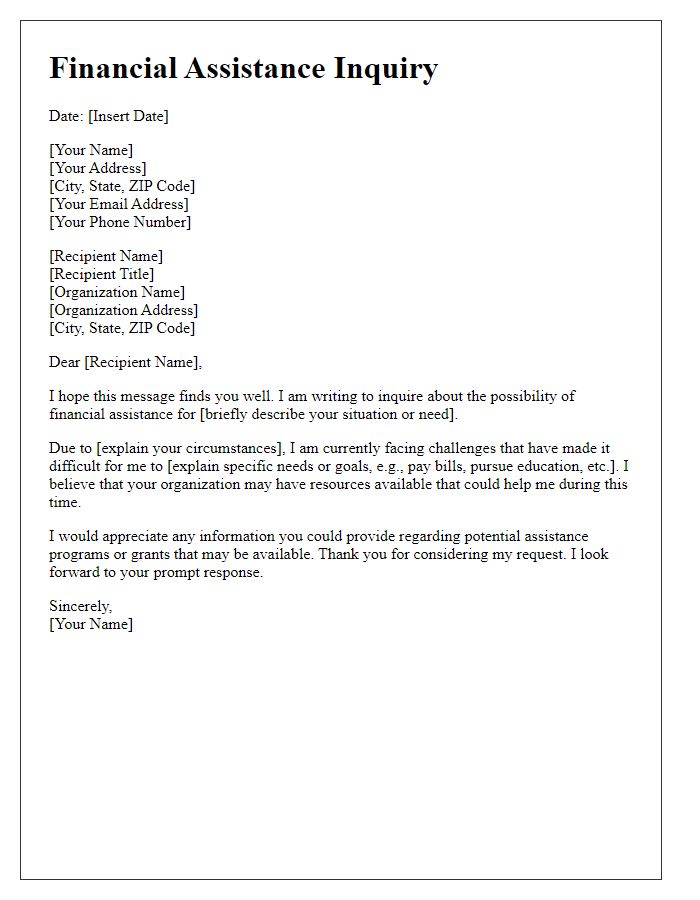

Are you in need of financial support but unsure how to ask for it? Crafting the perfect letter can make all the difference in conveying your needs and securing assistance. In this article, we'll guide you through the essentials of writing a compelling request, from setting the right tone to detailing your circumstances effectively. Ready to take the next step? Let's dive in!

