Are you feeling overwhelmed by your financial goals and unsure of where to start? Finding the right financial advisor can make all the difference in navigating your financial journey, helping you to create a personalized plan tailored to your needs. With their expertise, you'll gain valuable insights into investing, saving, and planning for retirement. So, if you're ready to take control of your finances, join us as we explore the benefits of working with a financial advisor.

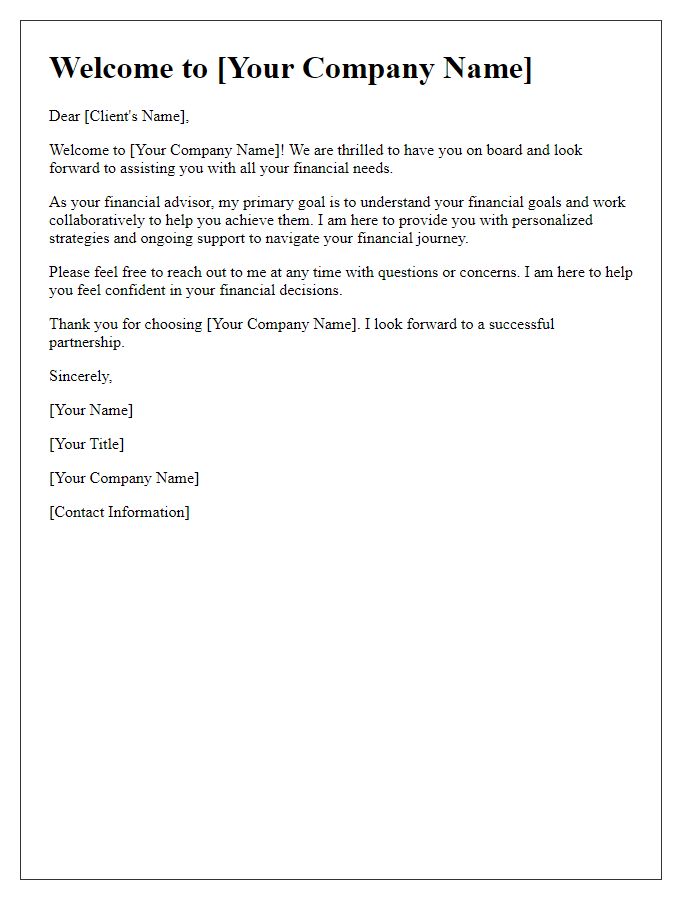

Personalization and Client Engagement

Financial advisors play a crucial role in helping individuals and families navigate their financial landscape, particularly in times of economic uncertainty. Personalization in client engagement involves understanding unique financial goals, investment preferences, and risk tolerance levels. Custom-tailored strategies can significantly enhance client satisfaction, as demonstrated by studies showing that personalized services can increase client retention rates by over 30%. Effective communication is essential in building trust; regular updates on market trends (such as stock performance metrics or interest rate fluctuations) and personalized portfolio insights foster transparent relationships. Additionally, utilizing technology platforms for real-time financial tracking and engagement can lead to more informed decision-making and deeper client connections. Establishing a robust client base requires consistent outreach efforts, including educational workshops on retirement planning or tax optimization strategies, to ensure clients feel valued and informed.

Clear Value Proposition

A financial advisor's introduction should highlight their expertise in wealth management and investment strategy. With over 10 years of experience, they provide comprehensive financial planning tailored to individual goals. Their approach encompasses risk assessment, retirement planning, and tax optimization, ensuring clients maximize returns on investments. Using sophisticated financial tools and market analysis, they monitor portfolios closely, making adjustments as necessary to protect assets and enhance growth. This unique value proposition emphasizes a personalized service that adapts to changing financial landscapes, aiming to secure clients' financial futures by aligning investment strategies with their life objectives.

Service Offerings and Expertise

Finding a qualified financial advisor to help you navigate your financial landscape can greatly impact your monetary success and overall peace of mind. Expert advisors offer services such as retirement planning, investment management, and tax strategies, tailored to individual goals. Areas of expertise include wealth accumulation, risk management, and estate planning. Professionals may hold certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), ensuring a high level of proficiency. Clients benefit from personalized strategies that reflect their unique financial situations, taking into account factors such as income, expenses, and long-term aspirations. Establishing a strong advisor-client relationship can lead to informed decisions, leading to greater financial security.

