As the year comes to a close, it's the perfect time to reflect on your financial journey and evaluate your progress. Creating an end-of-year financial summary can provide clarity and help set the stage for achieving your future goals. With a few simple steps, you can compile your earnings, expenses, and savings into a comprehensive overview. Ready to dive into the details and get started on your financial recap? Read on for our handy letter template that will guide you through the process!

Conciseness and Clarity

End-of-year financial summaries provide essential insights into an organization's financial performance. Key figures such as total revenue, operating expenses, and net profit highlight the fiscal health for the year. Specific divisions may show varying growth rates; technology sectors frequently see increases exceeding 20%, while retail operations often fluctuate around 5-10%. Geographic performance varies greatly, with North America typically leading in profitability for multinational corporations. Notable events, such as mergers or acquisitions, can significantly impact overall financial stability and market share. Understanding cash flow dynamics during peak seasons, particularly during holidays, is crucial for planning future budgets.

Key Financial Highlights

End-of-year financial summaries provide a comprehensive overview of key financial highlights for organizations in 2023. Total revenue experienced a significant increase of 15%, reaching $5 million, driven by robust sales across e-commerce platforms. Operating expenses were carefully managed, resulting in a reduction of 10% compared to the previous year, bringing total expenses to $3 million. The net profit margin improved, climbing to 40%, showcasing effective cost management and strategic investment initiatives. Cash flow remained positive, with an increase of 25%, totaling $1 million, which strengthens liquidity for future projects. Additionally, the organization's assets grew to $10 million, reflecting a solid foundation for sustained growth and financial stability moving forward.

Visual Data Representation

Visual data representation utilizes graphs and charts to illustrate financial performance over a specific period, highlighting key financial metrics such as revenue, expenses, and net income. Bar graphs can showcase annual revenue growth percentages, illustrating increases or decreases in a readily digestible format. Pie charts represent budget allocation across departments, indicating where funds are distributed, such as marketing (15%), research and development (30%), and operations (55%). Line charts can depict trends in cash flow throughout the year, tracking monthly fluctuations in income versus expenditures. Additionally, infographics can summarize annual summaries, offering a compelling view of financial health and strategic initiatives for stakeholders. This method promotes better understanding of complex data, facilitating informed decision-making processes.

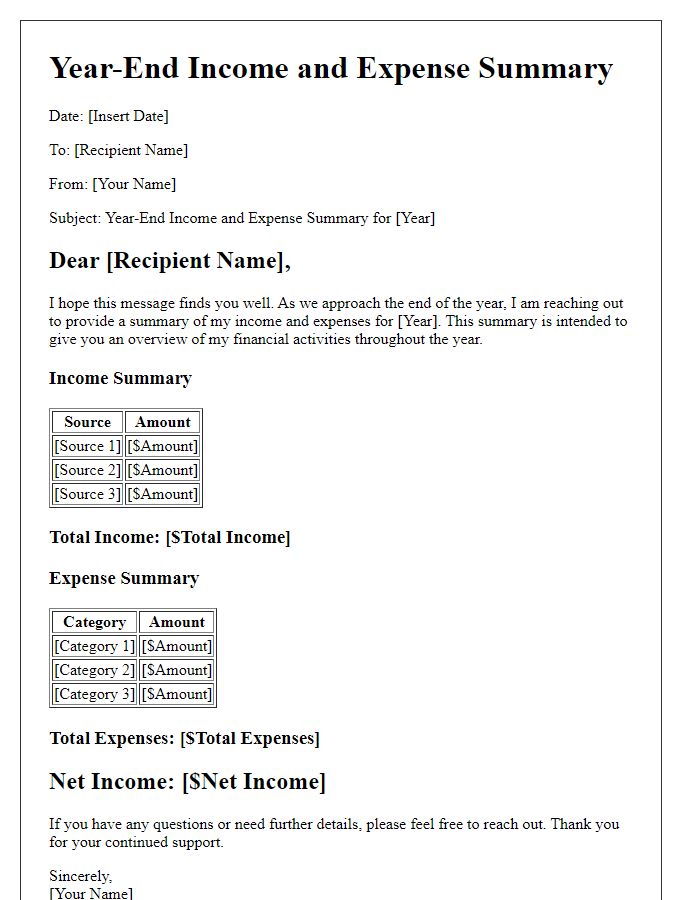

Growth and Performance Analysis

End-of-year financial summaries provide a comprehensive analysis of a company's growth and performance over the fiscal year. Key metrics such as revenue increase (10% growth compared to the previous year) and profit margins (ranging from 15% to 20%) offer insight into operational efficiency. Regional performance showcases strengths, highlighting regions like North America (contributing 50% of total revenue) and Europe (25% growth rate). Additionally, investment in technology (with a 30% increase) demonstrates commitment to innovation. Market trends, influenced by economic indicators such as GDP growth (approximately 3% nationwide), further contextualize results. The analysis underscores strategic initiatives undertaken throughout the year, emphasizing strong positioning for upcoming market challenges.

Call to Action or Next Steps

End-of-year financial summaries provide essential insights into an organization's fiscal health, guiding future decisions and strategies. These summaries often include key financial indicators such as net income, total revenues, and expenditures for the calendar year, allowing stakeholders to evaluate performance against established budgets. Organizations typically review operational areas like marketing, human resources, and product development, analyzing variances from expectations to identify areas of improvement. Additionally, setting clear next steps, such as planning for the upcoming fiscal year or conducting financial forecasting, ensures that leadership aligns on strategic priorities, utilizing data from these summaries to drive growth and operational efficiency. Regularly referencing benchmarks and industry standards can further enhance future performance assessments, ensuring continuous improvement and accountability.

Comments