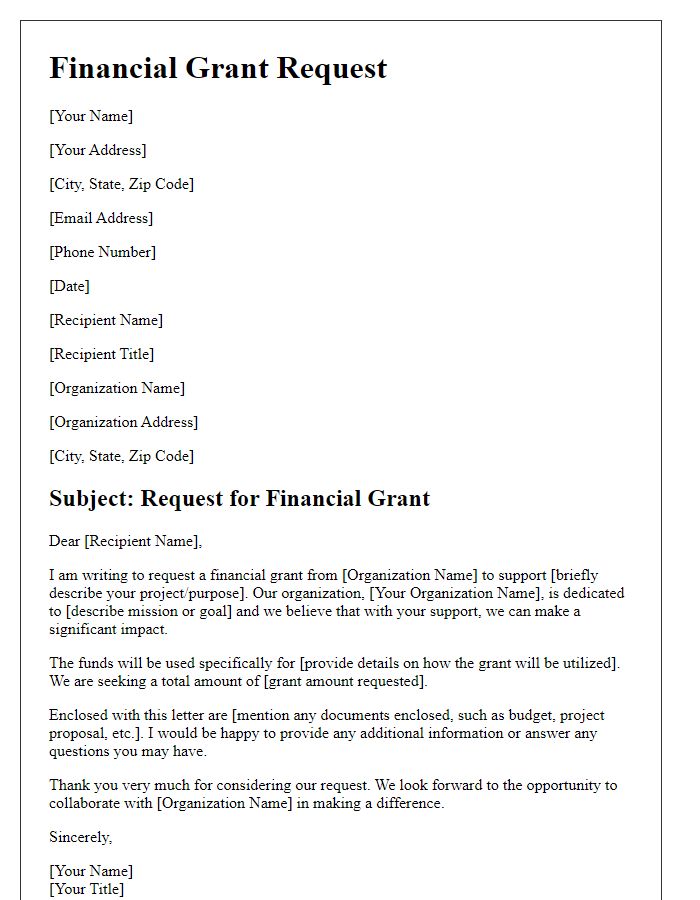

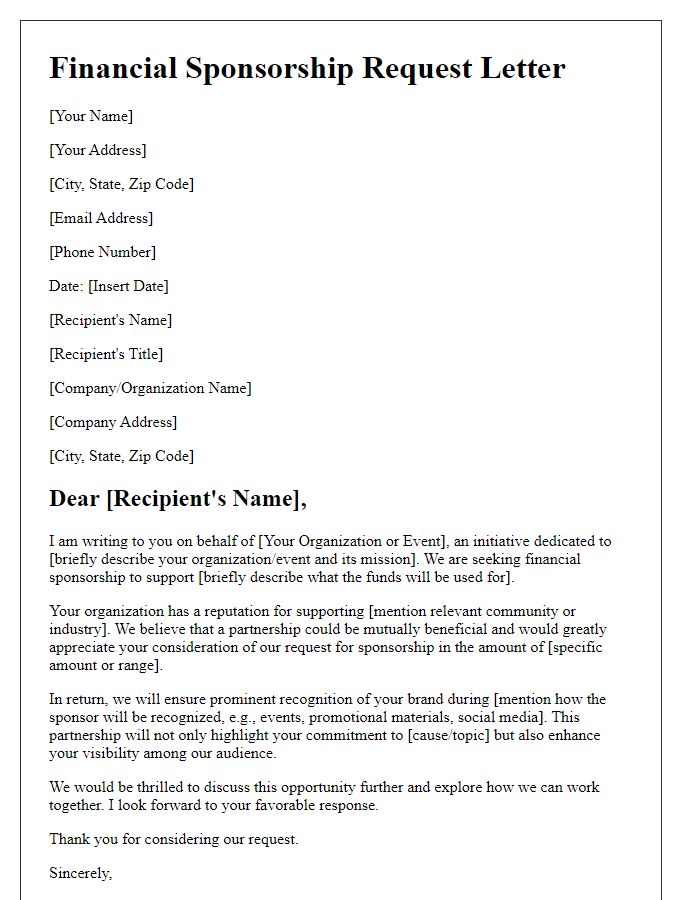

Clear purpose statement

In pursuit of sustainable community development, this financial support request aims to secure funding for a comprehensive education program targeting underprivileged youth in the East Side neighborhood of Springfield. The program, designed to serve 200 students aged 10 to 18, will focus on enhancing literacy and STEM (Science, Technology, Engineering, Mathematics) skills, which are essential for future career opportunities. By partnering with local schools and organizations, the initiative seeks to raise awareness of educational resources and provide necessary materials such as textbooks, computers, and tutoring services. Financial contributions will directly impact the overall goal of increasing educational attainment and fostering a culture of learning within the community.

