Are you ready to secure your financial future through a pension scheme? Enrolling in a pension plan is not just a smart move; it's a crucial step towards ensuring a comfortable retirement. With various options available, understanding the benefits and requirements can seem overwhelming. Join us as we break it all down and simplify the processâread more to discover how you can get started on this essential journey!

Introduction and Purpose

The pension scheme enrollment process provides individuals with a robust financial foundation for retirement, aimed at ensuring long-term economic security and stability. The purpose of this program is to facilitate voluntary membership in a structured retirement savings plan, offering participants, typically employees aged 25-60, the opportunity to accumulate funds through regular contributions. Employers may contribute to this scheme, enhancing the total retirement savings for employees across diverse sectors, including healthcare, education, and manufacturing. The initial enrollment period usually spans three months, allowing individuals to assess benefits, review investment options, and understand tax advantages associated with retirement savings accounts. An organized approach to this process promotes informed decision-making regarding future financial well-being.

Personal Details Section

Enrollments in pension schemes require accuracy in personal information to ensure proper management and future benefits. Essential details include full name (as per official documents), date of birth (typically formatted in DD/MM/YYYY), address (inclusive of street, city, postal code), and unique identifiers such as Social Security Number or Employee ID for verification and processing. Contact information must encompass both phone numbers (mobile and landline) and email addresses for efficient communication regarding updates. Additionally, employment details should feature job title, department, and date of joining the organization to assess eligibility and calculate benefits accurately. Properly filling out the personal details section is crucial for effective pension plan administration and timely financial security in retirement.

Enrollment Instructions

Pension schemes provide essential retirement savings opportunities for individuals, ensuring financial security during retirement years. Enrollment instructions typically guide participants through the registration process, outlining necessary documents like identification and proof of employment. Participants should be aware of key dates, such as enrollment deadlines and contribution rates (often a percentage of salary), which vary by scheme. Important identifiers, like Social Security Numbers in the United States or National Insurance Numbers in the UK, must be submitted accurately to avoid processing delays. Furthermore, understanding features like employer matching contributions and investment options is crucial for maximizing benefits. Careful attention to these details facilitates a smooth enrollment experience and promotes long-term financial health.

Benefits Overview

Pension schemes offer vital financial security for retirees, providing a steady income source upon reaching retirement age, typically 65 years. Participating in a pension plan, such as defined benefit or defined contribution schemes, allows individuals to save systematically, with employer matching contributions often enhancing savings. Tax advantages exist, where contributions reduce taxable income, and investment growth accumulates tax-deferred. Additionally, many schemes offer survivor benefits, ensuring continued financial support for beneficiaries, such as spouses or dependents. Enrollment in a pension scheme can significantly improve one's quality of life during retirement, combating potential poverty risks associated with aging populations, especially in developed countries.

Contact Information for Assistance

Contact information for assistance is crucial in the enrollment process for pension schemes, ensuring clarity and support for participants. Potential enrollees should be aware of dedicated phone lines, such as 1-800-555-0199, available Monday to Friday from 9 AM to 5 PM Eastern Time. Email support can be accessed at info@pensionscheme.org, allowing for detailed inquiries and swift responses. Additionally, the official website, www.pensionscheme.org, features comprehensive resources and live chat options to assist with common questions or concerns regarding the enrollment process. Furthermore, local branch offices located in major cities like New York and Chicago provide in-person assistance and personalized guidance for potential members.

