When you find yourself needing to navigate the often complex world of insurance claims, a well-crafted support letter can make all the difference. This type of letter not only articulates your situation clearly but also strengthens your case for the claims adjuster. Whether it's a health-related issue, property damage, or any unforeseen circumstance, having a solid template can help streamline the process. Curious to learn more about creating the perfect insurance claim support letter? Read on for expert tips and templates!

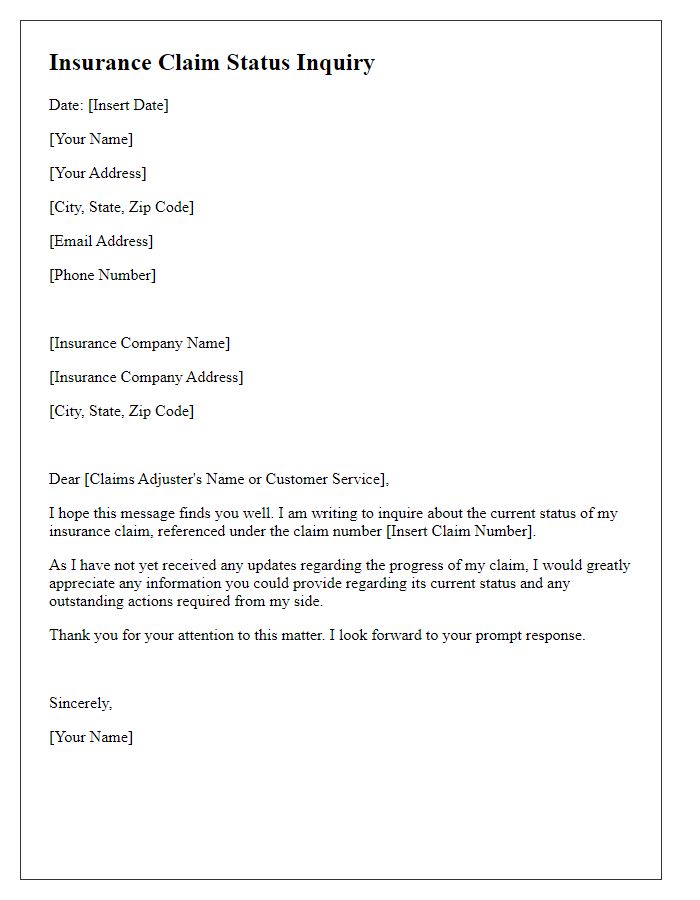

Clear Identification Details

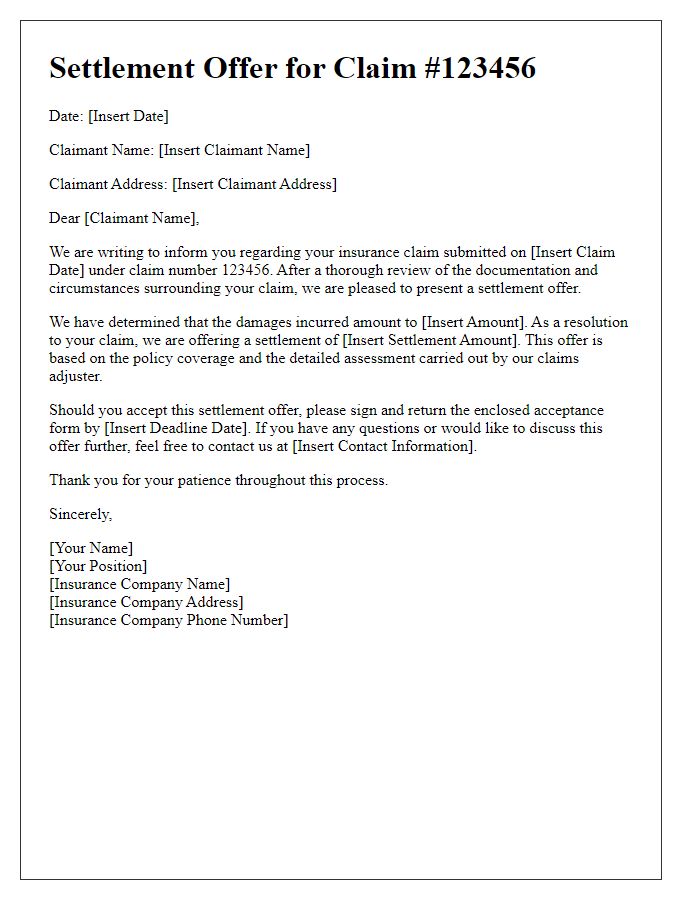

Clear identification details are crucial in an insurance claim support letter. Essential components include the policyholder's full name, the insurance policy number, and the contact information associated with the policy. Dates of occurrence for the incidents in question should be stated clearly. Specific details about the claim, such as the type of coverage relevant to the incident (e.g., auto, home, health insurance), and the claim number should be included for precise reference. Mention of any previous correspondence with the insurance company's claims department may also aid in clarity. Additionally, referencing the location where the incident occurred, such as a street address or city name, can provide context for the claim.

