Are you looking to take control of your financial future with predictable income streams? Establishing reliable income sources can provide stability and peace of mind, allowing you to focus on your passions. Whether it's through investments, rental properties, or a side hustle, creating a plan is essential for long-term success. Join me as we explore the various options and strategies to secure a steady flow of income!

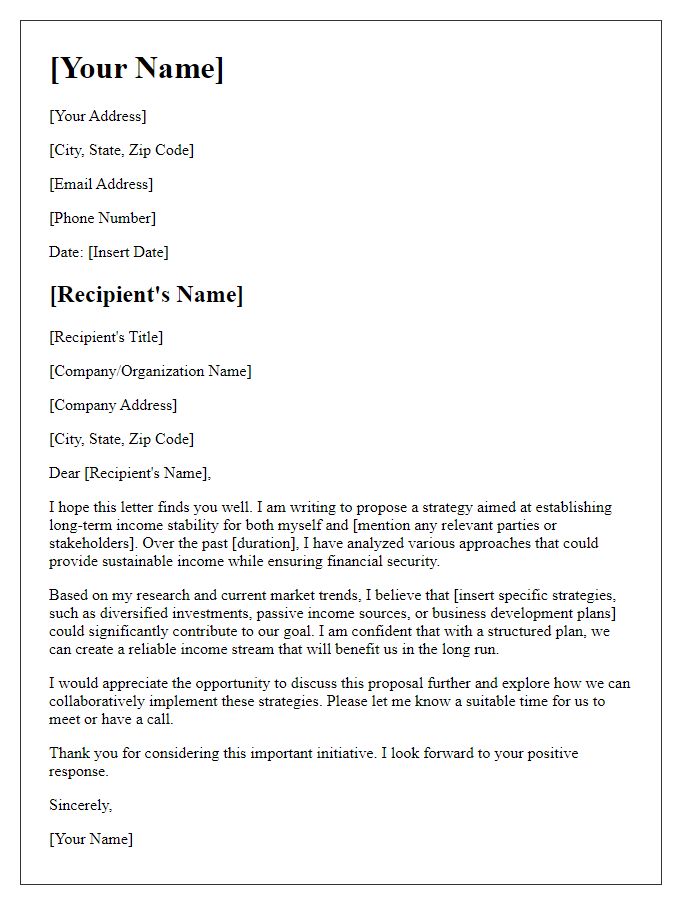

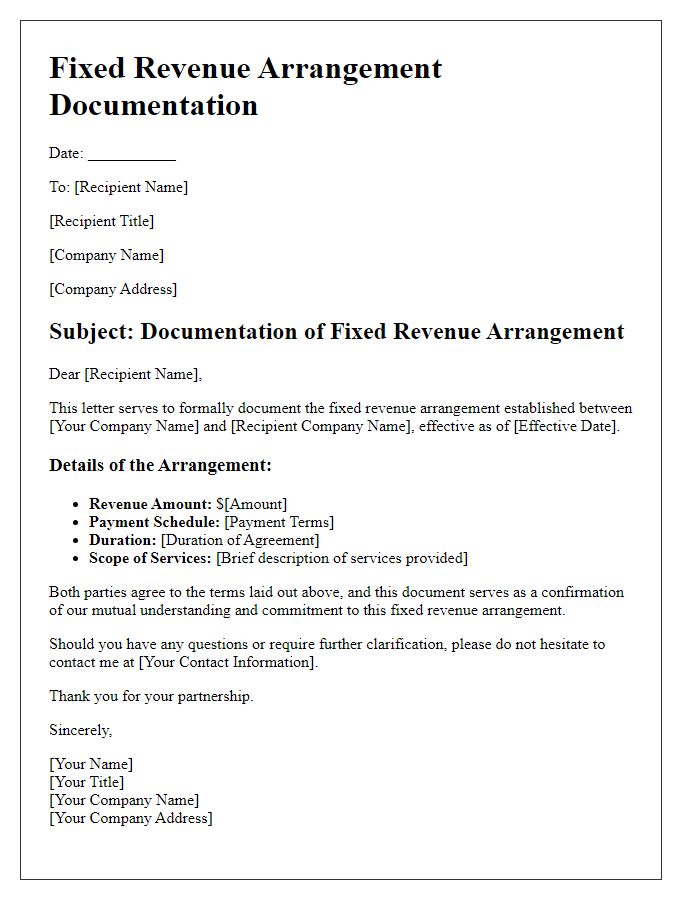

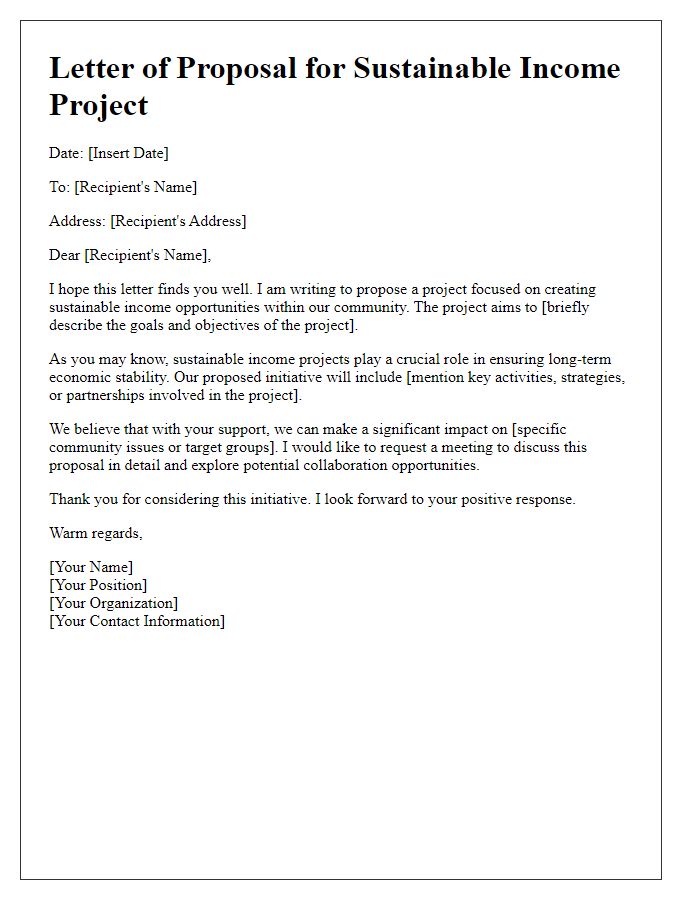

Clearly defined purpose

Predictable income streams can significantly enhance financial stability, particularly through various channels like rental properties or dividend-paying stocks. Rental properties, such as single-family homes in urban markets, have the potential to generate consistent monthly income, especially in regions with demand fluctuations, like the Southeastern United States. Similarly, dividend-paying stocks, particularly those from established companies like procter & gamble or Coca-Cola, provide regular cash flow, with yields often ranging from 2% to 4%. Utilizing these streams can lead to increased disposable income, allowing individuals to invest in other opportunities or save for future endeavors. Engaging in strategic financial planning, particularly through diversified portfolios, is crucial for maximizing returns and minimizing risk.

Consistent tone and language

Predictable income streams offer financial stability for individuals and businesses. Traditional avenues include rental properties, yielding monthly payments influenced by local real estate markets, often providing 6-8% returns annually. Dividend stocks, part of established companies like Coca-Cola or Johnson & Johnson, deliver quarterly payouts, creating a reliable cash flow. Peer-to-peer lending platforms, such as LendingClub, facilitate loans to investors, generating interest income around 5-7% annually. Additionally, creating digital products, like e-books or online courses, can lead to passive income, particularly with high-demand topics that attract a wide audience. Financial planning plays a crucial role in maximizing these income streams while mitigating risks associated with market fluctuations.

Detailed breakdown of income sources