Letter Template For Pension Scheme Enrollment Samples

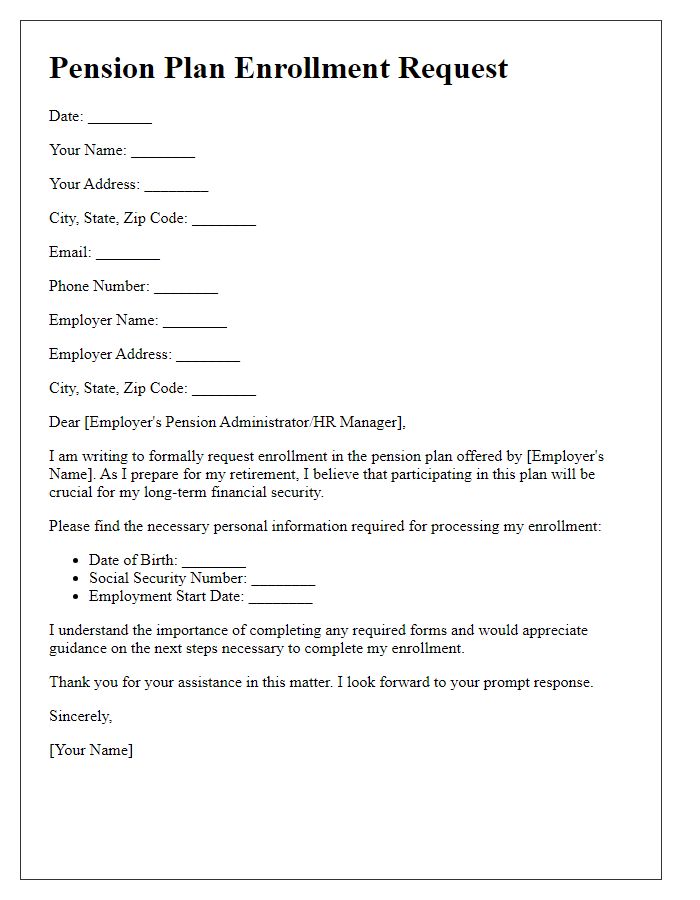

Letter template of pension plan enrollment request for retirement savings

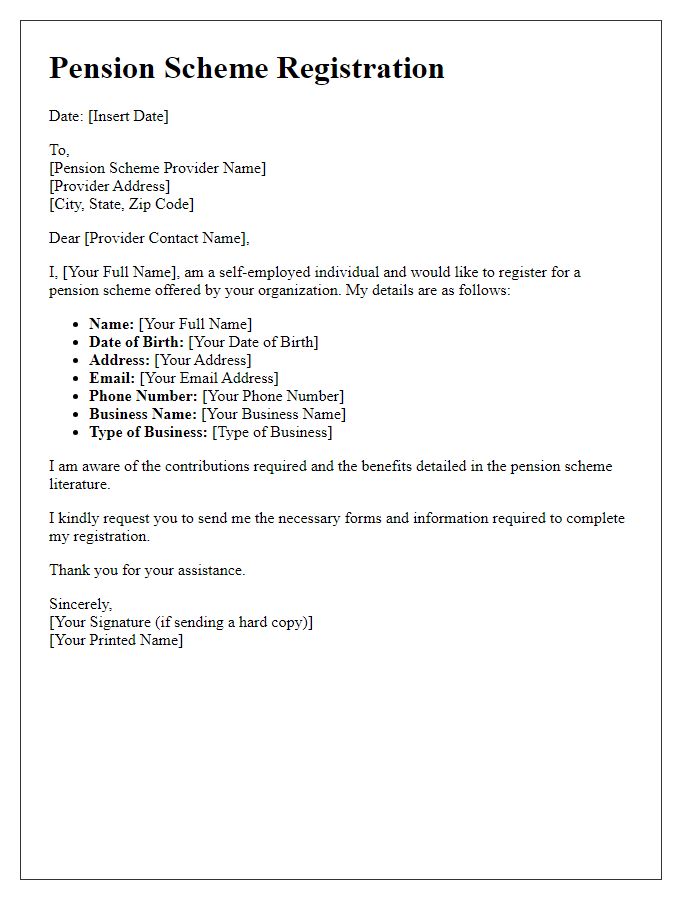

Letter template of pension scheme registration for self-employed individuals

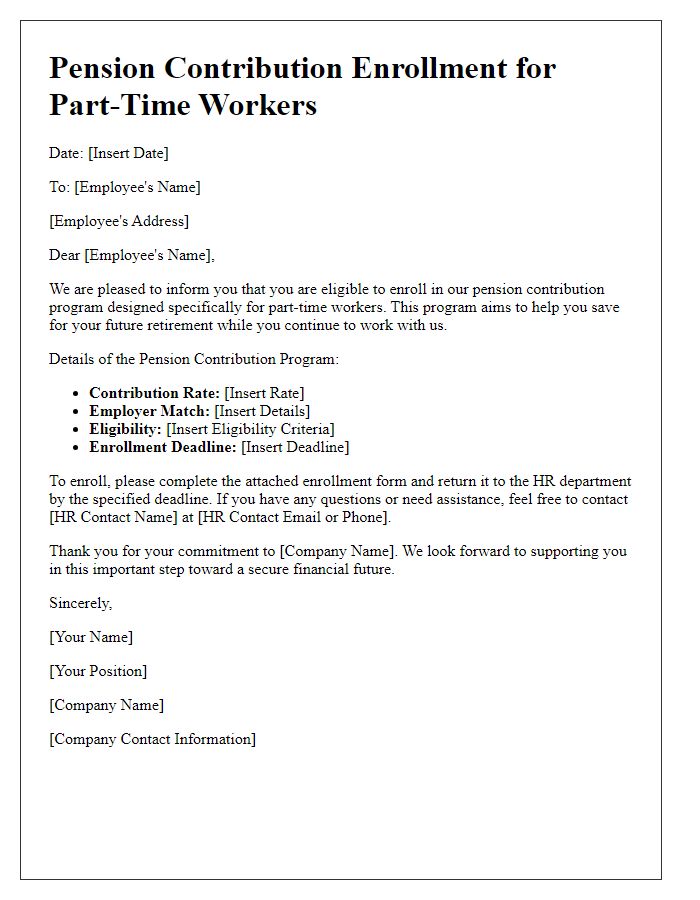

Letter template of pension contribution enrollment for part-time workers

Comments