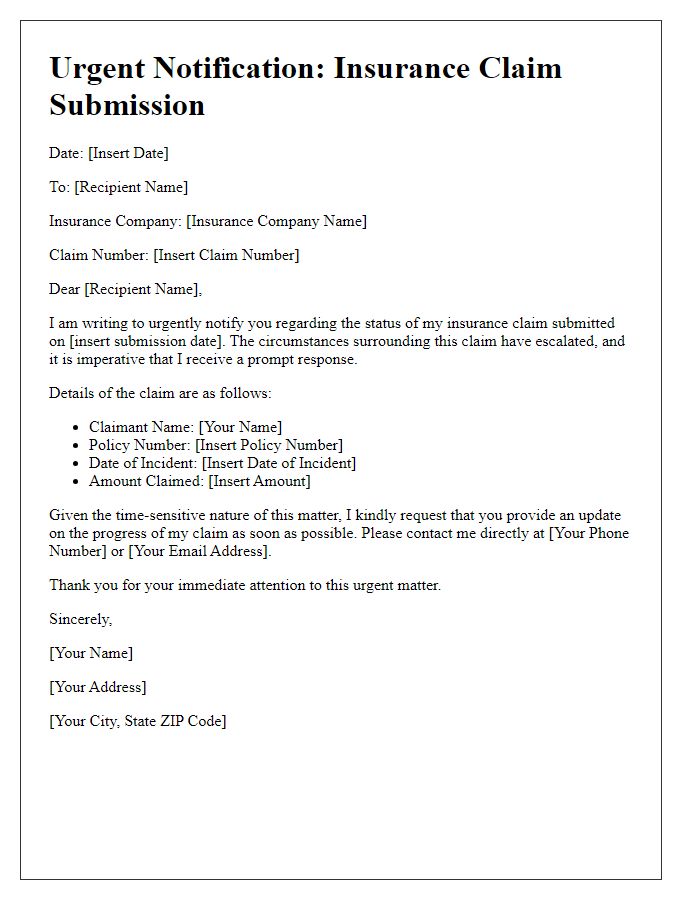

Detailed Incident Description

A detailed incident description is crucial for an effective insurance claim submission. On March 15, 2023, at approximately 2:30 PM, a severe thunderstorm hit the downtown area of Springfield, resulting in significant property damage. The National Weather Service reported wind gusts exceeding 60 miles per hour and over 2 inches of rainfall within an hour. The heavy rain caused water to seep into the basement of a residential property located at 123 Elm Street. Personal belongings such as furniture, electronics, and important documents suffered extensive water damage. Following the event, a professional water damage restoration service estimated the total loss at approximately $15,000, including repairs and restoration efforts. Local authorities filed a report documenting the storm's impact, which recorded multiple incidents of flooding throughout the region. This comprehensive overview helps substantiate the claim and outlines the need for compensation due to unforeseen weather-related damages.