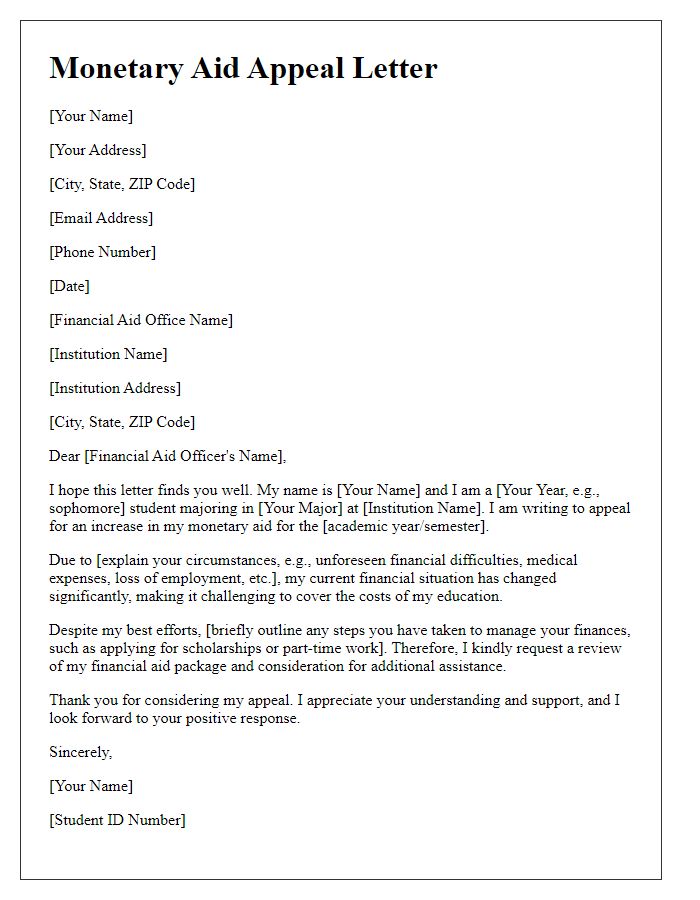

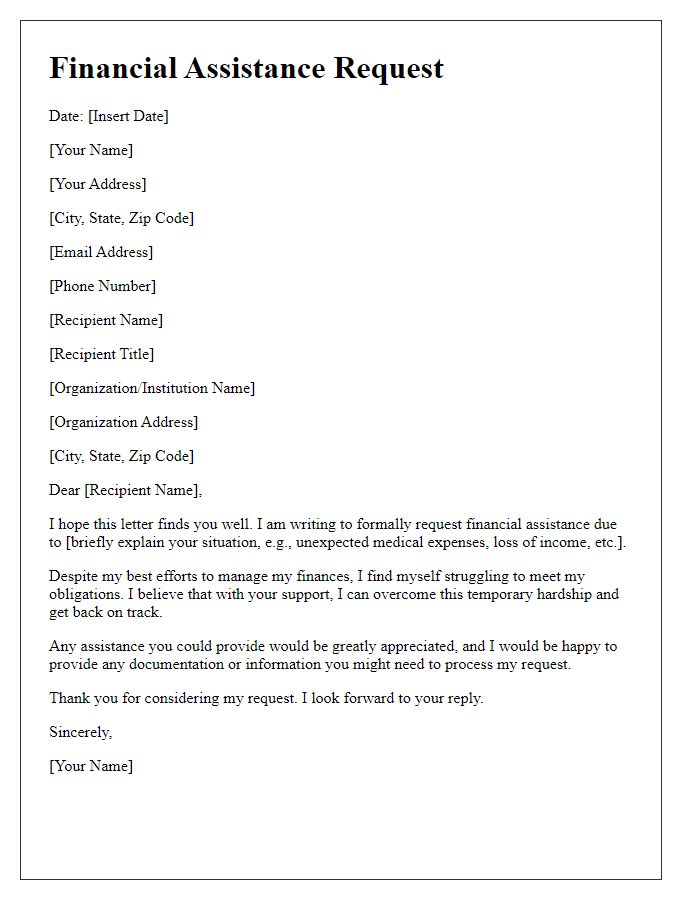

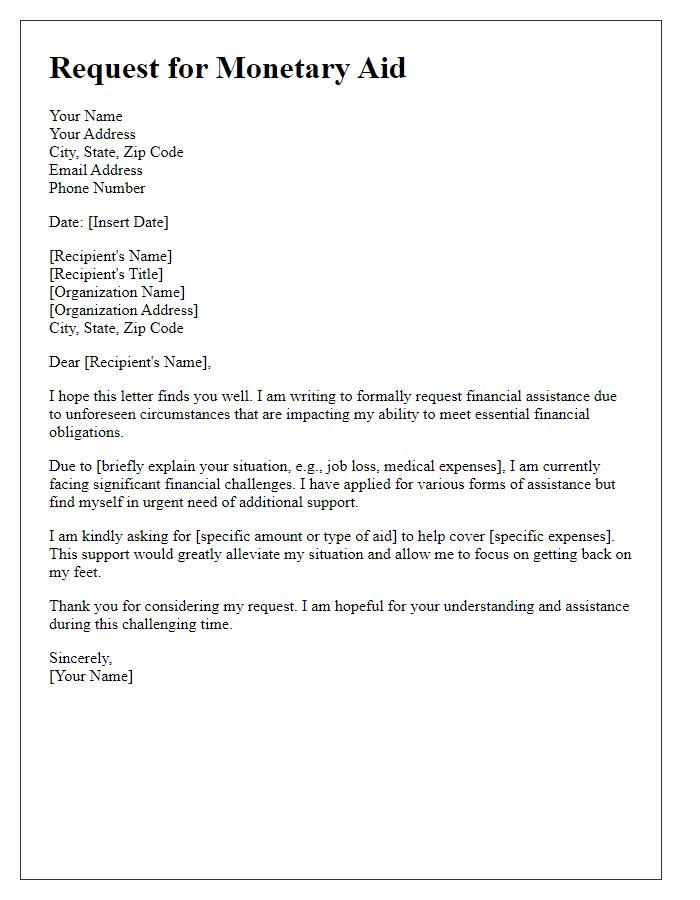

Detailed financial need explanation

A financial support request must clearly outline the specific needs and circumstances. For example, unexpected medical expenses (averaging $5,000) from a recent surgery burden an individual's budget in Chicago, Illinois. Diminishing savings (now down to $1,500) are insufficient to cover rent ($1,200 monthly) and necessary living expenses (utilities averaging $300 and groceries around $400). Moreover, employment difficulties during recovery hinder the ability to work full-time, resulting in a current income drop of 50%. Urgent assistance allows fulfillment of essential bills and prevents eviction. Providing detailed breakdowns increases the likelihood of receiving timely support.

