Are you ready to take your innovative ideas to the next level? Crafting a compelling letter to attract angel investors can be a game-changer for your startup. In this article, we'll explore the essential elements of a successful angel investor pitch letter, ensuring you capture their attention and spark their interest. So, let's dive in and discover how to effectively present your vision to potential investors!

Clear introduction and personalized greeting

Angel investors seek innovative opportunities in startups. A clear introduction to the business idea captures attention. Personalization in greetings, using the investor's name or referencing mutual connections, establishes rapport. Highlighting unique value propositions, like market demand or innovative technology, engages interested investors effectively. Clear communication of financial needs, such as funding amounts and usage, demonstrates preparedness. Investor backgrounds and successes should be acknowledged, creating a sense of alignment. Following up with expected outcomes or milestones underscores commitment and strategic planning.

Concise company overview with unique value proposition

Innovative startups in the technology sector often seek angel investors to secure funding for their groundbreaking ideas. A compelling company overview should highlight the unique value proposition, focusing on the problem addressed and the solution offered. For instance, a startup specializing in artificial intelligence-based solutions for healthcare may demonstrate how their platform reduces diagnostic errors by 30% compared to traditional methods, ultimately saving lives and decreasing costs for medical facilities. Emphasizing the scalability of the business model, market potential, and competitive advantages such as proprietary algorithms ensures that the angel investor understands the significant return on investment potential within a rapidly evolving landscape.

Detailed problem and solution statement

In urban environments, air pollution poses significant health risks, contributing to respiratory diseases affecting millions globally. For example, in cities like Beijing and New Delhi, PM2.5 levels often exceed 150 ug/m3, leading to serious health concerns such as asthma, lung cancer, and cardiovascular issues. Traditional air filtration systems lack efficiency, only capturing larger particles and omitting the harmful micro-particles responsible for health complications. The innovative solution involves developing a smart air purification system that employs advanced HEPA filters and real-time air quality monitoring sensors. This system not only removes 99.97% of airborne pollutants, including pollen, dust mites, and smoke, but also integrates with mobile applications to provide users with live updates on air quality and personalized health recommendations. Through strategic partnerships with urban health initiatives, this solution aims to enhance residents' wellbeing while promoting sustainable living practices.

Market opportunity and competitive analysis

The growing market for electric vehicles (EVs), projected to reach over 30 million units sold worldwide by 2030, presents significant investment opportunities for innovative companies. The rising demand for sustainable transportation solutions is driven by increasing environmental concerns and government incentives, such as the European Union's goal to reduce emissions by at least 55% by 2030. Competitive analysis reveals key players, including Tesla, which holds a significant market share of approximately 16%, and emerging challengers, such as Rivian and Lucid Motors, which focus on luxury segments. Additionally, traditional automakers like Ford and General Motors are rapidly transitioning to EV production, signaling a shift in industry dynamics. Analyzing regional markets, such as China--home to nearly half of the world's EV sales--highlights the intense competition and the need for differentiation through technology and customer experience. Identifying niche markets, like electric delivery vans and commercial vehicles, can present further opportunities for innovative startups to capture market share and drive growth in this evolving landscape.

Financial projections and investment ask

Financial projections are crucial for understanding the potential growth and profitability of a startup. Investors often seek detailed forecasts, typically covering three to five years, including expected revenues, expenses, and profits. For instance, a tech company might project revenue growth from $500,000 in year one, scaling to $5 million by year five, driven by user acquisition and subscription models. An investment ask outlines the specific amount needed, such as $1 million, and clarifies how these funds will be allocated--product development, marketing, and operational costs. Clear financial metrics, like a break-even analysis or projected return on investment (ROI), provide insight into the venture's sustainability, enticing potential backers with concrete data on future gains.

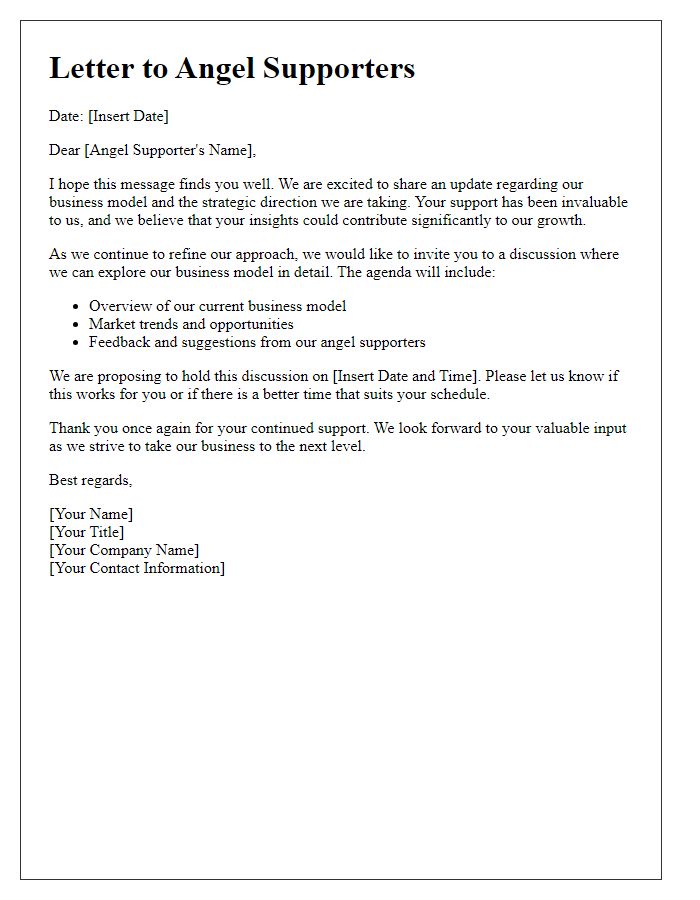

Letter Template For Angel Investor Pitch Samples

Letter template of business collaboration invitation for angel financing

Comments