Have you ever opened your monthly statement only to be greeted by unexpected charges that leave you scratching your head? We've all been there, and navigating the world of disputed charges can be quite the task. Whether it's a billing error or an unfamiliar transaction, knowing how to address these issues effectively can save you both money and stress. So, if you're ready to tackle those surprise charges, read on to discover a foolproof letter template for seamlessly resolving your dispute.

Clear Contact Information

Unexpected charges can lead to significant confusion and frustration for consumers across various industries, including banking and utility services. Consumers often experience unauthorized debits on credit cards or bank accounts, prompting the need for clear contact information to resolve disputes efficiently. Accurate contact information, including a dedicated customer service hotline, email addresses for dispute resolution, and department extensions, can expedite communication. A direct line to the fraud department ensures that concerns are addressed promptly, protecting consumer rights and restoring financial peace of mind. This streamlined approach is crucial for managing disputes related to financial transactions in today's digital economy.

Detailed Charge Description

Unexpected charges often stem from miscommunication or billing errors. For instance, a service provider may accidentally bill a monthly fee of $49.99 instead of the agreed $29.99 plan, leading to confusion. Additionally, a one-time setup fee of $100 might not have been disclosed clearly during the initial consultation, causing further disputes. Notable discrepancies can arise from automatic renewals of subscriptions, where a user expected cancellation but was still charged the full renewal fee of $199. Understanding the precise nature of these charges, their dates, and any relevant account details is crucial for resolution. Clear identification of the service or product involved ensures that both parties can address the discrepancies effectively.

Supporting Evidence

Unexpected charges on credit card statements can lead to financial discrepancies for consumers. Disputes often arise from unauthorized transactions, such as those involving subscription services like Netflix or software purchases through platforms such as Apple App Store. Evidence is crucial in resolving these disputes, including detailed transaction records, receipts, and communication logs with the merchants. Consumers should carefully document relevant details, like transaction dates and amounts (e.g., $29.99 for a monthly subscription), to validate their claims. Involving third-party reports from credit bureaus can further support the case, ensuring a comprehensive approach to the resolution process.

Resolution Request

Unexpected charges on credit card statements can lead to consumer frustration and financial strain. Charge amounts exceeding twenty dollars can signal possible errors or fraudulent transactions. Disputing these charges typically requires contacting the card issuer's customer service department, often located in major banking hubs like New York City or San Francisco. Providing transaction details, such as transaction dates, merchant names, and amounts, is essential for effective resolution. Many consumers utilize dispute forms available on financial institutions' websites to streamline the process. Keeping documentation, including previous correspondence and receipts, enhances the likelihood of a favorable outcome within the 60-day window set by federal regulations.

Signature and Date

Unexpected charges on a credit card statement can create significant financial stress for consumers. When disputing these charges, individuals must gather pertinent details such as transaction dates, amounts, and merchant names. Documentation like invoices or receipts is crucial to establish evidence of the dispute. Each credit card issuer has specific protocols, often requiring a written statement that includes the account holder's signature and the date of the dispute submission. Following this process can enhance the likelihood of a fair resolution to the unexpected charges incurred.

