As the year comes to a close, we want to take a moment to reflect on the incredible impact your generosity has made in our community. Your support has not only fueled our mission but has also galvanized others to join us in making a difference. We're grateful for your commitment and would love to share a summary of your contributions and the positive changes they've helped create. Curious to see the difference you've made this year? Read on to learn more!

Donor's contact information

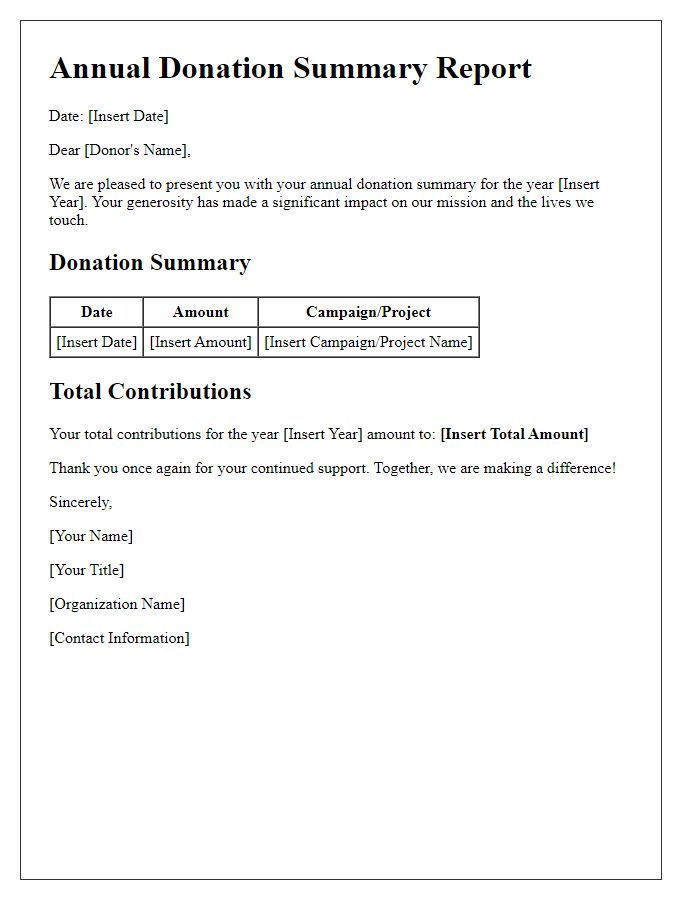

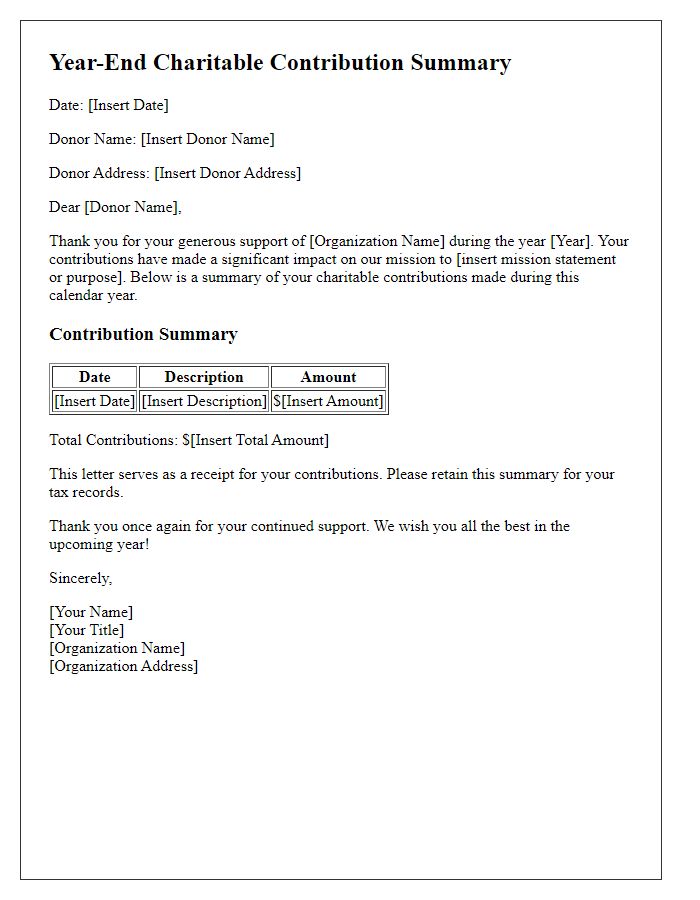

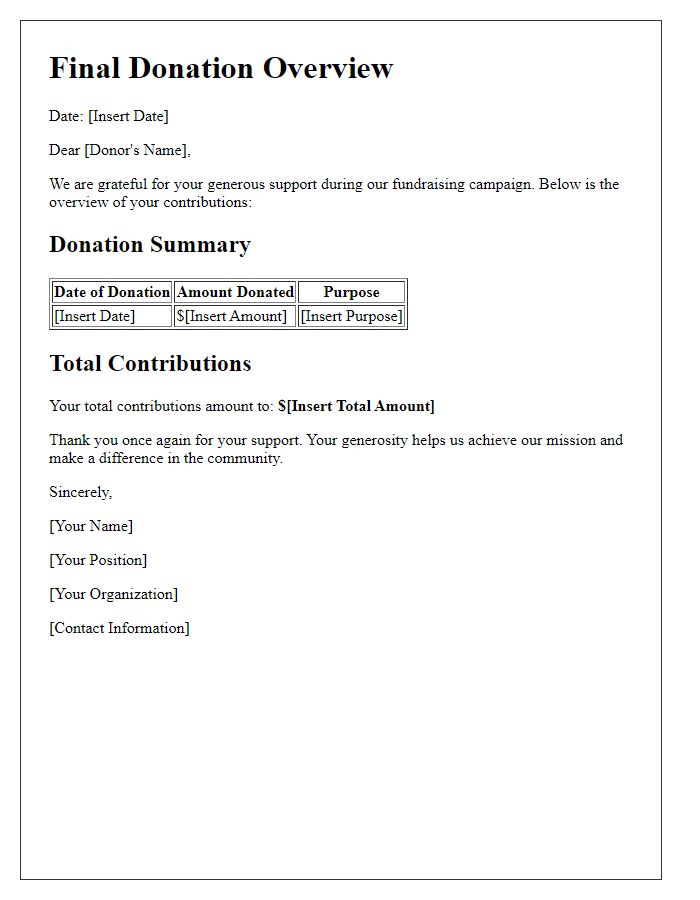

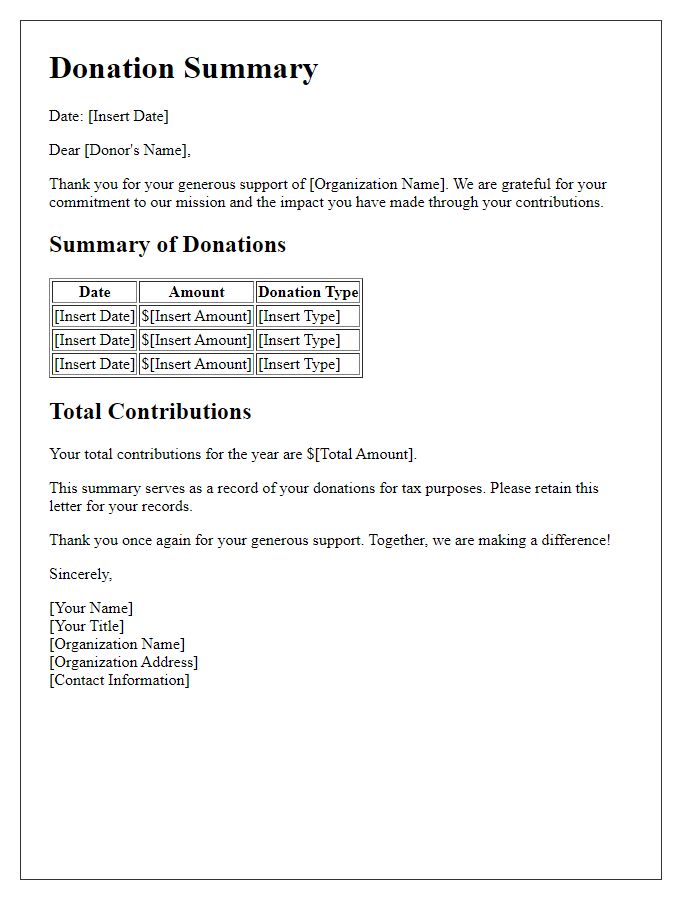

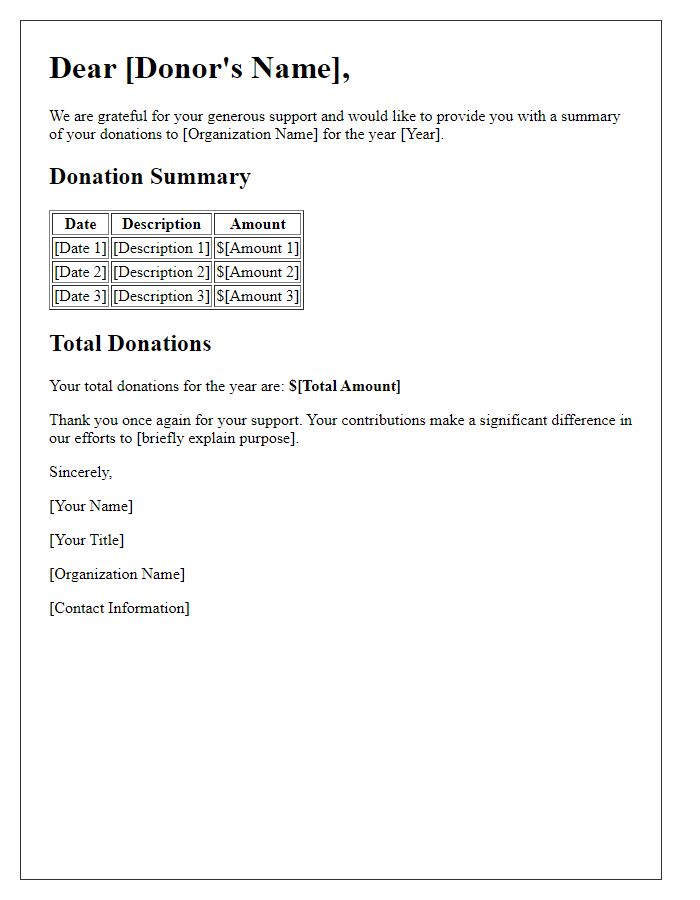