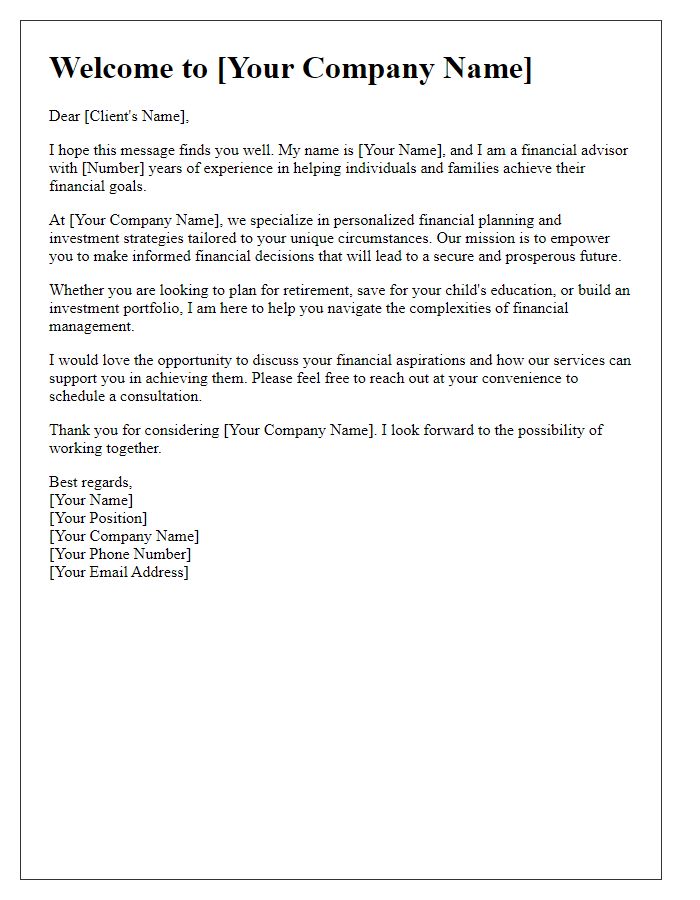

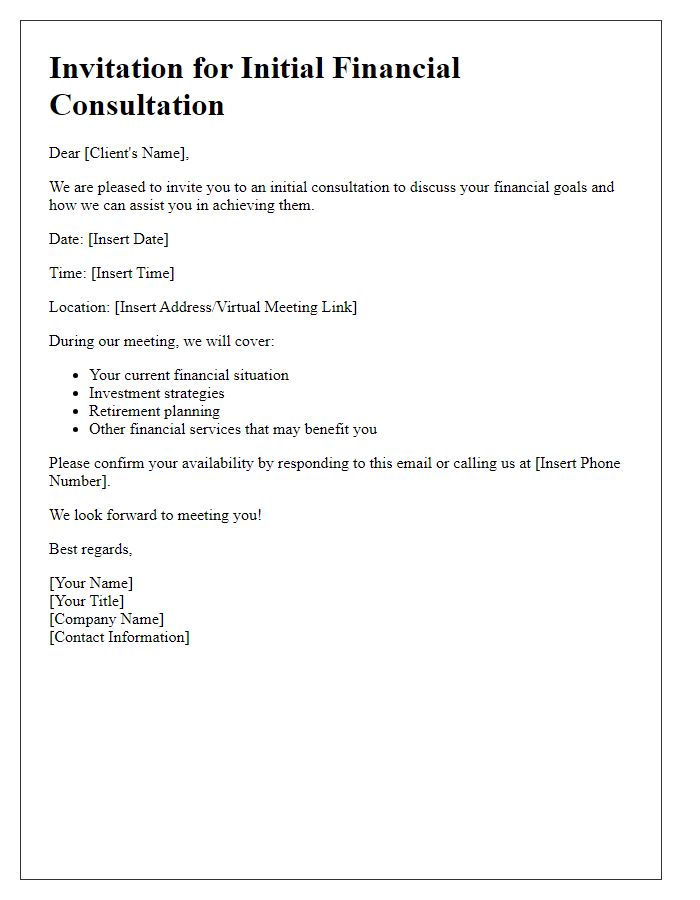

Contact Information and Call to Action

A financial advisor can play a crucial role in guiding clients through financial planning, investment strategies, and retirement savings goals. Effective communication often begins with clear contact information that includes the advisor's name, phone number, email address, and office location. A strong call to action encourages potential clients to reach out, whether it be scheduling a consultation or attending an informative seminar on wealth management. Building trust and a professional rapport is essential, as clients seek reliable advice on navigating complex financial landscapes, such as market fluctuations and tax implications.

Professional Tone and Trust Building

A financial advisor's introduction might involve discussing services like investment management or retirement planning. Professionals in this role often possess certifications from regulatory bodies such as the Certified Financial Planner Board (CFP) or Chartered Financial Analyst Institute (CFA). These designations enhance credibility and reflect expertise in financial strategies. Building trust is crucial; therefore, highlighting successful case studies, like helping clients achieve a 30% increase in their retirement savings over five years, is effective. Additionally, emphasizing personalized plans tailored to individual goals can resonate with potential clients, making them feel valued and understood in their financial journey.

Letter Template For Financial Advisor Introduction Samples

Letter template of introductory message for financial advisory services.

Letter template of initial consultation invitation for financial advice.

Comments