Letter Template For Unexpected Charges Dispute Resolution Samples

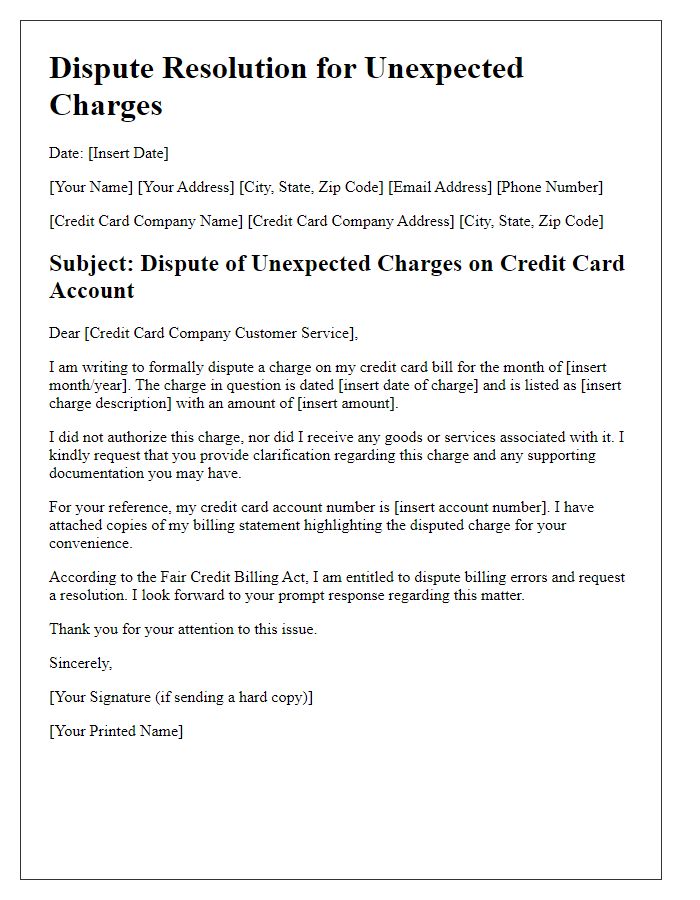

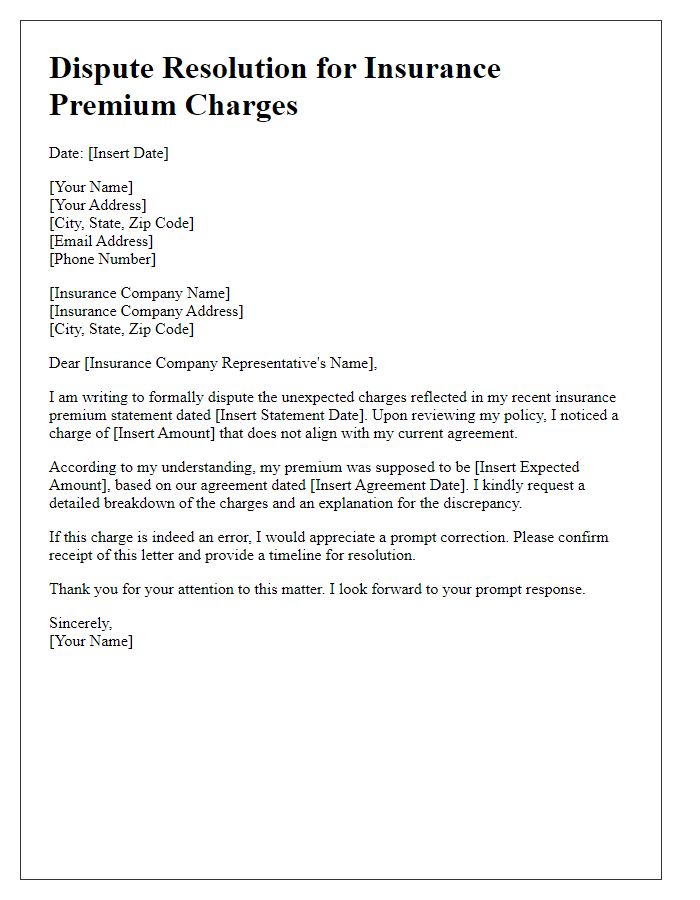

Letter template of unexpected charges dispute resolution for credit card billing errors