A comprehensive end-of-year donation summary outlines the key contributions made by a donor during the year. The document typically includes the donor's contact information, which may consist of the name, address, email, and phone number associated with the donor, ensuring clarity and ease of communication. This summary may also detail specific donation amounts, dates of contributions, and any particular fundraising campaigns or projects supported throughout the year. Including a total contribution amount highlights the donor's impact on the organization, fostering a sense of connection and appreciation. A personalized message of gratitude can further enhance the relationship between the donor and the organization, acknowledging the significant role the donor plays in supporting community initiatives or charitable endeavors.

Summary of donations

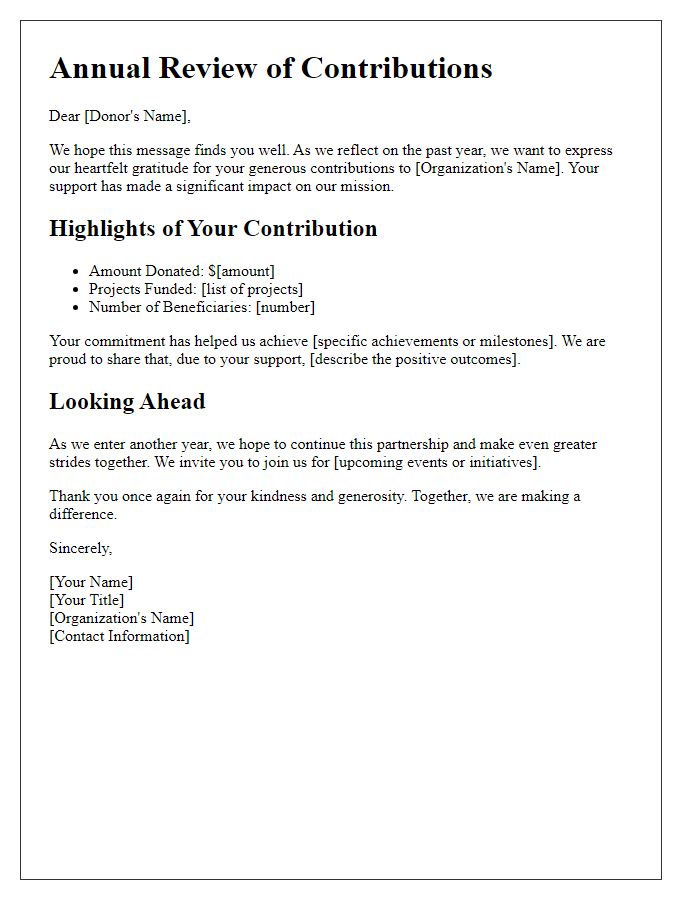

End-of-year donation summaries provide a comprehensive overview of charitable contributions made over the calendar year, detailing total amounts donated, dates of transactions, and specific fundraising events or campaigns. Organizations can highlight receipts for tax deduction purposes, include donor acknowledgments for key supporters, and summarize the impact of donations on programs or services provided, such as the number of beneficiaries served, funds allocated to specific initiatives, or community outreach efforts. Transparency through detailed reports fosters trust and encourages ongoing contributions, emphasizing the importance of donor engagement for sustained organizational impact.