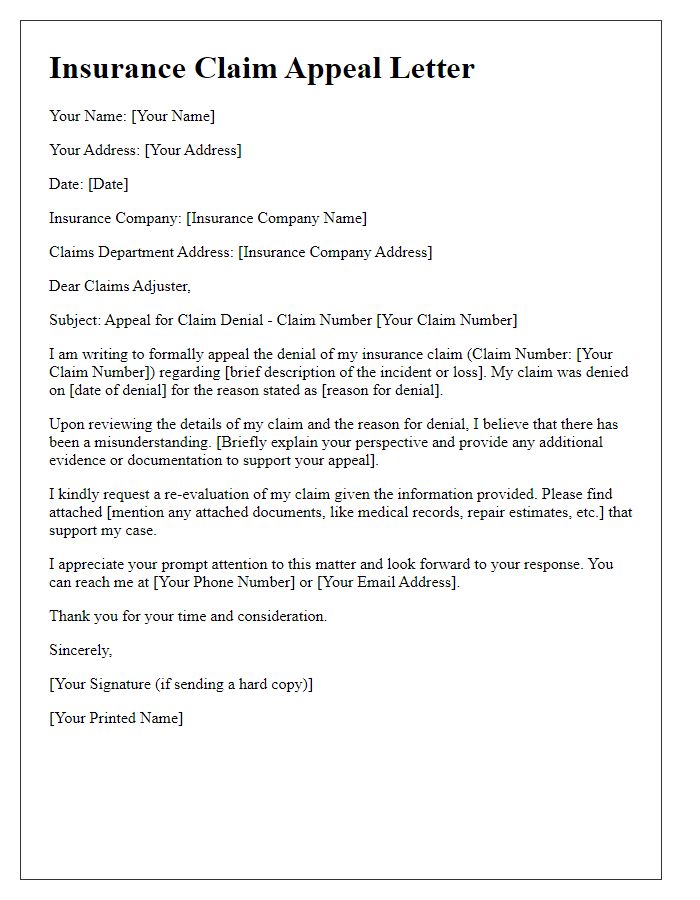

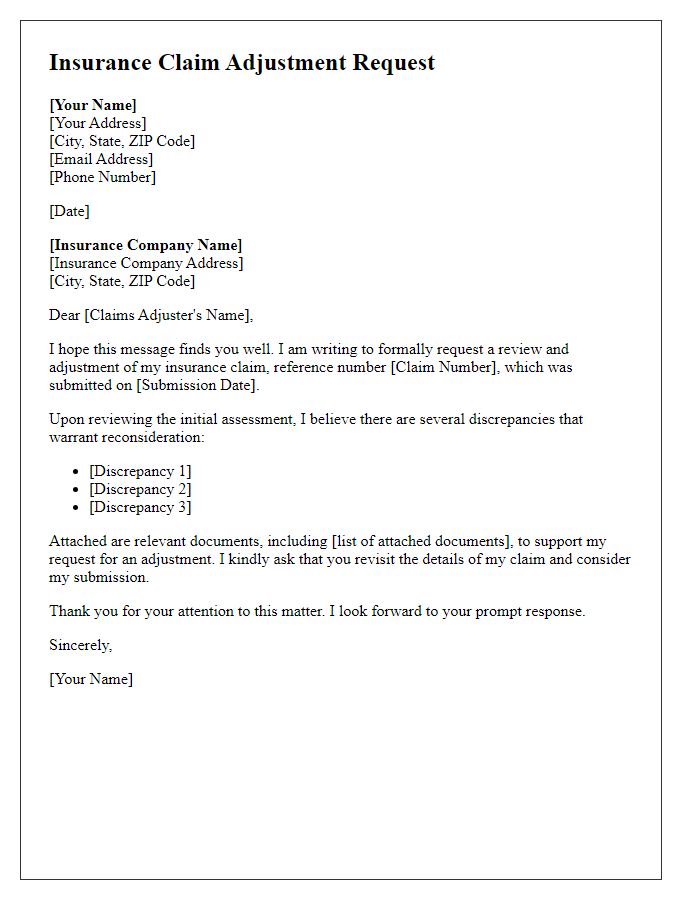

Specific Policy References

Insurance claims often require specific policy references to ensure accurate processing. Homeowners insurance policies typically include Coverage A (Dwelling Protection) and Coverage B (Other Structures Protection), which outline the protections for the insured property and additional structures. Auto insurance policies usually specify Liability Coverage, Collision Coverage, and Comprehensive Coverage, detailing the extent of coverage for vehicle damages and bodily injuries. Health insurance policies may reference specific plan details such as Deductibles, Co-pays, and Coverage Limits, essential for understanding the financial responsibilities of both the insured and the insurer. Clearly citing these policy sections helps to streamline the claims process, reducing confusion and expediting assistance.

Evidence and Documentation

Accurate documentation is crucial for supporting insurance claims, particularly in cases involving property damage or personal injury. Key evidence may include photographs of the damaged property, such as shattered windows or flooded basements, which can provide visual proof of the incident. Detailed incident reports, like police reports or