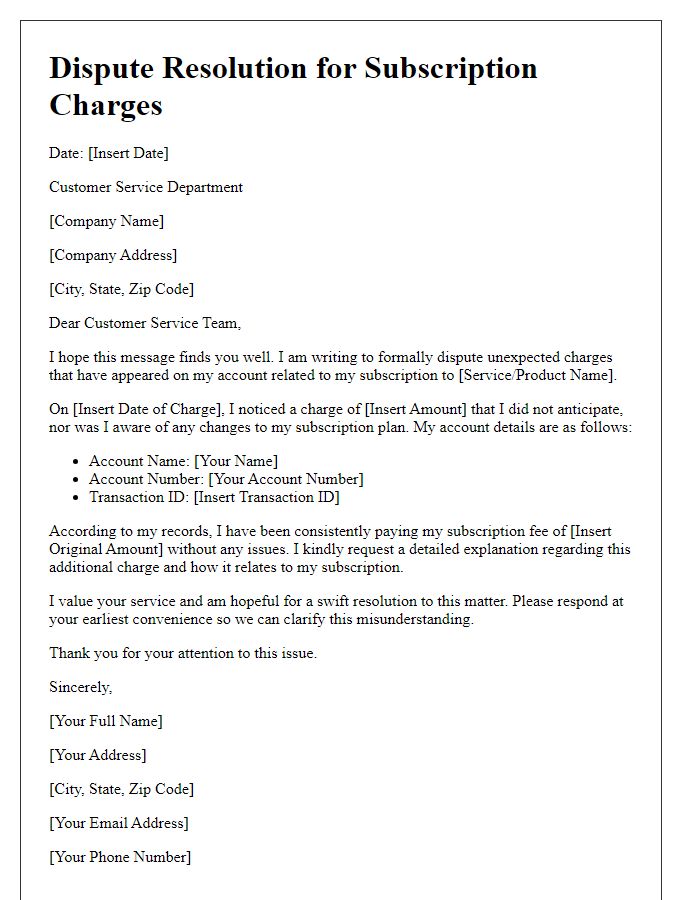

Letter template of unexpected charges dispute resolution for subscription service misunderstandings

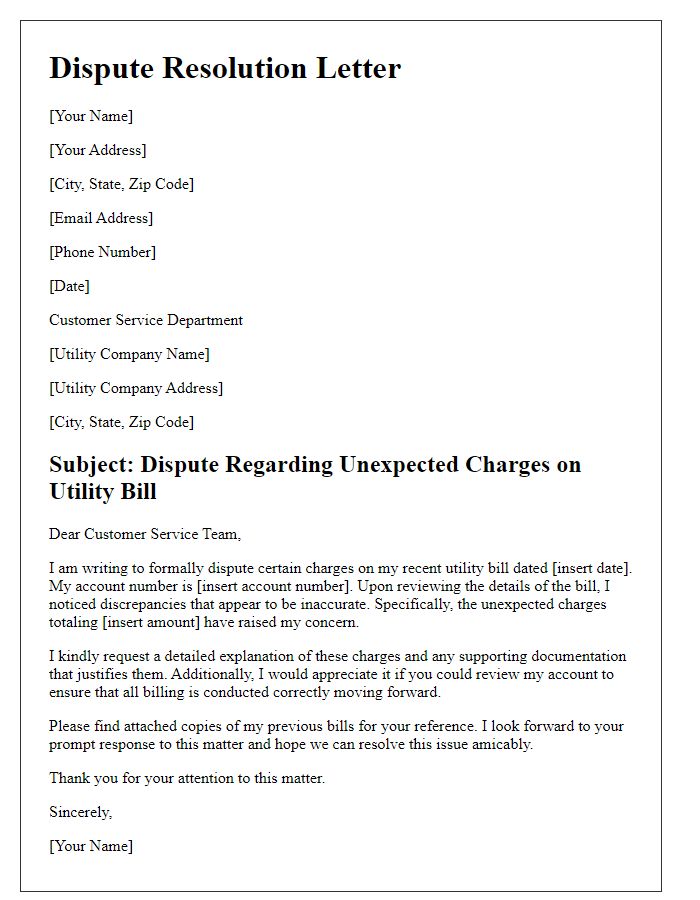

Letter template of unexpected charges dispute resolution for utility bill discrepancies