Predictable income streams can be essential for financial stability and planning. Various sources of income contribute to a steady cash flow, such as salaries from full-time employment, rental income from real estate properties in urban areas like New York City or Los Angeles, and dividends from investments in publicly traded companies like Apple or Microsoft. Benefits from government programs, such as Social Security or unemployment insurance, provide additional security for individuals over the age of 62 or those facing job displacement. Freelance or gig economy work, particularly in sectors like graphic design or ride-sharing services, can supplement traditional income. Furthermore, interest earned on savings accounts or certificates of deposit, especially in high-yield banks, can add predictable income, albeit at a lower rate. Diversifying these income streams can greatly enhance financial resilience during economic fluctuations, allowing individuals to navigate uncertainties with greater confidence.

Contact information for queries

Predictable income streams provide financial stability and security, especially for individuals considering multi-year investments or diversified asset portfolios. These income streams, such as rental properties generating monthly cash flow or dividend-paying stocks delivering quarterly earnings, can help individuals budget effectively. Additionally, annuities, financial products designed to provide regular payment over time, are increasingly popular among retirees seeking assurance in an uncertain economy. Understanding these income-generating mechanisms is crucial for strategic planning and wealth maintenance, allowing individuals to anticipate financial obligations without relying solely on fluctuating earnings or market volatility.

Call-to-action or next steps

Predictable income streams, such as rental properties and dividend stocks, play a crucial role in financial planning. Rental properties, often yielding 6-8% annual returns in urban markets, provide consistent cash flow through tenant payments. Dividend stocks, investments in well-established companies like Coca-Cola or Procter & Gamble, often distribute 2-5% of their share price annually, offering reliable income. Additionally, creating a diversified portfolio with fixed-income securities, like government bonds, can further stabilize cash flow. Individuals should assess their financial goals, determine the percentage of their income to allocate towards these streams, and regularly evaluate performance to ensure ongoing reliability and growth.

Comments