepancies after reviewing monthly bank statements or receiving notifications from their financial institutions. Quick identification of these unauthorized charges is crucial, as many banks provide a limited window (usually up to 60 days) for filing disputes. Reporting such unauthorized activity promptly can prevent further financial loss and assist in recovering funds. Families may experience added stress from these incidents, impacting their budgeting and financial planning efforts, especially when charges appear during critical periods (such as holidays or back-to-school shopping). In 2022, data showed that unauthorized transactions were most prevalent in online shopping environments, highlighting the need for robust security measures in electronic transactions.

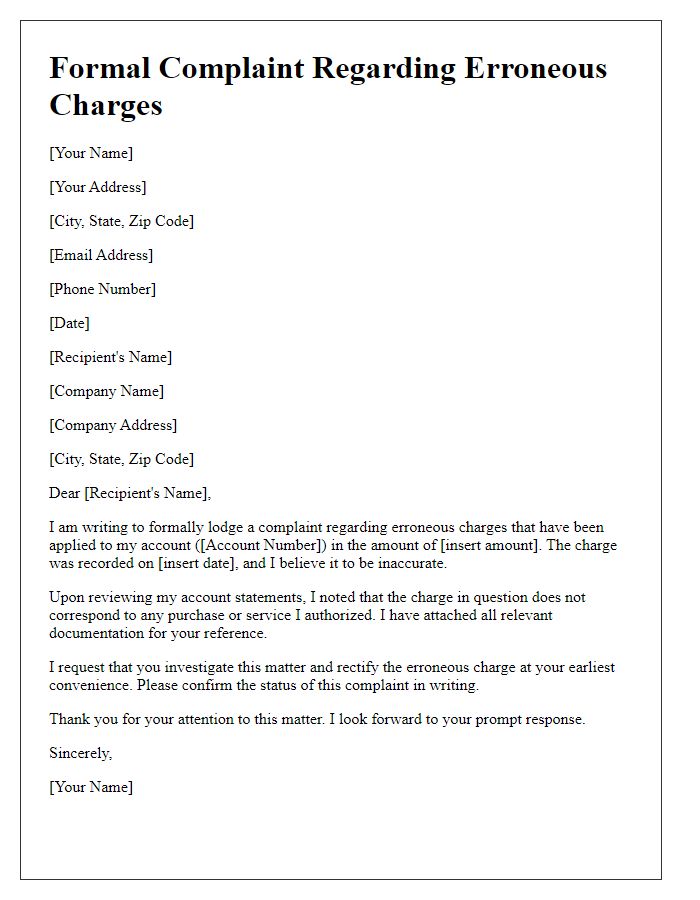

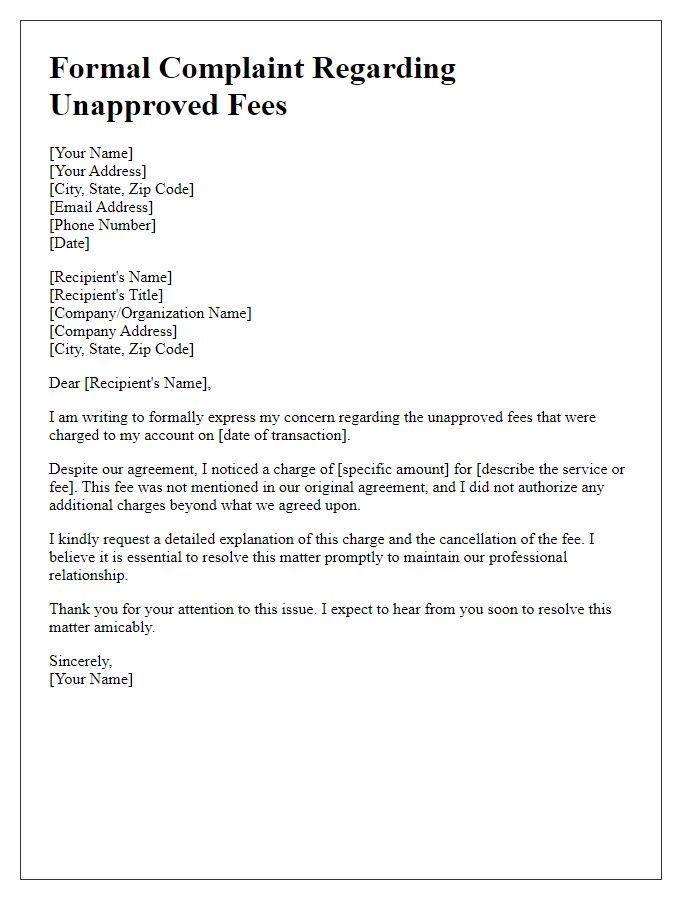

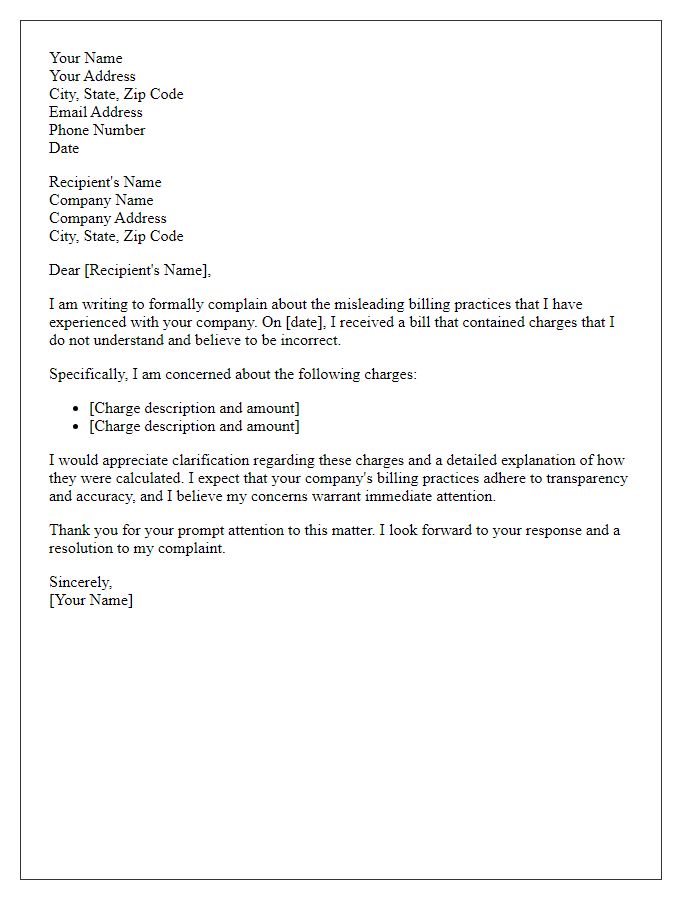

Letter Template For Formal Complaint Regarding Unauthorized Charges Samples

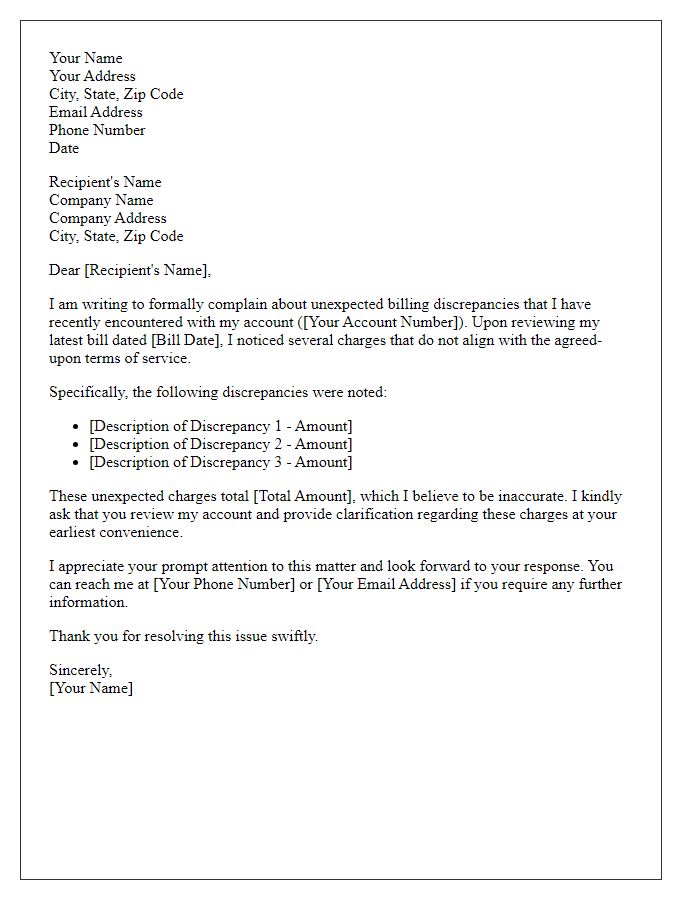

Letter template of formal complaint regarding unexpected billing discrepancies.