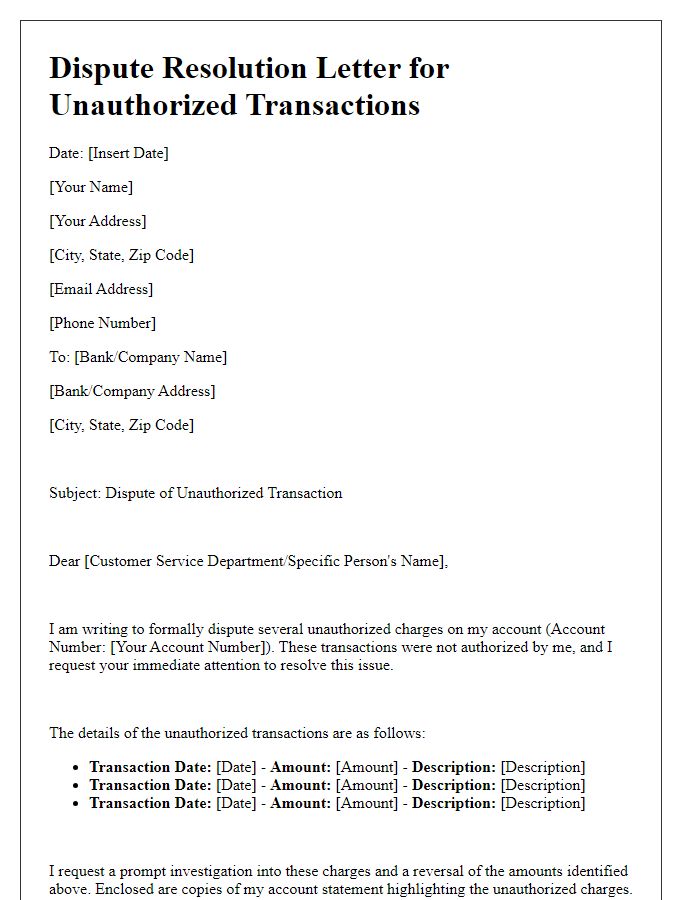

Letter template of unexpected charges dispute resolution for unauthorized transactions

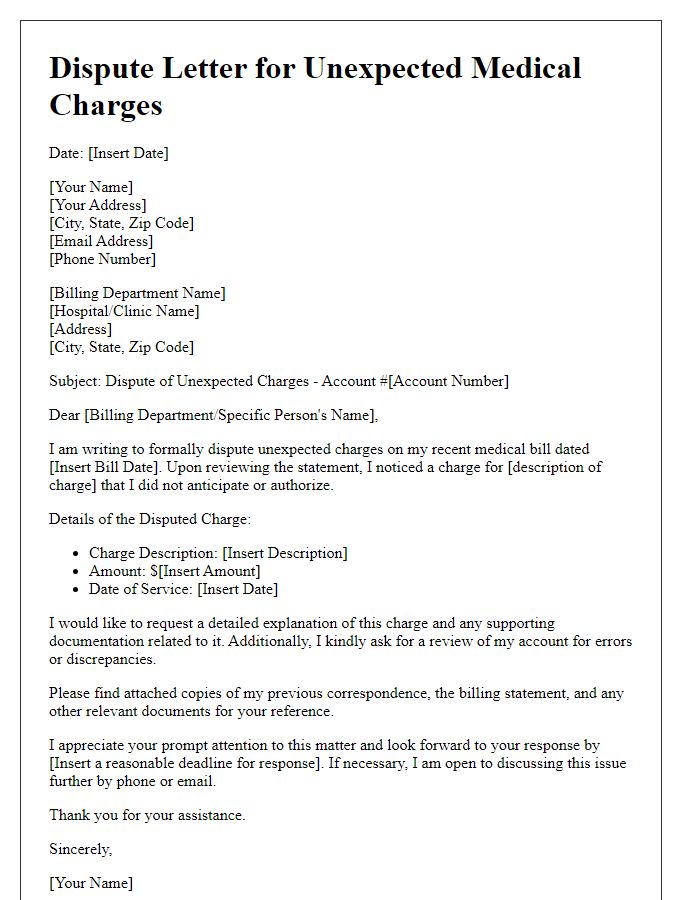

Letter template of unexpected charges dispute resolution for medical billing issues