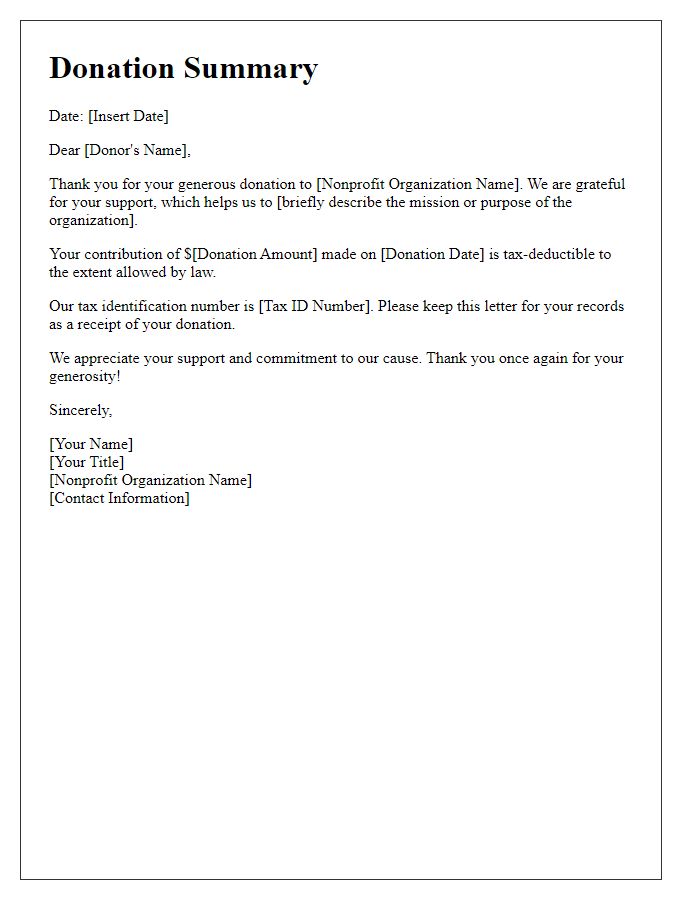

Tax-deductible statement

At the end of the fiscal year, nonprofits often provide donors with a comprehensive summary of their contributions for tax purposes. This document typically includes key information such as the organization's name, a unique identification number (EIN), the total amount of donations received throughout the year, and specific tax-deductible notes indicating that contributions may be tax-deductible under Section 501(c)(3) of the Internal Revenue Code. Effective summaries emphasize the impact donations have made on specific programs or initiatives, illustrating how funds have been utilized to progress the organization's mission, whether supporting educational outreach in underprivileged communities, funding medical research breakthroughs, or providing essential services to vulnerable populations. Clear formatting, including a date and donor acknowledgment, enhances the professional presentation of the summary, ensuring it meets IRS standards and is useful for donors during tax season.

Gratitude expression

End-of-year donation summaries represent a crucial communication touchpoint for non-profit organizations. These summaries highlight total contributions received throughout the year, acknowledging the generosity of donors who supported initiatives and programs. The summaries should mention specific fundraising events, such as the annual gala held in November at the Downtown Conference Center, which raised over $50,000 for community outreach projects. Additionally, summarizing the impact of donations by detailing how funds were allocated, like providing 200 meals per week to local families in need, emphasizes accountability and fosters donor trust. Expressing heartfelt gratitude in the summary not only recognizes individual contributions but also builds a stronger relationship for future support, encouraging continued engagement for the upcoming year.

Organization's contact information

A year-end donation summary is crucial for non-profit organizations like charities or community service groups. This document usually includes the organization's contact information, which typically consists of the organization's name, physical address, email address, and phone number for straightforward communication. Statistics illustrate that having up-to-date contact details increases engagement and fosters donor relationships, particularly in cities with vibrant philanthropic cultures like New York and Los Angeles. Each piece of contact information serves a distinct purpose; for instance, the physical address may be necessary for tax deduction purposes, while the email address facilitates quick updates on organizational achievements or upcoming events. Accurate and accessible contact information enhances transparency and builds trust with supporters.

Comments