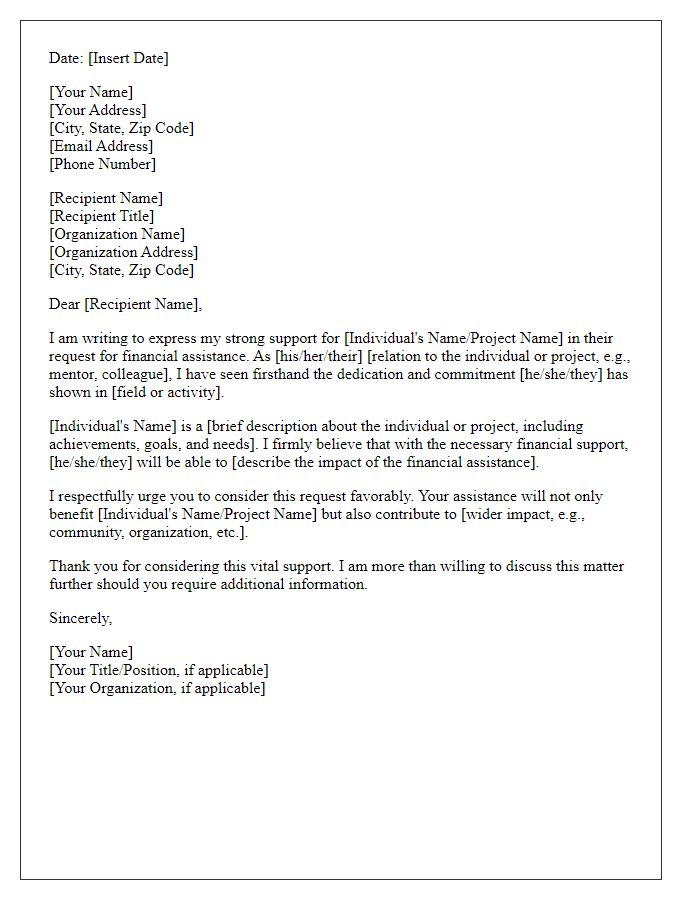

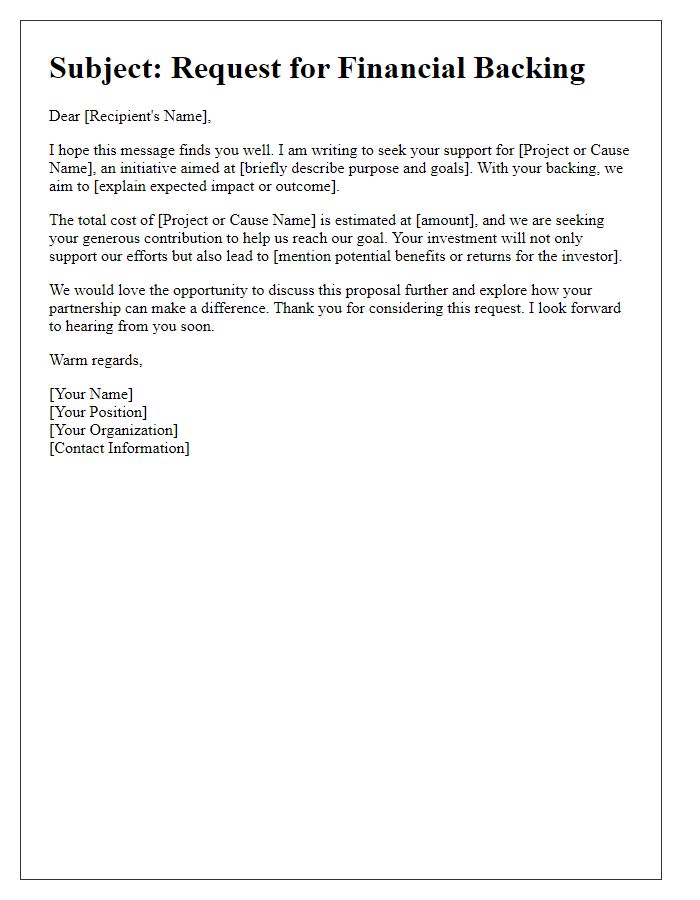

Connection to recipient's values or goals

The connection to recipient's values and goals can greatly influence the effectiveness of a financial support request. A clear alignment with the recipient's mission, such as community development, educational support, or environmental sustainability, emphasizes shared values. For instance, if the recipient is a foundation dedicated to educational initiatives, showcasing the project's focus on enhancing literacy rates in underprivileged areas would resonate. Highlighting measurable outcomes, such as increased graduation rates or improved test scores, demonstrates alignment with their goal of fostering educational equity. Additionally, providing testimonials from beneficiaries adds a human touch, further connecting with the recipient's purpose and enhancing the appeal for financial support.