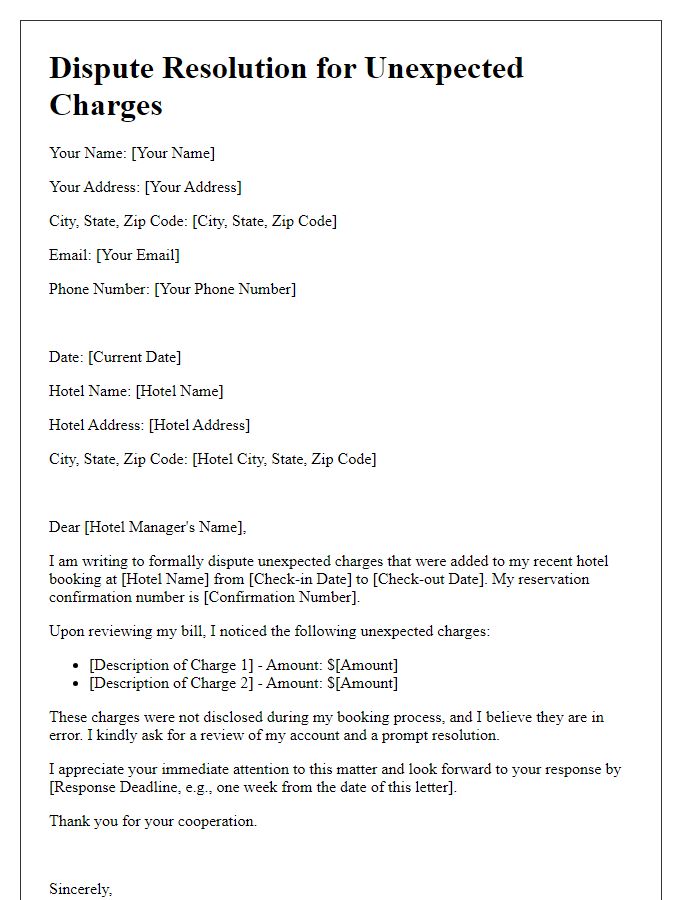

Letter template of unexpected charges dispute resolution for hotel booking errors

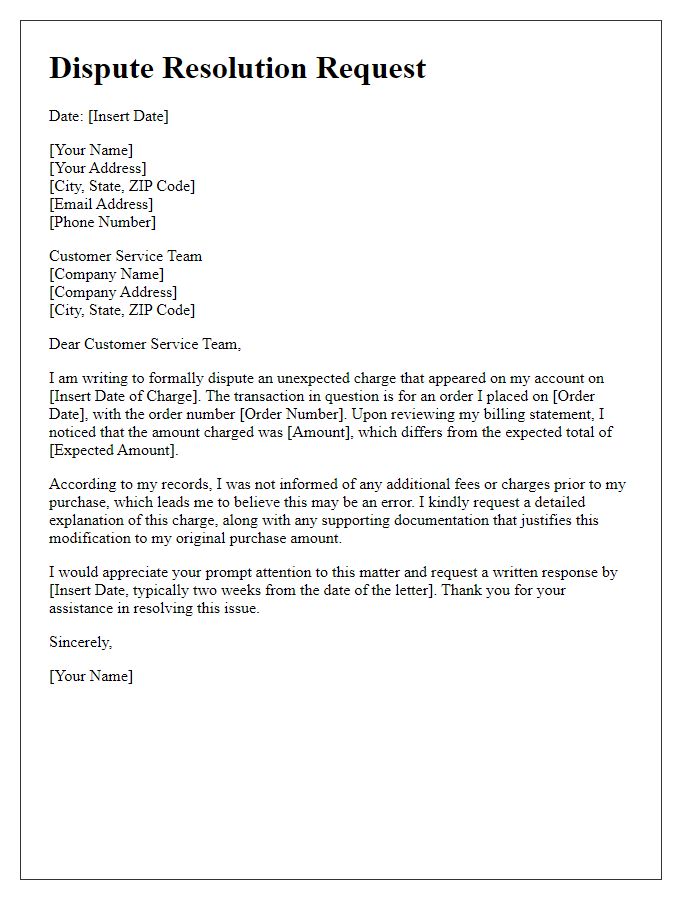

Letter template of unexpected charges dispute resolution for online shopping disputes