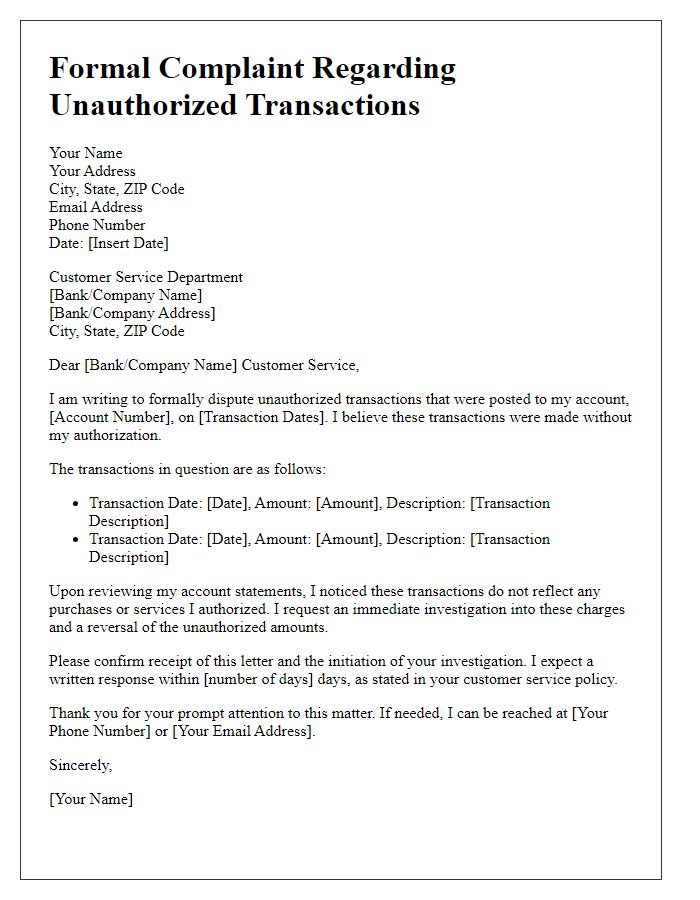

Letter template of formal complaint for disputed unauthorized transactions.

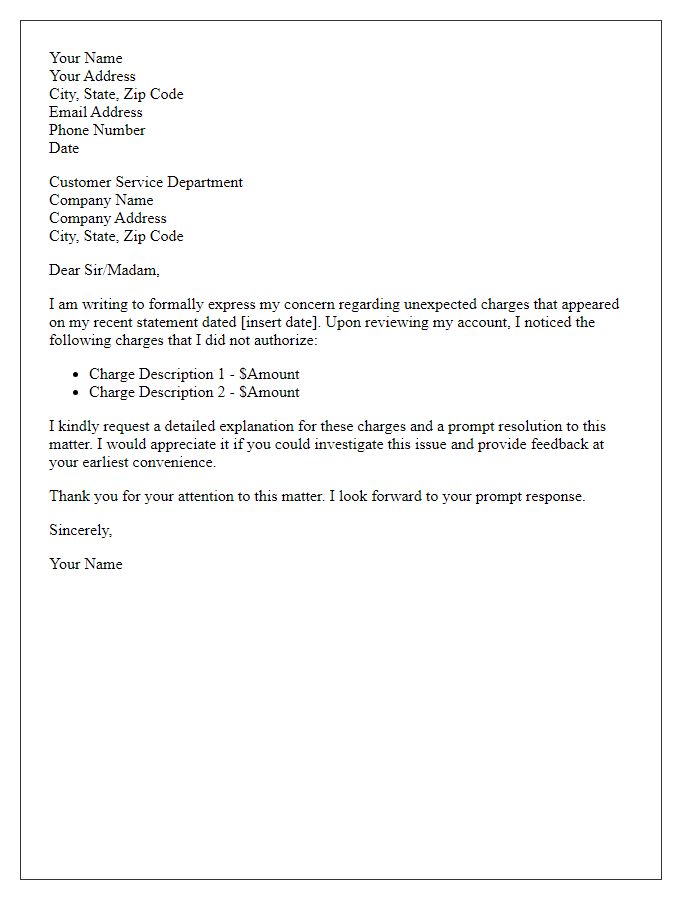

Letter template of formal complaint related to unexpected charges on statement.

Comments