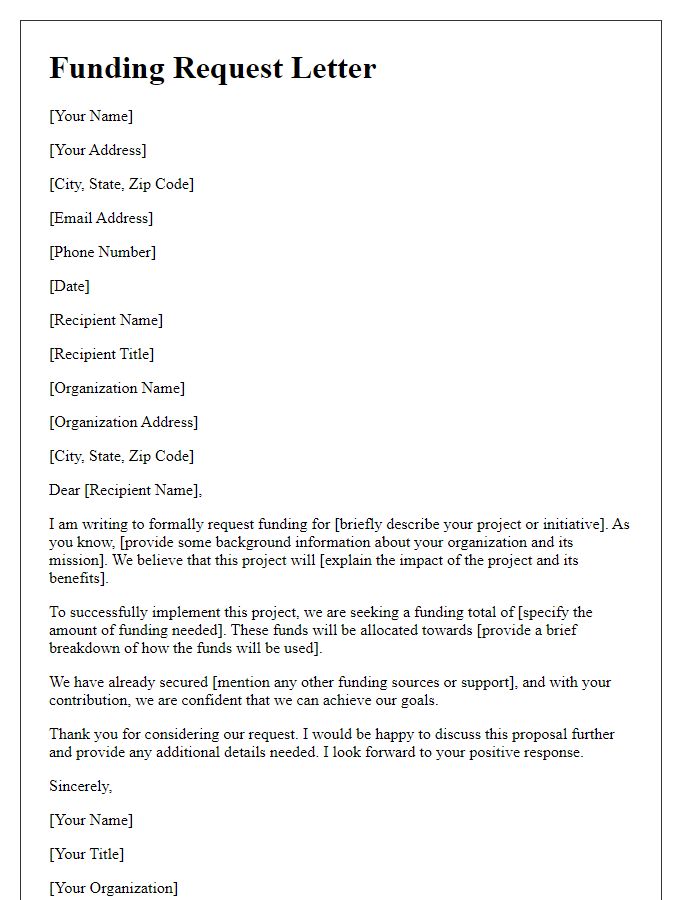

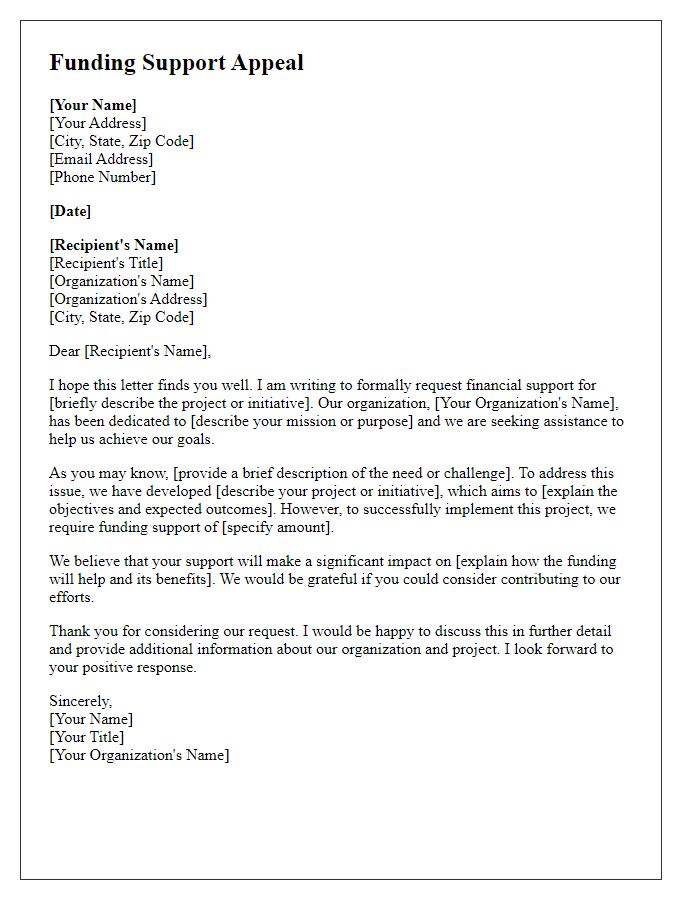

Specific amount and budget outline

To effectively seek financial support, a succinct and detailed request is essential. Specify the amount needed, for example, $5,000, detailing how these funds will be allocated across critical budget areas. For instance, allocate $2,000 for operational costs like rent and utilities, $1,500 for marketing efforts to increase outreach, and $1,500 for project development expenses including materials and staff training. Clearly outline the purpose, such as launching a community-based initiative to support local unemployment. Highlight the impact, like how this funding would improve the lives of at least 100 individuals within the community over the next year.

Professional and courteous tone

Long-term financial instability can disrupt the growth trajectory of small businesses, especially during economic downturns like the recession of 2008. Business owners may face challenges accessing capital from traditional lenders, such as banks or credit unions, particularly when credit scores dip below 650. Access to alternative funding sources, such as crowdfunding platforms like Kickstarter or GoFundMe, can provide crucial support for entrepreneurs seeking venture capital. non-profit organizations, such as the Small Business Administration (SBA) in the United States, can also offer assistance through grants and low-interest loans. In urban areas like New York City or Los Angeles, networking events hosted by economic development agencies provide entrepreneurs with opportunities to connect with potential investors and mentors.

Comments