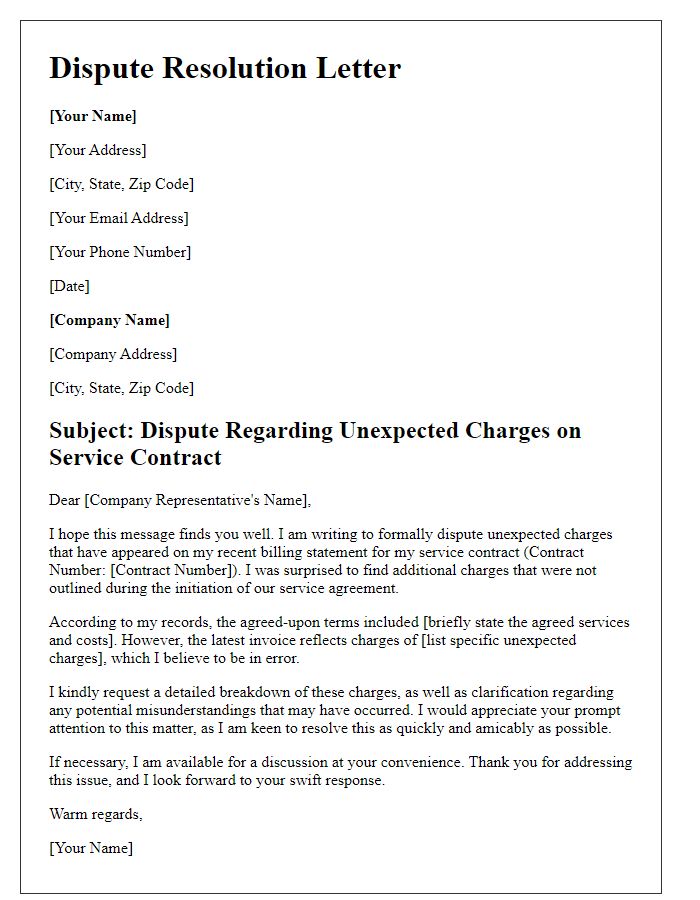

Letter template of unexpected charges dispute resolution for service contract misunderstandings

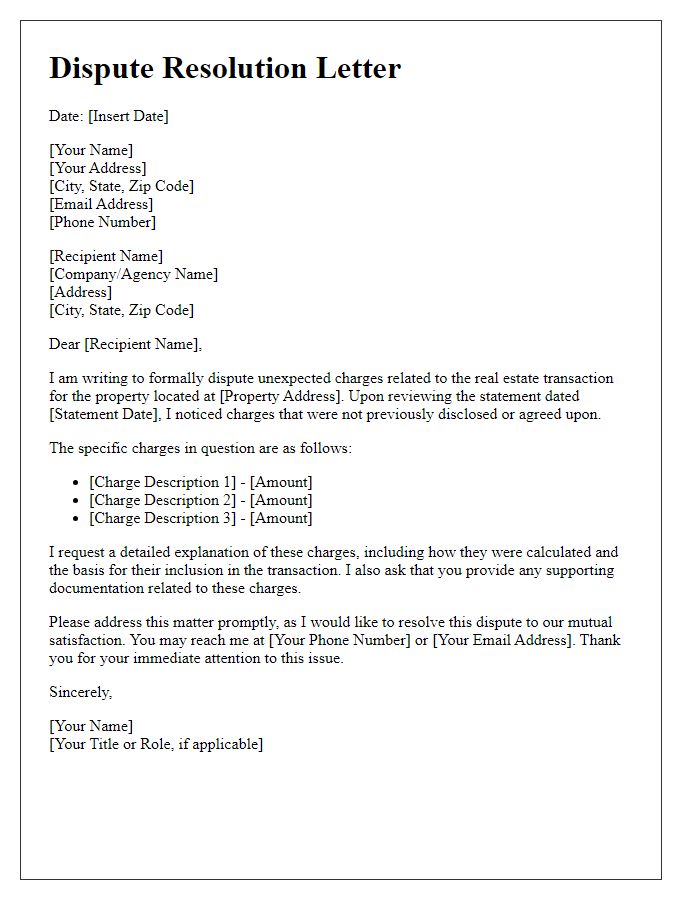

Letter template of unexpected charges dispute resolution for real estate transaction issues

Comments