fire department records, can further substantiate the claim by offering official accounts. Medical records and bills are essential for personal injury claims, illustrating the extent of injuries and associated costs. Additional documentation, like repair estimates from licensed contractors, can help establish the financial impact of the losses. Collecting and organizing these documents thoroughly can streamline the claims process, ensuring the insurance provider has all necessary information for a timely and fair evaluation.

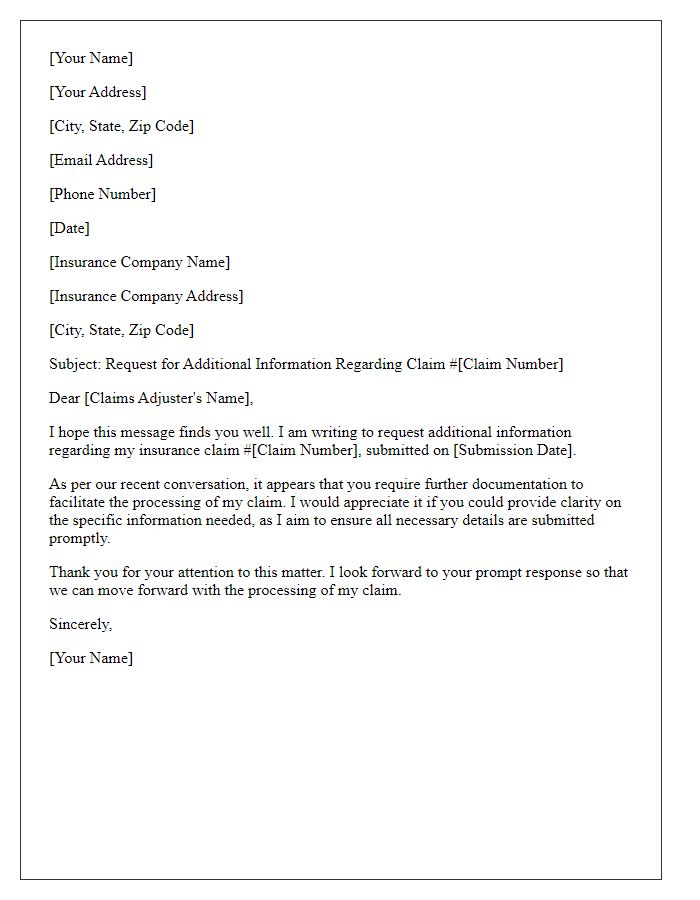

Contact Information for Follow-up

In the event of an accident or damage, maintaining clear communication with the insurance company is crucial for a successful claim process. Proper contact information ensures quick follow-ups. Essential details include full name, policy number, and claim number associated with the incident. Additionally, providing a valid phone number and an email address, preferably one frequently checked, will facilitate rapid responses. Geographic location can also be relevant, especially if local agents are involved. Effective record keeping and organized documentation, including dates and specific incident details, further support the claim's legitimacy and expedite resolution.

Comments